From Marketwatch:

New home sales rise 4.1% to 1.05 million pace

Sales of new homes increased 4.1% in August to a seasonally adjusted annual rate of 1.05 million from a three-year low in July, the Commerce Department reported Wednesday.

It was the first increase in new-home sales since March.

Sales are down 17.4% in the past year and are down 23% from the peak last July.

Sales in May, June and July were revised sharply lower. July’s sales pace was revised to 1.009 million, the lowest since March 2003, from an earlier 1.072 million.

According to the MarketWatch survey, economists were expecting sales to fall about 3.4% in August to a seasonally adjusted annual rate of 1.036 million. The August result is about 1.4% higher than expected.

The supply of unsold homes dropped 0.4% to 568,000, representing a 6.6-month supply at the August rate from 7.0 months in July.

The median sales price of a new home fell 1.3% year-on-year to $237,000, the first year-on-year decline since 2003. The sales price does not reflect the massive incentives builders have been offering to close deals.

…

Despite the sales increase in August, there’s little reason for near-term optimism about new home sales, economists said.

From the Census Department:

NEW RESIDENTIAL SALES IN AUGUST 2006 (PDF)

Sales of new one-family houses in August 2006 were at a seasonally adjusted annual rate of 1,050,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 4.1 percent (±15.5%)* above the revised July rate of 1,009,000, but is 17.4 percent (±11.0%) below the August 2005 estimate of 1,271,000.

The median sales price of new houses sold in August 2006 was $237,000; the average sales price was $304,400. The seasonally adjusted estimate of new houses for sale at the end of August was 568,000. This represents a supply of 6.6 months at the current sales rate.

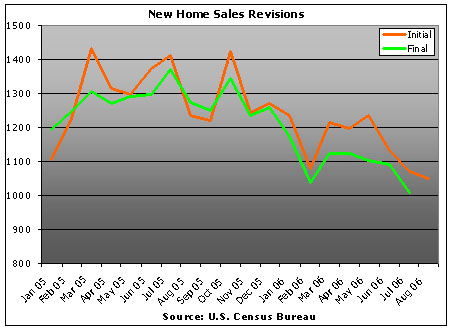

Keep in mind these numbers are being consistently adjusted downwards, some times significantly, in hindsight. Can the downward adjustment trend be any more obvious?

New Home Sales (in thousands)

January

Initial – 1,233

Revised – 1,173 (Down 4.9%)

February

Initial – 1,080

Revised – 1,038 (Down 3.9%)

March

Initial – 1,213

Revised – 1,121 (Down 7.6%)

April

Initial – 1,198

Revised – 1,121 (Down 6.4%)

May

Initial – 1,234

Revised – 1,101 (Down 10.8%)

June

Initial – 1,131

Revised – 1,091 (Down 3.5%)

July

Initial – 1,072

Revised – 1,009 (Down 5.8%)

Update: Added a graph of the New Home Sales Initial and Revised Numbers

Some major cooking going on.

Powers that be need to keep the illusion, so the ecomoney doesn’t go into a recession.

Damn I can smell the garlic and olive oil from here.

SAS

Numbers being adjusted significantly downward in hindsight..

April

Initial – 1,198

Revised – 1,121 (Down 6.4%)

May

Initial – 1,234

Revised – 1,101 (Down 10.8%)

June

Initial – 1,131

Revised – 1,091 (Down 3.5%)

July

Initial – 1,072

Revised – 1,009 (Down 5.8%)

Does anybody else just have a fundamental problem with the consistency of those revisions? I’m actually putting aside the fruadulent support that I do agree seems to be occurring…and only talking about the reason for publishing it in the first place – WTF is the value of a statistic that is consistantly off by 5-10%? Why publish it? Why bother? It has no value at all…

Just a waste of time.

Tend to follow the UK a lot (family there) and this article on Ireland, a booming market, is interesting:

“House prices falling by up to 20 per cent in Dublin”

“The extraordinary glut of houses coming on the market this month has led to widespread falls in the prices being demanded by estate agents….

While the downward trend is most evident across more expensive houses on the prime southside suburbs of Dublin, the Sunday Independent has uncovered significant falls in asking prices in other areas of the city.”

firstrung.co.uk/articles.asp?pageid=NEWS&articlekey=2954&cat=47-0-0

It seems like it will be easy for this “gain” to become neutral once it is revised next month

Read the PDF carefully. Pay attention to the error rates they’re claiming.

For the New England MOM and YOY data, the report claims +21.7% and +5%, but at the 90% confidence level, the error rates on those figures are 47.4% and 40.7%!

Those are HUGE error rates.

You folks crack me up. If the statistics agree with your thesis, you take them as the gospel. If they don’t, they’re “cooked.”

Frankly, I think everything needs to be analyzed closely. That’s why I’m not quite willing to jump on your doom-and-gloom, Japan-all-over-again bandwagon.

As I’ve said before, there’s a lot that can happen between now and the bottom of this market, where ever that bottom is. Few of you seem willing to accept the view that this may not play out quite the way you are hoping.

Another BW article.

The Most Affordable Housing Markets

Actually, I am kind of tired of reading such articles. It is basically a way of saying, if you can’t afford high market, look for cheaper markets. I guess they are probably still in there is no-bubble territory.

I never said anything was cooked. The point I was making is that one often needs to look much deeper than the headline numbers.

The media jump all over this figures, and seldom to people actually dig into the reality.

July was initially reported at 1,072,000.

Analysts expected August to come in at 1,040,000.

July was downward adjusted to 1,009,000.

August came in at 1,050,000, beating estimates and beating the “new” July numbers.

jb

Also, remember that many homebuilders were offering ridiculous incentives. If you weren’t informed, thought it was a good deal, you might be tempted to buy a new place, and certainly a new place over an existing home. Homebuilders have more room to play with prices, incentives, etc. And there was a lot of media about a “buyer’s market” (even though I don’t think we’re in one yet). I don’t think this is that surprising, but I doubt it will continue.

maybe these numbers will be revised downward; maybe not. one thing we do know is that builer sentiment has dropped off a cliff and builders are facing immense pressure to move inventory. it would not be a surprise if sales inched up in light of this. as njgal points out, there appear to be good deals out there relative to last year. there will be buyers jumping into this market at each stage on the way down– the question is whether more are scared off by the bearish trend or more are enticed. it would take a huge surge of buyers to reverse the trend of falling prices at this point, and this does not seem realistic even when these ostensibly positive numbers are taken into account

I am the one who says they are cooked.

You bet they are cooked or perhaps “tweaked” is a better word. A fellow blogger pointed out the error rates. Thats basically a disclaimer saying…”yeah we tweaked the data the best we can to say what we want it to say”.

One can always “tweak” the data to say what they want it to say, I a degree of course. And then the media idiots will jump on this, pump it in an optimistic manner, change market psychology, and wala… you get yourself some new bagholders.

Aren’t you the one who tried to tell me there is no meth market in NJ and no heroine market in NYC?

:)

SAS

Let’s face it, since January initial new home sales numbers have been adjusted down EVERY month for 7 straight months by 6.1% on average. Does anyone really believe the current numbers are accurate? The builders needed these numbers to help home buyer confidence. I am actually suprised though that there wasn’t a further sales pick up with all the incentives and discounting going on, and current lower interest rates

Aren’t you the one who tried to tell me there is no meth market in NJ and no heroine market in NYC?

Putting words in my mouth, SAS. I don’t purport to know anything about either drug market, thanks.

Q: Why does housing always goes up 100% in the Irish capital?

A: Because it’s doublin’

InfoDiva Says:

September 27th, 2006 at 11:25 am

You folks crack me up. If the statistics agree with your thesis, you take them as the gospel. If they don’t, they’re “cooked.”

Info: You are [of course] correct, and I agree that you cannot selectively cite or ignore data that support/refute arguments.

That said, I found Ivy Zelman’s September 6th analysis from her CSFB launching pad really inciteful. I don’t like the word “cooked”, because it implies a unsupported allegations of purposeful fraudulence. However, it is fair to describe some of the numbers as prone to inaccuracies that are systemic.

She was targeting more prices versus volumes, but read this little excerpt regarding New Home sales numbers….

2) Cancellations – As we highlighted earlier, new home sales data is reported on a gross order basis, meaning that cancellations are not stripped out of the results. While this is most important when analyzing sales unit data, it also can have a significant impact on median home prices. For example, if a homebuyer put down a deposit on a $250,000 home in March 2006 and cancelled later that month, that sale would still be factored into March’s new home sales data and pricing data despite the cancellation. If that builder then resold the home in April at a 10% discount to the original price, the

resale would not be included in April’s sales results. Therefore, we would have a situation where March’s unit results would be inflated and April’s median price would not reflect the price cut needed to sell the cancelled unit. As these “resold cancellations” begin to represent a greater share of total new home sales, this will increase the divergence between reported prices and effective prices.

First of all, even if it’s accurate, it’s just a tiny upward blip in a major downward trend. The RE bulls can spin it however they want, but when I look at Grim’s chart, my reaction is “so what”? One month does not a trend make.

After the Dow crashed in 1929, it still had some good days. It wasn’t like it was down every single day.

InfoDiva Says:

September 27th, 2006 at 11:25 am

You folks crack me up. If the statistics agree with your thesis, you take them as the gospel. If they don’t, they’re “cooked.”

LOL! Did you somehow scroll past the chart above? Revised downward almost every month for the last 20 months, in May by over 10%. Perhaps you need corrective lenses.

I meant “insightful”, but I think “inciteful” would be accurate as well :)

Forget the headlines, read the revisions. I don’t take anything out of the headlines.

To really get a good feel for the pulse of the market,just look at the mortgage purch apps.(not refi). For any market to continue a bull run, there has to be new $/sponsorship for this market. The chart shows that there is a drip of $ coming into this market. Incidentally, this market needs a flood of $. As a matter of fact, it needs a tsunami of $. Until this changes, buckle up.

Moreover, the report does not measure industry(30+ percent) cancellation rates.

InfoDiva you need to stop drinking ‘the MSM headline’ kool-aid and go crunch some numbers. Overall industry statistics are bleak and getting worse. You would know that by now if you actually got of your arse and did some research rather than feed your brain the crap the MSM serves you.

Putting words in my mouth, SAS. I don’t purport to know anything about either drug market, thanks.

The point is….

Things go on all the time that don’t go reported or go reported incorrectly. i.e the drug trade.

SAS

Stop with the personal attacks please.

It kills the board vibe.

Here you go InfoFiva; even the gov’t says it has little confidence in its report:

According to marketwatch.com, “The government cautions that its housing data are subject to large sampling and other statistical errors. Large revisions are common…. The standard error is so high, in fact, that the government cannot be sure sales increased at all in August. The 4.1% increase is **statistically meaningless**….”

These things are estimations, estimations based on models.

When the data shows a consistent string of downward adjustments over an extended time period, the model is suspect.

InfoDiva you need to stop drinking ‘the MSM headline’ kool-aid

You miss my point entirely.

I don’t drink ANYBODY’s Kool-aid, not even this board’s. Kool-Aid comes in many flavors, by the way.

I am merely suggesting–and as you can see, mere suggestion leaves one open to attacks on the state of one’s eyesight and judgment here–that the total housing and economic picture may be just a bit more nuanced than many on this board believe it to be.

lol InfoDiva…

I can understand where you are coming from, but also ask yourself…

“Are these attacks, not really attacks, and maybe I don’t understand something?? ”

Like I use to say to my third wife..”someone has to be weird to make you look normal”.

Get the drift?

btw Diva, speaking of wife, my current wife gets her nails done at Dashing Diva on the uws.. you should look into it. They do good work. :)

SAS

Diva,

one more thing:

“Putting words in my mouth”

I think I may have gotten u confused with another. Sorry.

SAS

Keep it tame please.

I haven’t had to delete anything yet and I’d like to keep it that way.

Personal attacks and non-topic arguments will no longer be tolerated. I reserve the right to edit or delete comments.

jb

InfoDiva the bleak industry data do not reflect any nuances; it was overbought during the last 3 years and as a result oversupplied today; with historically low savings rates, falling home prices, and high indebtedness coupled with the impending credit crunch these risk factors engender, a lot of families are going to be financially ruined as a result; we were not hoping for this outcome; we were trying to warn others to prevent it.

Headline reports like today’s, although warm and comforting to the sheeple, misinform them and coldly distorts their sense of reality. As a result, they make poor long term financial decisions based on artfully contrived assumptions such as new home sales up 4.1%– see, everything is fine honey; the market will turn next year; lets purchase that vacation home today.

What’s more, your laissez-faire attitude at this juncture **the begining of this ginormous bubble’s deflation** is simply astounding. It’s like we are all heading into an iceberg and you’re saying ‘what iceberg? I don’t see any iceberg; therefore, everything is going to be just fine. The rest of you are a bunch of kooks.’

Calculated Risk has a better graph of the NHS revisions.

NHS Revisions

jb

This report is truly phenomenal. Not as a report, but as a source of insight into how dysfunctional our financial and news reporting systems are.

Here is just one headline relating to the report:

Treasurys drop gains on strength in home sales – CBS Marketwatch

Who the hell made decisions based on the “strength” of home sales when there was no strength?

As has been noted, the report is both wildly speculative and almost certainly wrong on the upside. It really is insane.

For those who want to go a little deeper, it’s even more bizarre. Much of the “increase” in sales is related to a startling jump in sales in the Northeast. Now the last time I checked, I lived in the Northeast and every builder I know of is crying in his beer.

It actually puts Aug. 2006 sales ahead of Aug. 2005. Seriously. Despite every other month being way down, this one spiked up? Based on what? Were the incentives (a new car!) really good enough to push sales up past last year’s?

Finally, that’s a very nice chart JB, CR better watch his back.

One more thing,

(Since everyone was piling on)

Info Diva said:

“Few of you seem willing to accept the view that this may not play out quite the way you are hoping.”

That statement implies that we are rooting for disaster. It’s a very popular rhetorical tool these days more commonly known as demonizing your opponent.

It also is exactly what people who don’t want to face the reality of difficult decisions and hard choices do.

I, and I think most of the posters here, hope to heaven that this does NOT play out badly, but only a fool wouldn’t consider the possibility.

Maybe a magic fairy will come along, wave her magic wand and make everything all right.

How come it was perfectly fine in the past 3 years or so for home buyers to say, you know this house I bought last year is today worth 100K more, I made a 100k in a year just by buying a house.

Now lets flip this to you know the house I bought today, if i had not waited and bought last year, it would have cost me 100K more. I just saved 100k by waiting a year to buy.

So it is perfectly fine to brag that you made 100k in a year, but somehow its wrong to brag about saving 100k in a year, because people are going to get hurt.

Where is the logic? Where is the consistency?

That is why some people on this forum, and I am guilty of it myself sometimes over react to other posters.

In order for some home owners not to get hurt, (and its probably many homeowners), then those who do not currently own a home have to be hurt, and that hurt comes by paying an over inflated price, to keep current home owners from a crash and burn scenarion.

Wny us? We played by the rules, we saved our money, we did not get into credit card debt, we do not buy $300 jeans. Why should we pay? It really is as simple as that.

Hey, $300 jeans are back. Has anyone seen any trend data on high end jeans sales? Maybe we could suggest it to the Conference Board as a LEI for their models. Just a thought. :)

JM

Forbes beat you to it..

The Price Of Living Well

Over the past 12 months, our Cost of Living Extremely Well Index (CLEWI) climbed 4%, keeping pace with the Consumer Price Index’s 3.6%.

You know, I have finally learned not to give a horse’s ass about most peoples opinion.

I have learned to read and act on the fundamentals, I know people are irrational when it comes to greed, but the Laws of the Universe still apply. Just because one is ignorant of the fact does not mean the fact does not exist.

So, THE BUBBLE WILL BURST! Prudent people will survice, the ignorant and stupid will truly get hurt.

AND YES the NUMBERS ARE COOKED!

I did time as an intern at the FOMC.

The election dictates the numbers must be cooked.

’nuff said.

-Sapiens

Adding on to what delford said, what’s wrong with wanting prices to drop? Imagine if a Toyota Camry cost $20k in 2001. Then, due to a buying frenzy, Toyota jacked prices up 20% per year for 5 years so that a Camry now costs $50k. I want to own a Camry, but I’m not going to pay $50k for it. So while I wait for demand to drop, I’ll drive a beater and let everyone who’s paying $50k know what a stupid decision that is.

#38

You mean those who paid 10K for an XBox 360 last Christmas? :)

Welcome to Real Estate LaLa Land. You will be seeing more cooking and brewing of figures a la Anderson & Partners style with Enron, and numbers to try to gain whatever confidence they can as final desperate efforts .All those shennanigans will be shortlived because look around you everybody, in every nook and corner in the whole state there is development and building going on like we have never seen before and those properties are not yet in the market. Dont believe everything you see because a lot of statements and figures are rigged.

What’s more, your laissez-faire attitude at this juncture…

It’s not a laissez-faire attitude at all. Trust me, I see this market going down at least over the short term.

On the other hand, I’m not about to advise otherwise comfortable folks to sell in a panic, either, for fear that their houses will be worth 40% less a year or two from now.

And yes, there have been many, many on this board who have, figuratively at least, rubbed their hands in delighted anticipation over the “assets” they expect to acquire in the debacle they are convinced is on its way, and the pain they think will be inflicted upon “greedy grubbers.”

Look, I’ve been around for more years than I care to admit. Long enough to know that complicated things rarely play out simply and predictably.

Don’t forget the old saw about city planners back in the 1890s who predicted that our cities would be knee-deep in horse manure by 1920 if something wasn’t done about the horse problem.

“InfoDiva Says:

September 27th, 2006 at 8:06 pm

Look, I’ve been around for more years than I care to admit. Long enough to know that complicated things rarely play out simply and predictably.

Don’t forget the old saw about city planners back in the 1890s who predicted that our cities would be knee-deep in horse manure by 1920 if something wasn’t done about the horse problem.”

This is more than an innovation problem, this is a GLOBAL political problem. After all, what is the linchpin of the currency we now use?

Although your example may appear clever to you, note that innovation is not usually accepted with open arms, there are large vested interest in the status quo that will not accept change with open arms; and why would you accept change if you are an elite at the very top? Don’t you know, it’s good to be the King.

We shall see.

Cheers,

-Sapiens

Maybe a magic fairy will come along, wave her magic wand and make everything all right.

…or the NNJ version of a magic fairy.,, a recent college gradate in his 20’s relocating to NJ to take a job on Wall Street making $200k per year, who wants nothing more than to drop half-a-mill on your starter cape

From the WSJ:

http://tinyurl.com/jelvq

…Sales pace levels in July, June and May were all revised down; those adjustments were likely due to buyers backing out of sales contracts, according to MFR Inc. chief U.S. economist Joshua Shapiro. “Assuming that the August sales rate is revised lower next month, which seems quite likely given recent patterns, this report continues recent trends of data on actual housing activity showing continuing declines,” he wrote in a research note.

This comment is in response to the bandwagon issue, buyers versus sellers comments and statistics interpretation versus statistics as truth comments.

Many, if not most of the commenters on this blog have been around the block. Not dummies. They’re not here because they want to sit on a bandwagon. …Well, I’M not here to sit on a bandwagon.

Not many of these posters need to be told that there is a lot that can happen between x and y. It’s actually pretty funny to think about, because that’s what folks here have been discussing for a LONG time. All the things that can happen…politics, possible terror attack results, oil issues, taxation issues, the elimination of the middle class, the impact of just about everything. The one thing that remains is the genuine willingness to question, in the open-ended scenario.

And facts DO help. InfoDiva, if you want to examine viewpoints, try something. [And it’s just a suggestion. I’m no expert for sure. Chicago is the nice guy/peacemaker, not me.] Maybe on your first post #7, you could have deleted the first two sentences. The rest got your point across, the first simply started the backlash, and so were instigating. I think then, we could have had a REALLY good discussion of why people don’t trust positive numbers in a negative economy.

The concept that “InfoDiva” is trying to describe is called “confirmation bias.”

http://en.wikipedia.org/wiki/Confirmation_bias

And I agree that it’s an easy trap to fall in. Certainly I’ve fallen in it.

That said, if we weren’t talking about a single data point with a track record of being estimated too high, I’d be more sympathetic to InfoDiva’s POV.

Just my $.02.

[RentinginNJ Says:

…Sales pace levels in July, June and May were all revised down; those adjustments were likely due to buyers backing out of sales contracts, according to MFR Inc. chief U.S. economist Joshua Shapiro.]

Rent: C’mon man – show me the love

OT:

Pat: nice guy?

Jeez – no wonder I never had a date in high school :( :p

Yeah, but you got paid in spades, right? Just had to be patient.

Yeah, but you got paid in spades, right? Patience pays off.

DOPPLEGANGER SORRY

RentinginNJ: or the NNJ version of a magic fairy.,, a recent college gradate in his 20’s relocating to NJ to take a job on Wall Street making $200k per year, who wants nothing more than to drop half-a-mill on your starter cape

If that was the belief/story, things would be fine. The problem is that the reality is far worse. The median home sale in many towns is priced at 9x the median household income of the people living in that town. This means that the notional $500K property you mentioned is being bought by a household making south of $60K a year. And the only way this household can pay for the property – in combination with things like property taxes and home maintenance – is by taking out an interest only loan.

Pingback: Anonymous