The New Jersey Association of Realtors released their Third Quarter 2005 Housing Statistics a few days ago. There wasn’t too much fanfare about the data here, it’s a bit dated already, and says nothing we haven’t seen first hand. I actually expected some rah-rah from the cheerleaders about the data, but much to my surprise, there was no cheerleading.

NJ Home Sales Report – Q3 2005

A regular here on the blog, Grim Ghost, pointed out a bit of an anomaly in the data. If you go to Page 16 of the report containing Table 11, you’ll see the anomaly loud and clear. My jaw dropped just shy of the floor when I saw it. Why? Because if it’s correct, NJ real estate is in for a world of trouble.

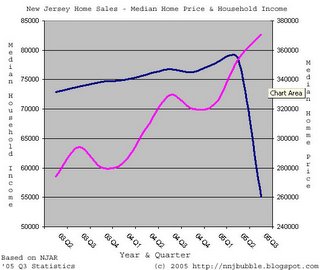

The median household income of home buyers for the first half of the year was about $78,000. A pretty high number considering the median household income for the state, however, a number that makes sense considering recent home prices. However, something very disconcerting happened in the third quarter of 2005, the median household income of buyers plummeted to $55,094, more than $20,000.

The implications of this anomaly being correct are incredible. It means a significant number of the homes sold in Q3 were bought by highly unqualified buyers using significant leverage to purchase these homes.

I called Amanda Sacco, the Communications Director for the NJAR this morning. She couldn’t say if the number was correct or not, but would contact the NAR for more details. Unfortunately should couldn’t get confirmation of the accuracy of that number but instead passed contact information to me.

Now, before we can jump to conclusions about that number (and believe me, it is an incredibly significant number), we need confirmation that it is indeed accurate. But, if that number is accurate, I’m going to have to ask everyone to put their seat backs up, tray tables upright, and heads between their knees because we’ve lost two engines and the gear isn’t coming down.

Caveat Emptor,

Grim

Grim — I don’t think that number is correct, since I dont’ think the realtors association has median income of the actual homebuyer. [ How would they know the actual homebuyer income ?]. I think they just took the area income. In that case, it may just be a typo.

The new number may be a mistake. It will be interesting to find out.

But the numbers for the other quarters do seem to be the homebuyer income — because they’re far too high to be the median income. The state median is about $56K, and these are running at $70K-78K before this latest quarter.

I’ll try to find out on Monday, I have a contact at the NAR research department.

grim

BRING IT ON!!!

A nightmare scenario just around the corner for many newly homeowners.

They have been sold a nightmare scenario. The word Illiquidity and losses never came to mind when they signed the dotted line.

Maybe it was the median “stated” income on all those liar loans.

This number is haunting me..

Ok, so I’m digging through the data trying to make sense of it. I first look at the sales distribution across the state. A marked decline in sales in Northern NJ, however an increase in Central and Southern.

Ok, it makes some sense here, median incomes are lower in Central and Southern. So it might make sense that the median income would drop if more central and southern sales were in the mix. However, the median home price is lower in those areas as well, and that stats definately show an increase in median price of sold homes, so while it might explain a portion of the drop, it doesn’t explain it all.

grim

But Grim, notice that even though the median income tanks, the median home sale price continued to climb AND, more interestingly, the median qualifying income grew even more.

Why is that? What is the difference in median buyer income and median qualifying income?

This just means that the speculators (with higher incomes) are getting out of the market. It’s only those who want to use the homes as a primary residence are left.