Decided to spend some time going through the tax records to see if I could determine how condos were affected during the last real estate crash. I’m sure many of you have spent time working with these systems to get an idea of prior sales or to snoop on neighbors.

These sales records represent a history of the real estate market over time. However, trying to clearly illustrate how the market reacted over time using these sales is not easy. Homes are not identical and sales are infrequent. In order to track the market you would need to find a number of comparable homes that have sold multiple times over the period.

Condos and Townhomes are better candidates for this type of analysis. Units are relatively similar, and large scale developments offer numerous sales data points over time.

I pulled the tax records for a handful of large-scale developments that were built during the last real estate boom to see what I could find. The first development that I took a look at is located in Clifton. Selected this one because I remember it being built in the mid to late 80’s. I’ve grouped these together by street and assessment value.

The next development is also in Clifton. At this point I was trying my hardest to try to think of any large-scale development I remember being built at that time. I was hoping that this building would have offered as many datapoints as the complex above, but unfortunately it did not. Interesting nonetheless.

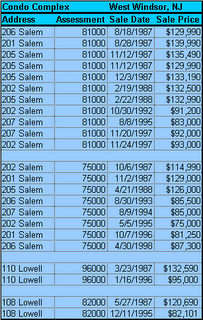

At this point I had racked my brain trying to remember the names and streets of condo developments. I spent some time flying around with google maps trying to pick out large-scale condo developments that fit the timeframe. Just when I was about to give up, this one popped into mind. This is very large scale development in West Windsor called Canal Point. This was built during the peak of the last bubble. I believe this complex saw auctions in the early 90’s.

There are a few points to take away from this:

1) Prices can fall dramatically. We’re not talking about a stagnant market where real values are eroded over time by inflation, but large nominal price declines. None of these numbers are inflation adjusted. Can you imagine buying a condo for $130,000 and it being worth $93,000 ten years later? Real estate goes down too.

2) Don’t be lulled into a false sense of security because you are planning on staying for 10 years. In many of these cases, the market declined steadily for ten years before hitting bottom. It took another bubble for them to break even.

3) There have been a number of comments lately stating that owners will simply take their properties off the market during a downturn, they just won’t sell. That simply isn’t the case. Many of these owners sold at substantial losses.

Caveat Emptor!

Grim

If anyone knows of any mid to late 80’s condo or townhouse developments, please post the name/address up. I’d like to come up with a more comprehensive table of condo sales over that time period.

grim

that is strange i saw that evergreen place they were asking

375 for a 2brm place it was s-hole.

and i heard it was in a fire and rebuilt that is why it was advertised as new, it was right off a main road and very close to passaic

Click any of the tables to enlarge.

As much as I’m amazed at the price drops, I’m also surprised at the amount of turnover near the peak of the late 80’s.

I guess the speculation was as rampant then as it was now?

Nice work Grim!

Rich

Mews complex in South Orange. Built in 1986 about 75 units. It’s downtown and right next to the midtown direct train station about a 32 minute commute to Penn. Great set of data to do your comparison.

a friend of mine was just telling me in the condo complex she’s lived in in morris county there are 6 identical units on the market. one just sold for $300k. peak price sold was $330k mid last year. that’s a 9% haircut and there are still 5 sitting for months. i expect at least another 15-20% decline over the next 24 months on average for condos.

grim,

You could pick a number of them along route 1 in South Brunswick and North Brunswick. Also in Highland park ther is a condo tower on Ainsworth, I remember 2 bedrooms going for 65K in like 1993 that was originally 130K I think. Maybe Pat can give some details? In Sussex Hampton commons off of Rte. 206. I will get you examples and road names for Sussex and Warren. I might be able to get some for Morris as well.

The Castle Ridge townhouse complex in East Hanover, Morris County was built in 1987. e.g. 69 Castle Ridge Drive, East Hanover, NJ 07936.

Grim — maybe you can do an analysis on this complex???

grim said…

Click any of the tables to enlarge.

8/17/2006 04:27:21 PM

Is there any way to reduce the tables if you think the images are too big?

Wow, the flippers were out in droves back then.

Grim:

The quality–and quantity–of your research and presentations truly boggles the mind. I just want to thank you for everything you do to keep this site informative, edifying, and entertaining. (golf clap)

-Jamey

Grim ..I was in Mt. Holly in the 90s..but if you want Central Jersey condos from back then here are some.

-Lawrence Square Village, Lawrence Twp.

-Twin Rivers, E. Windsor/Hightstown

-Foxmoor (many developments) big one in Hamilton/Robbinsville was there back then, has all style units.

go to http://www.foxmoor.com

-Society Hill – big one

——-

There are so many in Central Jersey, maybe do you want ones that have only condos, or ones with condo and townhouse sections?

Pat

“Can you imagine buying a condo for $130,000 and it being worth $93,000 ten years later?”

It was worse than that. I bought a condo in 1993 for $70,000. The sellers had purchased it in 1987 for $131,000. Bergen County.

I know a friend lost money selling her condo at Ledgewood Terrace in Little Ferry (Bergen County)07643. The units are on Liberty Street.

Grim and all,

My mother really, really wants to buy a place in an active retirement community. I have been looking for info on resale values of these communities. Can any offer either educated opinions or data re: how hearty these communities will be in the future. Do you think they will go the way of condos? Less stability than SFH? Or with the boomers still to retire, it is a good investment? I have been trying to convince her to hold off at least a year to see where things stand. In Monroe, our dear friend Toll has a retirement community he is planning 1200 units (a third have sold since 2002). What can I tell her to get her to think this through…Please help me save my mom!! :)

http://www.americascondos.net

/newjersey/newjersey.htm

http://tinyurl.com/n5nrl

Try that, too. It has city and condo name.

Pat

tracking 3 condos near me. all identical and been on the market a couple of months. peak price sold $450k about 8 months ago. here are the asking price stats:

original:

$429k, $419k, $409k

current:

$419k, $392k, $389k

all still sitting. i expect further price erosion as the winter months approach. the $389k person has been dropping more frequently and aggressively = more motivated to sell and that will bring down the rest. keep everyone posted.

Hilltop Terrace – Red Bank

Not new construction, but a conversion during the late 80s boom I believe.

I bought there in 1994 for $95K and I know other units were bought around the same time for a bit less.

I believe the person I bought from took a sizable loss, and I remember long-time residents telling me the units were selling $140K+ in the late 80s.

I know someone who paid $120,000 for condo in 1988 then resold for $85,000 in 1993.

Prices do go down. WOW!

YOU BUY NOW YOU WHERE YOU ARE A BAGHOLDER.

YOU WANT TO BAIL OUT A GRUBBING IN OVER THEIR HEAD SELLER. LET’EM SINK.

OR GO AHEAD BE A BAGHOLDER AND LOSE MONEY OR GET USED TO SITTING IN THAT HOLE FOR AT LEAST A DECADE TO BREAKEVEN.

777 springfield ave, summit — built in 1975

768 springfield ave, summit –built in 1977

Don’t know if it helps because they were not built in the 80s.

“Economists generally agree that the housing market’s rolling over. There remains a debate about the magnitude of the decline and its impact of the overall economy. Economist Joel Naroff said it is no longer correct to describe the weakening housing sector as a slowdown. ‘Rout’ is now the proper word, he said.”

“‘Things seem to be getting worse. By the end of the year, we will likely be looking at starts off at least 20% and permits 25%. Is that a bubble bursting? You tell me,’ Naroff

CAN U FEEL THE DESPERATION BUILDING?

YEAH………

BLEED’EM DRY

I realize that it’s difficult to obtain single family home data that allows an apples-to-apples comparison, but are condo prices a good substitute?

Seems to me that the fact that condos are often bought by investors, while the vast majority of SFHs are owner-occupied (at least around here), would mean that condo prices are far more volatile.

Grim,

Check out Cambridge Heights or Society Hill in Mahwah, those were built in the 80’s.

http://www.foxmoor.org

/statistics.htm

Andover Glen: 312 condominium units

Hampton Chase: 140 condominium units

Wyndham Place: 240 condominium units built 1988

Total Units: 692 units

Notting Hill Towhnhomes: 366 townhomes

Candlewood: 89 townhomes

Miry Crossing (VI): 91 townhomes

Miry Crossing (VIIA): 35 townhomes

Miry Crossing (III): 138 townhomes/condominiums

Sturbridge: 42 townhomes/condominiums

Brandon Hill (VI): 92 townhomes

Brandon Hill (VIIB): 33 townhomes

Carriage Walk: 108 single family homes

Total Units: 994 units

TOTAL FOXMOOR: 1686 units

Pat

So. Cal. In a Nutshell; Low Deposits, Spec Supply, Weak Demand & Falling Prices

JMP Securities LLC (Alex Barron 415-835-8955) BZH MDC MTHHousing – Industry Overview Aug 16, 2006 8:20:53 PM

Alex Barron, abarron@jmpsecurities.com, 415-835-8955

INVESTMENT HIGHLIGHTS

Southern California is showing increasing signs of weakness. Following ourlatest Florida trip, we recently spent three days in Southern Californiatouring the Inland Empire and San Diego. We thought it would be appropriateand timely to visit the Southern California market to compare and contrastcurrent market conditions in the single-family housing market to what we saw inFlorida. In many ways, California appears to be lagging Florida by a fewmonths. What we observed and the conclusions we draw in this report may insome ways have a bigger impact on the overall US economy and the publichomebuilders, given their exposure to this market, and will ultimately affectbuilder profitability in a greater way given the impact on the bottom line fromeach California delivery compared to a delivery in any other state. In a nutshell, there are four key takeaways that summarize the current situation inSouthern California in our view. 1) Home prices got too high, and homes are

incentives and steep price cuts to generate sales.

Home prices are too high, and homes are now unaffordable. Most of the communities we visited in the Inland Empire had prices ranging from the$400,000-$800,000 level. In San Diego, prices started in the $600,000 leveland went as high as $1.2 million. We found these price levels a bit shockinggiven that the Inland Empire is generally thought of as an affordablealternative to living near the coast in Orange County or San Diego. The temperature inland tends to be a lot hotter in the summer than near the coast,and several people have to commute over 1 hour to work. These price levelsseem to us to be excessive in absolute terms and we believe have now reached a peak. On top of the mortgage payment, buyers also need to pay HOA fees, realestate property taxes (typically 1.6-2.0%), plus Mello-Roos fees (taxes forinfrastructure development), all of which can be pretty sizable and have madehomes unaffordable, in our opinion, especially in the face of rising mortgage rates. Finance companies are now offering buyers 50-year loans as a way tolower their monthly payment. Builders are requiring extremely low deposits,and some are buying down rates or offering to pay the first few months ofinterest payments as a way to get buyers to sign up.

Minimal deposits are required to remain competitive. We were shocked to find out most builders only require a $5,000 deposit from buyers at the time ofcontract on homes with prices between $500,000-$800,000, with no otherrequirement until closing. This is effectively less than 1%! We had been under the impression that deposits were in the 3-5% range. When we checked in with company management from various homebuilders about this issue, we were

Page 1 of 3

told deposits in California were no different than those for the rest of thecompany and that they would be shocked if they were indeed less. When wepressed them on our findings, a few checked in with local division presidentsand came back to us saying that these low deposits were necessary to remaincompetitive since they had run into a wall selling homes because buyerscouldn’t afford a larger deposit. A salesperson for one builder told us thatwhen they tried to raise them to $8,000, they got pushback from buyers.

realitycheck, you have a very valid point, and I’ve been waiting for grim to get slammed for this, but as long as the discussion is focused on the near future of the NJ condo market, and doesn’t proport to predict all real estate in every situation…right?

Pat

purport ..spellcheck

p

as long as the discussion is focused on the near future of the NJ condo market, and doesn’t proport to predict all real estate in every situation…right?

Absolutely. But I’d really love to see the numbers for SFHs somehow.

Are there any large subdivisions of similar homes where the comparison could be made easily?

richinnorthnj,

Seems that Bergen County isn’t alone in seeing the slowest July in 10 years..

Home sales for July at 10-year low

Bay Area home sales last month suffered their slowest July in 10 years, a real estate information company reported Wednesday, reflecting a market where prices have remained high even as more buyers stay away.

In the nine-county area, 7,941 new and resale houses and condos sold in July, down 19 percent from June, and down 31 percent from July 2005, according to DataQuick Information Systems.

It was the slowest July since 1996, when 259 fewer homes changed hands.

I agree with realitycheck and Pat, condos and SFH are not apples to apples, but like Grim said finding apples to apples SFH’s is very difficult and condos are easier to compare. You almost have to know the SFH first hand.

I believe many more things can change in a house than a condo. You can take a house that sold for $250 in 1995 and is now listed for $750. If you just look at the #’s how do you know if there was ever an addition? Maybe every house on the block was redone to $2-3M range and the land alone is worth $750. Maybe they renovated the kitchen and baths and finished the basement. You can still get an idea of the inflation, but if you miss some of those things your “over inflated #” may not be as accurate as you would like.

Like anything, take it with a grain of salt; unless you know first hand and are 100% positive.

Fantastic work! Really interesting.

VHB

Linwood Park Fort Lee it’s co op so I dont know if you can get the data you might need to go though the mortgage records

Cliffside Park 07010

200 Winston Drive

300 Winston Drive

100 Winston Drive

The 200 & 300 built in the 70s at the former Palisades Amusement Park, each over 600 units. Most with Manhattan and River Views. Touted as Luxeury apartments.

The 100 built in late to early 90s

Lots of units to make comparisons easy

This is scary stuff esp since u say its not inflation adjusted and the value is in “current day” dollars.

–BM

My mother really, really wants to buy a place in an active retirement community…how hearty these communities will be in the future..

I think this is a case of “a falling tide lowers down all ships”. While some areas might fare better than others, I don’t see any market segment being immune from falling prices. In fact, an age restricted community just restricts your ability to resell the unit. The age restricted thing is basically a marketing gimmick aimed at securing building permits in a host community. “Let us build our complex because we will pay property taxes, but won’t put more strain on your schools”.

I think these places could be especially at risk in NJ for several reasons. First, there has been an age restricted building boom adding a lot of supply over the past few years. Second, NJ has a very high cost of living. Many boomers will be looking to leave the state for a lower taxes and an overall lower cost of living.

The Woodlands, West Orange

2 Ann Place

1989 – $150,000

1995 – $93,000

38% haircut

Adjusted for the magic of inflation (1995$)

1989 – $184,350

1995 – $93,000

50% haircut

Great job Grim!

rentinginnj

Thanks!! What you say definitely sounds intuitive and one of those gut feelings I have. I couldn’t believe it..one of the sales associates at another community (DR Horton) said to my mom and I quote “Don’t worry about selling your current place, take a home equity loan and use that money for a downpayment”. !!!! WTF…I was so angry when I heard that. Yeah, you don’t know if your current house will sell in this market, but since I have to close this office by the end of September, why don’t you just give me my sale and let’s move on!! Talk about unethical!! A senior citizen paying $1000 (taxes and maintenace) should then carry 2 mortgages too!! Sorry for the rant!

Any thoughts on the following? Hype? Realism? Awaiting your ideas….anon in Rutherford.

http://tinyurl.com/kyxqk

Grim,

Hats off to your original, thoughtful, insightful analysis. Would that nytimes reporters were so resourceful.

Not that I’m in the market for a house any more (maybe 2008?), but I still read your blog.

Valley heights in Clifton

cica: 1996

Cambridge Crossing Clifton

cica: 2000

Nice work putting together these stats!

Look out below, prices headed for the dumper.

Real Estate is cyclical in nature, I but you they are worth 500K right now…

but as long as the discussion is focused on the near future of the NJ condo market, and doesn’t proport to predict all real estate in every situation…right?

I have found streets in the town that I live in with homes that are all the same. Same house same lot size, same assesments. By pulling tax records I was able to find out that some of these home sold in 1987-1989 in the range of 150-180 and sold in 93-98 for 125-145. Doesnt seem like a big drop but considering the interest paid, maintenance, all the extra expenses that come along with renting, thats a lot to lose.

And I looked because I thought I remembered these homes selling that high in the late 80-s and I was right.

KL

FYI:

Grim has tax links on the main page under ‘Tools’ where everyone can do their OWN research of these condo developments.

You know, Caveat Emptor! And the best way to “be aware” is to educate yourself.

sleepy hollow condos in nutley NJ

erected in the late eighties. they were going for close to 300 about a year ago.

sleepy hollow condos are 107 -109 river rd in nutley nj

I’m sure Sleepy Hollow was built in the early 80’s. I used to hang out with the builder’s son then, who was working construction there for his dad over the summer.

He would always pray for rain…

jw

Grim,

How about the “Green Hollow” development in the Iselin section of Woodbridge, NJ?

My Old building in Downtown JC built in 1989 the condo we purchased 5 years ago was bought new in 1989 for $135K.. She sold it to us for $150 in 2001

How about Paddington in Mahwah?

grim –

your work is invaluable to me. I am an investor who I believe will profit by taking some positions in this. I don’t feel like broadcasting what I do to the world but in fairness it would be kind to share (though these investments are speculative) my thoughts with those who are helping me.

Would you like me to contact you and if so give me best way.

An appreciative fan.

My email address is listed on the main page.

nnjbubble@gmail.com

grim

Grim.

do you have any statistic on townhouse development in Mahwah, particulary in the Paddington section. I would like to sales in the time periods from 90’s to current.

Thanks,

grim: hate to be a party pooper – but when I see someone “relying” on information on this page, I think you should focus on “CYA”

Maybe you should have a large disclaimer on the front page here?

chicago

http://tinyurl.com/r5b8x

“High-end condos near top?

Demand for units is hot, but forecasters see a cooling-off period for sales.”