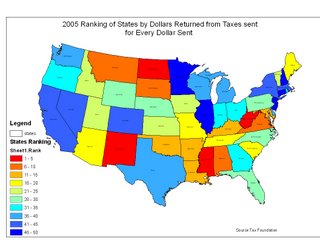

Ever wonder where your federal tax dollars go? And how much we get back for them?

Biggest Tax Donors

The state of Massachusetts gets 77 cents in federal spending for every dollar that it sends to Washington in tax revenue, according to a study by a tax policy think tank.

The nonprofit Tax Foundation released the results of an annual study which found that states that had more high-cost urban areas with higher median incomes chipped in more federal tax revenues than they got back in spending.

…

Scott Hodge, president of the Tax Foundation, said the disparity for states like Massachusetts has more to do with their citizens earning more money, and less to do with the congressional delegation not doing its job.

“The main culprit is not lazy congressmen who don’t bring home enough pork, but rather the progressive income tax,” Hodge said. The study identifies 18 donor states — those who contribute more to the federal tax pie than they get back — and 32 “beneficiary” states. New Jersey had the distinction of being the biggest donor, with that state only getting back 55 cents for every dollar in federal taxes paid by its residents and businesses.

Thanks to metroplexual for the link as well as the graphics. If you think this is interesting wait until you see the migration pattern charts!

Caveat Emptor!

Grim

Just a small explanation. I saw the data and wanted a visual of it. Often a chart is very good but seeing it visual makes patterns jump out.

Just an observation, as you can see the states that tend to vote Republican in Presidential elections tend to be the ones most subsidized. BTW, I wanted to do dollar amounts but the link would not go through. Maybe next week?

BTW Grim,

If you have data that you would like to see mapped by county or state, I would be glad to help out.

Well, that’s what you get with lazy voters who have no clue what’s going on. It truly amazes me how many people dont think that paying $12000 are year on top of an already bloated price is no big deal. It seems like people dont even consider the taxes.

For example, let’s say you guy something with the same relative price in Jersey City or New York City (yes the NYC place will be smaller). Now, New York City is the reason you’d even want to live in JC. No NYC = no JC,-okay? The stupid part is that I can get out with less on the monthly by buying in NYC because of the darn taxes!

Hey, not to change the subject (and I’d make this link a pop-up if I could) but following on from the other great posts here on NNJ, we posted the monthly median prices and sales for the Northeast. They’re kind of surprising)

BubbleTrack.blogspot.com

the subsidies are only going to get worse. increasing wealth stratification means that a higher overall portion of the tax burden will fall on the top. I’m not holding out hope for a flat tax anytime soon.

With respect to Bubble-x’s post re: the rising median house price in the Northeast, my bet is that this is due to an early recognition by the high sellers that the market has turned. High end sellers may be quicker to cut prices because they have more equity in their homes, they’re older, and probably more intelligent. The entry level market is stagnant— thus, you have median prices going up.

I thought the Republicans were against relying on the federal government for “handouts”

Oh wait, they only mean handouts for people who vote for Democrats…ROFLMAO

Anonymous,

check out this link if you want to see how bad states are. FAS

http://homepage.mac.com/wxguyinal/CFUI/FileSharing42.html

Skeptic-

What you’re saying might be right- the data we look at does not break things down far enough to tell.

Some of the other data not related to this post, or ours, has shown that higher priced units have been having trouble longer than the more moderate ones (at least in NYC). Not sure if that sheds any light, but hope it does.

I’d say, like I always do, that I am not too worried about what I think are short term moves in price. We can come with tons of reasons for them. The hard data, the hard fact, is that fewer people are buying… That predicts future price moves.

Bubble-X

BubbleTrack.blogspot.com

Not sure how the bubble comes down to Republicans and Democraps.

Seems to me a lot of people on both sides are making tons of money on housing.