From CoreLogic (no link):

CoreLogic® Home Price Index Shows Fifth Consecutive Month-Over-Month Decline

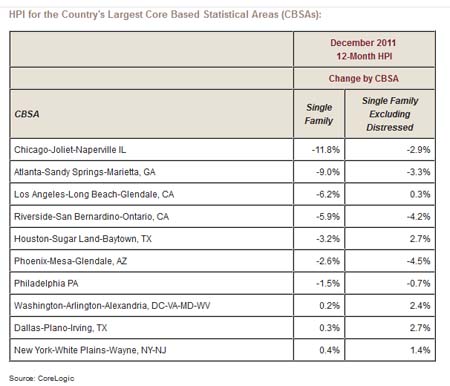

Home prices in the U.S. decreased 1.4 percent on a month-over-month basis, the fifth consecutive monthly decline. However, the HPI excluding distressed sales posted its first month-over-month gain since July 2011, rising 0.2 percent. The CoreLogic HPI shows that, including distressed sales, home prices in the U.S. decreased 4.7 percent in 2011 compared with December 2010. This year-end report shows that home prices continued the trend of year-end decreases—this is the fifth consecutive year with a decrease in the HPI. The HPI excluding distressed sales shows that home prices decreased by 0.9 percent in 2011, giving an indication of the impact of distressed sales on home prices in 2011.

Highlights as of December 2011

Including distressed sales, the five states with the highest appreciation were: Montana (+4.4 percent), Vermont (+4.0 percent), South Dakota (+3.1 percent), Nebraska (+2.5 percent) and New York (+1.7 percent).

Including distressed sales, the five states with the greatest depreciation were: Illinois (-11.3 percent), Nevada (-10.6 percent), Georgia (-8.3 percent), Ohio (-7.7 percent), and Minnesota (-7.5 percent).

Excluding distressed sales, the five states with the highest appreciation were: Montana (+7.7 percent), South Dakota (+3.5 percent), Indiana (+3.3 percent), Alaska (+3.1 percent), and Massachusetts (+2.9 percent).

Excluding distressed sales, the five states with the greatest depreciation were: Nevada (-9.7 percent), Minnesota (-5.2 percent), Arizona (-4.9 percent), Delaware (-4.2 percent) and Michigan (-3.5 percent).

“While overall prices declined by almost 5 percent in 2011, non-distressed prices showed only a small decrease. Until distressed sales in the market recede, we will see continued downward pressure on prices,” said Mark Fleming, chief economist for CoreLogic.

The New York-White Plains-Wayne, NY-NJ Metropolitan Division again pulls out a positive print (Bergen County, Hudson County, and Passaic County make up the NJ component of this area).

Good Morning New Jersey

From Reuters:

Home prices fall in 2011 for fifth year: CoreLogic

U.S. home prices fell in 2011 for the fifth year in a row, weighed down by distressed sales of houses scooped up at bargain prices, data analysis firm CoreLogic said on Thursday.

CoreLogic’s (CLGX.N) home price index fell 4.7 percent in 2011. Excluding distress sales, prices declined just 0.9 percent.

The report also showed home prices fell for the fifth consecutive month in December, down 1.4 percent compared to the previous month.

But without distressed sales, home prices gained for the first month since July 2011, up 0.2 percent.

“Until distressed sales in the market recede, we will see continued downward pressure on prices,” Mark Fleming, chief economist for CoreLogic, said in a statement.

It’s all going from gray to black.

Extinction before recovery.

Doom is imminent.

http://www.smartmoney.com/spend/real-estate/5-housing-markets-not-sinking-too-much-1328037931332/

Rebound /Hurry

http://blogs.smartmoney.com/advice/2012/02/01/new-relief-for-struggling-homeowners/

Help is on the way

http://online.wsj.com/article/SB10001424052970203806504577182874008099702.html?mod=WSJ_PersonalFinance_PF14

A buyers market

5 – Detroit? Not necessarily my first pick for a stable housing market… I mean, that Eminem commercial can only get them so far.

http://247wallst.com/2012/02/03/the-american-cities-where-no-one-wants-to-move/3/

Camden and Newark make the list with Newark # 1. Welcome Facebook

http://www.businessinsider.com/bernanke-to-savers-we-dont-owe-you-anything-2012-2

Please buy your home now so you can make money

One of those new Chrysler 300’s blew by me in the left lane on 287 this morning. Glancing at it in the mirror I thought it was a bentley or something. Looks pretty sweet.

8.grim says:

February 3, 2012 at 7:34 am

5 – Detroit? Not necessarily my first pick for a stable housing market… I mean, that Eminem commercial can only get them so far.

http://www.marketwatch.com/story/panasonic-swings-to-loss-expects-worst-ever-year-2012-02-03

Bringing jobs to Newark

Single Family Attached:

6 Month HPI Change

Aug-10

New Jersey – 0.16%

Downloaded the report from Corelogic. This was the only other positive number I could find regarding NJ. It’s on page 50 of 58 in asset_upload_file497_14069.pdf.

Grim: what’s Single family attached? (duplex/condo/townhouse?)

Think that means people buying them up to turn them into rentals or something?

blowout jobs numbers

+243,000

unemployment falls to 8.3

treasuries plunge, recession is over 92% of people back at work. anyone who bought the new bond issue from mcdonalds yesterday at the lowest rate for a 30 year corporate bond ever can go cry in their big mac.

Anyone who plowed into Junk or Stocks in December and January please feel free to dance in the streets.

BTW BAC completed a massive voluntary tender offer of high coupon bonds and issue a massive amount of new bonds at lower coupons in the last week, strong move to the hoop BAC. I salute you.

Dec revised upwards to 203k from 200k, November revised upwards to 157k from 100k.

Jan looks even stronger when you consider that it includes a big loss of government jobs, down 14k (which is a good thing)

The S&P 500 has rallied 21 percent since its 2011 low on Oct. 3

People in underwater homes scared with money in cash. The other shoe has just dropped. You went all in on a bad investment, housing and avoided the good investment stocks. Ouch. Lets hope they don’t chase this rally and buy in now only to get hit by a near term correction coming as this is too much too soon. But they will they can’t resist buying at the top and selling at the bottom.

Almost 8% in January alone for the Fidelity Real Estate Fund. Easy money has been made.

Fidelity Real Estate Investment Portfolio

YTD Return (02/01/2012) 7.68%

Refi appraisal came in solidly above expectations yesterday (~15% over my purchase price). Locked in my sub-4 30y.

Figures. Whenever I have money to invest it’s like the worst time to do it.

18.JJ says:

February 3, 2012 at 8:42 am

The S&P 500 has rallied 21 percent since its 2011 low on Oct. 3

People in underwater homes scared with money in cash. The other shoe has just dropped. You went all in on a bad investment, housing and avoided the good investment stocks. Ouch. Lets hope they don’t chase this rally and buy in now only to get hit by a near term correction coming as this is too much too soon. But they will they can’t resist buying at the top and selling at the bottom.

Maybe I should explore that as an option. Since I put on the dormer with new bath, maybe I actually have some equity now. I’m at 5.5% now. Good credit. Sub 4% rates would really help. But then there’s that European fund…..Ugh the agony. What’s a regular guy to do?

20.grim says:

February 3, 2012 at 8:46 am

Refi appraisal came in solidly above expectations yesterday. Locked in my sub 4.

The hard part is the timing. On October 3rd we all should have went all in and margin to the max. But noone knows when bottom is. Just like noone knows the day a top was reached.

Timing was good from sense people with muni funds got all cap gains reinvested in December and we at least go two 401K payments in. People also have 2009 or 2010 stock grants vesting around this time too.

Basically from December 2008 to December 2011 we had a buyers market in Equities, treasuries, MBS, Munis and investment grade and junk bonds. For three years it was full steam ahead. That was a long long long buying opportunity. Anyone who had their 401K contributions at the max in 2009, 2010 and 2011 can tell you from Feb 2009 till Feb 2012 it is a complete 180.

Brian says:

February 3, 2012 at 8:49 am

Figures. Whenever I have money to invest it’s like the worst time to do it.

18.JJ says:

February 3, 2012 at 8:42 am

The S&P 500 has rallied 21 percent since its 2011 low on Oct. 3

People in underwater homes scared with money in cash. The other shoe has just dropped. You went all in on a bad investment, housing and avoided the good investment stocks. Ouch. Lets hope they don’t chase this rally and buy in now only to get hit by a near term correction coming as this is too much too soon. But they will they can’t resist buying at the top and selling at the bottom.

Hopefully this jobs number is the start of a real turn around, and yet we have the CBO report earlier in the week which most of the media ignored.

Also where go interest rates, especially in light of Bernankes promuise to keep them low for almost anoher 3 years!!! Hashe boxed the Fed into a corner?

What will the realtors say buy now while rates are low, while rates are low , but not as low as they were, and going higher?

22 – at 5.5 you’ll probably hit payback on your closing costs in under a year

Here is your reaosn for the rosy unemployment numbers:

http://www.zerohedge.com/news/record-12-million-people-fall-out-labor-force-one-month-labor-force-participation-rate-tumbles-

If the Repubs do not get on board and inform the masses that the data nothing but a smoke screen they are going to take a unbelievable beating in November.

Before construction, we appraised at $225,000. Current loan balance is $233,000. We added a dormer off the back of the cape that only has a full bath in it. No other rooms. Also ripped off all of the asbestos siding and installed new vinyl and shutters. I’m not sure I would have the 20 percent equity. I could put some of the money towards the principle to get there, it might be worth the cost of the application and appraisal to find out.

It would be nice…the mortgage payment is doable right now just a bit uncomfortable.

25.grim says:

February 3, 2012 at 9:01 am

22 – at 5.5 you’ll probably hit payback on your closing costs in under a year

Did you get nailed with extra taxes on the extension?

Brian says:

February 3, 2012 at 9:12 am

Before construction, we appraised at $225,000. Current loan balance is $233,000. We added a dormer off the back of the cape that only has a full bath in it. No other rooms. Also ripped off all of the asbestos siding and installed new vinyl and shutters. I’m not sure I would have the 20 percent equity. I could put some of the money towards the principle to get there, it might be worth the cost of the application and appraisal to find out.

It would be nice…the mortgage payment is doable right now just a bit uncomfortable.

25.grim says:

February 3, 2012 at 9:01 am

22 – at 5.5 you’ll probably hit payback on your closing costs in under a year

It wasn’t bad. It went from $5988.62/yr to $6106.80/yr.

28.JJ says:

February 3, 2012 at 9:16 am

Did you get nailed with extra taxes on the extension?

You dormered for just the bath? Or did you dormer the whole back?

Just the bath. No other addidional rooms. Went from one full bath to two.

Put in new carpet upstairs, painted it inside, made the upstairs like a master suite for wifey and me. 2 kids are downstairs. We really needed the second bath…just had our second child and it was getting crowded. Sucks standing in line in your own home waiting to go to the bathroom.

30.grim says:

February 3, 2012 at 9:27 am

You dormered for just the bath? Or did you dormer the whole back?

Grim [15];

unemployment falls to 8.3

Imus this morning, without the slightest hint of irony, “Happy days are here again.” McDowell says “Lowest in three years,” which is another way of saying this is the best a democrat administration can do.

Not bad at all. I was not actually aware judging from the smells in parts of New Jersey that bathing and showering was so popular that it would warrant two bathrooms in a home.

Brian says:

February 3, 2012 at 9:24 am

It wasn’t bad. It went from $5988.62/yr to $6106.80/yr.

28.JJ says:

February 3, 2012 at 9:16 am

Did you get nailed with extra taxes on the extension?

Grim:

who did you do your deal with ?

I originally only wanted an additional 1/2 bath…you know I need a second place to make a stinkey.

33.JJ says:

February 3, 2012 at 9:34 am

Not bad at all. I was not actually aware judging from the smells in parts of New Jersey that bathing and showering was so popular that it would warrant two bathrooms in a home.

Brian

Is it just me or is this disgusting. but a friend lives in Hunterdoom and has a cess pool in yard and a well for drinking water. To me that is drinking out of the toliet. Only in Jersey can you poop, pee and drink from same hole in the backyard. Bet he has a buried oil tank out there too. Three Mile Island New Jersey.

It’s good exercise for your immune system. Clean drinking water is for nancy boys ;)

36.JJ says:

February 3, 2012 at 9:42 am

Brian

Is it just me or is this disgusting. but a friend lives in Hunterdoom and has a cess pool in yard and a well for drinking water. To me that is drinking out of the toliet. Only in Jersey can you poop, pee and drink from same hole in the backyard. Bet he has a buried oil tank out there too. Three Mile Island New Jersey.

So says the guy with that lives on an island with the highest cancer rates in the nation. Stick to stocks, bonds and easy women JJ

Montclair is seriously considering building affordable housing on 2 out of 4 prime lots of open space adjacent to Brookdale Park. The lots alone are valued between $250k-$350k a piece. The finished 3 or 4 bedroom homes would be sold for between $105,000 and $219,000.

http://www.northjersey.com/topstories/montclair/138545724_Already_1st_Ward_s__most_diverse_street__.html

http://montclair.patch.com/articles/councilor-africk-is-the-town-willing-to-pay-500-000-to-promote-affordable-housing-in-the-first-ward

I just read the BLS report. It is indeed a sketchy piece of business this month.

#40 Lots of low paying jobs in the report.

FInally figured out how to use those FEMA flood maps. Looks like I need to saty away from the lower areas on the section that I am looking at in Hillsdale.

Kick 1.2 million out of the workforce each month and we’ll full employment in a decade. Pop the corks!!!!

You guys gotta stop this debbie downer talk. This is not going to help me on my appraisal report.

grim (20)-

Congrats. Now you can go to work creating a hard perimeter.

Unemployment is down and welfare rolls are up and what else is new?

Grim –

Would you mind emailing me the bank you’re refinancing with?

USBank offered 4.125%, $1700 cc (~1.5yr payback vs. current 4.95%).

thanks!!!

BLS UE numbers are all lies. Now, they’ve taken their lying into hyperdrive.

If the Rethugs wouldn’t take Bojangles and his criminal accomplice, Holder, to task over trying to politically broker a fraudclosure settlement that would let the crooks go scot-free (and give Bojangles a “victory” to crow about in the State of the Union address), they won’t challenge the BLS numbers, which we call all expect to be glowing right through 11/12.

Meanwhile, the two most valuable job skillz in Amerika are the ability to repeat, “you want fries with that?” and “welcome to WalMart”.

Bleg for Contractor referal in Morris County – interior(kitchen/bath), electrical; and exterior (siding/windows/masonry/paving)

reply to john (underscore) doebinski (at) yahoo (dot) com

One of my employees is a new attorney, admitted into the bar in two states. Left yesterday at 4AM for an interview in Concord, NH.

She got there, and the interview was called off. Firm decided they didn’t need anyone and didn’t feel like dropping a dime to call and let her know. They also didn’t offer to reimburse her for gas, lost work day, etc. Nothing.

To the BLS, she is “employed”.

Somebody wake me up when we attack Iran.

I just sleep there. I spend most of time in Manhattan with the longest life expectancy.

Painhrtz – I ain’t dead yet says:

February 3, 2012 at 9:52 am

So says the guy with that lives on an island with the highest cancer rates in the nation. Stick to stocks, bonds and easy women

Meat [50];

Useless without [firm] name. Shame is a powerful tool.

There Went Meat says:

February 3, 2012 at 10:34 am

Somebody wake me up when we attack Iran.

Are We Not Men? We are Tebow…..

http://www.youtube.com/watch?v=Hm-cfUXtIoI&feature=related

Meanwhile I am actually out looking at houses.

Being a young female lawyer is only useful in order to marry an older male law partner and being the young educated trophy wife. Why would she actually want a job doing it?

There Went Meat says:

February 3, 2012 at 10:32 am

One of my employees is a new attorney, admitted into the bar in two states. Left yesterday at 4AM for an interview in Concord, NH.

She got there, and the interview was called off. Firm decided they didn’t need anyone and didn’t feel like dropping a dime to call and let her know. They also didn’t offer to reimburse her for gas, lost work day, etc. Nothing.

To the BLS, she is “employed”.

Maybe we can give Tebow to Iran as a hostage.

jj (56)-

I am imagining my employee giving you a punch in the throat after you say this to her.

Still can’t figure out how this firm made it through financial crisis without a BK. And with that coupon.

REALOGY CORP SR SUB 12.37500% 04/15/2015

CUSIP 75605EAW0

Coupon 12.375

Maturity Date 04/15/2015

[56] JJ Being a young female lawyer is only useful in order to marry an older male law partner and being the young educated trophy wife. Why would she actually want a job doing it?

It certainly worked for Santorum’s wife. She took it a step further, she shacked up with a 30 year older abortion doctor starting in her very early 20’s and had him put her through law school. Six years later when they split she went to clerk at Santorum’s firm and was married to him in about a year.

How can she be your employee if unemployed. I worked in a big Partnership once. Men would get to one level below Partner around 31 and made Partner around 35. Pretty much the men started thinking around marriage at 31. The younger pretty girls fresh out of school had to around 28 to decide what are my odds of making Partner myself or should I hitch my wagon to a guy a few years old who looks like he may make Partner. However, an engagement or marriage may throw me off Partner track. Most female Partners told me the lucky ones are the ones who hitched their wagon to a Partner and are at the country club at 40 with kids. The next lucky onces are the careers gals busiting their butts at 40 rich. The worst off are ones who went for Partner and failed or picked the guy up for Partner who did not make it.

Big decisions girls in aggresive Partner track jobs must make before their 30 birthday. This is why I am regarded as an esteemed mentor to women, I tell it as it is. Most bosses lie.

There Went Meat says:

February 3, 2012 at 10:55 am

jj (56)-

I am imagining my employee giving you a punch in the throat after you say this to her.

There Went Meat says:

February 3, 2012 at 10:55 am

jj (56)- I am imagining my employee giving you a punch in the throat after you say this to her.

Let Stephen A. Smith do the talking for you….

http://www.youtube.com/watch?v=FHbxHY_OLrI

[51] Meat Somebody wake me up when we attack Iran.

My bet is we outsource that work to Israel and try to look outraged and appalled when it happens. It will be very soon, though.

http://online.wsj.com/article/SB10001424052970204652904577197443305400820.html?google_editors_picks=true

A modest home for Palm Beach

STATS: A home of about 2,286 square feet, according to the owners, with three bedrooms and 2½ bathrooms, asking $2.3 million, or $984.25 a square foot. Property taxes in 2012 are $27,291, say the owners.

snip

“Meanwhile, the two most valuable job skillz in Amerika are the ability to repeat, “you want fries with that?” and “welcome to WalMart”.”

Oops, no more “Welcome to WalMart”.

http://www.huffingtonpost.com/al-norman/wal-mart-greeters_b_1243029.html

Mitt Romney’s tax return ruffled some feathers when it showed that the would-be GOP presidential candidate paid about 15 percent in taxes last year. As it turns out, Romney paid more in taxes than the average American corporation in 2011.

According to new data from the Congressional Budget Office, as reported in the Wall Street Journal Friday, U.S.-based companies paid only 12.1 percent in taxes on profits earned domestically. This is the lowest rate in four decades, and it’s forcing budget forecasters to increase their deficit projections for the coming years.

http://bottomline.msnbc.msn.com/_news/2012/02/03/10309301-if-you-thought-romneys-taxes-were-low-wait-until-you-see-what-companies-pay

jj (61)-

Do you work for BLS? A lawyer working for hourly wage/no bennies is of no concern to them, either. A job is a job.

“How can she be your employee if unemployed.”

NJ ExPat,

The problem with that strategy is tht Israel lacks the conventional munitions capable of taking out the underground facilities. That leaves the US using our newer massive ordinance or Israel opting to use special weapons.

We could opt to employ special weapons ourselves but, I doubt that the Nobel Peace Prize winner wants to be the second president to order the use of nukes; at least Truman was dealing with a declared war against an enemy who had committed many atrocities in many nations and he could argue that using the weapons would shorten the war by months and save huge numbers of American troops.

So, the question is this, does Israel attack using special weapons or do we attack with our new “bunker busters” either in concert with Israel or to preempt Israeli actions?

May you live in interesting times.

“Mitt Romney’s tax return ruffled some feathers when it showed that the would-be GOP presidential candidate paid about 15 percent in taxes last year. ”

If he wants to reduce his tax burden, Romney should vote for Gingrich, who wants to reduce taxes on cap gains to 0%.

More BLS lies and half-truths from today’s report:

“It appears the record surge in people not in the labor force is not the only outlier in today’s data. For the other one we go to the Household Data Survey (Table 9), and specifically the breakdown between Full Time and Part Time Workers (defined as those “who usually work less than 35 hours per week”). We won’t spend too much time on it, as it is self-explanatory. In January, the number of Part Time workers rose by 699K, the most ever, from 27,040K to 27,739K, the third highest number in the history of this series. How about Full time jobs? They went from 113,765 to 113,845. An 80K increase. So the epic January number of 141.6 million employed, which rose by 847K at the headline level: only about 10 % of that was full time jobs: surely an indicator of the resurgent US economy… in which employers can’t even afford to give their workers full time employee benefits.”

http://www.zerohedge.com/news/final-nail-todays-nfp-tragicomedy-record-surge-part-time-workers

I worked for BLS I would say that 8% unemployment in 2012 compared to 4% unemployment in the 1950s should be considered we have 192% employment rate as 60 years ago women were homemakers and not in the workfoce. The fact that over last 60 year 50% of the population entered worforce and we were able to create jobs them all is outstanding!

Nom,

Speaking of cap gains, this is interesting:

http://www.irs.gov/irb/2008-14_IRB/ar08.html

And now i have to change diapers too. thank you women’s lib movement.

The jobs thing: I said this the other day; friends of ours, husband and wife, both had management positions with a combined income of about 300K. Both got let go within the last two years. He’s now doing part time gigs as a sales associate at Macy’s and Enterprise and she’s doing taxes on an as-needed basis for H&R Block. There are your jobs numbers.

Brian,

Diapers are no big deal. As distasteful as it may seem, it is also good father/child bonding time. For years, mothers were the ones who did that and, as so, were the ones the children saw as providing comfort. There are worse jobs, and I have done them, than changing one’s own child’s diaper.

Another guy who had morte money than sense:

http://www.sbnation.com/nba/2012/1/31/2761217/the-tragedy-of-allen-iverson

After a judge garnished Allen Iverson’s bank account to pay a debt, it became clearer that his tragedy is coming full circle. And that’s heartbreaking to someone who grew up at the peak of his stardom.

Follow @sbnation on Twitter, and Like SBNation.com on Facebook.

Jan 31, 2012 – From the second the NBA left Allen Iverson, I wondered what in the world he would do without basketball. It seems “paying his bills” wasn’t on his to-do list.

The gumshoes at TMZ say Iverson’s bank account has been garnished to pay an exorbitant jewelry bill. Per American custom, that’s brought out snickers and finger wagging. Iverson made over $150 million, according to basketball-reference.com. Now, he’s 36-years-old and can’t even come up with the money to pay for bling he’s too old to wear.

People laugh when rich folks struggle. In this case, I see two levels of tragedy. There’s the predictability of it all. Even the best adjusted athletes have a million factors to fight when their careers are done, from divorces to simply trying to fill the hours of each day without practices and games. Plus, athletes, figurative lottery winners, are like the literal ones — they often find a way to blow all their cash.

snip

“He’s now doing part time gigs as a sales associate at Macy’s and Enterprise and she’s doing taxes on an as-needed basis for H&R Block.”

Isn’t it wonderful that our growing economy has provided them with work, good, meaningful, didnified work? They are truly blessed.

dignified, even

So free tax returns and discounts on clothes sounds good. Bottom line in a good economy the marginal get 150K jobs that are quickly lost.

gary says:

February 3, 2012 at 12:08 pm

The jobs thing: I said this the other day; friends of ours, husband and wife, both had management positions with a combined income of about 300K. Both got let go within the last two years. He’s now doing part time gigs as a sales associate at Macy’s and Enterprise and she’s doing taxes on an as-needed basis for H&R Block. There are your jobs numbers.

Managers – what do they do exactly? They should have had targets painted on their backs here during the recession. Execs were gunning for them so bad. So much dead weight in a company in the form of middle management. I kill myself all year, doing the work of 3 people on a project. At the end of the year at my appraisal they say theres no money for raises again. Great okay so how is it you got a raise, promotion with stock awards on top of your already 6 fig salary?

When they let one lady go here, it was fine. We just reported to the director. Life was easier anyway without somebody micromanaging me. Serves her right. They were outsourcing us like crazy during the mid 2000’s.

Shore [77],

And not only that, according to Corelogic, the HPI (whatever f*ckbaggery calculation that mess comprises) has increased in our area so I guess it’s a really, really,really good time to consider buying a house. :o

Brian [80],

I agree but thank goodness they now have three jobs between them (ack! cough!) and Corelogic says housing is up in our area!!

I was told as staff extremley long hours for no pay for 20 years and you shall have your own corner office and staff to do your work. Don’t move my cheese Brian. I write more but the sun off my water view in my corner office is making it hard to see. Plus I have a managment only meeting where we can discuss the staff, cant invite staff what do they know.

Gary,

Only if one has a shred of self respect. Otherwise, there is no need to buy a house. Remember, overpaying for a house is a sign of both intelligence and se-xua-l prowess.

JJ,

Just curious: how many shovels, buckets and boots do you go through in a year?

Move my cheese! Oh yeah they sent me that book twice now. Too funny.

Don’t Sweat the Small Stuff

Brian says:

February 3, 2012 at 12:54 pm

Move my cheese! Oh yeah they sent me that book twice now. Too funny.

All the cheese is rancid.

[50] meat

That blows, but I am not surprised. NH firms suck; the partners in them think they’re the schniz but they are pretty much local yokels except for the few with big city BIGLAW experience.

My wife clerked in NH for the Chief Justice of the state Supreme Court. She could not get looked at by NH firms. She went to DC and did three interviews. Came away with three offers, and is now a well-regarded pharma attorney.

If she is going to NH or Mass again, have her call me first. She has my card.

[72] shore,

not that interesting. Simply clarifying when and how to establish the gain/loss. Bigger issues used to be the outrageous basis that artists would come up with, or the resolution of the question of whether such work was actually a capital asset.

Actually, I should give out investment advice. Whatever I do everyone should just do the opposite.

Well I’m off to Tiffanys to overpay for jewlery for my wifes birthday.

Then its time to fill out the application so I can overpay for shares in mutual funds.

Ah well, at least I have the $1 off coupon for yuengling. Go Giants.

By the way Gary I do hope your friends get back on their feet.

84.Shore Guy says:

February 3, 2012 at 12:35 pm

Gary,

Only if one has a shred of self respect. Otherwise, there is no need to buy a house. Remember, overpaying for a house is a sign of both intelligence and se-xua-l prowess.

Today’s the anniversary of the Dutch Tulip Mania collapse:

http://www.zerohedge.com/news/final-nail-todays-nfp-tragicomedy-record-surge-part-time-workers

MERS on the hot seat –

Big news, old news or no news? (Zbigniew’s?)

NY’s Schneiderman sues banks in foreclosure effort

http://online.wsj.com/article/APbd3b4cafb23449689c2e6fec0d11633e.html

oops:

http://www.zerohedge.com/news/day-history-ponzi-schemes

plume (89)-

Thanks. I actually think she will score something soon.

And on that note, Nom is getting lost for a few days. Got a lot of work here suddenly, and then there’s the whole Super Bowl thing.

On Monday, I will either be very relieved or utterly devastated. If the latter, I will be in no mood to deal with Giants fans (most of whom aren’t that bad but this is the NYC area). Either way, I plan to hide indoors for a few days as there will either be a lot of sore egos out there or one in here, and I don’t feel like dealing with it.

Peace out, enjoy the game, but I hope I enjoy it more.

re: Refi

Brian, who owns your current mortgage?

The credit union. They didn’t sell it.

They let me refi once underwater. I really had to beg though. They wouldn’t give me the current rate either. It helped a bit, I went from 6.5 to 5.5 and I’ve paid quite a bit of the principal.

97.xolepa says:

February 3, 2012 at 1:27 pm

re: Refi

Brian, who owns your current mortgage?

3b: I looked at those flood maps…that looks about right. I kind of know which areas flood based on recent experience so feel free to post links to stuff you’re interested in.

Most areas of WT don’t flood. ;-) My house usually gets a tiny bit of seepage if we get hard rain, but the pump only kicks in when it’s a lot of precip at once, like 4″ in a couple of hours or more.

And you might also look at the following parts of Westwood; the streets between Mill St. and Washington Ave and adjacent cross streets, as well as Roosevelt and Lexington Avenues between Old Hook Road and Harrington (and cross streets, such as Lotus, etc.).

re: #96 – Nom -Princess the camel,the star of New Jersey’s Popcorn Park Zoo, says the Giants win. Since I am going to the game I certainly won’t question the camel’s record.

Do you want me to pick up a Pats souvenir for you? Perhaps Brady’s teeth off of the astroturf?

http://www.indystar.com/usatoday/article/52808408?odyssey=mod|newswell|text|IndyStar.com|s

Brian – you might want to wait for the new harp programs

We’ll see if they get it past the tea party guys.

I called the credit union relentlessly last time and finally they caved and refi’d me. I’m not shy about pursuing that method again either.

100.grim says:

February 3, 2012 at 2:06 pm

Brian – you might want to wait for the new harp programs

If you don’t like what they stand for, that’s one thing. But what’s wrong with actually doing in office what you claimed you were going to do during the campaign? (the tea party)

And most of them sold out anyway… i don’t understand

(100)

If you have a current FNMA/FMAC mortage, you don’t have to wait for the new HARP programs. They’re already here. It’s called HARP II. How do I know? I just closed on a refinance this morning on my primary residence using the new program, in effect since 11/2011. I was not underwater, no where near. You don’t have to be, you can even be underwater 15%. Current mortgage payers, though. I did not need appraisals. Mine was computer generated by the big bank servicing the loan. Pleasantly surprised. Reduced interest from 5.375 to 4.125.

This new program is suckers play. The first Harp found no takers so Congress opened it to all. Essentially a giveaway like the Clunkers, which I took advantage of 3 years ago. Thank you, Obama, again.

And all this from a resident in Hunterdon county, where most towns don’t even have Democrats on the ballot.

Speaking of refi – I know several people that are quite POed they cannot refi @ 4%. Underwater by 100k or more, one even said 170k this week. They are going to be even more POed when the rates go up and they missed their window completely, it will be walk a way time for those divorcing or losing jobs.

Anyone who pays their mortgage (assuming they can get thru a few years without access to credit) is a dope.

Eventually, we’ll devolve into civil war and/or TPTB will hit the reset button (at the point where they realize the sheeple are forming into mobs with pitchforks) for everyone who’s underwater.

Just remember, sheeple: help is on the way.

juice (104)-

Wow. Pissed that they can’t refi negative equity into an unsecured loan @ 4%.

It is the end of days.

Whether or not I like what they stand for is totally irrelevant. What the current president has to understand, and the tea partiers too is that government is a forum for negotiation. Politicians from the right and left can make proposals from way out in left field but from there, they need to work together to pass legislation that is more centric and therefore do what’s best for the country.

If Obama and the tea partiers in the House actually want to get anything done, they have to learn to successfully negotiate with each other.

102.joyce says:

February 3, 2012 at 2:37 pm

If you don’t like what they stand for, that’s one thing. But what’s wrong with actually doing in office what you claimed you were going to do during the campaign? (the tea party)

And most of them sold out anyway… i don’t understand

Pitchforks? Who outside of Hunterdon County has pitchforks? Ha Ha. I not only have one, but I also have a 6 foot scythe. Grandfather made it. Old country talent. Man, I would like to feel that whipping through the wind again.

107

The government (espeically Federal) is not supposed to give you anything. It doesn’t have anything to give… without first taxing it from someone else or borrowing it from a future generation or printing.

More negotiation and compromise will only continue to screw things up. There is a black & white right & wrong in most cases … people need to stand on principle.

No more bailout of any corporation or individual, let the foreclosures, bankruptcies, and liquidations occur. There will be so many of them it will take a while… but let it happen already.

Forget underwater people. Old folks have no high car loans or mortgage to refinance or pay off. They are are afraid of Stocks, Junk Bonds and even munis. They sit at zero percent year after year. Missing the entire 30 year bond rally, three year old stock rally and 11 year old gold rally.

BTW my 401Ks went way up since December. God Bless you Ben, Tim and Obama you are truly doing the lords work. Mitt and Neutt please go away, we have jobs, cheap mortgages and a bull market. We don’t need you anymore.

By the way my uncle is a tea party guy. Loves to show us pictures of him shaking hands with Chris Christie. Total Christie fan boy. He cracks me up.

BTW refinancing does zero to your balance sheet. Folks are too stupid to realize it.

You have 50K in bank and owe 400K at 5% and now you spend 2K to refinance and have 400K at 4%. Your net worth is now 48K. But you say the monthly savings. Well that is wild card. Unless you save 100% of it or use savings each month to pre-pay mortgage you have not accomplished anything.

In fact last time everyone refinanced in 2003 they just used money for vacations, mobile homes, new cars and dining out.

Squeel like a pig

Brian says:

February 3, 2012 at 3:15 pm

By the way my uncle is a tea party guy. Loves to show us pictures of him shaking hands with Chris Christie. Total Christie fan boy. He cracks me up.

“In fact last time everyone refinanced in 2003 they just used money for vacations, mobile homes, new cars and dining out.”

WRONG jj!!! They used the money to pay off their credit cards then they used their credit cards for vacations, mobile homes, new cars and dining out.

The rally pushed pushed the Dow, up more than 5% in 2012, to the highest level since May 2008. The Nasdaq, up more than 11% for the year, climbed to its highest level since December 2000. The S&P 500 has gained almost 7% this year, and is at a six-month high.

I dunno, I mean, they take an awful lot of my money WTF?

109.joyce says:

February 3, 2012 at 3:07 pm

107

The government (espeically Federal) is not supposed to give you anything. It doesn’t have anything to give… without first taxing it from someone else or borrowing it from a future generation or printing.

More negotiation and compromise will only continue to screw things up. There is a black & white right & wrong in most cases … people need to stand on principle.

No more bailout of any corporation or individual, let the foreclosures, bankruptcies, and liquidations occur. There will be so many of them it will take a while… but let it happen already.

There is nothing in the universe that the US gubmint can’t make worse.

112 – it does in 30 years…

400k at 5% – $373k in interest paid

400k at 4% – $287k in interest paid

“The rally pushed pushed the Dow, up more than 5% in 2012, to the highest level since May 2008. The Nasdaq, up more than 11% for the year, climbed to its highest level since December 2000. The S&P 500 has gained almost 7% this year, and is at a six-month high.”

Time to short JJ? Seems like cart is way out in front of the horse.

Invest that 230 a month savings at 5% over the term of the loan and you’ll have an extra 200k towards retirement.

Or use it to pay off the loan 6 years early

Average person lives in a home 7 years. Other issue is rates rise you have trapped yourself in the home. You end up like a rent controlled tenant in a too small apartment. Also your tax deduction falls the lower the rate. If people just took a few bonus checks and put them towards mortgage it would be gone in 2-3 years. Why commit to 30 years of payments.

Anyhow GM up 8% today RRRRRHHHHHHH> Also GMAC bonds huge recovery since October RRRRRRRRRRRH> I smell inflation and rates won’t be low for long. If we are all making tons of money in stocks and bonds won’t be long before we start spending!!!!

grim says:

February 3, 2012 at 3:38 pm

112 – it does in 30 years…

400k at 5% – $373k in interest paid

400k at 4% – $287k in interest paid

re: #115 – JJ the NASDAQ is a joke it will never recover nowhere near 4500. The media should never even mention it because of the trillions lost investing in it.

(115)

Whow! Whoopie! Am I supposed to be impressed. What was the DOW in 2000-2001? About 11.5K at its highs. What is it now? What’s the annualized growth on that? Is it better than RE from that point on? I was making tax-sheltered returns much higher on rentals along that time frame.

I guess. But I hate debt. When I paid off my mortgage in Nov 2008 and started plowing into the market the effect was amazing. I am now up to $5,000 a month interest and dividend income. You need to plow into the market. Pretty much as long as I reinvest just the $5,000 a month in just 15 years it will be real money!!

My first boss told me. “you cannot save money, you can only make money” I did not understand his quote for like ten years. But he is right. He never worried about nickles and dimes he brought in the millions. I lent Bank of America 150K last year at almost 10%. I like that move better than refinancing 150K from 4 to 3. Think about it you are still paying Bank of America. I like it better when Bank of America is paying me.

grim says:

February 3, 2012 at 3:42 pm

Invest that 230 a month savings at 5% over the term of the loan and you’ll have an extra 200k towards retirement.

Rental is good steady income. But really someone who bought a two family house with 100K down in March 2009 vs someone who bought Apple Stock for 100K on that day it is not even close. I like rental income. I am looking at an REO. But it is not get rich quick. Think about this Bank of America Stock was 4.90 three months ago and now is almost 7.9. Percentage wise that is like buying a house for 490K doing nothing to it and selling it three months later for 790K, not going to happen. Other issue with RE too many idiots invest. Neighbors house was for sale and guy was desparate. Then the nuckle head neighbors wifes friend buys it and pays extra as it is near her friend and near school she likes. That women is an idiot she bought a property above market based on irrational thoughts.

xolepa says:

February 3, 2012 at 3:54 pm

(115)

Whow! Whoopie! Am I supposed to be impressed. What was the DOW in 2000-2001? About 11.5K at its highs. What is it now? What’s the annualized growth on that? Is it better than RE from that point on? I was making tax-sheltered returns much higher on rentals along that time frame.

This market probably still has time to run as the dumb money hasn’t come back in yet. Meanwhile, wonder where the smart money will move next? Asia maybe? But EMs been up for several weeks. Or is it time to bet on Europe?

“Anyhow GM up 8% today RRRRRHHHHHHH> Also GMAC bonds huge recovery since October RRRRRRRRRRRH> I smell inflation and rates won’t be low for long. If we are all making tons of money in stocks and bonds won’t be long before we start spending!!!! “

Duck Vader. Funny is that lost ten years does not apply to me, I bid on my house in Dec 1999 and closed on Feb 2000 so nearly all my money was out of market in March 2000. The house bled me dry till 2003 and I only ramped up savings in 2008. Pure luck I started my first brokerage account the week after the crash of 87.

Now may be a good time to take some cash off the table. Pretty common now for people to have build up huge sums in last four years in stocks, MBS, Junk Bonds and Munis. With the wind at your back we are all good sailors.

Grim

why do you not mention the NJ numbers for Core Logic?

the depreciation for New Jersey is

New Jersey

-3.0%

-2.8% (excl distressed)

Isn’t that the NJ re report?

It is the beginning of the spring season and realtors are all over the internets trying to convince everyone that re is bouncing (at least in their state or town or neighborhood)

Prices are flat or down but one thing I do see changing is homes priced cheap, REOs, estate sales sell quick. Prices may be same but they are selling.

PGtips says:

February 3, 2012 at 4:43 pm

It is the beginning of the spring season and realtors are all over the internets trying to convince everyone that re is bouncing (at least in their state or town or neighborhood)

The depreciation in NJ accelerated according to Corelogic

New Jersey -2.3% -2.5% (excl distressed) November

New Jersey -3.0% -2.8% (excl distressed) December

No offense, but isn’t this the most relevant piece of info for this blog?

banco popular is uptoday. I guess puerto ricians are paying off their mortgages now!! Yea

Anyone who touches BPOP paper is, IMO, a flat-out casino gambler.

I bought 50,00 worth face of BPOP TRUPs round a price of 61 with a yield of almost 12%.

No gambling. Remember, BPOP has not paid back TARP. Trups are one level above pref stock US put in. I am one level up in liquidation chain. Plus BPOP is on the super strong buy list at the IBs, it is completely mis-understood and it is profitable and bank is around 160 years old.

In October-December I bought 100K worth of MBNA/NB/ Countrywide/BAC Trups at a yield of 10% at a price of 91 now at par.

I bought 300K worth Munis in January – March 2011. The best I bought 400K worth of junk from Tarp companies in December 2008 to April 2009. Mind you I buy and sell. So nearly all my Tarp play and muni play is gone. But Bank Trups came and went. 8.5% Bank of America bonds trading at 85 are a thing of beauty. I never gamble. Calculated risk. Buying a 500K house when you have 100K in the bank is a huge risk. Heck I also bought 15oK worth of European Financials.

Today I am 40K away from one million in my trading account. You make trading sound like a bad thing. Chifi may thing I am nuts. But I also have an MBA and street cred. We just do it differently, but man he has some good things too. Housing is a good investment but not fun. Crazy part this trading started with me wanting a trade up house but I just hit the biggest three year bull market in the century during my investment run.

LONDON/NEW YORK (Frankfurt: A0DKRK – news) , Feb 3 (IFR) – The junk bond market was poised Friday to break the record for weekly volume, with investors ploughing money into the sector in a way that recalls the days before the global financial crisis.

Wary of being left out of the rally, buyers are chasing high-yield returns in the US and Europe (Chicago Options: ^REURUSD – news) in what some analysts see as a symptom of herd mentality in the market.

Go look at the Citi MS research on BPOP they have been calling it a screaming buy and undervalued for months. I should have bought the stock. But heck I will take 12% for the whole 20 years on bond if I have to.

#32 PG The asking prices out there now are the lowest I have seen in years. Even in the better Bergen Co towns. Towns considered not as “good” prices even lower. For instance in New Milford, lots of houses with a 2 handle, some of them are in the flood zone, but not all, and lots more in the low threes. These again are ASKINg prices.

#104 Juice: They are going to be even more POed when the rates go up and they missed their window completely,

Fed backed themselves in a corner with their no rise in rates until Fall of 2014. If they evnhint before then that they will raise rates, bye-by to this limited economic recovery.

#132 –

Yeah. If you look at the NJ specific data – not just the state of NJ as a whole, but of some of the areas, the NJ numbers don’t look so good. The Newark/Union area, which I assume includes Summit, Chatham, Millburn, Maplewood, S. Orange, Westfield, Berkeley Heights and other train towns are for the most part down.

If Bergen County, Hudson County, and Passaic County are similar to the Newark/Union area, then maybe the reason the “New York-White Plains-Wayne, NY-NJ Metropolitan Division” is up has more to do with the NY component than NJ.

No?

..At 102%, His Tax Rate Takes the Cake

By JAMES B. STEWART | New York Times – 12 hours ago

Meet Mr. 102%.

James Ross, 58, is a founder and managing member of Rossrock, a Manhattan-based private investment firm that focuses on commercial real estate and distressed commercial mortgages. “I realize I am very fortunate, and in fact I am a member of the 1 percent,” Mr. Ross wrote in an e-mail. His résumé is studded with elite institutions: Yale, Columbia Law School and stints at the law firms Cravath, Swaine & Moore in New York and Holland & Hart in Denver. Since his company fits the category of private equity, he even has carried interest, the kind of incentive compensation that enabled Mitt Romney to pay such a low tax rate.

Yet Mr. Ross told me that he paid 102 percent of his taxable income in federal, state and local taxes for 2010. “My entire taxable income, plus some, went to the payment of taxes,” Mr. Ross said. “This does not include real estate taxes, sales taxes and other taxes I paid for 2010.” When he told friends and family, they were “astounded,” he said.

Seems like if they Flat Taxed “All Income” at 102% they could solve the deficit issue?

Newark-Union also includes Sussex and Hunterdon. Do we really need to talk about housing demand in Sussex now that prices are down? Remember, the primary motivator for folks purchasing in those areas was that they couldn’t afford being further east. Mike – You want to chime in here? Chip?

Remember, prices declined from the outside in, they’ll stabilize from the inside out. Inside referring to the higher tier communities, etc.

The geography of the Newark-Union MSA is ridiculous when you consider it stretches from Union and Essex to the east, all the way into Pike County PA and down to Hunterdon. Do you really think the housing market in Hudson has anything at all to do with the market in Pike County PA?

The reason I don’t like looking at aggregate state statistics for NJ is that they yield descriptive statistics that aren’t generally descriptive of anything someone can actually buy.

What you get when you look at the entire state, is a distribution that starts to resemble a long-tailed dumbell. Median and average fall where the center of the dumbell is, but coincidentally, where almost no real homes exist to purchase. I’ve said it before, but this is what I mean when I say you can’t buy a median home in NJ.

By the way, in Q3, the median house in NJ was priced at $305k. I’d love that median house for $305k, can you point me to it?

Now, when you realize that South Jersey’s median of $202k is pulling down North Jersey’s median of $385k, you start to get the point. Even more so when you look at Cumberland County’s median of $144k versus Somerset’s median of $500k.

It’s not that the statewide median isn’t a good indicator of overall directional performance of the entire state, it is. But it tends to be misleading since it’s really not the states geographic boundaries that drive buyer behavior. It just makes more sense to look at metro areas like the NYC Metro, or the Philly Metro, since those numbers are more in-line with what folks are looking for to drive their sale/purchase transactions.

Grim 139 Surely, an excerpt from Times on RE NJ:

“The market misery is not all concentrated in the south, however. In the northernmost county, Sussex, the inventory is 20 months. In the $400,000-to-$599,999 bracket, five and a half years’ supply is already on the market.

In the town of Vernon, which is home to several popular ski areas, and where construction was booming in the mid-2000s, the average sale price of a home was $250,000 in 2007, according to the real estate Web site Trulia. Now the site has it at $100,000.”

Now this fact will certainly skew the numbers for Newark-Union area.

Link: http://www.nytimes.com/2012/01/15/realestate/new-jersey-in-the-region-rural-areas-slower-to-rebound.html?_r=1

Problem is finding the happy medium where the underlying sample sizes are large enough to yield estimates of the population that have some reasonable level of confidence (and don’t graph out looking like an EKG). Realize, probably less than 5% of the total state housing stock turns over in any given year. Given the incredibly vast deviation between types and prices of houses, we’re making huge presumptions about the ability to gauge overall price trends of 100% of the houses in the state based on these tiny, and incredibly erratic samples.

Don’t think I’m right?

Look what happened in Q3 (which is ~3x the number of single month sales, a larger sample size).

Sussex County – Down 19.7% year over year

Essex County – Up 14.7% year over year

Clearly it’s time for the mortuary in Sussex, and the champagne in Essex. Fact of the matter is, prices of all homes didn’t fall 20% in Sussex, and rise 15% in Essex, however the median prices of the homes sold in Q3 changed relative to the median prices of the homes sold a year earlier. Maybe the most recent homes were smaller, in worse condition, had a greater percentage of distressed sales, etc. Is the data actionable? No. Good luck trying to negotiate a price 20% under last years comps in Sussex. Or rather, would you feel comfortable paying a 15% premium over last years comps in Essex?

We can find enough numbers to thoroughly confuse everyone, and refute any argument positive or negative.

Grim 140 I can get you a beauty up here for 305 with taxes under 10k.

“Sussex County – Down 19.7% year over year” It is a blood bath up here, never the less the RE folks I know say prices are on the rise! I do not even bother to dispute, we would not want to let real numbers get in the way of their fantasy& cheer-leading to the masses.

This one closed at a price of 380K this past September.

In December of 2004, it sold for 582.5K.

Let me know if you need me to do the math for you.

http://www.trulia.com/homes/New_Jersey/Hillsdale/sold/187591-44-Riverdale-St-Hillsdale-NJ-07642

This one closed at a price of 487.5K a few weeks ago.

In February 2002, it sold for 360K which results in a normal 3% YOY appreciation but it also had many upgrades including the granite/stainless thing, etc. Now, here’s the really interesting part; it sold for 270K in May of 1999 and then 360K in 2002 which indicates that this madness started around year 2000. I can attest to this because we were standing in lines for open houses in 2000 as houses were getting multiple bids on the first day of listing.

Again, let me know if you need me to do the math for you.

http://www.trulia.com/homes/New_Jersey/Hillsdale/sold/518566-345-Liberty-Ave-Hillsdale-NJ-07642

Like I said, half time is over, the game adjustments have been made and now you’re going to see one team get trounced as the other runs up the score. The question is, which team are you on?

This one, in Graydon and Ellery’s town, closed at a price of 700K a few weeks ago.

In July of 2005, it sold for 850K.

Any Questions?

http://www.trulia.com/homes/New_Jersey/Ridgewood/sold/122309-340-Northern-Pkwy-Ridgewood-NJ-07450

148 – I don’t get it, $700k for that? What am I missing? I’ve been Captain Sunshine lately, but that place? Suckers.

Found a 30 acre wooded farm REO near relatives in the Midwest.

They’ve been cutting the price 10K/ mo and it is now at $4700/acre including a house and full set of buildings in good condition. I am getting tempted to jump because the land price alone in that area was $2000/acre in the 90s.

There will be a point sometime soon where it will be more than I can stand.

jj (135)-

I understand the play of getting in at the head of the line with BPOP, but why haven’t they paid back TARP (not that it really matters, since this is akin to asking why the burglar hasn’t paid back the shyster)?

You don’t find this worrisome?

grim [149],

I guess it’s not as bad as paying 850K for the joint and then taking a 150K loss. Talk about the “ouch” factor.

grim (139)-

New Jersey- west of 287- is Nagasaki after the bomb, in terms of RE.

When I see real, exposed numbers like the listings I posted above, I wonder sometimes who’s “giving” and “getting” when I see “data” from organizations like Corelogic and NAR.

gary (146)-

It really started in NJ around 1996-97.

Meat [155],

I don’t dispute it at all, which is why the eye of the storm is just now over head.

gary (154)-

When was the last time you heard NAR talking about the incredible number of houses that go under contract these days but never close?

gary (156)-

The very last pennies of the really dumb money is now being sucked in. Just like the stock & fixed income markets right now.

Once the last fools are stuck in their longs, everything gets the shank. Rope-a-dope.

Meat [157],

Let me complete that thought:

“When was the last time you heard NAR talking about the incredible number of houses that go under contract these days but never close? Any questions?” :)

#141 grim:I’d love that median house for $305k, can you point me to it?

Bergenfield, Dumont, New Milford, all in prestigious Bergen County.

#141 grim I’d love that median house for $305k, can you point me to it?

Bergenfield, Dumont, New Milford, all in prestigious Bergen County.

Out looking again today.

I looked at those BLS numbers again from yesterday, I don’t really see any reason to cheer. But what do I know, I spend most time talking to myself anyhow.

#141 grim: You can find lots of cheap houses in Bergenfield, Dumont and New Milford. In fact there would be no trouble buying in those towns at 1990’s prices.

Being moderated not sure why.

There were two number you should have mentioned. the NJ and NY-Wayne-Bergen etc. You ignored the former although the latter it is not NJ meaning it does not guarantee that the prices in Wayne-Bergen have gone up, even using corelogic because as you know case-shiller says they go down. The only number we are certain it is about NJ was the NJ one and you said nothing about it. Whatever.

Also, who says that the prices have stabilized? Stop this myth because data says otherwise. Manhattan streeteasy index is down for the last two months. Case shiller is down. Everyone here noticed that prices are the lowest they have ever seen. We are on the outside to inside price decline to use your own words. Manhattan has just started to show weakness.

Who says that numbers are confusing? You hear that when numbers do not support one’s view. there is no better index than case-shiller at the moment due to the pairs methodology. Unfortunately, it says that in NY-Nj area we are currently double-dipping.

“Look what happened in Q3 (which is ~3x the number of single month sales, a larger sample size).

Sussex County – Down 19.7% year over year

Essex County – Up 14.7% year over year”

I am not sure if you really believe the above. I won’t even bother–these are the kind of numbers you get from the realtor newsletters.

Unfortunately, statistics is all bout aggregation. The more areas an index includes the more stable the number is. If one wants to go local, one needs to change methodology to something like the case shiller index. Gsmls medians, realtors newsletters, and the like are laughable

The federal budget deficit and our federal debt explained in a way that even a liberal member of congress can understand:

http://a4.sphotos.ak.fbcdn.net/hphotos-ak-ash4/419326_357704940907766_112018892143040_1445401_1502282932_n.jpg

A little Gilbert and Sullivan to bring some culture to the discussion

http://www.youtube.com/watch?v=y54FRMedT_s

Jill: if you are around. We checked out the one on Magnolia today, the Brook is right across the sreet from the house; so no way would we even consider it. Also that area of Magnolia is old and dumpy, so again no way. The other side of Magnolia ( tripel number addresses) is much nicer. Also the area around Liberty Avenue is nice, so we will concentrate around that area as well. Also I have decided I am willing to drive to the train but only in town. Who says I am a train diva!!!

Stu / gator we’re thinking about heading up for the first weekend of Jazz Fest 2012/ maybe we’ll catch you guys there.

http://www.openforum.com/articles/how-realtors-help-clients-price-a-house-to-sell?utm_source=twitterfeed&utm_medium=twitter

#139 -etc..

All that makes sense, but wouldn’t the same reasoning apply to the index when it shows an increase in price? NY, White Plains, Wayne, NY & NJ Metro – They seem pretty diverse as far as what someone is looking for in a home. How can you throw in Wayne with White Plains? In Lodi with Manhattan?

3b #171: Sorry, you’re still a train diva. :-)

You should also look in Westwood in the following areas: Between Mill St. and Washington Avenue/Lafayette to 1st Street…also Roosevelt and Lexington Avenues. Don’t let the word “Avenue” fool you…they are through streets but not terribly busy.

#178 Jill: Sorry Westwood would not do it for me. We would not leave River Edge to go to Westwood. We will exhaust looking in Hillsdale.

Watching Madonna makes me feel really old.

I personally think this material is terrific. I am in agreement with much of the information provided and am motivated to find out more. I’m hoping more information will be added in the near future. http://www.samsung1080phdtv.net/

Giants win 21/17.

Hey, Nom. If you are lurking, New England played really well tonight. The game well could have gone the other way.

I believe that is one of the so much vital info for me. And i’m happy studying your article. But should remark on some general things, The site taste is great, the articles is actually great : D. Excellent process, cheers

I have been surfing online more than three hours these days, yet I never found any attention-grabbing article like yours. It is pretty worth enough for me. Personally, if all site owners and bloggers made good content material as you probably did, the internet can be much more useful than ever before.

Great items from you, man. I have take into account your stuff prior to and you are just extremely wonderful. I really like what you’ve bought right here, certainly like what you are stating and the best way during which you assert it. You make it entertaining and you continue to care for to stay it smart. I cant wait to learn much more from you. This is really a tremendous site.