The following is an advertisement from Freddie Mac. It appears on the back cover of the current issue of National Review.

savings (noun)

1. A fund of money put by as a reserve.

nest egg (noun)

1. Slang for money saved, often in a savings account, in preparation for retirement or other significant use.

wealth (noun)

1. An abundance of valuable material possessions or resources; riches.

2. The state of being rich; affluence.

debt (noun)

1. The state of owing something.

2. Money or goods or services owed by one person to another.

3. An obligation to pay or do something.

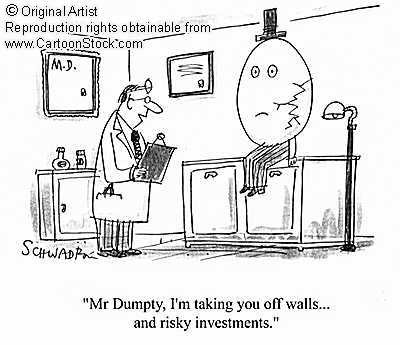

Wealth may include your home, however, homeownership does not necessarily equal wealth. The fact that you may have equity in your home does not mean you are wealthy either, however the unpaid portion of your mortgage most certainly means you are in debt. How can Freddie Mac get away with advertisements like these?

The American Consumer is being duped into believing assuming outrageous levels of mortgage debt is the road to wealth. Freddie seems to be saying that it’s OK for you to have half your savings tied up in your home. After all, it’s your nest egg and everyone else is doing it too! I can’t get over what a dumb ad this is, and I can’t believe people are falling for the newspeak. Freddie, we’re not buying it.. We’re not going to put all our eggs in one basket. The higher we elevate this concept, the harder it’s going to fall..

Humpty Dumpty sat on a wall.

Humpty Dumpty had a great fall.

All the king’s horses and all the king’s men

Couldn’t put Humpty together again.

Grim,

Please check your email. I sent you a copy of the Harper’s article. It goes well with this posting (i.e. debt = wealth)

RentinginNJ said…

Grim,

Please check your email. I sent you a copy of the Harper’s article. It goes well with this posting (i.e. debt = wealth)

Is it online? If not please post it grim.

I saw the same add and had the same reaction. I would also add that there analogy is interesting because the sentiment is fed by the bubble and peoples perceptions of the wealth effect. Don’t count your chickens till your eggs hatch or in this case don’t count your equity until the bubble deflates.

I would love that article too…

Today’s Star Ledger:

Jersey’s credit card bill keeps getting bigger

With new borrowing already planned, debt ballooned to $33 billion in’05

Tuesday, May 09, 2006

BY DUNSTAN McNICHOL

Star-Ledger Staff

New Jersey added more than $3 billion in new public debt last year, meaning the state now owes banks and bondholders more than $3,000 for every resident.

A decade of heavy borrowing to build schools, refurbish highways and shore up the annual state budget has pushed the balance on New Jersey’s state credit card to $33 billion, $3.4 billion more than last year’s total for the state, according to an annual report by Moody’s Investors Service…

http://www.nj.com/news/ledger/index.ssf?/base/news-6/1147153737232060.xml&coll=1

Those interested in the Harpers article please email me at:

nnjbubble@gmail.com

Put the word “Harpers” in the subject line. I’ll respond with a link to the article.

grim

Subject:Harpers

Email:boycotbob@yahoo.com

The head ponzi mtg schemer

FYI – the title is [purposely]related to a famous book written by a brilliant economist.

http://en.wikipedia.org/wiki/The_Road_to_Serfdom

FOMC Meeting Tomorrow.

Any predictions for changes in the statement?

grim,

the FOMC will hike it up again .25 with alot of ambiguity as to where it will go next. Bens learned his lesson after being spanked by Bartiromo.

amen brother amen.

David

Bubble Meter Blog

Last one in will have a rotten nest egg.

“Making home possible”–what an perfectly idiotic, fatuous phrase.

“Making the housing bubble possible, by injecting excessive liquidity in the market” would be more truthful.

Any predictions for changes in the statement?

I’ll bet the statement stays pretty much the same. “Were in the neutral range…future policy action will depend on the data”.

The only changes in the statement will reflect Bernanke’s style.

Otherwise – regardless of whatever these media clowns say – there will be no message implied.

I think that the stock market is in for a rude awakening. By the end of the year, we have a legitimate shot at staring down the double-6’s – as in, 6% Fed Funds and a 6% Ten.

chicago

BOYCOTT HOUSES!

Go on vacation and forget about the starving realtors and desperate in denial sellers.

The Fair weather realtors will now switch their alliances to buyers.

Wait.

Prices will be tumbling in latter part 2006 beginning 2007.

Booooooyaaaaaaa

Bob

First take – no surprise – yawn