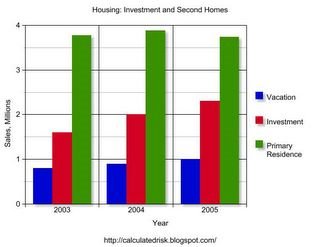

Here is a great graph, coming to you hot off the presses at Calculated Risk. This graph is part of a series of articles on the NAR second home sales data, specifically, More on Second Homes. Calculated Risk is home to some of the best housing graphs on the web.

Using the NAR sales numbers, this graph shows vacation and second home sales for the last three years. Purchases of primary residences actually fell slightly in 2005, while vacation, and especially investment purchases, rose sharply. This appears to be evidence of significant speculation.

I only briefly took a look at the NAR data this afternoon, but didn’t have a chance to post it up. When I saw this graph over at Calculated Risk, I knew that all I had to do was post it up. The graph speaks for itself.

Speculation? What speculation?

besides what’s obviously shocking about this figure is the fact that NAR misstated it. they reported 39.9% of all purchases were 2d homes, when in reality it was 47%.

given their past record with data, this misstatement is very suspicious.

the fact that about half of all homes are purchased as investments now should cause people to wonder why the real estate market should be regulated with kid gloves when other markets are regulated so heavily. watch for stats like these to come up in Congress after the meltdown as a justification for greater federal regulation of real estate transactions

This post has been removed by a blog administrator.

This post has been removed by a blog administrator.

I think we need to enable the word verification again.. we’re gettin blammed, spammed, or whatever you call it.

Boooyaaaah!

The real estate meltdown is in progress.

Kick back and wait. It will be well worth it.

We’re not in the downtick just yet. Things are not moving in the up to $900,000 range in Mendham (waaaaaaaay out of my range, but interesting to watch) too quickly, but the inventory seems to be hovering.

jp

This is getting exciting, who needs fiction? Then again the NAR obviously provides it :), they may have to sell that pretty new building they have in DC to cover their legal problems when all is said and done. Ooops I forgot this is America and in this country you can have a lefty congresswoman slap a police officer and get away with it…I’m sure Feinstein or Boxer would have done the same thing. I guess we”ll just have to settle for gravity to effect it’s reality in the markets.

OT You gotta see the home page for Trump’s mortgage company…the picture which says luxury on it, has chairs that are just crap…amazing to me what people think is “luxurious”.

http://trumpmortgage.com/home/index.php

PS: Not just the chairs, the table everything is GARBAGE.

Be patient when page loads with his propoganda, then they show the pics…people truly are stupid!

im finding 30-40% of houses are empty at lake mohawk. in the 300-450,000 range. when i check taxes and last sale date. most were bought in 02-04. plus many are for rent as well as for sale.i also have a friend looking in camden county says the same thing is happening 30-40% are empty

Anonymous said…

im finding 30-40% of houses are empty at lake mohawk. in the 300-450,000 range. when i check taxes and last sale date. most were bought in 02-04.

6:01

Just anectdotally, I had two conversations with 2 recent Lake Mohawk owners that bought about 3-4 years ago. They bought the places as “weekend houses” after 9/11. I think some of the runup in NW jersey is due to people looking for safehouses as they were both from NYC.

BOYCOTT OPEN HOUSES.

LET THE SELLERS SIT IN DENIAL ACCUMULATING MTG AND TAX BILLS WHILE YOU WAIT IT OUT WITH LESS PRESSURE AND WITHOUT A HUMUGEOUS MTG PAYMENT WHICH SHOULD BE REDUCED IN NEXT 12 MONTHS.

THANKS TO THIS BLOG I DID NOT LISTEN TO THAT SLIMY REALTOR TRYING TO CONVINCE ME TO BUY NOW CUZ HOUSES ONLY GO UP.

Trump’s casino’s can’t even make money. What’s up with that? The house is supposed to have an advantage and they still have to file for bankruptcy protection.

http://www.washingtonpost.com/wp-dyn/content/article/2006/04/04/AR2006040401629.html

hehehe

Bob

“BOYCOTT OPEN HOUSES. … THANKS TO THIS BLOG I DID NOT LISTEN TO THAT SLIMY REALTOR TRYING TO CONVINCE ME TO BUY NOW CUZ HOUSES ONLY GO UP.”

Then this one’s for you…

$50,000 price drop:

MLS 2259341

93 Meadowbrook Rd, Short Hills

$799,000 => $750,000

Days on Market: 16

I was tempted to attend the open house for this one, but did not.

I’ll boycott all open houses until the prices return to normal.

Let the sign-in books remain empty, and let the houses see no foot traffic, until sane asking prices return.

Richie said…

Trump’s casino’s can’t even make money. What’s up with that? The house is supposed to have an advantage and they still have to file for bankruptcy protection.

8:26 AM

Fiscal mismanagement. Poor strategic decisions. Poor cost control. Hubris.

Wow, just wow.

What’s even more funny about the Trump website is the list of partners (click on “About Us” and then “Our Trusted Partners”). They are all businesses owned by Trump (with exception of Ellie Mae I assume).

I went into Trump University and found this course for only $39.95

Bubble-Proof Real Estate Investing – Wealth-Building Strategies for Uncertain Times

Publisher: Trump University

with Dolf de Roos | Gary Eldred | Curtis Oakes

Introduction by Donald Trump

If you listen to the pundits, you must be waiting for the real estate market to come crashing down. Talk of a “real estate bubble” has scared investors and homeowners alike. Now three masters of real estate investing take on the “bubble babble” and puncture the myths that have spread through the media.

Debt Consolidation Debt Consolidation Programs can help you reduce your interest burden by charging an interest rate lower than the rate on your existing loans. Debt consolidation loan can also allow you to make small monthly payments by extending the loan period

Hi, Thank you for having this info on the web. I enjoyed your post. If you may have any interest in

debt consolidation

then I know where you may get your solution. For your comfort, I have enclosed the link, so if needed you can visit the site. Thanks again for your lovely blog. credit