Pimco released their fourth quarter 2005 Market Outlook:

Slower Growth With Inflation Pressure, But High Uncertainty

Pimco, taking a bearish position of real estate, is forecasting a slowdown, however, they stop short of forecasting a full-blown crash, but instead take the cautious soft landing position.

The direction of the U.S. housing market will be a critical factor in determining Fed policy over the next year. Recent gains in the U.S. property market have not only supported consumer confidence but also produced a surge in housing-related employment and residential investment. The greatest threat to the housing market is a decline in affordability. The last decade’s gain in home prices relative to incomes are not sustainable because higher mortgage rates and increased energy prices will reduce what consumers can afford.

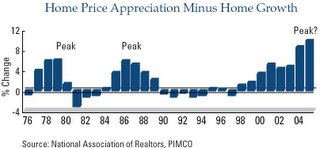

Most intersting in this report is their graph of Home Price Appreciation Minus Home Growth.

A beautiful illustration of the last two housing busts. However, it certainly looks quite different this time. I’m really not sure why Pimco took the cautious position, judging from the graph it’s quite obvious that should the lending prop fall out from the housing market there is no telling what might happen.

Caveat Emptor,

Grim

The Fed’s housing aim

NEW YORK (CNN/Money) – No Federal Reserve official could ever publicly admit it, though everyone in the financial world seems to believe that it’s true: the Fed is going to raise rates until it’s taken the heat out of the housing market.

And if it as true as everyone thinks, these tight-lipped Fed folk must be secretly doing a little victory dance behind the thick gray walls of the Board of Governors in Washington.

…

The latest tally of mortgage applications form the Mortgage Bankers Association shows a blip up after three weeks of declines, but applications are now down nine percent from last year. In fact the MBA points out in its press release today that mortgage applications last week fell below their 2004 level for the first time in six months.

…

How much further do they go? Will they overshoot and really crack the housing market? It is surely a risk they are aware of and one we can only hope they take seriously in the policy decisions ahead.

Grim

The morons at the FED think they are Gods. They think they can flatten out and do away with economic cycles.lol!

Fed can’t stop this:

Treasuries Fall as Foreign Demand at $13 Billion Auction Falls

Nov. 9 (Bloomberg) — U.S. Treasuries fell the most in two weeks as demand from international investors, who hold almost half of all U.S. government debt, declined at the second auction by the Treasury this week.

The results of the $13 billion sale may indicate that yields near the highest of the year are too low to draw investors into a market where the central bank is still raising interest rates. The drop in debt prices wiped out more than half the rally the past two days. The Treasury will sell $13 billion of 10-year notes tomorrow.

“The foreign bid was a disappointment, the level was a disappointment,” said Alan De Rose, a proprietary trader and Treasury market strategist at CIBC World Markets Corp. in New York, one of the 22 primary U.S. government securities dealers that are obligated to bid at the auctions. “There will be plenty of pressure on the market.”

grim