From CNN/Money:

Those looking to glimpse the future of the housing market may want to start watching help-wanted ads rather than the real estate section.

Experts who say the housing market is cooling, but won’t implode, argue that solid job growth should be enough to prevent a collapse in home prices. But others who see a housing “bubble” ready to pop say a developing slowdown in home building itself could hurt job growth enough to put a big dent in housing.

“The economy was healthy when the stock market plunged in 2000,” said Dean Baker, co-director of the Center for Economic and Policy Research in Washington and an outspoken advocate of the housing bubble theory, but stock prices “had gotten out of line with reality.”

…

Past housing downturns have seen builders slash their work forces by up to 40 percent, said Baker, the housing market bear, and with an estimated 3.5 million people working in residential construction, the loss of more than 1 million jobs would obviously cause problems for the labor market.

Add job losses at mortgage firms, building supply retailers and real estate agencies and the downturn in home building could itself further weaken one of the key supports for real estate.

…

“Those people losing their jobs are the classic home owners. This could be a vicious circle,” he said.

—————-

The past provides some insight into what the future might hold for New Jersey. The collapse of the housing market in the early 90’s went hand in hand with job losses across the region.

From the BLS:

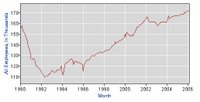

Construction Jobs (in thousands), Statewide, Seasonally Adjusted, 1990-2006

Total Nonfarm (in thousands), Statewide, Non-Seasonally Adjusted, 1981-2006

Caveat Emptor!

Grim

Just say “NO” to RIPOFF HOUSE PRICES

Ba ba ba ba ba ba BOYCOTT HOUSES!

Is it worth your time to wait for 25-50% price reductions?

BOOOOOOOYAAAAAAAA

Bob

Take a look bubble heads.

Go ahead sign up for those monthly mtg slave payments.

http://www.harpers.org/MostRecentCover.html

This post has been removed by the author.

Grim,

how are you? I have been busy for a while and have not posted in a long time here.

I finally sold my investment apartment in Fort Lee.

I bought it in June 2002 for $275K. I put it out on the market June 2005 for $439K. Someone bid it $440K in August 2005 but the deal didn’t go through as the buyer was not qualified.

The condo was empty since Sept. 2005 and I finally closed it this Monday at $415K.

I am very happy that I finally got rid of this condo before the price goes down even more.

Will write here from time to time.

Great cover picture on harpers….

Interest post over on Craigslist this morning..

I need a foreclosure bail-out loan by this friday May 5th! I have cloe to 100k in equity, my credit is low. I need to hear from people that can close this loan by Friday, not people that think they can do it! Everyone can do the easy loans, lets seperate the men from the boys and see who can close this one by Friday! If you can close it by Friday I have an EASY refinance for you as well. I am a real estate agent – so I can give you several deals. Please call

HAH!

I am a real estate agent – so I can give you several deals.

Don’t these agents have good leads into finance companies?

-Richie

ISM Services came in way above estimates. Price index up to 70.5 from 60.5 last month, a very large jump.

Factory Orders in way above estimates.

A realtor with low credit?

HA!

Interst rates are soaring up!

Mtg rates going to do same.

House prices plunge!

Oh I know mtg rates do not matter.

Yeah righto!

Who needs jobs when you have credit? Acording to Alan “Bubbles” Greenspan earnings and borrowing are one and the same.

Dear fellow bubble followers. I would like to buy a house in the next couple of years. I am actually ready to do it now. I’d love the bubble to pop so I could get a better deal in Seattle. My problem is the data on this site: http://www.economagic.com/cenc25.htm it shows that average house prices hardly ever go down since 1963. This includes the “crash” periods. I think the biggest down period was in the West in the 90ies, the prices went down only 15% and recovered in about 6.5 years. Any comments on that?

Seattle Bubble Follower:

Keep in mind that average price graphs of real estate prices do not take into account changes in inflation.

A significant amount of those price gains are simply due to inflation.

What is different about the current cycle is the extensive amount of leverage that many, if not most, home buyers have used to “afford” their properties. The next economic downturn, when and if it comes, will put lots of pressure on those who are in debt. That includes home owners with large mortgages.