From the Otteau Group:

MarketNews – July 2011 Edition

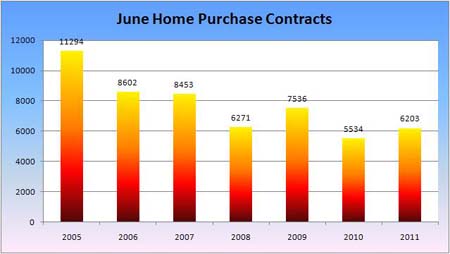

Further evidence of stabilization in the housing market occurred in June as combined purchase contracts for resales and new construction increased by 12% from one year ago. This follows a 13% increase in May, reversing a trend of declining purchase activity over the preceding year. The market’s June performance essentially matched 2008 when the recession was still in its early stages. These recent improvements in the face of weak employment growth, high unemployment and restricted access to credit suggest that housing demand is stabilizing.

Morris County

June- Contracts – Average List Price @ Contract

2005 – 680 – $576,079

2006 – 530 – $581,612

2007 – 590 – $588,867

2008 – 437 – $562,040

2009 – 482 – $519,283

2010 – 345 – $555,394

2011 – 451 – $511,095

Passaic County

June – Contracts – Average List Price @ Contract

2005 – 337 – $401,431

2006 – 264 – $401,994

2007 – 255 – $415,140

2008 – 216 – $386,827

2009 – 239 – $340,387

2010 – 170 – $340,144

2011 – 235 – $309,998

Essex County

June – Contracts – Average List Price @ Contract

2005 – 621 – $507,495

2006 – 487 – $512,381

2007 – 463 – $590,607

2008 – 416 – $546,241

2009 – 416 – $505,004

2010 – 319 – $523,475

2011 – 402 – $473,992

Union County

June – Contracts – Average List Price @ Contract

2005 – 504 – $457,957

2006 – 405 – $500,554

2007 – 334 – $548,958

2008 – 330 – $509,950

2009 – 365 – $427,301

2010 – 249 – $446,194

2011 – 316 – $401,201

Somerset County

June – Contracts – Average List Price @ Contract

2005 – 463 – $528,572

2006 – 433 – $518,230

2007 – 415 – $550,447

2008 – 363 – $493,887

2009 – 359 – $487,077

2010 – 267 – $567,648

2011 – 294 – $516,456

Bergen County (NJMLS)

June – Contracts – Average List Price @ Contract

2005 – 1185 – $606,868

2006 – 919 – $635,588

2007 – 885 – $638,281

2008 – 716 – $601,092

2009 – 854 – $529,741

2010 – 711 – $561,425

2011 – 759 – $553,159

Interesting that contracts were up in every county without the $8,000 tax stimulus

driving demand. OK Grim you might as well shut down the blog now….everyone

get back to work!

Interesting that contracts were up in every county without the $8,000 tax stimulus

driving demand.

Could very well just be rebound from the “pulled sales forward” effect of the stimulus. Don’t forget that contracts dropped precipitously last after the stimulus ended. While we’re showing improvement, remember that the % improvement is from the post-stimulus level, not pre.

Volume led pricing on the way up, volume led pricing on the way down. My thoughts are that volume will lead pricing on the way up again.

And what the heck is up with Somerset?

January – June Contracts

Morris

2010 – 2266

2011 – 2218

Passaic

2010 – 1209

2011 – 1123

Essex

2010 – 1883

2011 – 1915

Union

2010 – 1786

2011 – 1777

Somerset

2010 – 1698

2011 – 1487

Bergen

2010 – 4119

2011 – 3760

Good Morning New Jersey

grim (3)-

Somerset County is the death zone of NJ real estate.

But it showed what is arguably the most stable pricing from an aggregate statistical perspective.

I’d rather see the list by towns than county. In Union County the average for Elizabeth would probably be about $225,000 and for Westfield $525,000

I know of 3 two families sold in Elizabeth in the past year for about $150,000 and an old never updated with cedar shakes bilevel in Clark that went for $425,000 after the first open house

anyway in yesterdays Ledger estimates for Merck job cuts in New Jersey alone are 6000 Hey Gary can I have a “any questions” for this one

Elizabeth

YTD – Contracts – Average List Price @ Contract

2005 – 212 – $295,165

2006 – 168 – $314,684

2007 – 101 – $339,912

2008 – 71 – $280,991

2009 – 118 – $205,083

2010 – 93 – $180,668

2011 – 133 – $167,373 (50% off peak)

Westfield

YTD – Contracts – Average List Price @ Contract

2005 – 223 – $785,280

2006 – 217 – $893,962

2007 – 232 – $891,380

2008 – 175 – $816,215

2009 – 165 – $723,010

2010 – 163 – $767,083

2011 – 175 – $744,376 (17% off peak)

#10,

Cut, cut and cut, but pay my dividend.

What strikes me about Union County is the huge disparity in income, education and culture in such a small geographic area. Elizabeth, Linden vs Summit, Westfield.

Grim No. 11 Much better Thank You

Frank 12 Hopefully the dividend does not get cut, the ledger did say Singulair one of their biggest money makers is coming of patent down the road

So, what does “recovery” mean to the RE cheerleaders when sales are up but prices continue to drop? Is it a matter of, “Grab the fallining knife, every one is doing it,” or do they actyally believe that increased sales volume is a sign of strength? Heck, I was in a Borders Friday and there were many units being sold, but it was no sign of strength.

Falling, too

As for the debt negotiations, this is about the best cartoon I have seen on the issue. it captures the absurdity Empty Suit in Chief’s position quite well:

http://media.townhall.com/Townhall/Car/b/mrz072811dAPR20110728014519.jpg

This one captures B.O.’s current stature quite well:

http://media.townhall.com/Townhall/Car/b/mrz072711dAPR20110727124526.jpg

Seeing as how Government Workers have 100% Medical, once they cut back Medicare, the health care costs simply shift back to their other Government Tax Payer funded plan. Medicare cuts only effect Private Sector folks.

Gary/Ket/Nom/Clot,

One last cartoon that points to the folly of Obama’s economic statements:

http://media.townhall.com/Townhall/Car/b/mrz071211dAPR20110712124517.jpg

Grim #11 is pretty amazing, thanks for sharing. Good idea mikey.

We’re 17% off peak price in Haughty Jersey and the number of pending contracts has increased. When we reach 25% off peak, the pending contracts will increase even further. Any questions?

Shore,

That big-eared f*ck pulled off when of the biggest scams in history. And I wouldn’t put it past him to bilk the proletarians into electing him to a 2nd term.

Gary, let’s face it, the high per capita use of granite and travertine has put strong limitations on westfield’s price correction.

It strikes me odd that elizabeth city, being a train town with proximity to nyc, has decreased by more than 50%. Sue Adler said this would not happen.

So we are back! (to 2002 prices) — Oy.

So for every 10% correction in a low socioeconomic town, there is only a 3% correction in an affluent town. Got it. This supports my original thesis and frustration with my town. Were prob not quite as affluent as westfield but probably are growing faster with population and new development. Comps consistently show only 10-15% off peak while surrounding towns are down 30%. As a bubble sitter, this absolutely kills me.

21 – Good one, lol.

Unfortunately for us, the gov’t is operating via a ponzi scheme. Can’t laugh at that one. IMHO, S&P and/or Moody’s will make us cringe this week (although they really f*cked up previously).

#26 Have You been to Elizabeth?

Neanderthal Guess you don’t get over to Elizabeth much. Friday they were throwing stones at the cops and had to bring in adjourning towns for backup. You don’t want to be in that train station after dark trust me. The bloods & crypts mark their territories on the telephone poles and parking signs. Cops are afraid to take jobs at the high school. I do my business there and get out. It’s priced accordingly.

Relax people the elizabeth train town/sue Adler post was sarcasm. Scary that I’ve got to clarify that. Or is it just the lack of coriander in the kitchens?

Neanderthal,

Comps consistently show only 10-15% off peak in affluent towns…

In two years, it will be 20 – 25% off peak.

Mikey we don’t mention bloods and crips on real estate listings, we just describe a diverse community and talk up the top of the line security system.

#33 I am guessing it will be more. Just FYI, all the big boys on the street ar laying off again, sales trading and IB.

#32 I figured that, but hey you never know. I bet there were Realtors during the bubble that were stressing the attrsctiveness of Elizabeth becasue it is a train town. In fact they are probably still some doing it.

Please be advised that all of these facts, figures, etc discussed are not applicable to Brigadoon-on-Hackensack. Where prices are up 26% since last year. Just want to make sure that fact has sunk deeply into everyones mind.

Neanderthal thought you were being sarcastic, just wanted to make sure.

In inner city areas of North Jersey small multi-family homes (2 to 6 units) can be purchased for prices that show positive cash flow. I’m not talking about total pieces of garbage in the worst areas, but homes in decent condition in reasonable locations. There are also properties of this type needing renovation that are equitably priced. Even when you allow for 10% vacancy and reserve 10% for repairs these properties are throwing returns in the double figures for a cash on cash return.

There are buyers and there is demand, but there is still plenty of inventory available. Now factor in that there has not been a normal flow of REO for more than 8 months (these areas will see the majority of new inventory) and there is still more inventory than demand. What happens when the REO begins to flow again?

When this sh*t storm began I believed that once inner city prices reached a level where small multi-family homes could be purchased, renovated and rented with strong cash flows, prices would stabilize. Another theory down the toilet…

27 – Essex what makes you think nj are anywhere near 2002 prices? Cs is still at 2004 and theres a huge difference between 2004 and 2003 and 2002 levels.

OK boy scouts with bandanas and tattoo’s

#33 gary I fully expect to lose money when I buy, that is why I am reluctant to put a lot down. If my spouse did not work in NJ, I would go back to NYC.

I am also do not want to drive to the train station every day, as I prefer to walk and it is cheaper and less hassle. So I will also look in and around the Hillsdale area.

#40 We may not be there, but we will. I am seen some prices in the land of Unicorns that is getting very close to 02 prices. And a couple where asking prices now are around 80k more than was paid in 02. Between one or two price cuts, and then the realtors commission and other fees, that 80k can be eaten through quickly.

#33 Note to self, look at Park Ridge taxes so low in comaprison to other towns.

So, is Elizabeth the new Asbury Park? Or, is it the other way around?

Asbury Park has oftened been refered to as Elizabeth by the sea

Come to papa…..

http://www.indexuniverse.com/insidecommodities/index.html

Wasn’t someone updating the case shiller chart with all of Otteau’s bottom calls a la Irving Fisher’s “permanently high plateau” call in the great depression? This could be another quote bubble for the chart.

It seems to me a bit hasty to call a seaonal bump the price bottom. With the foreclosure tsunami potentially being unleashed sometime soon with a foreclosure gate settlement, and the pending double dip, those are just two of several headwinds. And I think a large cut to the Federal budget with an accompanying tax increase will trigger an almost immediate recession.

There’s a huge difference between stabilization and consolidation.

Market pundits also told us that the Nasdaq had stabilized from 2004-2007 and was building a base to penetrate old highs. One should not confuse an uptick in volume as a precursor for higher prices. On the upside, volume peaked in 2005, yet prices continued to rise until 2007. We will experience the same in reverse, volume will rise as prices continue to fall.

There are more than 10 million mortgages underwater. In addition to this, 40% of those who hold a 2nd mortgage are underwater. With record inventories and deomographic changes looming on the horizon, this market will be fighting hurricane force winds for a long period of time.

30 year [39]

In Elisabeth and other inner cities the demographics is changing – while the total number of people stays more or less the same, the average household size gets bigger due to further increase in the share of Hispanics. So, fewer housing units are needed. RE construction boom in these cities in the mid-2000s totally unsupported by the true demand (where most new houses had either been bought w/subprime or for a flip) aggravated this further. I don’t believe any price stabilization there until they bulldoze away a significant portion of the city.

Now that grim is an owner he will flood us with stabilization posts and stats. Too bad those posts appear after he bought rather than before so we could buy too :) It’s futile though.

Prices are going down down down and the driving force is fundamentals not sentiment. Houses are overpriced and costlier to maintain if one factors taxes and maintenance and most people have less money to spend on them if they want to raise families and/or retire in dignity. It’s not a stock market game. Most people are not timing bottoms-numbers don’t work for them yet.

40. Oh nothing, just 13 months of inventory in my town and a visit from the Realtor who sold me my place. YMMV

Now that grim is an owner he will flood us with stabilization posts and stats. Too bad those posts appear after he bought rather than before so we could buy too :) It’s futile though.

You know, the last time someone called me an idiot for doing (or not doing) something, it was 2005.

Zing!!

“the last time someone called me an idiot for doing (or not doing) something, it was 2005.”

Wait until you have been married longer. The frequency increases.

Prices in my neighborhood are going to 2002 levels. One house has dropped it’s price 15k a week for 3 straight weeks.

55 is the real zing

“You know, the last time someone called me an idiot for doing (or not doing) something, it was 2005.”

So using your metric, we will not bottom before 2013. good call.

Speaking of idiocy, or at least a missed opportunity:

http://www.nytimes.com/2011/07/31/world/middleeast/31iraq.html

With the killing of UBL, we should have declared victory and gotten the heck out of the sandbox and Afghanistan. We can do little to positivly influence the places over the long term, just ask the British who were there a lot longer than we. Both Iraq and Afghanistan will disolve into whatever fate holds for them. If danger rears its ugly head, we can hit them again, but no need to stay there because we think nuts will take over, otherwise. History shows that the nuts will takeover, anyway. So, lets get out and save lives and cash.

Shore

you of all people know it’s not that easy. The militay industrial complex would never accept that without a serious fight

#47 Last years seasonal bump was called stabalization as well; it urns out it was not.

Ket,

We have soooooo much equipment to replace after being worn down by the sand and pace of operations, the complex will be fine.

Didn’t housing demand fall off a cliff in in May-June 2010, as demand was pulled forward with the 4/10 deadline, 8K homebuyers credit? If yes, then Otteau is comparing a 6/11 small rise to a distorted 6/10 #, an insignificant stat. In an environment of record low interest rates and a 20% decline in prices, the blip in 6/11 as compared to 6/10 is putrid.

I could not open the link. Did Otteau also include underlying fundamental factors to support his position? Changes in volume , up or down, mom or yoy do not correlate to a corresponding increase/decrease in price. Demand peaked in 2005, yet as demand fell prices continued to rise, until 2007. We will see the same on the way down. Volume may increase for 1-2 years, or longer, as prices decline.

His chart, with no other supporting data, is trivial, just noise.

Oh snap.!

Oh snap! Dude you must be old. :)

“If yes, then Otteau is comparing a 6/11 small rise to a distorted 6/10 #, an insignificant stat. ”

Don’t you know BC, that is the way the public gets fed statistics? They need not be an honest assessment of the situation as long as they hew the line of “all is getting better” or “we are great.”

“With the killing of UBL, we should have declared victory and gotten the heck out of the sandbox and Afghanistan.”

Shore I disagree. Instead we should structure their govt to be supportive of america/england and rig their vast oil industry so that its revenues pay for roads, schools and military so that as time goes by, their own oil revenues are totally paying for our occupation while supplying our own country and oil companies with a neverending amount of black gold. Then after that’s complete we need to do the same in iran. But then again I thought this was always the plan from the get go anyway.

I really support ron paul bigtime but when he talks about pulling all our troops home I swear he’s living in a bubble. Do you know how quickly the russians and chinese would be all over those valuable resources, minerals, gold and oil supplies in iraq and afghanistan? We wouldn’t even get our tanks shipped home before they were moving in by the boatload to plant their flag and secure the nat resources that would propel their own superpower status for the next 100 years.

Shore – an excellent follow-up to the yesterday’s argument

http://www.nytimes.com/2011/07/31/opinion/sunday/tuning-out-the-democrats.html?src=rechp

“I thought this was always the plan from the get go anyway.”

I am firmly convinced, based on many discussions with folks in DC, that the goal was to ensure that Iraqi oil kept flowing, mainly as an isurance policy in case the Saud family foud themselves swing at the end of ropes.

That said, we need not have a physical presence in the country in order to ensure that the west has access to Iraqs oil. In fact, inasmuch as oil of a given quality is fungible, the overall world supply is more important than a given source dedicated to supplying a given user.

From Cobbler’s link (a Democratic polster who is married to a Democratic member of congress):

“Today, a dispiriting economy combined with a well-developed critique of government leaves government not just distrusted but illegitimate.

“GOVERNMENT operates by the wrong values and rules, for the wrong people and purposes, the Americans I’ve surveyed believe. Government rushes to help the irresponsible and does little for the responsible. “

And another excerpt:

“Our research shows that the growth of self-identified conservatives began in the fall of 2008 with the Wall Street bailout, well before Mr. Obama embarked on his recovery and spending program. The public watched the elite and leaders of both parties rush to the rescue. The government saved irresponsible executives who bankrupted their own companies, hurt many people and threatened the welfare of the country. When Mr. Obama championed the bailout of the auto companies and allowed senior executives at bailed-out companies to take bonuses, voters concluded that he was part of the operating elite consensus. If you owned a small business that was in trouble or a home or pension that lost much of its value, you were on your own. As people across the country told me, the average citizen doesn’t “get money for free.” Their conclusion: Government works for the irresponsible, not the responsible. “

But wait, theres more (and,other than a path to citizinship for illegals, it makes sense):

IF they want to win the trust of the public, Democrats should propose taxing lobbyist expenses and excessive chief executive bonuses and put a small fee on the sale of stocks, bonds and other financial instruments. By radically simplifying the tax code to allow only a few deductions, the Democrats would generate new revenue and remove the loopholes that allow special interests to win favorable treatment. The ordinary citizen, according to our surveys and focus groups, feels there is no way to play that game and views simplifying the tax code as an important reform.

To show that government can protect the nation’s interests, Democrats should advocate policies that would control the borders and address problems of undocumented workers.

Dealing with this is even more important in Europe, where anti-immigrant and anti-Islamic parties are surging at the expense of the mainstream left and right parties in France, Austria, Italy, the Netherlands, Sweden and Norway, site of the recent slaughter for which an extreme right-winger has claimed responsibility.

In the face of such madness, it is tempting to view the issue as illegitimate, but mainstream parties do so at great cost. Our work in Austria and Britain shows that it is possible for progressives to champion immigration policies that protect the labor market and promote and require integration, beginning with language and schooling.

In the United States, those who advocate comprehensive immigration reform are demonstrating that they consider responsibility a primary value. My surveys show that voters want comprehensive immigration reform rather than half measures. They would like to see strong enforcement at the border and in the workplace, and the expulsion of troublesome undocumented immigrants. While favoring toughness, they also want to find ways to put undocumented workers on a path to citizenship.

These measures, if pushed by Democrats, would show that government operated by the right values. Just as Mr. Clinton’s welfare reform in 1996 required efforts to make work pay and expand child care, immigration reform can show how progressives punish irresponsibility and reward responsibility.

Finally, progressives have to be serious about reducing the country’s long-term deficits, constraining special interest spending and tax breaks and making government accountable to the ordinary citizen. The deficit matters to people and has real meaning and consequences. A government that spends and borrows without the kind of limits that would govern an ordinary family is going to have big troubles. Voters I’ve studied say things like, if “we keep spending like this, we’re going to be bankrupt and there won’t be anything for anybody,” especially “our children.” The final straw is the government’s decision to continue spending and to put the country deeper into debt and more dependent on China.

shore [72]

The problem is that objectively TARP and bailouts did save the economy from much worse disasters than those that happened (just go back to this blog 3 years back…); fall into the abyss changed to sliding downhill. Subjectively, perp walks and spending decent part of the bailouts directly supporting the Main Street were desperately missing.

That plane analogy would be more accurate if you had Dick Armey and the wingnuts standing in the back of the plane shouting.

“Turn of the engines, we can’t afford this fuel were burning!”

Debt deal supposedly done. Risk on. We could get an old fashioned melt up Monday…

[216] [prior thread] Cobbler

“at least doing it from the tax side will largely extract the capital sitting in the cash accounts of the corporations and well-off,”

Wow, well, I have been hearing from the left that we should seize private capital to pay off the deficit. Not an unprecedented method, but it didn’t work so well in the countries that tried it before. I still have some Imperial Russian bonds that bear witness to that.

[76] hype

Futures remarkably muted. Gold down but nothing like I expected. Futures up, but no more dramatically than many of the ups and downs over the past week.

The markets priced this. I predict that the market response will be underwhelming.

No vote tonight?

Surprised that the crisis can wait. Suppose it’s a cordial and well mannered crisis as to not interrupt a Sunday night at home.

What crisis? Did they padlock Dunkin Donuts?

Clot previous

“Agreed. The red card was correct, because the defender’s intent to injure was clear.”

Totally disagree, this was a solid yellow. Yes, Monszon went in late and clipped him as he was going over him, but no intent. On the other side Klinsman played a ball to the goal line that he had no chance of getting back. He took a hard landing from the flyover that he would have taken, regardless if he had got clipped or not. There was no last man back or straight on goal.

Yellow and direct free kick.

#77 Nom

“Wow, well, I have been hearing from the left that we should seize private capital to pay off the deficit. ”

So which Fallacy of the day does this fall into?

[82] fabius

It is in a class by itself.

nom [77]

If the capital is fully utilized you reduce private spending by the same amount you increase taxes, just moving from the private investment and consumption to the governmental (presumably, with lower multiplier – which to me is not obvious as the government could be mandated to be a user of domestically produced stuff, while the consumers spend relatively more on imports). If the capital being taxed is sitting in cash accounts as it is now, you reduce private investment and consumption by lesser amount than you increase the government’s (only through negative wealth effect), so you get net benefit even with the lower multiplier.

In our current situation moving towards lower deficits via tax increases would be less damaging for the total (private + govt) spending level than via cutting govt spending. Based on your worldview, you may consider added taxation immoral (as taxation in general) – but I’ve been addressing a purely economic question.

#23 gary,

The big ear insullts, really?. “bilk the proletarians into electing him to a 2nd term.” That overlooks that 8oolb gorrilla that is ?”There’s no credible oposition!’

O was assured 2012 when the GOP decided to let the Tea Party out of the box. They could have very easily turned round and choked them off at the source, but they were making the right sort of noises , so they let them run. Now they can’t close the box and the end game will be O wins 2012 and roll on through 2016, the wingnuts overrun the GOP and seize control. At that point they are unelecetable past 2020.

[82] fabius

Interestingly, there is a poorly-written story on the front page of today’s Star-Ledger that suggests the US has refused to tap into this pool of wealth to close the deficit and reduce the debt.

Of course, I must be delusional, right? No way any responsible journalist would suggest this. I must be suffering from that loathsome disease called fiscal conservatism. No argument from you thus far.

Oh, wait. What’s this from the Star Ledger article?

“Beyond govermment, US companies led by giants such as Apple and General Electric have saved nearly $2 trillion at home and $1 trillion more overseas . . . While the U.S. government’s $14.3 trillion debt is an eye-popping figure, the country has plenty of resources. It’s just that over many years, Americans and their leaders have chosen not to tap them to pay the government’s growing bills. So the United States could be deemed to be an international deadbeat for a debt load that it has the financial wherewithal to pay off. . . . .

The [US] is a lot like a rich businessman who owns two homes, a yacht, and millions of dollars in stock but is in debt because he took out a big loan to play for a private plane. This fellow could always have used some of his wealth, for instance his stock, to pay cash for the plane. But he didn’t want to. Now, with the weak economy, he’s finding it hard to pay off the plane simply out of his salary. By putting most of his wealth beyond reach, he has boxed himself in.

Likewise, U.S. politicians have made a value judgment that they shouldn’t tap much of the country’s wealth to pay for government programs. That judgment, in turn, reflects the preference that many Americans themselves have expressed for years for leaving private resources in mostly private hands. . . ”

BTW, the author, Zachary Goldfarb, writes for Washpost, and I have now learned that Star Ledger cut out a large portion at the end of his article. The remainder I post below:

“But while the country is flush with assets, it doesn’t mean the government can seize them to pay for public debt. “I don’t think you can say there are buckets of money and let’s grab it,” Warnock said.

The United States finds itself in a very different situation from Greece, Portugal and other European countries that are struggling with debt and trying to avoid default. These Europeans have far less wiggle room, owing the vast majority of their debts abroad while owning relatively few assets.

What’s more, these countries have poorer prospects for economic growth. They are being charged interest rates to borrow money that one might expect at a payday lender. And they are locked into a single currency — the euro — which deprives them of a crucial tool: devaluing your currency to make your products cheaper and more attractive to customers in other countries.

The U.S. economic picture is not that rosy either. But economists still expect growth to pick up over the coming years, which will boost tax revenue and make it easier for the nation to afford its obligations. U.S. companies remain competitive, and if firms put their cash to work, it could fuel growth even more.

And if politicians could come to an agreement over government finances, most economists say the U.S. government could bring its debt to heel.”

FWIW, I find it hard to believe that Goldfarb wrote the entire article. It is poorly-written and the message is indecipherable. I have no idea what he is reporting except that there are plenty of private assets in excess of the US debt. What he suggests it that they could be “used” (read seized) to pay off the debt except that Americans have put private assets off limits.

If you have a different take, I’d like to hear it.

#82 Nom,

Supprising, it seems so false attribution.

Is it an new sub branch of existential?

[84] cobbler

“Based on your worldview, you may consider added taxation immoral (as taxation in general) – but I’ve been addressing a purely economic question.”

You assume much. And incorrectly, I might add. Further, you are not addressing a purely economic question. You invoked tax policy, which is a tool to implement, inter alia, economic policy. Think of it as applied vs. pure science. Further, you refuse to recognize the “elastic” concepts of distortion, which, in the extreme, results in deadweight loss. Remember the first rule of capital: It goes where it is welcome and stays where it is well-treated.

In your world, you can “assume you have a can opener.” In mine, I have to make sure there really is a can opener.

[87] fabius

“Is it an new sub branch of existential?”

Perhaps. But Mill and Bentham weren’t much appreciated for their existential views.

#86 Nom,

I won”t comment on excepts of an article althfough I think it is trying to go after the premise that the corporate person needs to be looked at to see if they are paying their fair share.

I would put it this way. Lets say that you flipped 180 degrees and came at the tax code from the perspective of not minimising clients obligations and instead looked at incresing gvmt revenue? Where is the low hanging fruit and were are the long term gains?

#89 Nom,

Neither were Cheech and Chong!

#69 – Cobbler and Shore Guy

Re NYT article:

If this guy wants people to stop “Tuning Out the Democrats” then I suggest he stop equating the Democrats with “center-left”, “progressives” and “liberals.”

There’s lots of people who consider themselves moderate Democrats. I happen to be one of them. There’s also quite a few voters who identify themselves as unaligned moderates, independents or dissatisfied Republicans who don’t like the Tea Party and will consider a candidate who isn’t a Republican.

But if you pitch the Democrats as the party of the left, you end up alienating those who don’t consider themselves as part of the left.

If this is how an expert is going to do outreach — by reinforcing the perception that Democrats=left, then Democrats are in trouble. What he said about immigration was simply not true either; at the national level it’s been nothing but pander-pander-pander for years and “comprehensive immigration reform” will still allow mass migration through extended family reunification and automatic birthright citizenship.

It’s great that the market is up now. Make sure that before you invest into any properties that you have check and use all possible resources available and research more.

Also I found this FREE app that might be use to check and evaluate your investments.

http://www.bigfresh.com/apps/investment-property-valuator-ipv

Very interesting points you have mentioned , thankyou for posting . “It is seldom that liberty of any kind is lost all at once.” by David Hume.

Good article,I will follow your articles.fighting

wish you can write better and i like it so much

Thank you very much, thanks for your nice share.nice well

We need job growth and consumer confidence prior to seeing and real improvement in the real estate market