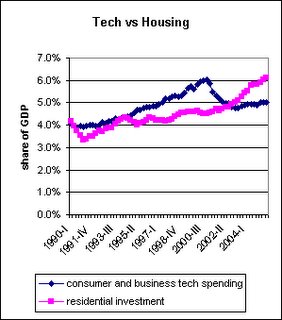

The housing bubble has surpassed the roaring tech bubble:

The dark blue line is consumer and business spending on technology (hardware and software), as a share of GDP. The light purple line is residential investment, as a share of GDP.

In the third quarter of 2005, Americans spent 6.1% of GDP on building new homes or renovating existing ones. That’s a bigger share of the economic pie than tech got at the height of the boom.

To me, this has become a no-brainer. These levels of residential spending are not sustainable, guaranteeing a housing downturn in 2006 (incidentally, as far as I can remember, this is the first time I’ve made this forecast). And the downturn will likely be sharper than most people expect, including a drop in median home prices nationwide.

—–

Even more evidence of a housing bubble, yet the experts continue to deny.

Caveat Emptor,

Grim

nice graph grim. to me just another piece of solid evidence that things aren’t different this time, it’s just where the money is flowing in anticipation of it being a solid investment. it’s called a speculative frenzy, just one that has lasted a bit longer than most thought. this of course doesn’t invalidate the claim as the cheerleaders would like you to believe, just takes longer to reach the conclusion.

i’ve said it before and i’ll keep saying it. there’s far more risk of housing going flat to down then up at this point, and i don’t see that prediction changing anytime soon.

Just to clarify, the graph is not mine, it’s from the site linked in the URL above it.

Don’t want to take credit for work I didn’t do!

Grim

grim:

A 2006 sell-off is a tall order to fill.

I think that for NNJ, which is NOT AZ, FL, CA, N-VA, this process will be long, slow, laborious and anemic for 2-5 years.

Keep up the grimming though. Much appreciated.

chicago

More evidence that insanity is widespread in the housing markets.

It will fall faster than anyone is anticipating.

The level of leverage is unprecedented. Patience and thrift will payoff in the end. Do not listen to the industry peole trying to spin and maniulate the news. Remember they have an agenda to keep the ponzi going and their lifestyle high. Buyers do not fit in with this agenda. Buyers are left out in the cold to fend for themselves.

I think, in fact I see Norther NJ falling right now, and inventory rapidly rising.

Plus I am hearing of many houses in my small zip code that have been pulled until after the holidaya.

There are homes that sold in my town earlier this year, that if they were on the market now, the sellers would take a loss.

It is happening quickly, and it only makes sense.

Like I always say, if they can go up 20 to 25% a year, they can go down 20 to 25% a year. This one will be swift and furious.

I had a friend over and he told me a mutual friend that just bought a big house will be selling now because of the taxes being over $25K a year. That plus the increase in their mortgage is going to force them out. I would expect more of this.

A 25% drop will hurt a lot more then a 25% gain.

Ie: A 400k home with 25% appreciation = $500k.

That same $500k home with 25% depreciation = $375k.

Yowzers!

The collapse has already started. Just noone will speak the unspoken word.

“Houses Prices are going down”!!

LOL!!!

And the prices real need to drop big to justify stagnant wages and little population growth.

Let the Plunge bottom out 50% lower.

This only takes them to about 2001 prices.

My husband and I are going to look at a house tomorrow that looks absolutely perfect for us in Morris Township. I am just starry eyed over it. We were thinking of renting to wait out the market but we’re going to see this place and if it is as wonderful as it looks, I’m thinking about making an offer.

Asking price is just over a million; it’s been on the market for 8 months and was originally listed at $1.2M. So if we love it I’m thinking of offering them 20% less than their current asking price. All they can say is no, right?

Despite how great this house is I refuse to be upside down on it for years….anyone have an opinion if I should bid less?

Thanks for the charts and facts, Grim. I will be using them to build a case for why our asking price is what it is if we do make that offer!

Michelle

You should bid what you can afford with a conventional mortgage that has interest rate terms that are consistent with the length of time you expect to remain in that home.

It is as simple as that – hopefully that calculation will yield an answer that suits your tastes!

I agree with C-F, his advice is sound.

grim

Thanks guys.

We can “afford” the mil, but I hate to pay that for something that may drop. The only reason I would think about going for this house is that it’s just truly fabulous. We’re mid-century modern architecture fans and there aren’t that many good examples of it in NJ. So I think we would stay in the house for a VERY long time.

Of course I said that about our house in California that we only ended up staying in for 3 years…

Thanks again! I’ll let you know if we lowball and it works!

Michelle

Great chart. Even given propensity of consumers to dedicate more net worth to housing, the trend line cannot be sustained. Very strong evidence of a near term correction or sideways movement.

How do I get information for contractors… Some people believe that to create is great but build is like changing the past forever… If you want to create a beautiful home Visit contractors and you can see what a little change can create..