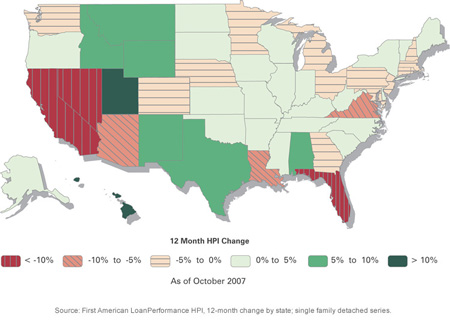

From LoanPerformance:

First American LoanPerformance Releases October 2007 House Price Index

12 Month Change By Top 30 CBSAs (Core Based Statistical Areas) As of October 2007

Honolulu, HI 17.91%

Salt Lake City, UT 11.63%

Austin-Round Rock, TX 8.62%

San Antonio, TX 7.89%

Raleigh-Cary, NC 4.56%

Houston-Sugar Land-Baytown, TX 4.52%

Charlotte-Gastonia-Concord, NC-SC 4.47%

Dallas-Fort Worth-Arlington, TX 3.92%

Seattle-Tacoma-Bellevue, WA 2.18%

Portland-Vancouver-Beaverton, OR-WA 1.73%

Chicago-Naperville-Joliet, IL-IN-WI -0.22%

Philadelphia, PA -0.61%

New York-Northern New Jersey-Long Island, NY-NJ-PA -1.83%

Atlanta-Sandy Springs-Marietta, GA -2.13%

St. Louis, MO-IL -2.76%

Detroit-Warren-Livonia, MI -3.16%

Minneapolis-St. Paul-Bloomington, MN-WI -3.33%

New York-White Plains-Wayne, NY-NJ -4.13%

Miami-Miami Beach-Kendall, FL -4.85%

Boston-Quincy, MA -6.01%

Cleveland-Elyria-Mentor, OH -8.10%

Washington-Arlington-Alexandria, DC-VA-MD-WV -8.11%

Tampa-St. Petersburg-Clearwater, FL -9.21%

Phoenix-Mesa-Scottsdale, AZ -10.08%

Orlando-Kissimmee, FL -10.16%

Los Angeles-Long Beach-Santa Ana, CA -10.45%

Miami-Fort Lauderdale-Miami Beach, FL -10.89%

Oakland-Fremont-Hayward, CA -11.44%

Las Vegas-Paradise, NV -11.65%

Cape Coral-Fort Myers, FL -14.01%

Riverside-San Bernardino-Ontario, CA -15.70%

Source: First American LoanPerformance HPI, Single Family Detached Series

Wait a minute, that NYC area number is negative, there must be a mistake!!

wtf is going on!! what happened to the layout!!

Trying out a new layout. This template has too many CSS errors for me to figure out.

It doesn’t display properly on Safari, Firefox, or Opera (mobile).

jb

What is the story with Utah, NM and TX?

Holy crap! The developer for Trump and Gulls Cove in JC (and Metrostop in Hoboken) can’t get banks to lend him money for his Esperanza project in Asbury Park. From the Star Ledger, Dec 12:

“Geibel declined to discuss specific market conditions that forced him to reach the decision to halt construction, but Councilman John Loffredo said that in previous conversations with Geibel, the developer said banks were leery about lending money because of the softening market.”

Doesn’t look good…I wonder how sales are in JC and Hoboken. Can he get the money he needs for those places? Anyone know?

wait till next year this time – either all red or they will have to insert a new color to show categories within >10%!!!!

can someone try and match this chart to the % rate of increase of prices over the last 5 years? – i bet there will be a lot of correlation!

everyone seems to forget that its the high prices thats stalling the market and not the credit crunch, lack of mrtgs, …..

From the Star Ledger:

Asbury Park could go to court over stalled high-rise

The Asbury Park mayor and city council today gave the developer of a stalled ocean-front high rise 30 days to get the project restarted, and five days to answer a litany of questions about the financial status of the project.

The developer of the Esperanza complex abruptly stopped construction and sales last week because of the cooling real estate market. Asbury Park officials said today that if the complex’s developer, Hoboken-based Metro Homes LLC, does not comply with the city’s deadlines to resume work, the city could go to court to have Metro Homes legally removed as the developers of the property.

The 224-unit luxury condo complex was to many a symbol of the city’s rebirth, to rise in place of a rusting hulk that stood deserted on the oceanfront for years of stalled growth before it was torn down in 2006. Officials said last week that halting the Esperanza’s construction could have a wider effect in slowing Asbury Park’s redevelopment.

My comment from September 3, 2007. It smelled bad then; it smells worse now:

Clotpoll Says:

September 3rd, 2007 at 8:36 pm

Joan Hamburg was on WOR Friday AM, hawking and spinning Asbury Park like it was the Hamptons. The Esperanza guy and a couple of other local bigs were there, pumping like mad.

Like what Asbury Park needs is a bunch of overpriced condos and goofy restaurants that sell rancid tuna tartare and $12 blue martinis. Friggin’ Soho at the shore. Yeah, we need another Soho. Let’s go to Abercrombie.

Pathetic.

From Bloomberg:

S&P Cuts Alt-A Mortgage Bonds; Analysts Warn on Prime

Standard & Poor’s reduced its ratings on about $7 billion of Alt-A mortgage securities, citing a sustained surge in delinquencies during the past five months on loans considered a step above subprime.

The lowered bonds represent about 1 percent of the $694 billion of securities backed by Alt-A mortgages created in 2005 and 2006, the largest ratings company said today in a statement. Countrywide Financial Corp., Bear Stearns Cos., and Lehman Brothers Holdings Inc. issued the most debt downgraded, S&P said.

“These actions reflect a persistent rise in the level of delinquencies among the Alt-A mortgage loans supporting these transactions,” along with S&P’s expectations for further home price declines, the New York-based unit of McGraw-Hill Cos. said.

The downgrades underscore how loosened lending standards across the mortgage market and borrower fraud are mixing with the first nationwide declines in home prices since the Great Depression and a tightening of credit to sour a wider range of home loans, not just subprime mortgages to borrowers with poor credit. Alt-A loans are sometimes called “near-prime.”

Prime “jumbo” mortgages from recent years packaged into securities also have rising delinquencies that may create losses among some bonds with investment-grade ratings, according to reports yesterday by New York-based securities analysts at Credit Suisse Group and UBS AG. UBS called increases in late payments on adjustable-rate mortgages, or ARMs, from this year “alarming.”

“It’s not just a subprime problem,” Joshua Rosner, managing director at New York-based research firm Graham Fisher & Co., said in a telephone interview today.

(emphasis added)

(continued)

Since July, late payments on Alt-A loans in bonds issued in 2005 have increased 37.3 percent to 8.62 percent, while delinquencies for such mortgages in 2006 securities rose 62.1 percent to 11.64 percent, S&P said. Moody’s Investors Service late last month completed a review of certain Alt-A bonds, downgrading or placing under review a total of $11.7 billion.

…

While late payments and defaults on prime jumbo loans remain relatively low, the mortgages are “deteriorating at almost the same pace as other mortgage products: a down-turn in the housing market has revealed a higher correlation in mortgage credit performance than most anticipated,” UBS analysts led by Laurie Goodman in New York wrote yesterday.

Times are tough in Brigadoon:

1) Folks are now target-marketing the acid-dropping set; check out these lovely photos:

http://homes.realtor.com/search/searchresults.aspx?mlslid=2440377&ml=3&typ=7

2) Even better, if you’re in the market for a car, all you need to do is buy a house: see MLS #2440377

Wow! What a deal!

I could just goto the BMW dealer and save $1.2 million bux.

grim: can you give us a cross section of this map that includes the number of CFAs in each region?

essex – you’re not selling your bimmer are you?

13 chi

That’s be all the places that prices are rising. Duh.

Detroit-Warren-Livonia, MI -3.16%

New York-White Plains-Wayne, NY-NJ -4.13%

How can this be? Don’t they realize how many people work in finance in NY?

In all seriousness…WTF?

njpatient Says:

December 19th, 2007 at 11:15 pm

13 chi

That’s be all the places that prices are rising. Duh.

njp: ah yes….please pass the Gray Poupon…

Portland is looking pretty good. Washington even better. Good news.

17 chi

but of course

Grim, can you show the graph displayed in EUR and GBP? It’ll provide marketing fodder for our transatlantic pals on the other side to come shop in the US instead and bolster our RE values. As opposed to a privileged few here who going shopping there with our Dollaz..

1.8%..and 4.1% down..after a historic run up in prices that ballooned most homeowners net worth…and all the hype about arm resetting and mortgage problems…not exactly a number that will make you mail in the keys and line up to be a tenant….so far the housing crash..is more like landing on a featherbed……what a dud.

From Yesterday:

3b, I believe you are talking about this quote from Pret concerning the hordes of Ivy Leaguers who come here:

“pretorius Says:

September 28th, 2007 at 10:55 am

Among people whose circumstances enable them to choose where they live, the common denominator in the New York City area is these people tend to be very rich or very smart.

Take the richest 10% of the New York metro population and compare this group to their counterparts in North Carolina, and there is simply no comparison. It is the same with the smart people. Thousands of Ivy League graduates head to New York each year. The same cannot be said for anyplace in the South.

Why do the richest and smartest people choose to live in New York and a few other places, such as San Francisco? Because today they prefer places with character – particularly dense, older neighborhoods having locally owned shops which you can walk to, along with transportation options besides the car. Bust most of all, they like to be around other very smart or very rich people, and the New York metro has plenty of both.

On the other hand, North Carolina attracts people having mainstream American tastes. These ideals include large single family houses located in massive subdivisions, automobile dependency, and a preponderance of national chain retailers and restaurants. The growing cities of North Carolina fit this description, making them very attractive to the typical American middle manager or bureaucrat. It is not surprising that many people in these roles relocate to North Carolina from New York and New Jersey.”

I believe the comment generated quite a debate that day.

And here is one of the comments about wealthy Asians buying up real estate.

“pretorius Says:

July 3rd, 2007 at 9:33 am

People seem to be ignoring the surge in American household net worths that has taken place during the past several years. This is one of the fundamental factors behind the recent rise in home prices, I believe.

Although I don’t have state-by-state figures, it is fair to assume that New Jersey household net worths are significantly higher than the national average.

In New Jersey, home prices have increased faster, equity portfolios are larger stemming from higher incomes (high earners own more stocks), and the states high immigration level has produced above-average entrepreneurship and small business ownership.

There is a enormous amount of family wealth in the New York City and North Jersey areas that can be used to finance home purchases. In my view, this affects Hudson County more than other parts of North Jersey because wealthy immigrant families, particularly of Asian heritage, are helping to finance the purchase of

their children’s first homes.”

Don’t thank me, I’m a giver.

1.8%..and 4.1% down..after a historic run up in prices that ballooned most homeowners net worth…and all the hype about arm resetting and mortgage problems…not exactly a number that will make you mail in the keys and line up to be a tenant….so far the housing crash..is more like landing on a featherbed……what a dud.

Two years ago you told us that real estate had forever changed, a new paradigm. We would continue to see double digit growth into the (un)forseeable future. It was imperative that we all purchased homes, otherwise they would be forever unaffordable.

A year ago you told us that while your prior prediction was incorrect, and real estate was no longer skyrocketting, it would never, ever, fall. The worst possible case was flat prices. Again, we should purchase homes immediately, lest we lose out on the double digit appreciation that was sure to resume.

Now, you come here to tell us that while prices are falling (which you assured us could never, ever, happen), the drop will only be minor.

What’s next, a forecast based on a return to double digit appreciation?

Thank you Lisoosh for unearthing those posts. Where is this stuff about parents buying unemployed children $700k homes? I think it is safe to say that it is nowhere to be found.

So, Lisoosh, do you disagree with what I wrote in those posts?

lisoosh (23)-

Nothing’s as cool as a tough chick giving some guy the treatment. Very Uma Thurman/Kill Bill.

From Newsday:

Nassau foreclosure filings down, Suffolk up

The latest RealtyTrac foreclosure filing figures are out, and they are surprising: Nassau’s rate is down.

Nassau had 350 filings in November, down 34 percent from a year earlier, according to the Irvine, Calif.-based online marketplace for foreclosure properties. There was one filing per 1,309 households.

Less surprising are the figures from Suffolk and Queens. Suffolk had 500 filings last month, up 54 percent from November 2006. There was one filing per 1,078 households. In Queens there were 1,338 filings last month, up 55 percent from a year earlier. There was one filing per 622 households.

The Nassau numbers don’t jibe with what area industry insiders are seeing. Local housing counseling agencies are reporting 10-fold increases in calls from people seeking foreclosure prevention assistance.

“There’s something wrong with those numbers,” said Todd Yovino, who runs Huntington-based Island Advantage Realty, which specializes in selling foreclosed properties for banks. His inventory in the metropolitan area is up more than threefold this year.

#15…………hahhaha! Not yet! We dodged a few bullets around here this last go round, but for now…the Bimmer is safe.

GRim Any info 2459756 Looks like flip gone flop or someone running will they have a chance.Which they don’t at 398 + 10k taxes in the sticks oh I forgot maintance.

From the Southbergenite

Dormant home stirs concern

http://www.southbergenite.com/NC/0/730.html

Residents of West Gouverneur Avenue in Rutherford are concerned about the state and safety of a currently empty house on the block. After being sold in the summer, the new owners performed an internal demolition on the house, completely removing the insides and in the process leaving the house open and exposed to the elements for several months

—snip—-

The last paragraph is an LOL moment:

“They would be heartbroken if they ever saw the house [in its current state],” said one neighbor about the former owners. The former owners were longtime Rutherford and West Gouverneur residents who moved out fairly abruptly this summer, claiming they could no longer afford to pay the taxes

And now the town has an eyesore on its hands!

It’s a flip, never lived in, never furnished. However, they’ve not yet hit “flop”.

Purchased: 10/17/2006

Purchase Price: $319,950

MLS# 2351615

Listed: 12/08/06

OLP: $465,000

LP: $449,900

DOM: 193

Withdrawn

MLS# 2459756

Listed: 11/07/07

OLP: $420,000

LP: $398,000

DOM: 43

Active

Holiday Sales in U.S. Fall for Third Week After Winter Storms

http://www.bloomberg.com/apps/news?pid=20601087&sid=alYT7mc12Plo&refer=home

Sales in the seven days through Dec. 15 fell 0.4 percent from a year earlier, following declines of 2.7 percent and 4.4 percent the previous two weeks, Chicago-based ShopperTrak RCT Corp. said yesterday.

Ben Stein got the “No One is Indicted Part Right”

Posted on Thursday, December 13, 2007, 12:00AM

If I were to choose a cartoon to represent the financial events of 2007, it would be the familiar one of Lucy promising Charlie Brown that this time, definitely this time, despite all the lies in the past, she would hold the football firmly in place while he practiced placekicking. Then, of course, she snatches it away and he goes flying onto his backside.

In the case of 2007 and investors, Lucy is, as always, Wall Street. The football is collateralized mortgage obligations, and the placekicking dupe is you and me. But the smart observer is the guy or gal or who knows this crisis won’t go on forever, and the time to buy stocks, mutual funds, and ETFs is when everyone is worried — not when they’re chirrupy and happy.

What Went Wrong

Let’s start at the beginning.

It’s not even six years after the catastrophe of the high-tech fraud and stock collapse, and, after endless professions that Wall Street would stick to the highest levels of probity and honesty, it’s back to the same old tricks. The trick is — as always — to sell “securities” that are not at all secure and are worth far less than the con men on Wall Street say they are.

This time around, the “securities” were immense pools of mortgages issued often with minimal or no credit checks on the borrowers, often on the collateral of homes that were worth less than the loans. Very often, the borrowers had little or no equity in the house, so that as soon as the real estate market went into a cyclical correction of extra-large size (to correspond with the real estate boom that was also of uniquely large size), the borrowers simply left the keys in the mailbox and went back to renting.

In many cases, the borrowers were themselves deceived about the terms of the loans and the likelihood that they could refinance their way out of any problems that occurred.

Crunching the Numbers

No one, and I mean no one, knows how large the losses have been as the buyers of the mortgage pools have seen their investment dry up and blow away. By my rough calculation, with help from the president’s Council of Economic Advisers, about 6 trillion dollars of new mortgages were issued between 2005 and mid-2007. Of this, about 20 percent might have been subprime. That makes $1.2 trillion.

Of that, about a third might default (many more from the last period of the lending binge, when standards simply vanished), which would indicate losses of about $380 billion. Of that, about 60 percent will be recovered when the houses are seized in foreclosure and, after the legal fees are paid, sold to shrewd buyers. That leads to a net loss to pension funds, municipalities, labor unions, hedge funds, and wealthy foreigners of about $150 billion, as a very rough number.

That number may be even greater when upwards of $40 billion in losses on mortgages call Alt-A’s — where the borrowers didn’t have poor credit, but the interest rates reset too high for them to afford — are added. If we also assume that defaults might be even greater on mortgage pools sold since the middle of 2007, the total unrecoverable losses will be about $200 billion to $250 billion. Ouch!

On top of that, there are losses on structured investment vehicles, in which speculators basically borrowed short-term money to buy long-term debt — always risky — and possibly some losses on car loans as well, but that’s not yet clear. There are also losses to hedge funds, which are loosely regulated pools of investments, but their accounting is generally murky.

Still with me? Because there’s light at the end of the tunnel.

The Usual Suspects

But first, here are some amazing facts about this debacle: As far as I know, not one person on Wall Street has been even indicted for, let alone convicted of, fraud. Not one. In fact, the leaders of the major investment banks, banks, and brokerages that sold this worthless stuff — and kept some of it in-house, leading to immense losses for their firms — have been retired with immense severance bonuses.

The former head of Merrill Lynch — who led his firm to near ruin by selling this garbage, and led his clients (whom he had a fiduciary duty to always put first) to disastrous losses — was given a retirement package of about $160 million. The people at the banks who supervised this meltdown were routinely paid multimillion dollar wages per year.

A Peek Ahead

Here are two even more amazing facts: Despite this massacre — which went far beyond where I originally thought it would go — the stock market is still up for the year by a few percentage points, even though financial stocks are by far the largest sector of the S&P. Even more amazing, the economy is so large and so resilient that the losses will not be enough to cause lasting damage to the nation as a whole. (Some individuals, however, will be ruined.)

The losses of $200 billion or so amount to only about 2 percent of bank credit, and far less than the percentage of total credit available domestically and from foreign investors. The Federal Reserve is available at the flip of a switch to replenish the lost liquidity of banks, and new, wealthy foreigners are still lining up to invest in our financial entities.

There will obviously be an economic slowdown, and possibly even a shallow recession. But we’re extremely blessed to have good fiscal stewardship from our government and top-flight guidance at the monetary-policy pentagon (the Fed). Unless they make major mistakes, we’ll get through this in halfway decent shape.

Get Over It

Still, the lessons for us are keen and cut like a knife. But be brave — these periods of crisis are inevitably the time to buy, even if you have to wait years for the crisis to sort itself out. It takes guts and counterintuitive thinking, and if you don’t have the stomach to do it, no one will blame you.

If you do jump into the pool, be sure to diversify, give yourself guaranteed income from variable annuities and annuities, and stick with proven entities like very largely varied index funds at home and abroad. As you all know, I particularly love the emerging market funds and ETFs for the long haul.

Oh, and the next time Lucy offers to hold that football, kick her instead.

FEDEX POSTS LOWER PROFIT, CITING FUEL PRICES AND ‘WEAK’ U.S. ECONOMIC GROWTH

From MarketWatch:

Bear Stearns posts loss on mortgage write-downs

Bear Stearns Cos. Thursday reported a fourth-quarter loss of $854 million, or $6.90 a share, compared with net income of $563 million, or $4 a share, in the year-ago period. The company said it wrote down about $1.9 billion in mortgage inventory net of hedges, which reduced fourth-quarter earnings by $8.21 a share. Bear Stearns said members of the executive committee will not receive any bonuses for 2007. “We are obviously upset with our 2007 results, particularly in light of the fact that weakness in fixed income more than offset strong and, in some areas, record-setting performance in other businesses,” said James Cayne, chairman and chief executive officer, in a statement.

“said James Cayne, chairman and chief executive officer”

[35],

He’s still dancing? Now an insolvent Barclay’s is suing Bear. Great drama unfolding.

From the WSJ:

Barclays Sues Bear

Over Failed Funds

By KATE KELLY

December 20, 2007

Barclays PLC, stung this summer when two big hedge funds run by Bear Stearns Cos. collapsed, is suing the Wall Street firm and two of its fund managers, claiming among other things that Bear misled it about the performance of the highly leveraged funds.

In a complaint filed in U.S. District Court in Manhattan, Barclays alleges that Bear, its money-management unit Bear Stearns Asset Management and two senior BSAM executives, Ralph Cioffi and Matthew Tannin, defrauded it in borrowing and investing capital.

The two funds that Messrs. Cioffi and Tannin managed, known as the High-Grade Structured Credit Strategies Fund and the High-Grade Structured Credit Strategies Enhanced Leverage Fund, collapsed in July, wiping out $1.6 billion in investor capital. Their failure is now under examination by regulators at the Securities and Exchange Commission, the state of Massachusetts and federal prosecutors in Brooklyn, N.Y.

Barclays lent roughly $400 million to the BSAM enhanced fund, which started operations in September 2006. But less than a year later, both funds faced a cash shortage that rendered them unable to meet investor or lender requests for their money back when risky bets on the market for loans to borrowers with weak credit went bad.

The United Kingdom bank’s suit — which people familiar with the matter say comes after months of failed settlement talks — is seeking unspecified damages, in an amount to be determined in a jury trial.

In a statement, a Bear spokeswoman said the suit was without merit. “While we do not like to see investors or counterparties lose money, we believe this lawsuit is an attempt by Barclays to avoid taking responsibility for its own actions,” she wrote in a statement.

http://online.wsj.com/article_print/SB119810284016240529.html

28 essex

Shwoo!

#25 pret: You did say it. Again I would say go back and check, if you feel you must defend yourself.

Think hard, 700k condos Wall St layoffs, I said what happens then, you said even if they were unemployed they would still come to NYC, creative, innovative, I said even without jobs, you said yes their parents would buy 700k condos for them.

Surely you must rememebr that converation.

21 mrT

real estate bubbles do not pop in a rapid manner like stock bubbles do. RE bubbles take years to deflate. Look at the bubble from the late 80’s early 90’s. JB has the charts and has posted them numerous times. If i remember correctly it took about 3-5 years for things to bottom out then. We have run much higher this time and have further to fall. You can argue that we may fall faster or slower then the previous RE bubble, but my personal opinion is that it will take longer, my first guess would be 4-6 years for the whole shebang to get worked out and then prices will sit stagnant for while….

Edison station to add 350 spaces

Commuters using the Edison train station will be able to use 350 new permit parking spaces starting in February.

The township announced a deal yesterday with Manhattan-based Central Parking Systems to offer a 350-space parking lot about a mile from the Edison train station for use by permit-holding commuters.

Central Parking Systems will offer the spaces at a cost of $60 per month for Edison residents and $75 per month for nonresidents. The lot will come complete with a fleet of three 14-passenger shuttles that will bring commuters back and forth from the train station to the lot from 5 a.m. to 8:30 p.m. Monday through Friday.

…

Choi said the township will soon begin seeking public input regarding economic revitalization of the north side of the train station to provide some long-term parking for commuters.

3b #39,

I do remember reading that on here, I don’t recall who said it and I don’t remember the figure 700k.

#23 lisoosh Thanks for checking, it might have been on that day, or perhaps later in Oct, and yes it caused quite a lively debate.

And I stand. by the fact that he said what he said about 700k condos etc.

3b, I checked, lisoosh checked. Nobody can find the post that has fueled your insults and hostility, the same way nobody found the book I plagiarized.

It is your turn to search. Either find it or concede it doesn’t exist except inside the head of a few njrereport posters with excellent imaginations.

Theinternetisseriousbusiness.jpg

Most important story of the day…

From Bloomberg:

MBIA Bond Risk Soars on $8.1 Billion Subprime CDO Disclosure

The risk of MBIA Inc. defaulting on its bonds rose after the company disclosed it had insured $8.1 billion of a complex security linked to repackaged subprime mortgages.

Credit-default swaps tied to Armonk, New York-based MBIA’s bonds soared 115 basis points to 595 basis points, the widest on record, according to CMA Datavision in London. The contracts are used to speculate on the company’s ability to repay its debt or hedge against the risk it doesn’t.

I think I found the post that is causing the fuss. 3b, do you think this is the one? Do you disagree with what I wrote?

Here is the post.

“There is more to New York than a high-paying job market.

Smart people enjoy being surrounded by other smart people, and smart people prefer older cities with personality to newer cities where everyone lives cookie cutter suburbs. That is why the New York and San Francisco attract so many smart people. And that helps explain why $700,000 buys a small apartment in New York and San Francisco but a Toll Brothers McMansion in successful, boring cities like Phoenix and Charlotte.

In addition, many Ivy Leaguers come from rich families, and these families are as rich as they’ve ever been. That family wealth can make a $700,000 condo affordable for couple on only $250k per year.”

I was responding this post from a guy who debuted the $700,000 amount stuck in people’s heads.

“not sure why you think all of those ivy leaguers move here except for the jobs. even for those who are just dying to move to NY under any circumstances, if your job option now becomes consulting rather than banking, do you still buy that $700,000 1 BR two years out?”

I think I was an ivory leaguer in a previous life.

The posts in #47 are from November 21st.

3b, I don’t believe you knowingly lied. But you and others have clearly misrepresented what I wrote, blatantly and repeatedly.

This must be a prospective knock-down, but the worst condition I’ve ever seen in the MLS:

http://homes.realtor.com/search/listingdetail.aspx?ctid=25543&typ=1&sid=ddadb3a67ee74fceb9cfa4582b4c88b1&lid=1093422965&lsn=1&srcnt=130#Detail

pret –

in my opinion, people move here because of job opportunities – all the rest is great, but many people can’t stand the hassle, and would love to have the same jobs somewhere else – but, they’re here.

of course, not everyone – there are some woody allens of the world – ny or nothing – but face it, it’s the jobs that keep most people in ny, not the people that keep the jobs in ny.

tcm #51,

A lot of my peers when I graduated wanted to live in the city because it was the cool thing to do. Some of them had shyte jobs but that wasn’t the point for them at all. Being able to say they live in Manhattan was the point. A lot of them are still there, almost ten years later. Some of them still have shyte jobs, some have done incredibly well.

#47 pret: I am not going to get into a pssing match with you,and no that was not the post I am refering to.

The post that started this pointless exercise was where you said (this is the last time I am going to discuss this), that even if people do not have jobs (Wall Street layoffs), they will still come here,and their wealthy parents will buy them 700k condos.

scribe,

I’ve seen some properties in terrible disrepair, but very few actually bothered to show interior photos. At the most these listings would include a shot of the lot, and potentially the exterior. Most times you would find these listed as land/property for sale. They made it clear that the structure was not inhabitable nor able to be repaired.

I remember seeing one listing that carried interesting showing instructions:

“NO POWER, NO LIGHTS, DO NOT ENTER HOME, NOT STRUCTURALLY SOUND.”

MBIA discloses $8.14 billion in CDO squared exposure

Morgan Stanley analyst ‘shocked’ that MBIA withheld info.

>>

How many times can you be shocked and surprised in 24 hours?

Pret – I looked those posts up as a favor to 3b, because I remembered those conversations too. He paraphrased many of the posts you have made, yes, but from others perspective he did a pretty fair job of it.

I’m not going to dig around for more $700k posts or the tales of your flips where the parents paid for the kids housing, but they exist.

The reason why all of this annoys is because you seem to continually and consistently confuse the NY/Tri-State premium with the bubble. And when people show consistent evidence of the bubble, you dismiss it as jealousy/bitterness/a lack of understanding/blindness whatever, you just don’t provide hard evidence to the contrary.

Everyone here knows this area is more expensive than B*mf*ck Kansas. Duh. Everyone knows that salaries here trend higher and prices are higher. It’s not a surprise that a shack in Mississippi is less than a years salary, a ranch in Oklahoma a couple years and USUALLY a colonial in NJ 3-4 times New Jerseys inflated wage. You’re not educating anyone there.

But when those numbers climb to 6,7,8…11 times the regular salary and people start questioning the basis for that, to continually insist that they just don’t UNDERSTAND how SPECIAL this area is and to throw out 2 or 3 anecdotes rather than some hard evidence, smacks of arrogance and obtuseness.

You have a goldmine here of relatively well paid, well educated middle class individuals talking about how unaffordable things have become in a very short time span. Seems to me a smart investor would view that as the canary in the coal mine, however you’ve been constantly and consistently dismissive of other peoples life experiences.

Oh well. More fool you.

From the WSJ:

http://blogs.wsj.com/economics/2007/12/20/dr-seuss-green-eggs-and-cdos/

…

Would you buy my CDO?

I do not like them, Broker Joe

I do not like your CDO!

Would you like it here or there?

I would not like it here or there

I would not like it anywhere

I do not like your CDO

I do not like it, Broker Joe

…

Our SIV has had a few rough knocks

Get in now, you sly old fox!

I am slyer than a fox

And I don’t think you have the docs

That you must have if you foreclose

And so a judge will thumb his nose

At you, your SIV, and CDO

Who owns the mortgage?

I don’t know

And you don’t either, Broker Joe

I would not know it here or there

I would not know it anywhere

I will not buy your CDO

I will not buy it, Broker Joe!

…

But you can trust the agencies

They’ve rated this stuff Triple-B!

This tranche is still investment grade

You buy it here, your year is made!

The agencies have been asleep

Their ratings are just like ‘Bo Peep

That is, they’re from a fairy tale

As fiction goes, they’re off the scale

And I do not believe them, Joe

And so your tranche is a no-go

You think at 50 it’s a do

Until it falls to twenty-two

I do not like your CDO,

I will not buy it, Broker Joe!

…

Have you met our in-house quant?

He’ll model anything you want!

Except, that is, transactions costs

No thanks, I do not want the loss

From any quant’s sexy black box

Or mortgages unbacked by docs

Or mindless buys of kiwi-yen

Or ABX headed to 10

Or any other credit turd

I’ve spoken, Joe, so hear the word

I do not like your CDO,

I will not buy it, Broker Joe!

Clot – I think Pat wins the tough chick smackdown prize.

She does it with a more acerbic wit and shorter sentences. I tend to verbose. Stubborn though.

Clot – I think Pat wins the tough chick smackdown prize.

She does it with a more acerbic wit and shorter sentences. I tend to be verbose. Stubborn though.

JB [58],

LOL.

No link, came across my desk.

Bernanke: There you go. I got nominal interest rates down to zero. Now its your turn.

Wall Street: So what happens now? Nobody wants to invest in assets because they think they can only go down in value.

Bernanke: Well you can all lend to each other and keep the markets liquid.

Wall Street: You must be kidding. We are in a liquidity trap. We don’t want to lend because it is too risky.

Bernanke: Then I will fly around in my helicopter and drop dollars onto the streets of New York. If I can’t then I will buy subprime houses … oops that is what I am doing already.

Wall Street: Rates are zero so we will wait for they can only go up. That is why the Bond market is collapsing.

Bernanke: But according to Milton Freidman and Keynes, I am doing the right thing.

Wall Street: Look at Japan in the 90’s. You need to build more freeways, hospitals, start another war, that sort of thing. Get the budget deficit up a bit more and provide meaningless jobs for people. Until you learn from the past, we will just sit here.

Bernanke: My job is over. I am off to be Goldman’s next CEO. Bye, bye

#52 – sync –

well, it’s hard to respond to what your friends are doing, because i’m not sure what you think a “shyte job” or doing” incredibly well” means. i also don’t know if there are any other things holding them here or not, or if in the privacy of their own home, they wish they were somewhere else ( i mean the one’s who stay regardless of the fact they have shyte jobs). or if the one’s doing incredibly well would be very happy doing incredibly well somewhere else – maybe they’re doing incredibly well here, because the good job is here – which was my point.

having said all that, i do agree that a lot of college kids want to move here – i don’t blame them – what i was trying to respond to was the implication that smart people move here because they want to be near smart people – i’m sorry, i think there are lots of smart people in the world who like open space, outdoors, nature, short commutes, family time etc. who would love to move out of ny to a place that was less of a hassle IF they could find a job there.

#61: The so called “enlightened”, open minded, holistic society that lives in the NYC Metro area in reality have loud mouths, closed minds, expensive taste (and CC debt to go with) and will personally attack those who disagree with them.

BC Bob,

I just had my first experience w/repercussion of the falling dollar. Went to buy the Irish import cologne/perfume from the local Irish shop, big price increase. I mentioned it to her, because I have been buying for quite a few years, sorry dear the falling dollar!

I thought people lived in NJ/NY because of the jobs. Period. Why would you live here if it wasn’t for your job? The weather kind of sucks. The traffic definitely sucks. And the people are slightly rude.

I also live here because my entire family is here and that’s important to me. But other than those two things (family and jobs) I don’t know why anyone would live here, especially with the outrageous prices.

Now moving to NYC after college, that’s a whole different animal. Not related to NJ at all. And many of them will leave, a few will stay.

I agree that economic opportunity is the New York metro’s biggest lure.

Wife’s job and our families anchor us to this horrible area. I would love to move to upstate NY…but stuck in Bergen County for now :(

Since when is 700K a lot of money?

Scribe #50,

Wow, that takes cajones to ask $249,000 for an inhabitable dump in Colonia. At least there was no realtor propoganda about “hidden gem” or “needs TLC”. I guess they are looking for flippers. Reminds me – I was watching Flip That House on Saturday and they had an episode with some male model types who decided they were so smart and good looking that it was time to form a flipping company. They bought and flipped a place last May and said it would be the gem of Hamden, CT. Well, I checked on zillow. The house is still unsold. Hilarious..

John #67,

I must have missed it. Since when is $700,000 NOT a lot of money?

[i]A year ago you told us that while your prior prediction was incorrect, and real estate was no longer skyrocketting, it would never, ever, fall. The worst possible case was flat prices. Again, we should purchase homes immediately, lest we lose out on the double digit appreciation that was sure to resume.

Now, you come here to tell us that while prices are falling (which you assured us could never, ever, happen), the drop will only be minor. [i]

Actually I recall even mainstream media talking incessentaly about a housing bubble even 2 years ago…and most experts talking about either a pause or soft landing because the rise in prices had been above average…and then of course there was a crazy fringe talking about a crash and to save yourself a place in line at your nearest soup kitchen.

Example of just one article from mid 2006..note the opening sentence.

Everybody agrees that the housing market is drifting down from record highs. But is it coming in for a soft landing, or is it about to crash?

That’s what economists debated at the National Association of Home Builders’ spring construction forecast conference, held on Thursday in Washington, D.C. Attended by building-product manufacturers, builders and others involved in the housing industry, the semiannual event covered the likely trajectory of housing prices, starts and sales over the next year or two.

Although most of the economists on the panels have close ties to the industry, none was projecting a continuation of the five-year housing boom, which peaked last July. Nearly all described the housing market as “in transition,” although they couldn’t agree on how much favorable factors like strong overall job growth, low unemployment and moderate inflation will be able to mitigate the drag of rising mortgage interest rates, lack of housing affordability and wage stagnation.

lisoosh #56,

Verbose? I found your last post to be… perfection.

700K is only about 15 times the per capita personal income for the Edison NJ metropolitan division.

Mr T,

I believe Grim’s response was about YOUR prior prediction, not the NAR’s or NAHB’s.

Unfortunately the kettle family in tied to NJ because we have a lot of family here as well. I agree with the sentiment that if you dont haver family or one heck of a job tieing you to NJ, then why are you here???

#56 lisoosh: Thank you for the support, I am glad to know that I am not imagining things.

On a happier note, I received an early Christmas present lat night.

A Christmas CD by a group from Cape Breton called the Barra McNeills, they had what I consider to be the best version/interpertation of Auld Lang Syne, a truly beautiful song if performed in the traditional style.

I will be Cape Breton in April, and in the summer I will be going to Ireland (again).

I will also be visiting Scotland, I had been to Edinburgh when I was a teen, so have not been there in quite some time, I will also be visiting Inverness in the Highlands including the Isle of Barra. I am of course looking forward to the trip.

Bear Stearns cut 1,400 jobs in fourth quarter, CFO says

http://www.marketwatch.com/news/story/bear-stearns-cut-1400-jobs/story.aspx?guid=%7B75AE6F35%2D9BFA%2D4A5D%2D9986%2DB10CBF1D442F%7D&dist=hplatest

http://blogs.marketwatch.com/greenberg/2007/12/straight-talk-on-the-mortgage-mess-from-an-insider/

Money quote: “So, in a nutshell we have 90% fewer qualified buyers for five-times the number of homes.”

“I agree that economic opportunity is the New York metro’s biggest lure.”

Pret[66],

Do yourself a favor, make some adjustments regarding the financial sector, Mayor Bloomberg has.

MS- China

UBS- Singapore

Citi- Dubai

Bear-??

You have London taking the lead in IPO’s, hedgies and syndicated finance. The recent explosion in derivatives puts Chicago in the lead in this area, [the merger of merc and bot].

There is a power shift taking place from west to east, except for derivatives. Come down to Wall Streer someday and visit Hermes, Tiffany’s, apartments and condos. Oh by the way, all former finacial offices.

This is a major shift taking place. Open your eyes. One other point, it might be prudent to carry some dirhams in your pocket.

so far the housing crash..is more like landing on a featherbed……what a dud.

MrsT,

Tell that to the folks on Briar Court..

39 Briar Court, Hardyston NJ

Purchased: 3/25/2005

Purchase Price: $452,611

MLS# 2446411

Sold: 12/14/2007

Sale Price: $400,000

(12% Loss)

55 Briar Ct, Hardyston NJ

Purchased: 5/25/2005

Purchase Price: $460,148

MLS# 2446223

Sold: 11/1/2007

Sold Price: $420,000

(9% Loss)

82 Briar Court, Hardyston NJ

Purchased: 10/18/2004

Purchase Price: $524,486

MLS# 2427383

Sold: 12/17/2007

Sale Price: $395,000

(25% Loss)

28 Briar Court, Hardyston NJ

Purchased: 01/23/07

Purchase Price: $556,015

MLS# 2465060

Currently Active

Asking Price: $495,000

(Potential Loss 11%)

37 Briar Court, Hardyston NJ

Purchased: 12/8/2005

Purchase Price: $456,725

MLS # 2433854

Currently Active

Asking Price: $418,999

(Potential Loss 8%)

68 Briar Court, Hardyston NJ

Purchased: 1/27/2005

Purchase Price: $551,206

MLS# 2451979

Currently Active

Asking Price: $529,000

(Potential Loss 4% – Won’t ever sell at this price)

#78 njbear: And my sources tell me they are not done. Teh Bear has always been notorious for cost cutting, etc.

grim,

What the h*ll is on Briar Court, nuclear waste?

NYC is like a revolving door. Tons of people move in every year straight out of college, most of them doing pretty crappy jobs. They share crappy apartments for a few years, often with big parental subsidies, before burning out and moving away. The shared 5th floor 1 BR walkup isn’t so cool anymore when you’re 28. Mom and Dad get less and less inclined to pay the bills. You start to think about whether you’ll be stuck in the same situation or worse at 30, 35, 40… More and more of your friends start to bail out. You realize that you don’t even do a lot of the things NYers are supposed to do. You don’t go to cultural events (too expensive) and are tired of feeling inadequate at the “cool” bars. All of the men / women you meet are crazy / egomaniacs/ philanderers/ goldiggers. Your mom talks about people you went to high school with who have spouses and children and houses and cars. It sounds nice. Maybe those people aren’t as dumb and lame as you thought. You are supposed to be a real adult now, but you don’t feel like it. The people in this city are really a bunch of children who refuse to grow up. Graduate school might be a nice way out…

Gary,

The Crystal Springs development in Hardyston. I’m about ready to dub that development ground zero of the real estate collapse.

That was only 1 street.

You ain’t seen nothin’ yet.

grim,

I remember a few years ago the RE sections of the Sunday papers pumping up that area big time. Of course, it’s a pretty area but the commute is deadly.

Asking prices are out of wack. Check this out. Two 3 bedroom + basement + 1 car garage townhomes in piscatway, they’re both about 30 seconds apart (by car), different developments, one is 10 years older than the other. Asking price difference is 170k.

http://homes.realtor.com/realestate/piscataway-nj-08854-1088951874/ – asking 319,900

http://homes.realtor.com/realestate/piscataway-nj-08854-1084537858/

– asking 489,900

It’s a nice drive on a sunny Sunday afternoon.

So scenic, in fact, that you barely notice that the highway narrows to 1 lane.

grim,

syncmaster Says: Your comment is awaiting moderation.

December 20th, 2007 at 11:48 am

So, when do the congressional hearings start on deceitful and fraudulent lending practices, schemes, scams and mis-representation? And who will be called to give testimony?

#78 – Jamey – Thanks for that post, interesting read.

#79 – Bob – Regarding Chicago, some of that business may be coming back to NYC. I’ve been hearing lots of nastiness coming out of Chi-town.

And I have another question; does anyone know if Suzanne is still doing research?

gary,

I too wonder about who will be called upon to play the role of Michael Milken in this charade.

When they held auditions for the part of Henry Blodget, I hear the lines wrapped around the block. Passersby mistook the crowd for a new condo conversion opening.

My 700K comment is a little sarcastic and a little true as I went to a few condo/coop sales in downtown NYC and that is the absolute bottom price for a fresh college graduate starter place and out in the surburbs that is the bottom price for a livable home. Yet plenty of people are buying. My co-worker who is a 35 girl was told by the male model RE broker at a new wall street condo downtown, that he will take her to the 1-1.5 million condos first even though her price range is 750k to 950K as he wants her to see what real condos look like so she does not get a bad impression of the building. After seeing the beautifull 1.3 million dollar + units we then went to the third floor 850K small one bedroom condo that faced a brick wall and was told that if she feels uncomfortable with her financal situation he could get further information on the small unit but he recommends she come back after bonus time when she can afford a nicer unit. With that he said he had another appointment and gave us his card. She had a $950K budget and we were treated like trash. WOW. That was only two weeks ago.

#91 – Gary – Yes, on how to clean a Frialator.

John #93,

… out in the surburbs that is the bottom price for a livable home.

Which suburbs do you mean by ‘suburbs’? We clearly have different definitions of the word in mind, because I know of plenty of suburbs where one can find livable homes for well below 700k.

We have the same amount of QUALIFIED buyers.

Last year we had unqualified buyers who were able to get loans.

Jamey Says:

December 20th, 2007 at 11:19 am

http://blogs.marketwatch.com/greenberg/2007/12/straight-talk-on-the-mortgage-mess-from-an-insider/

Money quote: “So, in a nutshell we have 90% fewer qualified buyers for five-times the number of homes.”

[90],

Futures are not coming to NY.

#97 – Are they staying in Chicago then at reduced staffing?

http://www.phil.frb.org/files/bos/bos1207.pdf

philly fed -5.7.

I always laugh when I think about Mike Milken. Many years ago when I was a junior auditor Drexel intraday in the afternoon was in violation of Net Capital (Last Day), Legal at DTC needed an auditor to observe as they were going to KILL their DTC number and use the reverse wire and demand of collateral feature to suck up all their available cash they could get a hold of to cover their net capital violation. As soon as the head of legal hit that button on her PTS terminal everything stop mid trade at Drexel!!! I went over to 55 Broad an hour later and saw all the Drexel people out on the street looking like 9/11 surviors all dazed. The reporters were all sticking their mikes out to get interviews and people were trying to figure if they were going to go to work the next day. I felt like the guy who flips the switch in the electric chair that day.

On a funny not a few months ago I heard that Dennis Levine has a consulting company up in midtown and is not that busy. My friend was in contact with him to hire him on a project as we thought it would be a hoot to hang out with him. Too bad my friend got canned for something non related to that so we never got to hang with Dennis.

grim Says:

December 20th, 2007 at 11:59 am

gary,

I too wonder about who will be called upon to play the role of Michael Milken in this charade.

Skeptic #83,

hilarious and I couldnt agree more. And that’s especially true for young women looking for love in a city that 65% female and 15% gay men. Alot of women I know have come do the NY thing, find that its not all great, then go home to marry their high school/college boyfriends.

98,

Not in S&P, 10 year, eurodollar futures. Of course, as hedgies leverage is cut there may be repercussions. In addition this, the grain side of the floor is exploding.

#66 Ann and #77 Kettle,

Have you lived anywhere else in the country (Note: Not critcizing)? I have and I will tell you that every place has its good and bad. Also NJ traffic is not that bad compared to the places in my list.

For the most part, those who live outside of the NY Metro area are pretty unintelligent and ignorant. Not that New Jersians are the epitome of intelligence, but we have a larger percentage of intelligent/non-ignorant people vs. non-intellignet/ignorant.

Phoenix – Dumber than boxes of rocks, traffic

Atlanta – Transient city, educated, but not from Georgia. Locals – uneducated and violent, ridiculous traffic

California – Soulless, ridiculous traffic

St. Louis, KC, Minneapolis, Denver – It’s the Midwest people – Nothing to do, Nothing special about the weather

Dallas – Transient city, not bad, better than Hotlanta, traffic.

Florida – Wow, dumb.

Pennsyltucky – Much like Southern NJ

Raleigh – Transient, educated, epitome of the burbs outside of city is the dumbs

Hawaii – The locals hate you, lots of petty crime, expensive

New Jersey – rude people, expensive

3b (44)-

I think it doesn’t matter. The takeaway is, pret has been exposed as a modern-day Pangloss and world-class blowhard.

Wow, Pangloss is a great descriptive noun.

I think I will add that to my book entitled “How to end baseless arguments with an idiot after mounding frustration”

Gary #89

Congress has to address more important things first like steroids in baseball, etc…

or mounting frustion, or a mounting mound of frustation.

Now the hometown guys sure are some dumb country bumpkins. Girl leaves at 21 years of age,does the NYC party scene, hamptons/NJ shore, ski house thing and basically maxes out her CC for 3-5 years while hooking up with guys who are out the door by date three. Dumb country bumpkin is sitting home saving and saving and maybe dating the one other girl in town. I don’t get it. My friend from the rural south with male model looks came up here at 21 with plans to stay till 30, after 200+ girls he went back down south to marry his 23 yo old virginal bible thumping beach blond dimm witted traditional baptist wife and stopped working out, last I saw he was 35 with a beer belly from all that good old boy cooking and driving everywhere.

I hope those down home guys have some industrial grade deutchs they can use on their high mileage hometown sweethearts.

ADA Says:

December 20th, 2007 at 12:19 pm

Skeptic #83,

hilarious and I couldnt agree more. And that’s especially true for young women looking for love in a city that 65% female and 15% gay men. Alot of women I know have come do the NY thing, find that its not all great, then go home to marry their high school/college boyfriends.

SS # 106

If anyone thinks that our society has not slipped into bread and circus need only consider the following statement

# SS Says:

December 20th, 2007 at 12:46 pm

Gary #89

Congress has to address more important things first like steroids in baseball, etc…

when performance enhancing drugs in professional sports is a congressional issue you know that there are VERY serious issue going on. “just ignore the man behind the curtain”

83 skeptic

Awesome depiction of the post-college NYC scene.

TJ #103,

for alittle perspective, beefore the age of 20 i had lived in the following

Georgia

Tennessee

New jersey

North Carolina

Mississippi

New Hampshire

Since the age of 20 i have lived in:

NJ

NY

MA

Ultimatly, its about perspective, but i feel that i have a good sampling of the east coast and generally dont romanticize towns/states. Ultimately its about where do you feel that you fit best. its a different answer for everyone

lisoosh (57)-

The volume of hard facts pret offers to bolster his arguments move in direct correlation to the strength of those arguments.

When one drinks the Kool-Aid, the flavor doesn’t really matter (although I’m partial to cherry).

OT

but for those who argue that current oil prices are not an issue might suggest you take a look at this

All Things Considered, December 19, 2007 · Heating oil prices are up sharply this winter. In Maine — where 80 percent of homes are heated with oil or kerosene — people are struggling to heat their homes.

The state’s low income heating assistance programs are helping, but because of the rising prices and high demand, they are running low on funds.

Meanwhile, the federal Low Income Home Energy Assistance Program is receiving a record number of applications from the state.

when the poor start to freeze in large numbers you are going to see some serious unrest start to develop.

103 T J

Yes, I have lived other places. I’m actually not a big NJ hater, but you have to admit that there aren’t that many reasons to live here if it wasn’t for the jobs and of course, family ties if you have them.

Personally, the weather is the biggest drag here for me. We go from cold to hot. Not much else. Even if I was going to live somewhere that has a winter, it would be somewhere a little bit prettier.

There are pockets of intelligent people everywhere and pockets of not-so-bright ones.

Southern NJ is actually not-so-bad in my book. Parts of it anyway.

ADA (101)-

I’m one of those who came to NYC from college and- by working far too hard and having some blind-ass luck- stuck.

Funny thing is, I’m not a regretful person. But as I approach 50, I increasingly wonder whether any of what I did was worth it.

The finger of suspicion

Dec 19th 2007 | NEW YORK

From The Economist print edition

“In America and elsewhere trial lawyers, state prosecutors and regulators look for the crime in subprime”

http://www.economist.com/finance/displaystory.cfm?story_id=10337884

John (108)-

Is “deutchs” how you spell “douche”?

Thanks for the soup all over my desk.

#104 clot: Oh that he is. But in the spirit of Christmas, and for my own sanity, going forward, I am just going to ignore him.

Kettle,

You are right; it is what fits you best. Personally I love the change of seasons and the geography. The fall is great in the harvest months (Pumpking, apples, peaches, etc.) I love a cold winter, snow, a fire and a homemade chocolate porter. The beach is an hour away during the summer and the fishing is great and we have great mountains for hiking in the spring.

Things I can not live with: conversations with ignorant people, homogenous cookie cutter neigborhoods, excessive traffic, “fake” people.

Things I love: Overall convenience of the state, close proximity to the ocean and the mountains (geography), great education system, diversity, and culture (food, festivals, etc.)

And even though I do not like rude people, horrible customer service and high cost of living, I am willing to sacrifice that for all of the other things you can not find in any other part of the country.

Ann – I am sorry to hear you don’t like the weather. I think that is one of the reasons NJ’ers like Virginia and North Carolina. The climate is a bit more moderate and consistent. However I also feel that one of people biggest factors for not leaving is proximity to family, which makes it sound like you are “stuck” here. But I think family is another great quality our state possesses. Those are just my thoughts and rambalings.

Clotpoll,

I’m a fan. Instead of an easy button, you have a bs button on your desk.

119 T J

I would LOVE a more temperate climate, although I like your description of the pleasant parts of living in Jersey and the changing of the seasons.

Maybe I wouldn’t appreciate spring so much if we never had a winter.

grim, is this 2008 election map? i figure republicans will take green (blue) state and democrats will take red (yellow) state. the key is how the color will change in next few months.

Questions for everyone:

1. How can you find out if a homeowner got the right permits for a basement that they finished themselves? Can you call the town yourself?

2. What’s the difference between real price and nominal price?

I can get the whole NY thing out of college – in fact, it’s probably better to do it then and get it over with than to drag a family to this region in order to chase some dream.

I like the New Hampshire ethos, love Montreal, like the sound of Ithaca upstate and so on, but REALLY hate the long cold dry winters. The UK is much more temperate.

There is some website that allows you to enter in your requirements – town or city, weather, culture etc. For me, Eugene, Oregon came out tops. In fact something like 7 of the top 10 for me came out on the West Coast, which has the same wet weather Scotland enjoys, lots of culture and a hippy vibe.

Keeping me from moving to the West Coast is familiarity (I’ve emigrated and moved plenty and am just plain fed up with it) and the proximity to easy and cheap air routes to family and friends. Can’t say I haven’t been tempted, but the West is just as bubbleicious so there are no cost advantages there.

I agree with Ann, the weather sucks. I don’t think it is so bad though – the Western part of the state is pretty, education is decent, the area is diverse and outside of the NY city circle, it can be pretty decent. Just need to allow this bubble to deflate to make it reasonably affordable again and it would be quite livable. :-)

Hot off the wire from the AP:

Bush Signs Mortgage Legislation

AP

Posted: 2007-12-20 13:28:50

WASHINGTON (AP) – President Bush on Thursday signed a measure to provide financial relief for financially strapped homeowners facing foreclosure or in bankruptcy.

The bill gives a tax break to homeowners who have mortgage debt forgiven as part of a foreclosure or renegotiation of a loan. No taxes would be owed on the value of any debt forgiven or written off. Currently such debt forgiveness is taxable income.

“When you’re worried about making your payments, higher taxes are the last thing you need to worry about,” Bush said in a bill-signing ceremony. He stood along side members of his Cabinet and lawmakers who pushed the measure.

While the measure is anticipated to reduce taxes of some strapped homeowners by $650 million, the cost to the government would be offset in part by limiting a tax break available on the sale of second homes.

The bill was in response to a mortgage crisis touched off this spring by a blowup in high-priced home loans for risky borrowers, throwing a pall over the economy. Foreclosures are at record highs and late payments are spiking. Lenders have been forced out of business and investors have taken huge financial hits.

“This is going to make a happy holiday for many homeowners,” Bush said of the bill moments before signing it into law.

An estimated 2 million to 2.5 million adjustable-rate mortgages – worth some $600 billion – will jump from low initial “teaser” rates to higher rates this year and next. Steep prepayment penalties have made it difficult for some to get out of their mortgages, and some overstretched homeowners can’t afford to refinance or sell their homes.

Fannie Mae faces huge risks from several areas combined:

1) Falling home prices that will greatly drive up foreclosures (causing huge credit losses)

2) Large exposure to Alt-A, interest-only, subprime and high loan-to-value mortgages

3) Dependence on foreign purchases of short-term debt to fund operations

4) Dependence on shaky mortgage lenders for revenues (i.e. Countrywide)

5) Dependence on shaky mortgage lenders to service mortgage delinquencies (foreclosure credit losses)

6) Dependence on shaky mortgage credit insurers to cover credit losses on high LTV loans

7) Huge derivatives exposure concentrated among few counter-parties

TJ

I actually think that northern MA and southern NH fit a lot of the things you like about NJ. northern MA or Southern NH would probably be my 1st choice of a place to settle if not for the family ties in NJ. My family is scattered to the four winds, but all of the wifes family is here, and for the kettle family its a priority to raise baby kettle around the rest of the family, which in this case means staying in nj by Mrs kettles family (fortunately we all get along very well, even with the crazy mother-inlaw). Also, just being realistic, no place is perfect. When the wife and i have discussed what our primary factors are we find most of them put us in the MA, NH area, but as i said before the trump for us is family. And yes i dont thing that MA is too much of a nanny state but as i said before no place is perfect

Grim, why is my # 126 in moderation??? what was the no-no?

#103 tj

wow! everyone you meet is dumb? everywhere?

i was born in nyc and so were all my family members: parents, children, grandparents etc, and i’ve never lived in those places, so i have no personal reason to defend them – but i do know people in some of those cities and they’re not idiots.

you know, a lot of people in those other places look down their noses on nj. i moved from boston a while back and when i told people i was moving to nj, i got a wrinkled nose and ewe!! look on their face. i think everyone was thinking elizabeth. i had to convince them that there are actually some nice spots in nj!

and forget ny’ers, they don’t consider nj part of ny anyway.

t c m,

Not everyone, but a greater majority. The ratio of intelligent to mind numbingly dumb is a lot greater in NJ. So, you are more likely to run into an idiot or a group of idiots elsewhere. It is really truly weird and scary when you find out what people think and actually know in other parts of the country. I can discuss about so many experiences:)

TJ, #130

I know i sound elitist, but i do agree with you somewhat. I suppose it comes down to the saying “consider a person of average intelligence; no consider that half of the people out there are dumber then that!” it is kind of scary that in a world as technology based as ours that the average individual has little idea how most of the tech the use actually works. I am not saying you should be able to build your own 747 to fly to the UK, but you really should have at least a functional concept of how the tech you use every day works…

Once you realize that spewing bs about ‘interpretive dance’ or some other NYC mainstay is no ‘smarter’ than talking about NASCAR, you will discover that the rest of the country really isn’t that stupid.

I don’t even consider Brooklyn, Bronx and Queens part of NYC. Lots of those BBQ tunnel rats in the city on Saturday nights ruining the place.

and forget ny’ers, they don’t consider nj part of ny anyway.

t c m,

Also, do you not find it weird that everyone else has an issue with NJ/NY, but we really do not have issues with anyone else? Do we scowl when people say they are from Boston, Chicago, California? Chicago is ultra competitive with NYC, yet I never knew we were their competition until I worked there. I think that everyone who lives elsewhere perceives NJ as, essentially, a crap hole. This is good because it will keep those ignorant idiots from moving here and reaping the benefits.

You should really compare NASCAR to the US Open, both places empty head fools just shake their heads back in forth for a few hours. The Tennis folks are slightly smarter as they must have a bigger bean in their head cause I don’t hear it shaking.

Aaron Says:

December 20th, 2007 at 2:32 pm

Once you realize that spewing bs about ‘interpretive dance’ or some other NYC mainstay is no ’smarter’ than talking about NASCAR, you will discover that the rest of the country really isn’t that stupid

I thought NJ was just a surburb of Fresh Kills, at least it appears that way on the cab ride from NYC to Newark airport.

Aaron,

you have a good point, a dance aficianado is at the base level no different then the nascar fanatic. The issue (for me anyway) is not an individuals tastes, but their quality of thought. I would much prefer to interact with someone who did not know much about a given subject but was an “intellectually curious” person. Then someone who is sure they know everything and is not interested in new ideas/concepts/experiences.

#134 –

yes tj, i have to agree with you there. i found a lot of that in boston! my sister lived in washington dc out of law school, and she found a lot of that, and i went to school upstate and found it also.

ok, i agree, we are smarter.

Aaron,

That was a very bad if not horrible analogy to prove a point. As acting ignorant in an elitist manner is just as bad if not worse than being plain ignorant. And how many people actually watch or discuss interpretive dance vs. those who watch NASCAR.

I hate to generalize, but basically any place that is within a 90 minute drive of Boston is subject to some of the most blatant racism I’ve ever seen. The only exceptions seem to be Cambridge and some suburbs that have a ton of high-tech/biotech workers.

As far as the weather? It’s really had to top this area, because (regardless of what you say) it just doesn’t get that cold, and the summers are so much more tolerable than anything south of here.

FYI – the is a reason for the Hamptons by the way…..if you look all over the entire country, there is simply no other place that has the same combination of beach, comfortable water and moderate temperatures in July and August, except maybe Hawaii or San Diego. San Diego is boring and Hawaii is too far away.

Kettle I have lived all over the country and have met all kinds of people, many of whom were interesting to talk to if you care to listen.

Once you put your cultural biases aside I haven’t seen a big difference in ‘intelligence’ between the places I have lived.

grim, #55

Yes, I thought it was odd that the agent did a photo layout of the interior.

But maybe he wanted to make it clear that it wasn’t a “bargain,” it was a knock-down.

TJ, you understand exactly what I was saying, but I can’t figure out what you just said.

t c m,

Good point. I believe those who take the time to watch or discuss interpretive dance may be a little more open to watching NASCAR than vice versa. But that is purely an assumption as I have not surveyed any of these people or will not likely find any statistics that will ever exist on that subject.

chifi / children are -(NPV) Says:

December 20th, 2007 at 2:43 pm

One caveat about the weather…..if you live near or within 20 mintues west of I-287 in NJ, for some reason you seem to get a hell of a lot more rain and snow…..I think it has something to do with the Watching Mts., but back when I drove from Hoboken to Basking Ridge/Bedminster, I would always marvel at how any system seemed to piss all over this area….sorry clotsoi

Aaron,

I am not being specific to one location there are both smart and dumb people anywhere you go. I personally enjoy hoping into cultures i am not familiar with, both local and international. It usually makes for an interesting learning experience. One of the most memorable experiences i had was just sitting down with a carpet seller in istanbul when he invited me for a cup of tea. 3 hours later he invited me to dinner with his family. It was a phenomenal experience and really showed me that people are the same where ever you go once you get past any superficial differences and that different is not always bad.

So if you are ever in istanbul and a carpet dealer offers you tea, accept and enjoy a conversation!

Aaron,

Sorry, I will put it this way.

How many NASCAR fans are there? Millions right.

How many interpretive fans are there? 4 maybe 5.

So to say the interpretive dance fans sufficiently describes NJ’ers vs. NASCAR fans, which does indeed describe the majority of non-NJers (based on the amount of NASCAR crap I had to buy my nephews in PA), makes your agruement weak. So if you can find an effective hobby that is as “average intelligent American” as NASCAR that would describe NJ’ers then I would have to agree with your statement.

Kettle1,

If you are ever in Amsterdam and someone offers you tea, you are in for a much more interesting experience.

I live in Jersey and hate interpretive dance and mildly tolerate NASCAR.

WWE.. now that I like!

Adding to your list and agreeing with some and repeating what some of my friends have said about outside areas.

Atlanta – You might be able to find another job but you might not be able to get to it. Your job is based on what side of the highway you live on going across the highway is commute suicide.

California LA – Soulless, Self hyping, and will remind you of Newark only bigger. Put a desk in your car your going to be working from there.

Dallas – What Atlanta should be, manageable traffic, overall I think Dallas is a great place but a lot of people have allergy problems moving to Dallas. Lots of NJ people moved there. All said they would never return if they don’t stay they go to Florida.

Florida – Dumb doesn’t begin to describe it all. Mix of seniors with pure trailer trash and thieves. Be sure you are too old to notice if you move here. If you work in the Mail room in NY/NJ you can be a manager in FL so for some its career advancement. The speed limit is 65 but everyone is going 55.

Raleigh/Durham – Outside of city is the dumbs. Limited number of things to do.

Chicago – Rude and cold.

Ohio – Paid for everything with cash but there isn’t a thing to do. Boring. Depressing. Cheap yes. Roads need work.

Oklahoma City – Dont ever think of going there its not for anyone from NY/NJ. You will hate it within a week.

Virginia – Your in the military or working for a militarily company. Gives the Half Abandoned feeling wherever you are. In some places its stuck 20 years ago in others its like its been abandoned 20 years ago.

Charlotte – New Yorkers and New Jersey people who were tired of the rat race. Traffic is random. One day clear the next day 20-30 mins more with no reason why. Its as if PA had NJ jobs in one state. Still small but growing fast. If you like the suburbs of NJ you will love Charlotte. If you need real city life you will starve to death or go stir crazy. You drink beer and go out to eat with several couples from your development.

South Carolina – Like people in PA that work in NJ you live there but you work in Charlotte. Lots of outdoor things to do very similar to PA with a better climate.

New Jersey – road rage, expensive, overtaxed, nothing is free not the roads, parks, or beaches. A friend in NJ is a friend for life, good food in a lot of places. Your bosses think you should work more than 60 hours a week and you will not get any credit for doing it. Bosses micro manage their people and don’t want you to take time off. The wrong people are fired all the time. Its the CYA state. Your friends live 30 mins apart from each other. You don’t know more than 2 of your neighbors. In some instances you didn’t know any neighbors.

Lisoosh, I read your comment in which you accuse me repeatedly of failing to provide “hard evidence” and call me a “fool.”

My views have been that the NJ home price boom that just ended was similar in scale to the one before it, and that this boom will also end in long period of stagnant prices instead of a complete bust. People fell over themselves to rubbish these views. They supported their positions by repetitively posting a chart purporting to measure US home prices across 3 centuries, by calling me slurs, or by producing evidence that was interesting but anecdotal.

In response, I built a chart that illustrates NJ home prices across the past 2 cycles, in real and nominal terms. I disclosed the data series I used. In addition, I identified the peaks and troughs and measured them. When new data becomes available I update the file and ask grim to post it.

If that isn’t hard evidence that helps support my view while also adding to the debate in a constructive way, what is?

https://njrereport.com/files/NJ_OFHEO_data.xls

This board seems kind of boring today without Trolls making controversial statements. Can we dedicate someone to make horrible or broad statements and post unsubstantiated facts for the sake of arguing?

Example. Did you know water is actually bad for you?

#123

Ann, was just looking that up myself a week ago.

investorwords.com is a great tool.

Nominal

Definition 1

Not adjusted for inflation.

Definition 2

The par value of a bond.

nominal asset

Definition

An asset that does not have intrinsic value. One example is currency. opposite of real asset.

real

Definition

Adjusted for inflation.

real asset

Definition

An asset that is intrinsically valuable because of its utility, such as real estate or physical equipment. opposite of nominal asset.

Re this bill Bush signed, since there’s no longer any tax consequences does that mean they’ve just invited people “to put the keys in the mailbox and leave”? These people’s credit histories are already shot from the late payments etc.

hehehe,

The barrier to exit has been removed.

Short sales and “Deed in Lieu” no longer involve a tax implication.

are COs hard to get? what other ‘certs’ are there to consider & their cost?

Mitchell,

That is great. NJ friends are friends for life. On the west coast, they act like they your best friend from day 1, but they will walk on you in a heartbeat for any selfish decision. I never say anything out of line in front of a co-worker from the west coast. It will come back to haunt you.

hmm troll you say…