Jayne and I were both home from work earlier than usual yesterday. We decided to take advantage of the little light left in the day and take the dog to the park. We packed up as usual and off we went, a normal day. We walked up the block, and rounded the corner towards the park, and were about half way through the 2 minute walk to get there. We walked passed a two family house with a large pile of cardboard boxes out front. I noticed these the other day too, odd since we were nowhere near “recycling day”. The neighbors were obviously upset about this, since there was a nastygram from someone on the pile of boxes, and a sticker from the trash pickup about when recycling came around.

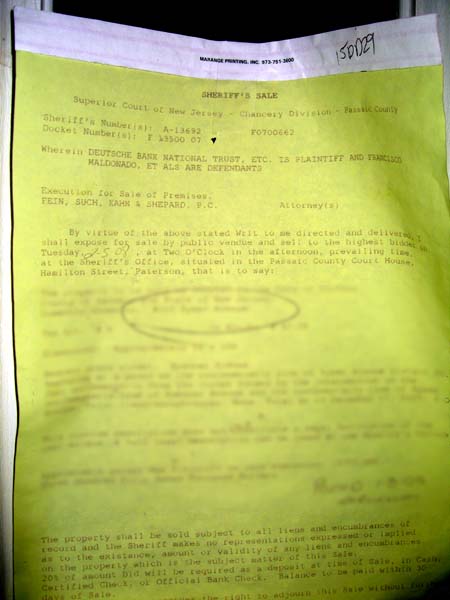

I muttered something to my wife about the “neighborhood going to hell”, and got a dirty look in return. About this time I noticed a yellow form taped up on the door, at first I thought it might have been a notice from the police about the trash. I couldn’t help myself, I had to go see. So I walked over, and couldn’t believe what I saw.

I’m not sure why it came as such a shock to me, I look at these things all day long. I’ve sat through Sheriff Sales on a number of occasions, and while they aren’t particularly uplifting, they usually aren’t ever shocking

Jayne, wanting nothing to do with my nosiness, was down the block already. I called for her to come back and take a look, she did. She managed to get out an “Oh my god”, and looked pretty shocked herself.

Was it just that I didn’t expect it? I did. Maybe I just didn’t expect it to hit someone so close to home?

From Bloomberg:

Moody’s, S&P Reviewing Bond Insurers as Losses Mount

Moody’s Investors Service and Standard & Poor’s increased their scrutiny of bond insurers after losses on subprime-mortgage securities prompted Ambac Financial Group Inc. to report writedowns of $3.5 billion.

Ambac may lose its AAA credit rating after reporting larger losses than the company previously indicated, Moody’s said in a statement yesterday. S&P is examining all bond insurers after increasing its predictions for losses on subprime mortgages.

Moody’s and S&P are starting new reviews one month after affirming ratings on New York-based Ambac and MBIA Inc., the two largest bond insurers. Both companies slashed dividends and announced plans to raise $1 billion to shore up capital and retain their top rankings.

“No one knows when the end may be in sight, including the raters,” said Richard Larkin, a municipal bond analyst at JB Hanauer & Co. in Parsippany, New Jersey. “The rating agencies have lost as much credibility as the bond insurers. Every time you turn around they’re changing their minds about what’s going to happen in the subprime-mortgage market.”

From the WSJ:

Countrywide Adjusts

Terms on Some Loans

By JAMES R. HAGERTY

January 17, 2008; Page A3

Countrywide Financial Corp. said it modified terms on loans and took other steps to allow 81,266 struggling mortgage borrowers to remain in their homes last year.

The Calabasas, Calif., lender is under pressure from politicians and regulators to prevent foreclosures where possible. Lenders also often find that they are better off accepting lower monthly payments from a borrower than going through a foreclosure, which typically results in a large loss. Those potential losses are even greater now that home prices are falling in much of the country.

Countrywide, facing big default-related losses, last week agreed to be acquired by Bank of America Corp. for about $4 billion in stock.

In a further 7,880 cases last year, Countrywide said, it agreed to “short sales,” in which the borrower sells the home for less than the loan balance and the lender agrees not to demand the remaining amount due.

Countrywide said it expects to modify loans or otherwise help even more borrowers this year. The company acts as the loan servicer, collecting payments, for about nine million home loans.

Foreclosure: coming to a neighborhood near you.

As much as I’ve been immersed in this world for the past six months or so, there’s something surreal about constantly dealing with people on the edge of ruin. Inevitably, much of the denial, despair and uncertainty of my clients has bled into me. Every approved short sale/mitigation becomes a cause for celebration; a short sale denied equals a stinging defeat (not to mention a lot of time and effort down the tubes). For some reason, when I can’t effect a solution for a client, I track the house all the way through to the sheriff sale. Why? I don’t know. Why does the coach of a football team, losing 40-0, stay on the sidelines and watch the game to the end?

The first thing I do each day is come here. Second, I pore over the list of new lis pendens filings. Third, I process and mail letters containing an offer of help to those newcomers to the dark world of the almost-foreclosed. In short, I’ve become the real estate equivalent of a funeral director. For these people, the best outcome I can effect is a workout that will short lenders, force the client from his home and- even though the black mark of foreclosure is avoided- wreak short-term havoc on his finances. Often, an undertaking of a post-short-sale promissory note to the lenders is required of the borrower…just to effect a most unsatisfying solution. At least it’s heartening to see that a surprising amount of people will go to extraordinary lengths to save their credit…even when walking away could be construed as the more prudent (and money-saving) choice. It is a sad state of affairs when foreclosure- or deed in lieu- is increasingly the best choice for thousands of strapped borrowers.

Make no mistake: more pain is on the way. I’m now noticing more high-end (home over 750K) lis pendens filings, more condo association liens for unpaid HOA dues (a sure-fire precursor of lis pendency) and more tax sale certificates.

http://www.cbsnews.com/stories/2008/01/16/earlyshow/contributors/raymartin/main3719955.shtml

Make Your Money Recession-Resistant

So did the dog enjoy his time at the park or what???

Heard through the grapevine a coworker is buying a place in Ewing. She’s a nice enough person but the tern “young and dumb” is probably not too far off. She’s also what many would call lazy. She dropped some word about attorney review the other day and somebody asked, “What kind of loan are you looking at?” Her response: “um, I don’t know I don’t really have to figure out until after attorney review, right?”

There are a lot of smart people at our office who are more than willing to give out advice if asked but she apparently sought none. There is also no doubt mommy and daddy are involved heavily, so maybe that’s why she thinks “interest rate” is the amount of time a bank spends looking at you and your hair over the year.

Clot [3],

You’re turning me into a bear.

I must be mistaken. I thought the first thing in the morning, you tapped into Larry Crudelow?

#3…Clotpoll is simply enjoying his daily cup of schadenfreude…with a morsel of moral superiority thrown in for flavor.

“Merrill Lynch & Co. reported a second straight quarterly loss after writing down $11.5 billion of subprime mortgages and bonds, ousting its chief executive officer and losing almost half of its market value in 2007.”

“The fourth-quarter net loss of $9.83 billion, or $12.01 a share, compared with earnings of $2.35 billion, or $2.41, a year earlier, New York-based Merrill said today in a statement. Analysts were estimating the largest U.S. brokerage would post a loss of $4.82 a share, according to a survey by Bloomberg. The decline resulted in Merrill’s first full-year loss since 1989.”

http://www.bloomberg.com/apps/news?pid=20601087&sid=aaUBMjNO.U0c&refer=home

When I did the interview for the Herald, the reporter asked me if I was happy about my predictions having come to fruition.

Yea..

About as happy as a doctor finding out his terminally ill patient died right on schedule.

Essex, do you really think the feeling toward your work and clients can be schadenfreude when it’s your livelihood and it’s feeding your kids?

Oh, 9 there you go, grim.

Everyone loves a disaster. We are fascinated by mortality. Admit it. You feel relieved it did not happen to you…yet.

SX (7)-

Schadenfreude? How so? What glee is there in dealing every day with people immersed in a world of shit? I’m a lot of things, but a sociopath isn’t one of them.

Whatever judgements I may make of my clients, they stay with me…and, they are certainly not helpful or relevant to the mitigation process.

You might be surprised to know that I don’t spend much time at all thinking about how my clients got to the point they did. At the core, their stories are all the same: you already know the plot and denouement if you’re a regular here.

As far as moral superiority, well, I have my own personal history to keep that tamped down. When I got into RE as a serious pursuit, I was 90K in the hole and pretty much foreclosure bait myself (and that was in an UP market). A little help from the family and some fortunate breaks pulled me away from the brink. However, the scare from that is one that lasts a lifetime.

There is no surer way to screw up RE deals than by passing judgement on people, then acting on the (usually) erroneous assumptions that flow from that judgement.

Grim in fact next to ogling disaster, we love the feeling of vindication. Not having fallen for the bait and swimming away free. Something like your experiences in the market.

Ah clotpoll, the reformed addict. I forgot that one….strong sense of moral superiority coupled with a faux empathy accompanies that one.

From Bloomberg:

U.S. Housing Starts Probably Fell in December to a 14-Year Low

Builders in the U.S. broke ground on fewer houses in December, making the year’s decline in homebuilding the worst in almost three decades, economists said before a report today.

Housing starts fell to an annual rate of 1.145 million, the lowest in 14 years, after a 1.187 million pace in November, according to the median forecast of 74 economists in a Bloomberg News survey. Residential construction probably declined 25 percent last year, the most since 1980.

Building permits may also have fallen, suggesting the housing slump will deepen as it enters a third year and threatens to push the economy into recession. Rising foreclosures will throw even more houses onto the market, hurting property values and further discouraging construction.

“Housing activity weakened noticeably as the year concluded,” said Peter Kretzmer, a senior economist at Bank of America Corp. in New York. “With inventories high and credit restrained, housing activity will remain at depressed levels at least through the middle of the new year.”

The Commerce Department will issue the report at 8:30 a.m. in Washington. Estimates in the Bloomberg survey ranged from 1.05 million to 1.2 million.

This past summer I saw a house across town that was in foreclosure. It belonged to a boy in my daughter’s class and his family. Very sad – divorce situation and struggling for years to keep the house. Every now and then for years I would see the first notice in the paper but they would be able to pull back. The mom really tried to keep the house but I don’t know that it was worth it. I remember one day the boy coming to school wearing his mom’s sneakers because he left his at his dad’s. The kid had only one pair of shoes. He is actually the nicest kid you’d ever want to meet. They moved to a garden apartment in town and are probably doing much better. I think the mortgage amount was around $360,000 so their rent must be lower than their mortgage payment.

Anyway, the bank finally foreclosed this summer and it was bought almost immediately. It’s a four bedroom cape that was in rough shape. I just saw that it’s back on the market for $450,000. they’ve done a lot to it but I can’t believe someone is trying to flip in this market.

SX (12)-

“You feel relieved it did not happen to you…yet.”

SX, you must not have walked into a RE office lately. Believe me, I do it every day…and the thought usually comes at some point every day that it COULD happen, and soon. A bad deal here, some fall-throughs there, some agents have a bad month or two…and all of a sudden, you’ve got some bad momentum going.

I have a small gang of very tough, experienced agents, but their experience and toughness only gives them a chance- not a guarantee- that they’ll make it through this sea of crap. I’ve lost count of the times that I’ve carried a desk fee balance forward or given away a personal lead to one of my gang…just to keep someone going. Any broker/owner that tells you right now that things are hunky-dory is either lying, delusional, or both. Until prices come down and deal volume rises- at least a little- survival is the name of the game. Take a look at the stats here, and you can see that no good RE agent is missing deals…there just aren’t many deals happening.

SX (15)-

“I forgot that one….strong sense of moral superiority coupled with a faux empathy accompanies that one.”

The only whiff of moral superioity I sense is blowing from your direction.

5 Cirrus

Tell your friend to avoid buying in Ewing if she can, especially in this downturn, that will be the first town in Mercer to really go way down. Well, other than Trenton, but that’s already been decimated.

Essex,

I would have been happy as a homeowner, a house appreciating at/near the rate of inflation. Unfortunately, buying a home became trading commodities. It was the soybean pit, in the middle of a drought. Some recognized it and decided to move on, others decided not to participate. I don’t seek vindication, markets are too humbling. As soon as you pat yourself on the back, you get slammed over the head with a 2×4. You have to constantly keep your eyes open for the next freight train.

Should those that exhibited prudence be interrogated?

Hope My landlord pays his mortgage … Bad idea to rent a house

BC (21)-

Our friend, Essex, obviously doesn’t participate in any markets.

Re Schadenfreude

There is some housing Schadenfreude going on for sure, in general. Example, look at Britney Spears, we can’t stop watching her downfall, the girl is literally dying on the TV and the ratings are going up, up, up. Or watching Supernanny. Why is that show so popular? Isn’t it to give ourselves a pat on the back and say, I’m a good parent, these people are terrible.

As far as housing, it’s the same. No one wants to see real people we know go through pain, but we can’t stop watching.

Some people think that people in the hole brought it all on themselves, were greedy or stupid; some think (like myself) that the government is to blame for letting this mess happen. If you were shut out of the housing market during the past few years, you might be rooting for the news stories that show the decline and booing when the gov’t says they are going to do something to bail people out.

I saw an interesting article the other day on National Debt, which indicated every man, woman and child is on the hook for $30K to pay it off. I immediately computed $30k x’s 10 = $300K to figure what I needed to pony up for the immediate family of kids and grand kids and decided it was doable. Then I looked beyond that for other items Society needs me to pay for, e.g. Entitlement Programs, ever expanding taxes, etc., and went Tilt. The biggest problem I see is so many promissory notes (e.g. Pension Funds)have been written based upon a Stock Market that must always rise (Irrational Exhuberance), that the number I am due when it Fails to defy Gravity, is larger then my life’s earnings. So, maybe it’s time to turn off the TV, disgard the newspapers, shut down the PC, and pretend “Ignorance Is Bliss”?

Ann (24)-

True dat. One thing for sure: you can tell the losers from the winners- on either side of the housing debate- by identifying those who are obsessed with assigning blame. That’s the big difference between a blog like this (mostly forward-looking) and a sewer like housingpanic (the ultimate finger-pointing LOD).

The door’s blown open, and the horses have left the barn. Pretty much everyone and every institution can accept a little of the blame. The much more interesting question is: what comes next?

Clot (13)Fpr me, best way to learn a lesson is to live it. I’ve screwed up so much – I wouldn’t dare pass judgement. I wish people would live within their means but having learned the hard way myself how can I expect others to be any different.

BTW -“Bring back debtor’s prisons.” from the other day was priceless. Talk about learning the hard way.

Quite the private vs. public sector conversation yesterday. The benefits here in Calif. vary district to district. Gone are the days of the life-time benefits. All new hires operate under a new, more austere set of rules. My district has always had a 10% cap on insurance. Retirees pay for coverage…copays for visits/meds. as do current employees. Current employees have 8% (then matched by district) taken from their checks for retirement plus medicare. No SS. In a neighboring district, if you didn’t retire with your 30 years in last year – no grandfather clause – you lost life-time benefits.

confused #228 – I have no idea if a person can marry again and have that 16 year-old covered by their insurance…don’t intend to marry again.

The governor unveiled his plan to cut 10% from this year’s budget across the board. That translates to $4B this year for schools and $14B next year. He has declared a “finacial crisis” so he is able to suspend prop. 98 that quarantees 40% of the budget go to schools. They say 600 of the 1000 districts in the state will be in the hole. (They have to carry a 2% reserve.) My district will be fine. No raises – we never get raises unless the money is there.

In Calif. -due to prop.13- we work with an unstable set of numbers each year..income tax and sales taxes plus a restricted property tax number. So we have good years and bad. Many assumed we had some in reserve due to our great influx of funds last year – we do not. But that doesn’t seem to be stopping the governor from going forward with his plans to start up a $14B health care program. And there is the QUIA (at a cost of $4B) program – Not even implimented yet. All they would need to do it wait on that then the cuts for this year would not even be necessary. QUIA gives money to “under-performing schools” so they can attempt to meet the “no child left behind” standards. My district won’t see a penny because we run test scores above the 800 mark.

Some say the governor is only posturing to try to get the dems/reps to work out a tax cut/spending cut budget for next year. I’m not sure how it will all play out.

One thing for sure..the numbers (re sales and foreclosures) are only getting worse…for now. California is a funny state. You never know what to expect.

From MarketWatch:

Housing starts plunge 14% to 16-year low in Dec

Construction on new homes fell 14% in December to a seasonally adjusted annual rate of 1.01 million, the slowest monthly building pace in more than 16 years, the Commerce Department reported Thursday. Housing starts for single-family homes in the West fell 16% to the lowest level since the data were first collected in 1959. National housing starts were lower than the 1.12 million pace expected by economists surveyed by MarketWatch. Building permits fell 8% in December to a seasonally adjusted annual rate of 1.07 million, the lowest since May 1993. For all of 2007, housing starts fell 25% to 1.35 million, the lowest annual total since 1993.

From MarketWatch:

U.S. Dec. housing starts fall 14% to 1.01M v. 1.12M expected

U.S. Dec. building permits fall 8% to 1.07 million pace

U.S. 2007 housing starts off 25% to 15-year low

U.S. Dec. West housing single-family starts at record low

U.S. 2007 building permits fall 25% to 12-year low

U.S. Dec. housing completions fall 8% to 1.30 million

From the U.S. Census Bureau:

NEW RESIDENTIAL CONSTRUCTION IN DECEMBER 2007

WASHINGTON MUT INC SUB NT 8.25000% 04/01/2010

Basic Analytics

Price (Ask) 95.501

Yield to Worst (Ask) 10.595%

Yield to Maturity 10.593479%

OK, I told you guys to bout the countrywide bonds, that should shoot back to par if they got taken over. I am “guessing” the wamu bonds will pop to par if chase makes a move. If not YTM is almost 11% and the only risk is they have a complete bankruptcy. Seems the vultures screw the commmon stockholders on the deal but they can’t screw the bondholders.

Grim,

I usually just wander thru and rarely comment…I gotta say though,I hope New Jersy doesn’t end up as bad or even in the ballpark as SW Florida is right now. Our county had as many FC’s as sales in Dec. 5 outta 9 homes over the last three years on my street. None resold yet. And its getting even uglier.

Like i said…Friends and Family are in the area so i hope it doesn’t get to ugly…

Chris

John (31)-

“…the vultures screw the commmon stockholders on the deal but they can’t screw the bondholders.”

Same as it ever was.

Cramer in full rant on CNBC right now.

Everyone,

Get-together will be on Saturday February 9th in Morristown.

For those who can’t make Morristown (although I beg that you try), we’ll be getting together on the Gold Coast somewhere in the March/April timeframe for a “Spring Market Kickoff”.

Still working on selecting the venue in Morristown.

From CNBC:

PNC Financial Profit Falls on Higher Credit Losses

PNC Financial Services Group, Pennsylvania’s largest bank, on Thursday said fourth-quarter profit fell 53 percent, hurt by higher credit losses and the lower value of commercial mortgages in its portfolio.

…

“Fourth-quarter performance did not meet our expectations due to challenges that included unprecedented market volatility and credit deterioration in our residential real estate development,” Chief Executive James Rohr said in a statement.

Merrill Lynch’s (MER) fourth quarter was uglier than even the biggest bears on Wall Street expected. The brokerage firm lost $10.3 billion, or $12.57 a share, from continuing operations for the quarter ended Dec. 31, reversing the year-ago profit of $2.2 billion, or $2.29 a share. Analysts on average were looking for a loss of $2.41 a share, with the most negative view an $11-a-share loss expected by analysts at Citi. The latest quarter included an $11.5 billion writedown of Merrill’s exposure to mortgage-related securities, and a $3.1 billion loss tied to credit valuation adjustments on hedges with financial guarantors on collateralized debt obligations. Because of the writedowns, revenue for the fourth quarter swung to negative $8.2 billion from positive $8.4 billion a year ago –

Anyone here familiar with Monmouth county real estate? I’m looking for a townhouse near the shore (Little Silver to Long Branch area) for a weekend place and have been casually browsing realtor.com, but haven’t really noticed any pricing trends.

I’ve got a pretty broad price range in mind at the moment; $400k-$750k.

Here’s one I was looking at today: MLS ID# 20802167. Looks like a new listing, asking $759k.

At the lower end of my price range, there is this: MLS ID# 20800374, asking $419k.

Any helpful insights on the area would be much appreciated. Also, any suggestions on a good broker in that area?

From the AP:

Home Construction Drops 25 Percent

The prolonged slump in housing pushed construction of new homes in 2007 down by the largest amount in 27 years with the expectation that the downturn has further to go.

The Commerce Department reported Thursday that construction was started on 1.353 million new homes and apartments last year, down 24.8 percent from 2006. It was the second biggest annual decline on record, exceeded only by a 26 percent plunge in 1980, a period when the Federal Reserve was pushing interest rates to post-World War II records in an effort to combat an entrenched inflation problem.

Many economists believe that the current slump in housing will rival the dive in the late 1970s and early 1980s when housing construction fell for four straight years before beginning to recover after the severe 1981-82 recession. For December, construction fell by a bigger-than-expected 14.2 percent.

“Seems the vultures screw the commmon stockholders on the deal but they can’t screw the bondholders.”

John: Very often in complicated bankruptcies the administrative expense claims (lawyers, investment banks involved in asset sales) are so massive that they’re the only people who get paid. While bond holders have priority over stock holders, they’re still unsecured lenders who lose to holders of administrative expense claims and there’s a good chance of bond holders getting nil from the restructuring process.

27. Cindy Says:

confused #228 – I have no idea if a person can marry again and have that 16 year-old covered by their insurance…don’t intend to marry again.

I was just curious. Years ago, spouse had to be covered > 3 years prior to retirement for Public Sector retirement, so was surprised when a Private Sector Widow, without Retirement Medical Insurance, was getting Public Medical Insurance by marrying a Teacher post retirement. Of course all the rules have changed nowadays, anyway.

California is really hitting the big issues, sooner. I’m doing my part for Medical, I dumped my Vytorin months ago and started walking six miles a day instead. Cheaper & no negative side effects.

“When I did the interview for the Herald, the reporter asked me if I was happy about my predictions having come to fruition.”

Being right about something unsavory makes you a bad person, dontcha know…

Confused (41) I think the key has got to be “stop the bloodletting.” New hires can not have the lucrative packages of the past. Everyone here is adjusting. Also, some county employees who received that “OT plus salary” formula are being challenged in court. I of course never know details but the practice has stopped and those receiving the skewed formula are being challenged.

Confused (41)-

Vytorin = Pez, with better marketing and worse side effects.

Confused also.. Our PERS system is solvent for now but I read the NJ 4/07 report from yesterday with great interest because in tough times, “who knows what who will do.”

I printed up the 5 pages and gave it to my faculty senate leader last night and asked “Do we have someone all over this?”

Evidently – we do!

Grim #9, I look at it more like a patient with an infected and impacted tooth. The situation couldn’t go on forever and in the short term will hurt more, but getting it done is the most important thing.

Here is a gem from 2005 to remind us all of how much better it is to be a buyer today:

http://www.realestatejournal.com/buysell/tactics/20050620-efrati.html

22

Lol!!!

If your landlord can’t pay his mortgage, who’s worse off; you or him?

OK, as I am now here and not moving here I can’t be NJ bound (or maybe I am as I would have to pay back relo expenses if I moved again) so I will change the name.

Would someone with MLS access be kind enough to dig up the address, LP, OLP if there is one and DOM for 2455749?

thanks very much

kiwi,

31 Garibaldi

Listed: 10/22/07

OLP/LP: $849k (no price changes)

DOM: 87

No prior history on GSMLS

Purchased 9/5/2003 for $270k (prior to remodel, obviously).

#46 – a contract to feed squirrels forever? I would be interested to find out the implications of violating such a contract. Does the new homeowner have to give up his house? And what if some terrible intruder wearing a ski mask and black suit poisoned the squirrels when the poor homeowner was out of town for the weekend? I mean, surely the buyer would not be responsible for such an unfortunate happenstance?

35

“Still working on selecting the venue in Morristown.”

Someplace with boooze.

I am assuming I am only purchasing investment grade non mortgage related banks like Wamu, Captial One, Suntrust, Soveign type bonds. Firms that are distressed, but still maintain investment grade rating, pay at least 7% interest and are below par. I am guessing if things get worse, chase, wells etc. might buy them if commmon falls to crap and they will shoot back to par, or the Fed may help pay them out, also “brick” banks have lots of physical assets which help in a default. Banks often have huge real estate holdings and securtitized loan portfolios. I would not buy more than 5K bond in each of the banks. You can get wiped big time in a enron type bond of a firm with little physical assets. The bondholders get zero yet they did not particpate in the rapid stock rise. They took on all the risk of the common stock holders with much less possible reward.

Bonds of beaten down banks are now in an unusual state. The bondholders take on less risk yet have more reward. If you bought country wide bonds you were much better off than the country wide stock holders with less risk.

This is just chump change but for someone with 10-20K rolling out of a cd into a new low rate cd it might be worth a shot.

“Vytorin = Pez, with better marketing and worse side effects.”

ha! although if they sold Vytorin in little Snoopy dispensers……

Ah, the “feed the squirrels” article! That piece is a housing bubble classic.

#3 Clot: There were time I would think I would take great satisfaction from being right, particulary with some incredibly obnoxious housing bulls along the way.

But my wife would pull me back with her one line “if you do this, you will become just like them, is that what you want? And the answer was always no.

A family friend asked for advice a couple of years ago, newly married, wanted to buy a town house, we told them that they are young, and might want to consider renting, enjoying themselves, and wating for this thing to work out.

They thought it was a great idea, until 3 months later when they actually bought a town house (Orange Co), we remained silent.

Long story short 2 years later, baby comes they want a house, and they were dismayed when the realtor told them units exactly the same as the one they own,are on the market with asking prices of 50k or more less, than what these guys paid for theirs in 05.

Now they are stuck (down payment is gone), no satifaction on my part, just very, very sad.

3b (55)-

Nothing funny about that at all.

From Bloomberg:

Convicted Appraiser Exposes Toxic Debt Tie to Inflated Values

Home appraiser Julian “Tony” Perez conjured $7.5 million out of thin air in the first six months of 2001 by overvaluing 33 condominiums in the Atlanta area.

Perez valued eight unfinished properties at the Deere Lofts development on April 2. Some were missing ceilings, cabinets or sinks. Each had been bought the previous week for $90,000 to $167,000. Perez said they were worth $177,000 to $330,000, according to the U.S. Attorney’s Office in Atlanta.

“These are the worst condos ever,” Perez said last January during testimony at the federal trial in Atlanta of developer Phillip Hill, who used the appraisals to resell the properties. “Those values are super over-inflated, probably double what the amount of that property is probably worth.”

Perez and appraisers like him helped exaggerate U.S. mortgage values by as much as 10 percent, or $135 billion, in 2006, according to Susan Wachter, a real estate professor at the University of Pennsylvania’s Wharton School in Philadelphia. Such appraisals artificially inflated the value of collateral supporting mortgage-backed securities and are contributing to record foreclosures because borrowers end up owing more than their houses are worth.

Lenders and investors in mortgage-backed securities depend on independent appraisals to value their collateral. Buyers use them to make sure they aren’t overpaying.

3b, were those the new ones by Monroe-Woodbury?

46

I look at as being somewhat akin to grim being in the leading wave of docs who recognize that smoking cigarettes causes death (let’s say it’s the ’20s). He tells folks that smoking is probaby not a good idea. BC Bob and Chifi quit smoking, but grim mostly just gets ridiculed or ignored, while HGTV does half hour shows about which starlet looks the most glamorous holding a cigarette.

Then, all the smokers start dying. The medical studies are done, and the consensus begins to build: smoking, not so smart.

A herald reporter shows up at grim’s door and asks “are you happy all those people are dying?”

I’ll bet grim’s happiest that any number of folks who read this blog acted prudently due entirely to or in large part because of the information presented here.

The reporter’s question implies that grim would have been happier had fewer people listened to him. That’s self-evidently absurd.

From GlobeSt:

Good News (at Last) for Asbury Park

This oceanfront city’s two-steps-forward, one-step-back redevelopment process got some bad news last month when the Hoboken, NJ-based Metro Homes announced it was halting construction on its high-rise Esperanza condo project, citing the state of the national mortgage market Metro Homes. City officials informed the developer that it was in default of its development agreement.

That issue has yet to be resolved, and it remains another bit of bad news for a city that has seen more than its share of bad news over the past four decades. But this week, city officials got some very good news when the Washington, DC-based Madison Marquette and locally based Asbury Partners, the master developer of the 56-acre Oceanfront Asbury redevelopment, unveiled the Asbury Park Initiative, a five-part plan designed to advance that revitalization and generate increased support from private companies in the community.

Grim – I know I got dissed for not realizing that the saying “The secret of success is to find a need and fill it” was an old marketing mantra…but you did…you filled an obviously gaping hole re information for your industry in NJ. Think of all you helped.

#58 I am not sure, but will check. I thought the development they purchased in was built in the late 90’s,but they are close to Woodbury Commons.

I heard a guy on CNBC this morning say that the decrease in housing starts is great news because that means they’ll clear out all that excess inventory. Am I crazy, or is that the most whackadoodle spin ever? Does that mean Mr. Toll is saying “Yippee! I have lots of time now to spend my money!”

hi…

can anyone comment on the website realtytrac.com? is it worth $50/month?

i was thinking of subscribing and trying to buy a foreclosure/preforeclosure property with their “wealth” of resources… i don’t have any experience with the buying of these types of properties, but i thought i should at least investigate…

thanks.

Chuck Schumer’s Banker’s bailout bill

S. 2346 is on the Senate’s calendar tommorow. I believe it will be up for a vote.

This bill will raise the Fannie Mae and Freddie Mac conforming loan limits for 6 months and is designed to allow sup-prime borrowers to refiance into “safe” affordable mortgages. This bill will definetly pump more liquidity into the mortgage market.

85% of the refiancing is supposed to go to only subprime borrowers.

I cannot help but conclude Chuck Schumer wants to throw good money after bad in the housing market.

Congress should only pass a law which instead of expanding Fannie & Freddie limits to accommodate more mortgage refiancing with government guarantees, it would be better to have Fannie & Freddie buy existing mortgages at 50 cents on the dollar.

This way American taxpayers won’t get stuck with the bail-out. Wall Street wizards, hedge funds, and their securitized holders should take the first 50% hit.

Write your Senator and tell them NO!

Ridgewood

SLD 635 ALBERT PL $609,000 8/17/2005

($10k over original asking price of $599,000)

ACT 635 ALBERT PL $599,000 1/16/2008

this is so off topic but i had to share this insanity:

Sports Illustrated – PORTAGE, Wis. (AP) — Upset that his 7-year-old son wouldn’t wear a Green Bay Packers jersey during the team’s playoff victory Saturday, a man restrained the boy for an hour with tape and taped the jersey onto him.

Mathew Kowald was cited for disorderly conduct in connection with the incident with his son at their home in Pardeeville, Lt. Wayne Smith of the Columbia County Sheriff’s Department said. Pardeeville is about 30 miles north of Madison.

The 36-year-old Kowald was arrested Monday after his wife told authorities about the incident. Kowald was taken to the county jail and held until Wednesday, when he pleaded no contest, paid a fine of $186 and was released.

Kowald’s wife filed a restraining order Wednesday, so Kowald will not be able to have contact with his family, Smith said. Smith said other domestic issues have surfaced, though he wouldn’t elaborate.

The boy refused to wear the jersey Saturday, when the Packers beat the Seattle Seahawks in a playoff game, Smith said. Smith said the incident sounded strange when reported at first, but the mother took pictures with her cell phone and that type of evidence is difficult to dispute.

Kowald, contacted later Wednesday by the Portage Daily Register, said the incident started as a joke. His son challenged him by saying he wouldn’t root for the Packers. When he tied the boy up, the youngster was laughing while his wife took pictures, he said.

“Then he couldn’t get out and he got upset and that’s it. It lasted a minute,” he said. “I didn’t mean no harm, and he knows that, but I haven’t been able to tell him that.”

District Attorney Jane Kohlwey said there wasn’t enough evidence to support felony charges.

“I wouldn’t agree with what he did, but legally a parent can restrain a child,” she said. “I have no proof of emotional damage. … I have to follow the law.

Thanks grim,

those are the ones I have to stay away from, I have no clue how to value ie is there really $579,000 worth of upgrades in the house…..

can anyone comment on the website realtytrac.com? is it worth $50/month?

jlx,

If you are interested in a smaller area, it is much less expensive to go over to the records office and ask for the most recent Lis Pendens or Notice of Foreclosure Sale records.

Even easier is to log on to your county Sheriff website and get access to the Sheriff Sale list, if available. For example, Bergen County:

http://bcsd.us/sheriff_sale.aspx

However, realize that the pickings are slim in the preforeclosure market right now. Those with even a shred of equity will attempt to sell. Those who don’t will make their way through the foreclosure process to auction. Few, if any, will bid on these properties as the bank upset prices are typically higher than what the property is currently worth (the owners are underwater, so to speak).

The best place to find opportunities right now are in short sales and REO (bank owned properties).

Leave the pre-foreclosure deals to the sharks.

Most don’t have the stomach for it anyway.

Unless you are OK with knocking on someone’s door, telling them you know they are going to lose the house, and trying to convince them to sell to you, even though you are probably the 4th person to contact them that day.

I think there is race to the bottom of negativity in the media – only few days left and we will hear Great Depression on the news!!!

From MarketWatch:

Bernanke repeats substantive rate cuts coming

2%!!!! 200bp:)

#71 Al: And yet nobody accused the media of cheerleading, when everything was supposedly great right? No articles urging people exercise caution, no articles outlining what might happen if things blow up (which they have).

So its only the media’s fault when the news is bad, when the news is good, they are only doing their job.

Its like some in politics who believe if you disagree, you are unpatriotic.

thanks grim…

so if i want to look in ridgewood, for example, would i just go to the ridgewood records office and ask for this list of lis pendens/notice of foreclosures? and just like that, they’ll give it to me for free?

i’m wondering if there are any opportunities to save money with foreclosures… is there a book you can recommend? or would you even recommend this route for a new home buyer? i’m not a handyman, but i don’t mind doing a bit of renovation myself…

thanks again for the advice (and your website)

Hey – I am not accusing media of negativity – I am just noticing that medial like to focus on negative a bit too much – I almost do not want to watch news as all you see are murders, robberies, deaths, and corruption.

I part what news are doing right now is convincing people that murders, corruption and crime are normal part of life.

Note that the Philly Fed survey includes portions of New Jersey…

From Bloomberg:

Philadelphia Fed Bank’s January Factory Index Falls to -20.9

Manufacturing in the Philadelphia region contracted more than forecast in January to a six-year low, adding to evidence factories are throttling back as the economy slows.

The Philadelphia Federal Reserve Bank’s general economic index declined to -20.9, the lowest reading since October 2001, from -1.6 in December, the bank said today. Negative readings signal contraction. The index averaged 5.1 in 2007.

The figures indicate that the housing recession, entering its third year, is dragging down other industries. At the same time, a weaker dollar and stronger growth abroad are boosting demand for U.S. exports, keeping factory output from collapsing.

“We’re pretty doggone close to saying `recession,”’ Daniel North, chief U.S. economist at Euler Hermes ACI, a trade credit insurer, in Owings Mills, Maryland, said before the report. “Producers of consumer and capital goods are clearly seeing an incoming recession.”

Economists surveyed by Bloomberg News had forecast the index would rise to -1.0 from an originally reported -1.6, according to the median estimate. The index averaged 5.1 in 2007.

N.J. shows December job gains

New Jersey added 3,700 jobs in December, wrapping up 2007 with a total gain of 29,400, state labor officials said Wednesday.

…

In December, jobs were added in education, health, leisure and hospitality, and professional and business services … Jobs were lost in construction and finance, especially in the mortgage industry.

#63 leavingqueens; Yeah, and now all they haev to do is find qualified buyers to purchase all of these houses.

From the Philly Fed:

Business Outlook Survey – January 2008

Activity in the region’s manufacturing sector weakened this month, according to firms surveyed for the January Business Outlook Survey. The general activity and new orders indexes fell sharply this month, and indexes for shipments and employment also turned negative. A significant share of firms reported a rise in prices for inputs and for their own manufactured goods. Also this month, the region’s manufacturing executives were less optimistic about future activity, and most future indicators have fallen considerably over the past three months.

…

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, fell sharply from a revised reading of -1.6 in December to -20.9, its lowest reading since October 2001 (see Chart). [footnote] Forty percent of the firms reported no change in activity from December, but the percentage of firms reporting decreases (41 percent) was substantially greater than the percentage reporting increases (20 percent). Other broad indicators also suggested declines this month. Demand for manufactured goods, as represented by the survey’s new orders index, fell dramatically, from a revised reading of 12.0 in December to -15.2, its first negative reading in 15 months. The current shipments index fell 17 points, from 15.0 to -2.3. Indexes for both unfilled orders and delivery times remained negative.

…

The outlook for manufacturing growth over the next six months was less optimistic than in December. The future general activity index declined from a revised reading of 11.1 in December to 5.2 this month. The index has declined 34 points over the past three months (see Chart). The percentage of firms expecting growth in activity over the next six months (32 percent) is only slightly higher than the percentage expecting decreases (27 percent). The indexes for future new orders edged down two points, while the future shipments index increased three points. Firms’ expectations for future employment, however, were virtually unchanged: The future employment index increased one point, and nearly 39 percent of the firms still expect to increase employment over the next six months.

#85 Its with the county, not the individual municipality.

Great, now the Fed chief who once stood tall and said housing isn’t affecting the economy is now panicking like Greenspan and going buck nutty.

sync,

NJ unemployment jumped to 4.5% in December from 4.2% the month prior.

from another blog

I figured out Bernanke’s 2008 economic roadmap

January 15, 2008

In early July of 2007, before the August panic, I sold everything and went 100% cash in several currencies. I held on to my cash for many months while studiously trying to figure out how the sub-prime fiasco would pan out and how the Federal Reserve would respond. I finally figured it out.

The first thing everyone needs to understand is that Ben Bernanke, the current Federal Reserve chairman, is an absolute nut. After reviewing some of his published papers (via Marc Faber’s reports) I am now convinced he’s a pompous arrogant asshole who doesn’t even understand basic economic theory. If you don’t believe me, just watch his answers to Ron Paul’s perfectly reasonable challenges on youtube then ask people in Zimbabwe if the only consequence to a weakened currency is higher prices on imported goods.

Ben Bernanke has spent his entire career proselytizing the omnipotent power of central banks to cure every economic flu with inflation — that’s right, inflation — and now he has control over the printing press. Have no doubt, he intends to use the American economy like a lab rat in a vain attempt to prove his asinine theories. He’s betting the stupidity and ignorance of average investors will compel them to believe fraudulent economic figures published by the government despite contradictory evidence produced by their own eyes and wallets.

Don’t get caught in their trap and don’t believe their lies. Wishful thinking is not a long term investment strategy. If you want to make money you have to put your emotions aside and wake up to the reality of this catastrophe. Inflation is not contained, it’s rising dramatically. GDP is not growing slowly, it’s contracting. The US dollar is not a valued currency, it’s worthless paper.

The second thing you need to understand is that all central banks around the world are working in collusion to export American inflation abroad. They are trying to spread price increases around the world to cushion the impact on America’s failing consumer driven economy. Despite what you’re hearing on typical business news propaganda networks, every major currency is being vastly outperformed by gold — even the Euro. And that’s not unique, in fact many commodities are rising faster than any of the major fiat currencies.

Ben Bernanke’s plan is simple. The primary cause of this economic calamity is that foreigners are no longer willing to lend Americans money to buy the goods they produce, therefore, the solution is to debase the US dollar by whatever means necessary to entice foreigners to re-enter American markets. He believes that frozen mortgage resets and government bailouts of corporations through money auctions will tide everyone over until foreigners are willing to come snap everyone up for pennies on the yuan. In that scenario, the market will hit a bottom even without a large decrease in nominal asset prices and useful idiots everywhere will continue their consumption binge. He ignores inflation because he believes an economic slowdown in the meantime with create enough disinflationary pressures to counteract higher commodity prices.

Of course, his plan is ridiculous. International trade is now a game in which Americans produce dollars and foreigners produce things dollars can buy; if people are no longer willing to accept those dollars because they’ve been so terribly debased, we’re right back to where we started. Obviously foreigners will buy some cheap American assets, but that won’t solve the problem. The average American will not be able to consume more products because Citibank manages to barely escape bankruptcy. Banks are not loyal to any nation, they will invest anywhere profits can be made. No matter what happens with the stock market, easy credit is gone and the American consumer is toast.

Also, the inevitable consumer driven slowdown will not spread as dramatically as many people predict. Conventional wisdom tells a fanciful story of coupled economies that rise together and fall together in tandem, which couldn’t be further from the truth. It’s normal for some regions to experience growth while others suffer. Are people really arguing that China is more coupled with America than Texas is with Michigan? Economies are not coupled by geography, they are coupled by industry and capital — all of which is abroad. If Americans had money they wouldn’t be begging Arab oil sheikdoms and Chinese communists to rescue their faltering businesses.

What everyone needs to understand is that China doesn’t benefit when their people work around the clock at slave wages (by American standards) to send cheap goods abroad in return for currency that will soon be worth less then their own. If the Chinese allow their currency to float they would benefit much more by consuming those products themselves. And the Arabs can sell their oil anywhere — last time I checked oil burns just as easily in Asia.

Historians used to call WWI the great war, then WWII happened. Let’s get real, the end result of helicopter Ben’s disastrous monetary policy will be a new depression much worse than the first, because this time it will be inflationary. Protect yourself by buying anything that can’t be replicated at rates equal to Bernanke’s ability to print money. Taking into consideration changing weather patterns, it appears to me that food may be the new black gold. All commodities and precious metals that have stable demand will increase in price.

jlx,

REO represents the best opportunity for the lay-person. Next best is a short-sale deal. Pre-foreclosure? Way down the list. The risk is very high, and the potential for acceptable returns just isn’t there.

I’ve seen agent-sold properties going for lower prices than similar properties at the foreclosure auctions. Realize that a bank is going to bid up to it’s upset price (lien + legal). If there is a second lien on the property, you can bet they’ll be bidding even higher in an attempt to resell the property themselves, to minimize loss.

The downside to REO and short-sale is that you are looking at a smaller subset of the market.

DJIA 12408 right now. Who thinks we will see 12,250 by week’s end?

Was anyone also on ML conf.call this morning???

Lots of very unhappy campers ( stockholders) and employees…they could not BLEEP them fast enough. Also they are bringing ” hatchet man” .:( will be tough in there to!!!…

Al,

The media is nothing but sensationalist propaganda with a little bit of real info sparingly sprinkled in.

The question of a depression may not be an unreasonable question. Between the massive debt levels that the US is carrying, our lack of base manufacturing, devaluation of the dollar, increasing energy prices and general price inflation, we have entered a period where a depression is an actual possibility. A global recession is more likely, or possibly stagflation, but a depression would not be out of the question espescially given how poorly the government and the FED appears to be handling the current fiscal “crisis”.

Clot,

My wife and I intend to buy late summer or fall. I like the idea of a short sale just to avoid wading through a sea of fantasy sellers & get something at a realistic price for today’s market.

Can any realtor handle a short sale on the buy side or do I need to find someone who specializes in short sales?

86 shore,

It would not shock me to see 12,000 wihtin a week

Watching Bloomberg now….Bernanke testifying…says moral hazard isn’t a major concern

Why do I like REO so much?

1) Properties are often distressed. Owners trashed the place when they left. Damage from a lack of maintenance. Landscaping dead, lawn overgrown. Properties as-is. Lots of buyers will get turned off, even at the lower price. The uglier the better, but only if those defects can be easily repaired. Correctable defects are opportunity. When buyers are looking for granite and stainless, look for formica and harvest gold. Learn to love dirt and grunge.

2) You have a bank on the other end of the deal. No emotion. They didn’t raise their kids there, they don’t have fond memories of swimming in the pool on the first hot summer day, etc etc. Nothing worse then trying to negotiate with a homeowner that is in love with their home. Don’t fool yourself into thinking they’ll just hand the property over in a sweetheart deal. No free lunch, but I’ll take any negotiating advantage I can get.

3) As REO portfolios bulge, banks are going to be willing to push negotiation further. Who would you rather lowball, a speculator with 1 extra property on hand, or Countrywide with a few thousand?

4) Less bad-karma than pre-foreclosure. Your going to need to be a ruthless b*stard to get a good deal in pre-foreclosure. With REO the damage was done, and you weren’t anywhere near it. The owners are gone, the properties are vacant. Neighbors think you are a “good guy” for buying the deteriorating property and cleaning it up. With pre-foreclosure, you’ll be the jerk who kicked out the Wilsons.

Bernanke also saying no recession, just slowdown in growth.

from CNN

Bernanke: Juice the economy ‘quickly’

I heard a great description on NPR the other night by some economist. His main point was that you cannot cause a 13 trillion dollar market to move quickly, is hasnt been done in the past with smaller markets and it will not work with one of the largest economies to ever exist.

Shore,

do you think the DJIA will hit 12250 by today??? once again it wouldnt shock me

# 88 “given how poorly the government and the FED appears to be handling the current fiscal “crisis”.”

If anyone here has ever had an employee, a coworker, a friend, or relative who had an addiction you will likely note the similarities to our current economic situation. Right now, so many of us are addicted to debt. Like a crack addict uses the “tool” of crack to achieve a certain temporary feeling of wellbeing, many American consumers use the “tool” of debt to buy things thaty give them the temporary feeling of wellbeing.

Whether an addiction is to gambling, alcohol, narcotics, etc., people seldome overcome the addiction until they hit bottom. In the vast majority of cases, attempting to coddle an addict and gently ease them into a new set of behaviors does not work; “tough love,” which in an employment situation may involve terminating employment, is what does the trick.

I suspect that the same is needed with our current economy. Proposed attempts to stimulate the economy by putting more money into consumers’ hands just continue to feed the consumption addiction. The underlying issue is not failure to spend, it is spending when people should not. We do not want to “oversave,” and strangle the avaibility of capital for economic expansion; but, our current negative savings rate cannot be sustained. People need to spend less, save more, and invest for the future.

Short term economic “stimuli” are not likely to fix the underlying issue. We need to correct the underlying addiction before any real improvement can occur.

Grim, What would you say is the best way to find REO properties?

Currently discussing Regulation Z in Bernake hearing.

#93 grim:Bernanke also saying no recession, just slowdown in growth.

Just semantics?

85 grim,

so i guess the pre-foreclosure route is probably a waste of time… if i want to get a list of reo/short-sale opportunities, do i need to go to each individual lender’s website? or is there a better way to get a comprehensive list?

as for the sheriff’s auctions, is it a good idea to go to those and try to bid for a house there?

sorry for all the questions…

and again thanks.

Hello,

My wife and I have decided to look at buying a home in northern New Jersey after renting for the past several years. I really just stumbled upon this site and have a few questions… perhaps someone would be kind enough to answer?

Is this site primarily offered as a public service for buyers and sellers? Or is this directed more towards real estate professionals?

I browsed around for a bit this evening… from what I gather, home prices in NJ have not come down quite as much as they have in other parts of the country, but may be starting to move lower as sellers become more realistic. Is this the general consensus… and would you expect a bottom in 2008?

I see that qualifying for jumbo loans is becoming an issue. Are there any special things I’d need to be concerned with as a first time home buyers? We have no debt, excellent credit, a combined annual income of about $250,000, and would be looking to put 20% down on say a $1,000,000 home. That would put us at a monthly payment of about $5500 according to my estimates.

This is literally my first day of learning about how to buy a house… so please forgive the questions if they are a bit naive.

-=Jake=-

Jake,

I’ll write up something a bit longer later, but let me just sum up.

1) This site is for buyers/sellers, not professionals.

2) Spend a week here and you’ll be more informed than more than half of the licensed agents in this state.

#91 Bernanke testifying…says moral hazard isn’t a major concern.

Did he perhaps say why it is not a moral hazard?

shore 96

The same economist on NPR also discussed how any stimulus package is a farce. The money that is in any such package has to come from somewhere and that somewhere is basically someone elses pockets. You are essentially robbing peter to pay paul. There is no net gain in that scenario. even if you argue hat the money comes strait from the fed, it is still coming out of everyone else’s pockets in the form of inflation

3b,

Semantics? Good question.

99 A recession is defined as two consecutive quarters of negative growth, so a slowdown would not count — even though it would feel like one anyway. It may be analogous to Clinton’s assertion that his activities with Lewinski did not constitute “sex,” inasmuch as there was no intercourse. I am sure Hillary did not see it that way, even if it did not meet the “definition.”

jlx,

Lenders often list REO properties on their site:

http://apps.indymacbank.com/Individuals/Realestate/Search.asp

http://www.banking.us.hsbc.com/HICServlet?cmd_PropertySearchDefault=cmd_PropertySearchDefault

http://www.premierereo.com/reo/consumerSvlt//nav/ConsumerNavL1.jsp/requestPage/consumer/PropertySearch.jsp

http://www.ocwen.com/reo/residential/res_reofindbystate.cfm?proptype=VA

http://mortgage.chase.com/pages/other/co_properties_landing.jsp

http://www.reoexperts.net/

http://www.countrywide.com/purchase/f_reo.asp

http://www.citimortgage.com/Mortgage/Oreo/SearchListing.do

http://bankofamerica.reo.com/search/

# 103 “The money… has to come from somewhere… basically someone elses pockets. ”

Ket,

Those who have been here for awhile know that I grew up poor, struggled to afford an education, and am no longer poor. I have no objection to paying taxes that provide for defense, build and maintain economic infrastructure and the like. I resent paying more in taxes than most people earn in a year and having that go to bailout people who made economic decisions that could not be justified by any clear-thinking person with a scintilla of common sense. I also resent having 1/3 of my taxes going to pay interest on debt that, in most cases,was accrued for current operating costs and not for infrastructure improvements.

Here are some sheriff sale links..

http://www.mcsheriff.org/sales/

http://www.co.middlesex.nj.us/sherifffc/foreclosures.asp

http://www.bcsd.us/sheriff_sale.aspx

http://www.camdencounty.com/sheriff/Sales/indexsales.htm

#91 Agreed

My first home back in ’91 (yes, I’m old) was an REO.

general question for the group,

taken as a whole, is building a home approximately the same cost as purchasing a pre-existing home; assuming that the new building is comparable in most aspect to the pre-existing home. If not what are the primary differences.

# 110 It is more expensive to build new, in my experience. In buying an existing home, one is buying a property where the labor was purchased at a lower wage rate. Many building products have also increased substantially in recent years.

On the other hand, if the existing home needs significant updates, especiallly to major systems, it is less expensive to put systems into a new home than it is to retrofit.

The bottom line, I suppose, is that it is situational.

#106 Great list ! Thanks!

” am just noticing that medial like to focus on negative a bit too much”

They’re finally reporting reality and acting responsibly. For years, they were cheerleading, which was NOT reality, and was irresponsible. You’re complaining about them now, when they’re finally reporting the obvious?

How odd.

shoreguy…do you have a link for that definition of recession?

102

… and welcome to the ‘Isle of Relative Sanity’

shore,

Mrs kettle and i are staring to lean towards trying to build something in the next 2 years or so. What si the best way to start roughing out costs? Would it make any sense to talk the various trades people about rough estimates this far out? I would guess that this far out would not be representative on the labor market at the tome of construction.

The other factor is that this would NOT be a Mcmansion. We are looking at ground loop geothermal heating and cooling ICF construction, solar thermal etc.

Is it just me or is anyone else scared about the future? Especially since Bernanke is in front of congress this morning telling them we need a “fiscal stimulus package” right now.

It might be the fact that I am a little young, 28, and haven’t been entrenched in a recession in the past, 2000-2002 was the closet but I was fresh out of college. So are we in for it?

I have a stable job, a mortage and debt I can pay on one salary, but I am fearing something bad or am I being irrational and this will just be like the past?

“With pre-foreclosure, you’ll be the jerk who kicked out the Wilsons.”

And there you have it.

shore, i should be alittle more clear,

I am perfectly capable of pricing out a solar thermal system or geo-ground loop, but i am not sure of the best way to get initial install costs in a residential market. Getting quotes and what not in industrial markets seems to be a little different (which is where my experience is)

Kettle1,

Are you looking for estimates on “ground loop geothermal heating and cooling ICF construction, solar thermal” or on construction of an entire home.

Will you be GC’ing it?

3b 99,

I beleive we’re in a mid-cycle slowdown, not a recession. I doubt the NBER will find a recession in 2008.

However, difference between economic growth of 1% and -0.25% isn’t very big – either way a sharp slowdown has occurred. So whether or not we’re in a mid-cycle slowdown or recession is more a semantic difference than a economic difference.

Unlike 2001-2, this slowdown is mostly a consumer slowdown, not a corporate one. For instance Wall Street job cuts have been modest even though we’re in a financial crisis.

Ket,

I am not an expert on this but here is the key: when you take bids, you need to make sure that the bids are based on the exact same structure, same materials, same workmanship. The only feasible way of doing that is to draw up a rough estimate of what you want, have an architect draw up the plans and construction documents (Watch out for rooms that require extra work. A room that allows a full sheet of drywall to go up, or an exterior wall that uses full sheets of plywood, rather than needing to be cut, can be less expensive than a smaller one).

After you know what will go into the home, you can then price out the cost of the “parts” — how many yards of concrete, yards of wite, sheets of plywood, bundles of shingles, etc. Then, taking bids from builders — after you specify the exact quality of materials you will require — will get you meaningful quotes.

That is my approach, anyway.

117 TJ

The more I hear BB and company speak, the more nervous I get. I don’t think the circs are bad enough yet that those folks can’t make them worse.

great list grim thanks!

# 117 “am I being irrational and this will just be like the past?”

Who knows. We can tell you after the downturn is over.

120

I would like to GC the whole thing, but after seeing my brother inlaw try to do that with his house while working fulltime, i am considering alternatives. I would like to GC as much as possible but realize that there will be time constraints due to the fact it wont be my full time job and will need something a long the lines of a part time GC.

I plan to spec out most of the construction myself and have a licensed civil engineer review and approve it.

I guess my question boils down to how early is to early to get quotes from various contractors for purposes of cost estimation/modeling and where do i fond info on regulatory costs (permits inspections and what not)

TJ #117, I’m not a whole lot older than you are, so my thoughts are, let’s sit tight and see what happens. The old timers all have their recession and hard time stories, this is probably when we get ours.

Are you ready to walk barefoot in the snow to get to work?

TJ, don’t be scared. The country is in better shape today than is has been in years.

The bad stuff isn’t as bad as it once was:

Crime down

Teenage pregnancy down

Smoking (huge killer) down

Road deaths (huge killer) down

Immigration & births up – means more economic growth and taxpayers will offset spike in social costs during next few decades

Meanwhile, educational and economic opportunities which set this country apart continue to grow.

126

It can’t hurt to get the data sooner rather than later. If you find that particular aspects of the construction will cost more than you expected, it will give you time to modify the project or find less expensive suppliers.

# 127

Walking barefoot in the snow only counts if it is uphill both ways, like when I was a whippersnapper.

Funny thing is my grandfather had pictures of when he used to have to ski to school all winter long( he was born and grew up in sweden)

Talk about a double whammy, just witnessed a major bloodletting.

I’m ready to call recession.

Grim,

What happened?

Can’t discuss, sorry. That was about all I can say.

For those who were paying attention, what was the recent high and to what level does the DJIA need to drop to meet the 10% reduction used to define a correction. It feels like we are close.

i’m watching the hearing, and in a way, i feel sort of sorry for bernanke – it seems that these representatives use soliloquies, posing as questions, to kind of get him to agree with their own financial agenda.

they also are in the habit of interrupting him when he starts to say something that may not agree with what they want to put forth.

(i.e. – policies about food stamps, healthcare, energy)

#7 I enjoy my daily fix of Clotpoll.

One of the biggest critcisms of Ben Bernake when he first “applied” for the job is that Bernanke has never actually worked in corporate America. His lack of real life economic experience makes him more likely to institute theoretically attractive policies, that have never been tested except perhaps in the Third World.

When he was first was coming into the spotlight back in 2005 he tried to postion himself as an inflation fighter and that he would run things independent from the Bush administration.

I guess he has changed his tune already and his lack of experience is sticking out like a sore thumb. The markets are reacting accordingly.

# 138

You mean experience on a school board and living in the ivory tower of Princeton is NOT the same as corporate experience? Who the heck nominated a guy like that? Those meanies on Wall Street should be nicer to him, no?

Can someone please ring up Paul Volcker?

I trust the guy from Teaneck more than I trust the guy from Princeton.

shore

not sure what time horizon you wanted, havent we dropped more then 10% several times already?

140

Amen.

Since the most recent high, not the all-time high. I just haven’t had a chance to go check. I figured someone here has the data. Then, I suppose the next benchmark is the 20% reduction to qualify as a bear market.

TJ #117

This is what we should be worried about.

http://flood.firetree.net/?ll=43.3251,-101.6015&z=13&m=7

What Gold Coast?

“Meanwhile, educational and economic opportunities which set this country apart continue to grow.”

Based on what? The increasing affordability of undergrad and graduate education? The increasing quality of our public schools?

129

I agree with shore guy. There is absolutely no reason you should not start now. However, no one will stand by any of their estimates for something two years in the future. Use the estimates as a general guideline on your costs and then work from there. One thing to caution you, I know a guy who just finished a house in upstate NY. He spent a lot of $$ building his dream vacation home (couple mil). This place is extremely eco-friendly and it cost him dearly in all aspects. His projected budget ballooned to twice his original estimate and it took twice as long to build the place as he originally projected. What he found was that anytime he deviated from the norm (very common in an eco-friendly home) we was punished in terms of cost and time. He is happy with his place ultimately but he was at a loss for words when it came to how far past cost and time his new house strayed. And just to let you know, this guy is an absolute stickler on cost and time, so he followed the project as closely as anyone could ever do since he is retired. This still meant nothing as he was in a powerless position when costs increased and time expanded. He heard “take it or leave it” many, many times and he had limited to no alternatives. The contractors knew it and so he “took it”. Be careful.

#142 – And not just because I think Bernanke is playing the role of G. William Miller in this farce.

Can someone please ring up Paul Volcker?

Best Fed chairman ever

Did you see him criticize Bernanke yesterday?

Talk about a double whammy, just witnessed a major bloodletting.

BTW. It’s hardly fair to drop a bomb like that and not give any details…

“Can’t discuss, sorry. That was about all I can say.”

grim, you’re beginning to sound like I’ve been feeling for the past month or so.

139 Shore

I don’t trust the guys on the Street either; quite the reverse.

Mike 146,

would you be willing to elaborate a little, it sounds like i have similar plans, minus the price tag

grim

“Can’t discuss, sorry. That was about all I can say.”

so should i start stocking up on freeze dried meals?

I guess you guys are nicer than me because I am pretty pleased to see the real estate bubble pop.

Let me be clear that I do have sympathy for those who were genuine victims of fraud at the hands of unscrupulous members of the housing/finance industry and for those who are now becoming collateral damage from the resulting recession.

However, I have zero sympathy for the many, many people who drove prices insanely high by taking out crazy/stupid loans and spending more than they could reasonably afford.

I also have limited sympathy for those people who work in housing related industries who are now falling on hard times. Guess what– you made a killing for the last 10-15 years and if you had thought about this for 5 minutes, you must have realized the good times were bound to end at some point. Hopefully you put some money in the bank and built up a client base derived from providing good service and actual value rather than just order taking. If so, you will be fine in the long run.

At the end of the day, the bursting of this bubble is necessary for the long term health of our economy. The fact that it is happening so swiftly and severely is good news because it means our economy will get back on track sooner rather than stagnating for a generation like Japan.

And, yes, it is also good because now responsible people who save their money and use debt reasonably will be able to afford houses again.

Why would anyone in their right mind want to build a house? Can’t you just buy a used one and take some pills to raise your collasteral, pull out some of your hair and then flush 100K down to the toliet.

#121 pret: For instance Wall Street job cuts have been modest even though we’re in a financial crisis.

\

The Wall St layoffs are just getting started, take it from me, and I have been in this business for many years, including GS, which has now become cult like in the eyes of many.

I am amazed that with all that is transpiring you are still in your goldilocks world, saying all will be well.

Again, part of this delusion on your part stems from the fact that you have never lived through a significant down turn.

You job hunting woes in 2001 do not count.

I do not begrudge you your optimism, but at times it appears as just reckless cheerleading, as reflected in your earlier comments about growth and opportunity.

Oh and by the way teen age preganncy is on teh rise again.

How is Bernanke’s speach going ?!

Good Grief !!!!!!

Dow at 12,274 – down 191

Oh and by the way teen age preganncy is on teh rise again.

yay abstinence only health classes. Why teach someone to drive when you can just tell them that it is not safe to drive and leave it at that?

Ouch, Dow down 190 points

This downturn will be worse than Gonorrhea

153 skep

Don’t mistake my earlier defense of grim for sorry at the current state of RE. I’m quite happy as well, and you state quite nicely why this does not translate to schadenfreude.

Circumstances will be better for people who behave responsibly, and that’s a good thing.

I don’t bother to make budgets or schedules for DIY projects.

Reason is I witnessed one of the best construction managers I know go dramatically over-budget and over-schedule when he added an addition to his home. This guy routinely delivered complex commercial real estate projects on time and on budget.

Managing construction projects, big and small, is one of the trickiest jobs out there. When there aren’t professionals working full time on a project, build in a lot of cost and schedule contingency or be prepared to cut back the project’s scope.

If you tie a dog up and whip him daily for 4 years, don’t be surprised if he bites you when you set him free.

come on kettle – abstinence only classes?

maybe in the media there’s a debate, but from my kids experience, it doesn’t exist. when my kid was in 8th grade, the teacher brought in flavored lubricant and had the kids taste it. another assignment was to go to cvs and look at the different types of condoms- there was all sorts of stuff – and it started in 5th grade.

hey, you can think its a good thing, or a bad thing, i don’t care, but i don’t think you need to have any fear about kids not knowing about sex and the associated risks and rewards.

Interesting, traders (CME housing futures) are betting on the bottom being hit in 2010, with prices 21% below peak.

http://bespokeinvest.typepad.com/bespoke/2008/01/us-housing-mark.html

TCM,

I do worry about accurate info being provided. such what sorts of health issues may be involved and how to prevent/aviod such issues. I have family in NC and have seen some of the sex-ed 2nd hand and at least in NC that do not seem to give any practical information about safe X. I dont expect this to as much of an issue in NJ, but it is an issue. There is a strong correlation between abstinence only education and increases in teen pregnancy and disease transmission.

Sorry about the thread-jack, back RE and what not

“maybe in the media there’s a debate, but from my kids experience, it doesn’t exist.”

I assure you it exists, and it’s not pretty. You just don’t run into it in this neck of the woods.

rent (89)-

A Realtor with experience can do this on a buyer’s behalf. However:

1. The seller’s first lienholder will order an appraisal to determine current market value. If your offer is not at that level, the lender will reject the sale and demand you pay more or that the house be marketed further.

2. A giant majority of potential short sales involve a second lienholder. Increasingly, these second lienholders stand to get nothing from the proceeds of the short sale. In those instances, the second position may- out of spite- disallow the short sale, thereby forcing the first holder to foreclose. Many seconds will accept partial payments and/or promissory notes, but that acceptance is never guaranteed.