Welcome to another edition of Lowball!

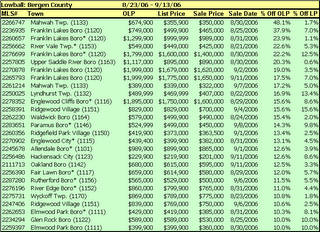

Lowball! takes a look at home sales from a different perspective. For those new to Lowball!, a lowball offer is when a buyer offers a significantly lower bid than asking in hopes that the seller accepts the offer. We take a list of home sales from the past month and pick out the sales that have the highest percentage difference between original list price and selling price.

The purpose of Lowball! is to show buyers that the market has changed and buyers now have considerably more leverage than sellers. Just a short time ago, Lowball! offers would have been laughed at and discarded, however, not any more. The fact that so many under-asking offers are being accepted is clear proof that the market is changing.The list does not contain all sales, I hand-pick the most interesting sales from the list. These listings might be the highest dollar drops, biggest percentage reductions, or sales in towns that are thought to still be ‘hot’. Please note, even with double digit percentage reductions, these homes are still incredibly overpriced.

Here are Bergen and Passaic for the range specified, I’ll publish the rest of the counties as time permits.

Sorry about the images, it’s just much easier for me to post these as graphics.

Caveat Emptor!

Grim

Wow, that Mahwah house must have been a real POS

MLS# 2266747 – Mahwah

2### Rio Vista Dr.

1br

1.5ba

TH/Condo (982 sq/ft)

Built in 2000

117 Days on Market

Grim,

That must have been the old Immaculate Conception Seminary. A few years ago they converted the empty seminary into luxury condos. Very nice historic building with nice woodwork on the interior which I am sure was ripped out during renovation.

You can see NYC if you stand on the roof…anyway..

Could we get the same for Morris County?

Would really appreciate it.

yessir

thank a lot in advance!

Foreclosures spiked in August

Rising payments on adjustable-rate mortgages contribute to 53% jump in foreclosures.

By Les Christie, CNNMoney.com staff writer

September 13 2006: 5:42 AM EDT

NEW YORK (CNNMoney.com) — The number of homes entering into some stage of foreclosure is surging, according to a survey released Wednesday.

In August, 115,292 properties entered into foreclosure, according to RealtyTrac, an online marketplace for foreclosure sales. That was 24 percent above the level in July and 53 percent higher than a year earlier.

It was the second highest monthly foreclosure total of the year; in February, 117,151 properties entered foreclosure.

Some of the bellwether real estate market states are among the leading foreclosure markets. Florida, had more than 16,533 properties in foreclosure in August. That led all states and was 50 percent higher than in July and 62 percent higher than in August 2005.

California foreclosures are increasing at an even faster annual rate, up 160 percent since last year to 12,506. And the formerly red-hot Nevada market recorded a spike of 24 percent compared with July and a whopping 255 percent increase from August 2005.

Rick Sharga, RealtyTrac’s vice president of marketing, says the rising foreclosure numbers are in part the result of rising monthly payments on adjustable-rate mortgages, which have a low introductory interest rate that heads higher after an initial period.

“Usually, foreclosures are a lagging [market] indicator,” he says. “But we’ve never had a situation like this with adjustable-rate mortgages amounting to $400 billion to $500 billion coming up for adjustment over the rest of the year.”

For a homeowner with a 5/1 ARM that’s now resetting, the adjustment could add at least two percentage points to the interest rate. That could send the payment on a $200,000 loan up from about $950 a month closer to $1,200 – $250 more each month.

These exotic mortgages, which have been issued by lenders at much higher numbers the past few years, default at a higher rate than do fixed-rate mortgages. And sub-prime loans, which are much more common than in the past, have a higher default rate as well.

But, Sharga says, “The real wild card is the nature of the loans themselves. Historically, ARMs were underwritten pretty conservatively. There has been a loosening of standards with lower credit worthiness and smaller down payments.”

Underlying causes

Homeowners are also in Dutch because of underlying economic conditions. Many of the worst hit markets, such as in the Midwest, are in areas hard hit by layoffs or other economic ills.

When housing markets were hot, homeowners could often avoid default through two ready made options, according to Sharga: They could sell to a ready market or they could use the increase through appreciation in their equity to refinance their homes. Increasingly, both those options are evaporating.

Contrary to what many consumers may believe, lenders are not anxious to foreclose on homes and put families out on the streets. Foreclosures tend to be money losers for lenders and are done mostly as a last resort.

Sharga says lenders are beginning to recognize that a problem is brewing and are taking steps to address it. They are much more amenable to a short sale, for example, in which they accept a low-ball, cash bid early in the default process that may not even cover their mortgage, in order to avoid a larger loss later. That can help homeowners by preserving their credit scores and easing their transitions into the rental market.

“Lenders say they’re looking for ways to work with homeowners in trouble,” reports Sharga. “So for homeowners looking at a default situation, the sooner they talk to their lender – and see what options are available – the better.”

Grim,

Would it be possible to post Somerset and Middlesex data also please.

This Middlesex county is not considered as NNJ (actually CNJ)but I think CNJ also experienced the same level or more on this housing bubble.

Thanks.

007

I thought I heard in the radio driving to work yesterday that people that live in Bergen county live longer. Is this true?

Anonymous said…

I thought I heard in the radio driving to work yesterday that people that live in Bergen county live longer. Is this true?

Live longer than what?

Grim,

“Would it be possible” for you to once again, do a cartwheel while drinking a beer in 10 seconds.

“Would really appreciate it”. Thanks again,

SAS

PS. Grim with all the goodwill work you do, you should start charging via paypal and make some good jack on the side.

SAS

“PS. Grim with all the goodwill work you do, you should start charging via paypal and make some good jack on the side.”

I’ll sign up for that. Can get some use out of my cc.

BC Bob

I thought I heard in the radio driving to work yesterday that people that live in Bergen county live longer. Is this true?

I believe you heard part of a story that is reported below in the Bergen Record:

Asian women in Bergen have nation’s top life expectancy

Please note, even with double digit percentage reductions, these homes are still incredibly overpriced.

Grim, thank you very much for all the information you provide and for all your insightful articles and comments. I have been an avid reader of your blog for the past 8-9 months, however this will be my first post.

For the past two years, I have been trying to follow the Hudson county market, with a special focus on Weehawken, West New York and Union City and then with a special interest in newly constructed condo buildings.

Real estate agents, although less cocky than a year ago, are still very bullish in this area. Any chance you could compile lowball figures for the Hudson County area, with a focus on condos?

Would be great to have some hard facts to refer to the next time I speak to an agent.

Thanks again for all your work and for sharing it so willingly.

Cheers

“Would be great to have some hard facts to refer to the next time I speak to an agent.”

Agents don’t want facts, they want fools.

Use the facts to time your purchase.

“Kathy Butler, a longtime real estate agent, recently began marketing Skip Wilkinson’s home. She says many sellers are having a hard time accepting declining prices. Like Wilkinson, they are ‘chasing the market down.’ By the time they realize their price is too high, the market has fallen further.”

“David Berson, chief economist for mortgage giant Fannie Mae, said he is having the same problem. He has had to adjust his national projections downward.”

“‘The actual numbers keep coming in weaker than we expected,’ Berson said. ‘The leading indicators of housing activity continue to point downward. Purchase applications from the weekly Mortgage Bankers Association survey continue to edge down. The National Association of Home Builders’ confidence index is at the lowest level since early 1991, when we were going into a recession.’”

“Butler said real estate agents and sellers should brace themselves for the possibility of a long downward trend. California’s home market tends to run in cycles, she said. ‘The cycles last for years, not for months.’ Butler said. ‘We need to realistically figure this will go on for a while.’”

“Gary Kent, an agent who works with Butler, said he tells home buyers that the days of buying and selling properties quickly for fast profits are over for the near future. ‘I am advising my clients not to buy now if you are planning to resell in a year or two, because you probably won’t make any money.’”

new to the site, which by the way is wonderful, could you explain the difference between OLP and LP.

Thanks

Check out the new show “Million Dollar Listing” to see realtor parasites in action leeching off the wealthy in Malibu, California.

These middlemen make $75K+ for a few hours (10 to 50) worth of work.

On realtor had a buyer that was a friend, and was revealing seller secrets to this buyer. It was never disclosed to the seller that the buyer was a friend of the realtor. All part of the realtor “code of ethics.”

Website for “Million Dollar Listing”

http://www.bravotv.com/Million_Dollar_Listing

(No offense KL, we know you’re an honest person, but these clowns give realtors a bad name.)

“OLP” = “Original List Price”

This is the price for a house when it’s first listed on the market. When a listing gets ‘stale’ (too many days on the market), realtors will relist a house with a new MLS ID and the “OLP” history is erased (This is dishonest and deceitful, but a widespread practice).

“LP” = “List Price” which is the current asking price, also known as “Greedy Grubber Wish Price.”

The PDF files kept on Senate site regarding today’s hearing give what some folks with talk about. Here is the link & some excerpt.

The Housing Bubble and Its implications for the Economy

From OFHEO Chief Economist:

OFHEO’s national House Price Index has never fallen over a period of a year or more, but it has come very close, and inflation-adjusted prices have fallen significantly, by 11 percent in the early 1980s and by 9 percent in the early 1990s. In the first instance, it took nearly 8 years for inflation-adjusted prices to regain the past peak and in the second case, almost 10 years. Certainly, a similar event is quite possible now.

From President of NAR

After five years of outstanding growth and being the driving force of the U.S. economy, the housing market is undergoing a period of adjustment. I have experienced this first hand as my prior home has been on the market, in Northern Virginia, for over a year.

Contrary to many reports, there is not a “national housing bubble.” NAR understands that the housing sector could not maintain a record setting pace indefinitely. A soft landing is certainly possible and under the right circumstances likely, but that soft landing is critically dependent upon policies that support a transition to a more normalized market and mitigate changes in local markets in the availability of mortgage financing and other essential elements to homeownership.

From President of NAHB:

The downswing in home sales and housing production should bottom out around the middle of next year before transitioning to a gradual recovery that will raise housing market activity back up toward sustainable trend by the latter part of 2008. This extremely favorable financing environment fueled buying activity in the interest-sensitive housing sector, pulling some demand forward in the process.

The surge in housing demand quickly put substantial upward pressure on house prices, aided and abetted in many parts of the country by land-use constraints that limited the amount of supply that builders could bring onto the markets in short order. In retrospect, it was the finance- and price-driven acceleration of buying for homeownership and for investment that drove housing market activity into unsustainable territory during the boom.

Cheers !!!

Since we’re decoding some of the terms used on this blog, we might as well go ahead and explain these:

Greedy grubber: Anyone who is trying to sell a house without discounting it 40% from last year’s pricing

wacko: anyone who dares question, in any way, shape, or form, the prevailing logic on this board

jack-ss : see wacko, above; syn. moron, greater fool, bagholder.

Post here at your peril, unless you’re willing to swallow the disaster-catastrophe-armageddon predictions hook, line, and sinker, and accept opinions and predictions as undisputed fact.

Oh My…inventory is ballooning again.

Welcome to the new home of Garden State MLS’ public search engine. Currently, there are 32,116 properties advertised for sale in NJ on our site.

Rats are jumping ship without a life jacket.

“Troll”:

http://en.wikipedia.org/wiki/Internet_troll

Anyone notice the crabbiness picking up?

32,116 houses for sale on GSML and this does not count the FSBO.

Oh well…..i wonder when it will break 35,000 listed homes.

looks like many missed selling at the top and are chasing the market down.

Take the hit fast before it turns into a stampede next year.

Even One-Way dave thinks prices are going down and flippers will be burnt.

Or else keep waiting and watch the invenotry just pile up. hhhmmmm.

OT but relevant

my in laws are trying to sell their place in freehold, it is a townhouse in perfect condition, with granite, stainless steel, new baths etc etc (the place was purchased 20 years ago and is all paid for) any way their realtor pressured them to lower their asking price around 6% and said to them it is only going to get worse for sellers and the spring will be a nightmare.

lucky for my in laws they are far from desperate but those who are, look out

if realtors are admitting it now it must be real bad

“There’s nothing like the smell of fresh inventory in the morning.”

Anonymous said…

“There’s nothing like the smell of fresh inventory in the morning.”

Who is this anon??? Hilarious, I just spit out half of my sandwhich.

BC Bob

Was me Bob. :)

(can’t always log in)

“Agents don’t want facts, they want fools.”

Another good line.

Some smart whips on this board.

SAS

unrealtor, that is funny. At one time, I was part of a panel for testing scents.

The ones associated with terms like “fresh morning breeze” and “with morning-laundered freshness” always ranked high up there. They could have smelled like doggie-doo. Still ranked.

Maybe your phrase could be a new insert in home listings.

“Just Reduced and there’s nothing like the smell of fresh inventory in the morning!”

Pat

“Post here at your peril, unless you’re willing to swallow the disaster-catastrophe-armageddon predictions hook, line, and sinker, and accept opinions and predictions as undisputed fact.”

Come, on…you love it!

O.K. Make one of these to wear while you read. It totally enhances the experience.

http://www.ericisgreat.com/tinfoilhats/

http://zapatopi.net/afdb/build.html

http://www.stopabductions.com/

Pat

Post here at your peril, unless you’re willing to swallow the disaster-catastrophe-armageddon predictions hook, line, and sinker, and accept opinions and predictions as undisputed fact.

Thank you for saying this. I’ve been saying this for sometime. Many here are absolutely giddy about a supposed disaster in real estate and I’m convinced that they’re extremely hateful and resentful of homeowners, real estate agents, mortgage brokers, real estate investors and etc. Their short list of hated individuals and professions is unending.

I won’t name names, but there are at least three regular posters here who stand out as being the absolute worst as far as this giddy attitude is concerned. Two of them have posted “cute” little comments in the string already.

I’ve just given up trying to present an alternative view.

reinvestor101 said…

I’ve just given up trying to present an alternative view.

Which is??

Fresh Inventory in the Morning.

Goes with:

Trenton Takes What The Taxpayer

Makes.

reinvestor101 said…

I’ve just given up trying to present an alternative view.

9/13/2006 02:13:57 PM

Please do not. Not everyone falls into said bucket.

Hadn’t seen you in awhile.

chicago

Forget “alternative” views. That is typical broker/realtor board spin-speak.

Much easier to stick with the FACTS and FIGURES. Like amount of inventory. Easy enough to track. A stat I would love to see (but harder to track) is number of brokers losing their jobs, per week. Would make me feel all warm and fuzzy.

Cheers.

HONESTMAN

I am a firm believer in karma.. I have gotten kicked by it several times unrealtor.. All those who wish others to “lose their shirts” and “feel warm and fuzzy” at someone losing thier job will get theirs.. No one should wish bad fortune or insult anyone with an different opinion.But that is what is wrong with our society today respect for a human being/eachother is out the window and we wonder why terrorists hate us..

RTMB

Wow, I post once a month..and I am lectured.

Please do not mix the topic of terrorism (important) with real estate (not so important, in the grand scheme of things). There is no justification for a terrorist to “hate us”.

For shame.

HONESTMAN

RTMB

9/13/2006 03:34:22 PM

I don’t wish ill fortune on anybody. There are many innocent people that are caught in this quagmire. I truly hope they can get through it. I didn’t get us in the mess that we are in, just trying to call it as I see it. I ask frequently for someone to present the other side of the coin, with hard core facts, not theories. I have yet to receive one legitimate, fundamental reason to be in this market at this time. I am all ears, maybe I’m missing something. That’s why I post my name, they know who to address. I try to keep it on the topic. However, when someone degrades me for renting or says I’m just a loser wannabe homeowner it is insulting. I have made a lot of $ in RE over the years. Don’t have to rent, just my decision at this time, my choice. Just think that RE, presently, is an overbought, way overvalued commodity. Just my opinion.

BC Bob

I am a firm believer in karma.. I have gotten kicked by it several times unrealtor.. All those who wish others to “lose their shirts” and “feel warm and fuzzy” at someone losing thier job will get theirs.. No one should wish bad fortune or insult anyone with an different opinion.But that is what is wrong with our society today respect for a human being/eachother is out the window and we wonder why terrorists hate us

I was just about to query “Honestman” about why he wanted stats on broker job losses, when I saw your post. Unrealtor and apparently “Honestman” are literally salivating like Pavlov’s dogs at hope of financial ruin befalling investors, homeowners, real estate brokers, mortgage brokers, the five year old next door and etc. The bottom line here is that this resentment is an outgrowth of a form of class war in this country that’s being started by those who don’t own real estate. Now, no one begrudges them for not choosing to buy, so why do they hate those who’ve chosen to invest in the American dream?

I don’t have a problem with folks just stating a dispassionate opinion, but it almost never goes there. Usually someone is yelling about some “greedy grubbing” investor, homeowner, real estate broker while spouting doom and gloom.

Grim:

OT – Regarding lowball Bergen or Passaic. You post these monthly. Have you looked at a random number, say 30, of properties each month, and calculated the average lowball percent or change?

Pat

Honestman.. If you understood my post (which clearly you did not).. Its is our arrogance in feeling that we have the right to insult and degrade people who’s opinion differs from our own.. Nothing to do with real estate if you choose to feel “warm and fuzzy” over someone losing their job is ,in my opinion, giving credence to the opinion that most Americans are arrogant, ignorant and self serving. And my apologies for singling you out.. There are many people who do this on this board. As for the lecture.. Welcome to this board..

Shame on you for wishing people to lose their jobs.

RTMB

Renee

Great site,Great blog,and the comments from your posters have alot of intelligence.The facts speak for themselves,no need for eccess opinion. Out west it is the same story. Solutions are lacking.Lowballing is ofcourse the best yet for sellers or buyers.Take a hit now or get run over in 6months.

“Shame on you for wishing people to lose their jobs.”

Is it a shame to wish I lose my job? Anyone want mine. It has made me addicted to Tums antacids.

SAS

“The bottom line here is that this resentment is an outgrowth of a form of class war in this country that’s being started by those who don’t own real estate.”

Ha. In your own head. Any class war in the US extends far and above real estate.

Reinvestor, frankly, your comments are to the extreme other side. Just as you say you believe all people who post here want to see a downfall for anyone who owns real estate For one thing, this is patently untrue, as I hope what I believe will happen will not happen to everyone – I have family and friends who own homes, many of whom are quite young, starting families and drank the koolaid you and other RE bulls mixed for them and are now carrying giant jumbo mortgages. And I’m all about personal responsibility, but there has been an awful lot of pressure on people these past few years and not everyone was strong enough to resist.

You, in fact, strike me as one of the perpetrators of the great “class war” you talk about – it seems from your comments that you believe that everyone here is just a pathetic, renting loser. So don’t be so quck to criticize every poster on this board.

i wish no ill will on anyone

but if you bite off more than you

can chew i feel bad for you. as for

buying a house you cannot afford

than taking out equity on said

house, after prices pull back now

you are all of a sudden worried

about things well sux for you

i work hard i save and i cannot

afford a home in a decent area

so i may be bitter but at least im

in the black

oh and i was the crazy one who did

not buy that 500k pos, and i still

drive my 4year old 4 cylinder

japanese car, what the hell was i

thinking with all my money in a

bank

pleae enlighten me

“..but there has been an awful lot of pressure on people these past few years and not everyone was strong enough to resist.”

lots of people have peer pressure daily but are strong enough to resist. These folks took the plunge without thining out the risks. Whatever happens they deserve it.

Someone has to win and someone has to lose in a way in this rela estate game. many prudent rational buyers refused to play in an irraional game. It went against them for making a sound decision. Those that decided to drink the koolaid now are left holding the bag.

Sorreeee but these are the consequences.

Cheers Renee. I take nothing personally, just blogging.

But all of these references to Americans, terrorists, etc. Are you, um, French or not a US citizen??? That would be very disturbing, as then it would appear that you are stereotyping Americans (calling us “arrogant”), and advising us that terrorists are justified in hating us, etc.

p.s. Shame on those real estate and mortgage brokers for suckering those nice families (who are now defaulting under their onerous ARM loans).

HONESTMAN

But that is just my point.. Why is there so much resentment on this board.. If you bought you have your reasons good luck. If your not buying (much like me ) and renting.. You have your reasons.. Each states there side with facts . Why is there a need for so much ill will? And unrealtor is right.. People who have a differing opinion on this board get slammed with insults more often then those who (like me) feel that this market has a long way to go before they should buy..

Renee

Honestman.. French are you for real.. Just because I have a French first name means nothing and again my point. I am not French. I am a US citizen born here and My husband was this close to dying on 9/11 so I am more patriotic then most.. your attitude is disturbing

Renee

anon: I do not think anybody wishes harm on any body else. but the reality is simply this.

The down turn in prices is going to hurt many people, especially those who have been reckless;the more prudent should be fine assuming they are still employed.

But staying employed is not a function of the housing market necessarily, unless you are employed in that industry or a related one.

Job insecurity is a fact of life today, and I am amazed so many people ambushed themselves by getting caught up in this now ending housing madness.

I think that perhaps what may cause soem people to be gleeful, is the fact they they and this applies to myself as well, have listened to so much nonsense over the last few years. Including as the other poster said loser renter, wannabee homeowner, anti-American (yes believe it or not), dumb, stupid afraid, doom and gloom, cannot afford it, the list is endless.

Now that the market is tanking, there is naturally a human tendency to gloat, and I myself have to keep that in check.

That being said however what is galling to myself and others who are maybe more robust in their postings, is the trend that we are seeing now, whereby former real esate bulls who now acknowledge that the bubble is bursting, are asking that something be done, that people be bailed out, that there will be suffering, and because of that, we cannt have the market continue to go down.

Where was the sympathy for the buyers who said hey I have 20% to put down, I have closing costs, I have an emergency fund, I have done all the right things, I played by the rules, yet they were shut out by so called investors or flippers, or some foolish people who decided to go with the no money down I/O,I will pay full price, because it will be worth more next year, cause Ciny my broker at Weichert told me so.

No, no sympathy there, just lots of pontificating from lots of clueless people parrotting rhetoric from the real estate industry about how the market has changed, and all the other nonsense that passed as knowledge.

Now to prevent the collapse in prices, we the people who have not purchased, our being asked to be compassionate, but not only compassionate, but to soemhow bail these people out, and this at our expense, because the only way these people can be bailed out is for us to buy at the prices that will keep them from going uunderwater, and of course we will need to keep this scheme going by expecting the next generation to continue to pay over inflated prices, and on and on and on.

Any you see that is not going to happen, it is inherently unfair to ask us to pay for other peoples mistakes.

Yes there is blame to go around, realtors, mtg brokers, appraisers etc, but at the end of the day it is personal responsibilty. You guys bought a hosue with no money down, you guys bid up prices, you guys went with I/O only mortgages, you guys believed the hype that real estate only goes up, you guys sucked the equity out of your homes for whatever purpose, you guys bought second homes and investment properties, thinking it would be a quick road to wealth and riches.

You guys did these foolish things, not me, and not other posters on this blog.

We will not pay for others foolishenss, to try and pull at our heartstrings now, in order to save somebody elses hide, and at our expense is insulting. And that is perhaps why you see soem of the giddiness and glee on this site.

Renee: How do you measure patriotism? And I would say that the families of those who died on 9/11 and the workers who are ill from working at the ground zero site, would not be overjoyed with your “this close” comment. Your family’s experience pales when compared to theirs.

My apologies to Grim and others, but could not let it go. Great blog here.

I understand it completely. I was told over and over by my husbands family that “that is what you pay if you want to live here” no matter how many stats I threw at them they laughed at me.. My husband and I almost bought a house last year.. Our broker kept saying we could do it with this great Option Arm mortgage.. We read the fine print we looked at the stats we decided to wait.. Everyone has this option. And I too have been on this board for almost a year now. I know about the wannabe comments.. But really that kind of what I am driving at.. Present fact give stats No this insulting stuff that really has no busniess on this board. If you have been here long enough you know How it was when it was first started then you know there was more fact giving and less insulting going on. And really your responsible for what you do and say not your realtor, parents or boss.

I had 3 friends die on 9/11 (2 whom I habve known for 25+years) and if not losing my husband isn’t good enough for you then maybe that will be. And I don’t think I was comparing myself to anyone.. What is with this board attacking people

Renee

Again, totally inappropriate.

How about that real estate?!?!

HM

“My husband was this close to dying on 9/11 so I am more patriotic then most.. your attitude is disturbing”

I stand corrected. I did compare myself to others. Having read it back. So the comment by anon was justified. My apologies for getting upset

From NJ Gal:

Reinvestor, frankly, your comments are to the extreme other side. Just as you say you believe all people who post here want to see a downfall for anyone who owns real estate For one thing, this is patently untrue…You, in fact, strike me as one of the perpetrators of the great “class war” you talk about – it seems from your comments that you believe that everyone here is just a pathetic, renting loser. So don’t be so quck to criticize every poster on this board.

I challenge you to find one post where I ever called someone a pathetic loser for renting. You won’t because I’ve never ever said that.

I, on the other hand, have been called every name in the book even though I’ve never responded in kind. Look at what Pat did today. An anon came on to suggest that there are alternative ways of looking at the real estate situation and she suggests that he needs to wear tinfoil hat as an alien protection helmet; a great way to foster discussion.

You don’t seem to have a problem with that as you’ve not commented on it, but instead you want to take me to task over something I’ve never said. Why is that? Do I detect some bias?

RE:

You are one of the contrarians on the board that is not a troll. We need your input. Thank you for making the effort to post here.

chicago

There is a difference between wanting to buy low and wishing other people harm.

I just want to buy low. I really don’t care what the seller’s circumstances are. If they own their house free and clear, good for them. If they’re levered up to their eyeballs, too bad.

Everybody in the transaction makes their own choice and none of us can force anyone else to do anything.

you have to, to some degree, blame the marketing/bs machine that convinced millions to get it. while personal responsibility is first and foremost, inaction on the part of regulators and greediness of lenders has to bear some of the blame for the people who won’t/can’t support their mortgages.

J

Your earlier comments certainly came across as that, with all your talk of a class war. If you didn’t mean that, I apologize.

With the exception of a few people, most people on here are none of the things that you and many trolls suggest, be it bitter renters or hoping for a massive downfall in which people lose their jobs, etc.

It seems that the financial decisions of the real estate bears (and reasons for them), which often differ vastly from the financial decisions of the “herd” make you and many other people very uncomfortable. Frankly, I have rarely seen a comment from the “anons” you defend that presents factual, statistical information. So if people react poorly to them, it’s somewhat understandable.

skep-tic said…

“There is a difference between wanting to buy low and wishing other people harm.”

I totally agree. Their situation is not my concern. If they bought 5 properties, it was done with the purpose of making a profit. The market giveth and the market taketh. Some people buy low and sell high, others do the opposite. That’s what makes any market. It is called the Real Estate market, not a one way street to astronomical, unrealistic, eternal gains. I’m only looking to buy long term value, not looking to flip. It is not readily available at this time, though it will be.

BC Bob

Frankly, I have rarely seen a comment from the “anons” you defend that presents factual, statistical information. So if people react poorly to them, it’s somewhat understandable.

Funny how you just simply ignore and gloss over the insults that were put against one of the anon’s today. Again, this anon just merely stated that he did not view the real estate markets in the same manner as some here did, but was met with an outrageous insult delivered by a popular poster on this blog (Pat). You won’t even acknowledge that this was done. Instead you justify it by blaming the victim by saying the insult was “understandable”.

At least we know where we stand here. I expect no fairness or evenhandedness.

From Chicago:

You are one of the contrarians on the board that is not a troll. We need your input. Thank you for making the effort to post here

I appreciate that Chicago.

Peace

Sorry Reinvestor, I missed that comment from Pat. But if you reread, I didn’t absolve everyone on this board – certainly we know that there are some people who are regular posters that behave as badly as trolls. But my complaint was your statement over the class war.