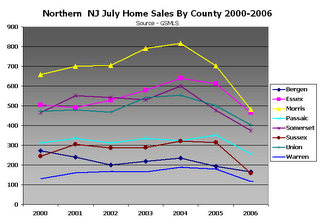

I’m posting this additional data based on a comment made to me on another forum. Someone accused me of selecting the date ranges I use in such a way as to accentuate the decline we are seeing. The comment made to me is one being made throughout the media, it is that the market is simply returning to normal. The author of the comment implied that the years I selected for my comparison, 2003-2005, do not represent a normal market, and that any kind of “normalization” in the market would be illustrated as a decline (Year-over-year or Multi-year).

In response, I’m going to post a multiyear comparison of July sales for the counties listed, the source is GSMLS. Data prior to 2000 is no longer available, so 2000 is the earliest comparison I can include. Thanks go out to the individual who provided me the July comparison numbers on such short notice.

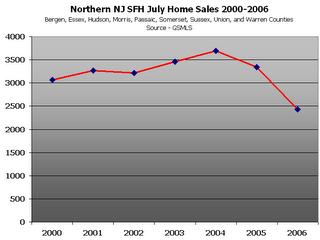

Overall Total:

(click to enlarge)

The Numbers:

Year – # Sales

2000 – 3063

2001 – 3271

2002 – 3216

2003 – 3458

2004 – 3688

2005 – 3338

2006 – 2428

Caveat Emptor!

Grim

Repost of the Bergen NJMLS data:

Here are the numbers for July, Bergen County ONLY. These numbers include SFH, Condos, Co-Ops & Twnhses.

The numbers mean the following:

Year Avg$ Med$ Sold UnderContract

1995 $229,172 $205,000 450 598*

1996 $269,956 $218,000 890 741

1997 $265,457 $218,000 1014 826

1998 $282,631 $222,500 1101 878

1999 $321,389 $250,000 1093 850

2000 $324,754 $260,000 986 842

2001 $381,572 $300,000 1059 855

2002 $416,943 $335,000 1069 893

2003 $469,366 $380,000 1130 1138

2004 $608,696 $455,000 1282 967

2005 $588,485 $480,000 1082 944

2006 $607,368 $490,000 902 751

*1995 data may be incomplete as I believe this is the first year this data becomes available.

I don’t know what to say except great job and thank you!

Excellent!

Nothing much to say, except “Read ’em and weep” greedy grubbing sellers and realtors.

Here are some builder incentives. How many pre-owned sellers can match these incentives??

1. Pay lease breakage fee

2. home buyback if prices fall

3. will pay mortgage upto one year if you lose job

4. will pay refinance costs upto 3 years

5. They will even buy your present home from you.

http://www.thinkkaplan.com/

Does anyone have county information for Hudson County? I didn’t see it in the info provided. I have been following the jersey city market for a while now.. and it does seem to be slowing down. Just curious on how much it slowed.

Grim,

Incredible work. A chart tells the whole story. We know it is happenning but to see it illustrated so clearly makes it more meaningful. What is amazing to me is the July 2006 sold #’s, you have to go back to 1996 for comparable #’s. Not only did this market come to a screaching halt, it also has accelerated its domnside move. Very powerful stuff!!!!! Thanks again!!!!

BC Bob

grim, next time instead of wasting your precious time tell them to stick it. by now if people can’t recognize the walk, bark and smell of the dog for what it is, they’re blind

i believe we’ll see a slight uptick in august and september (based upon my own personal tracking) and then back to a plunge through the rest of the year. many have reports unsubstantiated evidence that august saw some uptick in sales, probably due to getting in before school season starts. still it won’t change the trend which is down down down. prices are following but still lagging transactions. it’ll catch up.

Grim

Fair and balanced.

The middlesex county had 100% rise in inventory YOY. I am guessing the fall will be more dramatic here.

great job

Central Jersey Observer

let’s not forget about NYC, the anchor of the NJ real estate market with all those high paying jobs and wall street bonuses. remember it’s different there. NOT!

http://www.nypost.com/business/unsold_manhattan_apartments_at_10_yr__high_business_tom_bawden.htm

http://www.minyanville.com/articles/index.php?a=11044

If any one interested, please read the above article. It tells the bottom line.

Central Jersey Observer

As always, Grim, thanks.

Nice article

When sales fall, they call St. Joe

http://tinyurl.com/qmsep

CNS

Here are some builder incentives. How many pre-owned sellers can match these incentives??

1. Pay lease breakage fee

2. home buyback if prices fall

3. will pay mortgage upto one year if you lose job

4. will pay refinance costs upto 3 years

5. They will even buy your present home from you.

http://www.thinkkaplan.com/

8/22/2006 09:10:06 PM

I am a renter in one of their apartment complexes in North Brunswick. Well maintained properties but I would not buy the rental if it went condo. I can hear the neighbor pissin….. (ok that was a joke) …but you get the idea.

>> I can hear the neighbor pissin

that’s no joke. my former apartment i could hear everything that went on in the bathroom above me through the vent, pissing, crapping and all. no way to live.

Geez, if all the people living in N. NJ who claim to hate it so much would just leave, it’d be a whole lot less crowded.

Less full of malcontents and bitter displaced Manhattanites, too. :)

-Jamey

i believe we’ll see a slight uptick in august and september (based upon my own personal tracking) and then back to a plunge through the rest of the year.

I agree, we’re probably going to see a repeat of the trend we saw last year. August will increase from July levels, and we’ll trend downward via the traditional seasonal trend to the February low-point.

grim

Here is what I’ve found so far in Bergen County (SFH,Condo,Co-Op,Twnh) comparing 8/1 – 23, 2005 to 2006.

Year Sold UnderContract

2005 928 769

2006 564 593

REMEMBER: This is August 1 to August 23 as of 2:00 PM EST.

I agree, we’re probably going to see a repeat of the trend we saw last year. August will increase from July levels, and we’ll trend downward via the traditional seasonal trend to the February low-point.

grim

8/23/2006 10:01:01 AM

Not unless prices are cut, or there is a drop in mortgage rates [which to some extent there has been].