I know many of you have been waiting patiently for this data, sorry it took so long, I needed to make sure the numbers I was given were correct. You’ll understand why when you see the graphs.

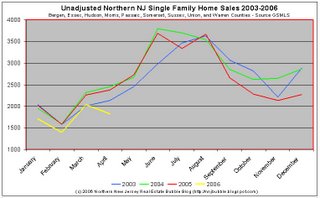

The first graph plots the unadjusted sales data (closed sales) for the counties listed. I haven’t included 2000-2002 as I do not yet have April data for those years. Please note the lower bound of the y-axis. It’s set to 1000, not to zero. I do this for a reason, it’s to emphasize the seasonal nature of the Northern NJ market. Also, there is quite a bit of data on this graph, setting the y-axis to zero makes reading it very difficult

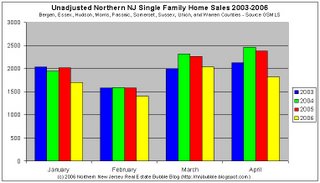

The second graph displays the same sales data (2003-2006) for the first four months of the year. Again, please not the y-axis, this time it does cross at zero.

For those who prefer the hard numbers:

January

Average Sales (2003-2005): 2000

2005 Sales: 2013

2006 Sales: 1705

(Down 15.3% Year Over Year)

February

Average Sales (2003-2005): 1583

2005 Sales: 1578

2006 Sales: 1395

(Down 11.6% Year Over Year)

March

Average Sales (2003-2005): 2193

2005 Sales: 2256

2006 Sales: 2033

(Down 9.9% Year Over Year)

April

Average Sales (2003-2005): 2322

2005 Sales: 2383

2006 Sales: 1817

(Down 23.8% Year Over Year)

I’m going to raise the flag now. While this data is from the same source, I don’t know what to make of it. I checked the figures for mathematical error twice and found nothing. The change seen here in April is a significant break from the traditional trend. I can’t confidently say whether or not this is error or not. We’ve seen similar breaks in the past, as the data shows.

Caveat Emptor!

Grim

good facts grim.

GLUTS AND GLUTS AND GLUTS OF INVENTORY PILING UP.

BOYCOTT HOUSES!!!

SEND A MESSAGE TO STARVING REALTORS AND GREEDY DESPERATE SELLERS. IT’S DIFFERENT THIS TIME AND IT IS GOING TO GET ALOT WORSE IN NEXT 12-18 MONTHS. ALOT WORSE.

BOOOOYAAAAAAAAA

Bob

thanks grim!

so far I don’t see anything alarming (yet). after all, it would be impossible for rising interest rates not to have an effect. plus, the numbers are only off by a few hundred, not thousands.

obviously this could just be the tip of the iceberg…it would be interesting to see how this plays out the rest of the spring/summer.

“We’ve seen similar breaks in the past, as the data shows.”

Grim, excellent job as usual. Just incredible. I must, however, respectfully disagree with your statement above. The spring bounce is the “Old Faithful” of the NJ housing market. This data shows that not only did it not happen, but sales actually fell. Given the reliability of the spring bounce (sure, some years are stronger than others), there is no other similar break on the chart that can compare with this one.

The data says what the data says. You have done a credible job explaining its limitation and possible flaws. Please don’t feel you need to downplay its significance with the statement above. If it raises flags; good! It gets people engaged on the issue. I would actually love to get a comment on this from the NJAR.

Great job! Keep up the good work.

If your a real estate investor and you’re looking to sell you better drop your price quickly and get out now.

These numbers are amazing, I wonder what excuses the real estate industry will come up with now?

If your looking to buy hold off, I strongly believe these numbers aren’t going to get any better any time soon.

The next few months would be interesting to see, as the trend downward only began last month. March numbers were comparable to those of March 2003.

The downward trend began in September of 2005 (the red line).

grim

I agree…the drop-offs are not really that significant since the hard numbers are only in hundreds not thousands. The percentage makes it look bigger than it really is.

At this point, it only shows that the market is cooling down which was obviously inevitable.

I think the next couple of months would be very telling as to whether we’re in a gradual decline or a rapid collapse.

Grim-

Yes, raise the flag and lead the troops on the charge of delusional sellers, greedy realtors, shady lenders, flippers, et al.

Head all ye sinners, the end is near!

Sorry, just a little giddy after looking at these numbers. Wow, more good more news for buyers!!!

I’m not sure why they anon posters don’t think the numbers are significant because they are only in hundreds vs. thousands?

During the three hottest years in the history of real estate NNJ was only averaging about 2000+ sales per month for the months Grim showed. If this was down by thousands, which is what you think would be significant, you’d have 0 sales. Not sure if that would even be possible???

Disregarding all the hype – from here, the media or otherwise…indicators show a gradual decrease in sales activity with prices still INCREASING (however slightly) overall.

Regardless of what analysis or advice you might get from so-called gurus, NOBODY knows what happens next.

People dismiss and even ridicule the idea of a soft-landing..do you really know?

Look at all the data, charts, graphs, spreadsheets, numbers, whatever…and see what’s THERE not where you EXPECT it to go.

Interesting article in the The Telegraph, a major UK newspaper regarding the US housing market:

Homes glut pressures US economy

By Ambrose Evans-Pritchard (Filed: 11/05/2006)

The US economy peaked in January and is tipping into an unstoppable “bust” whether or not the Federal Reserve halts its cycle of interest rate rises, Lombard Street Research has warned.

The economic research group said the US property market was crumbling, taking away the key prop of the consumer boom.

“The real US hard landing starts now,” said Charles Dumas, the chief global economist. “It’s going to be a long grind for two or three years, not as bad as Japan but going in that direction.” The price of new houses in the US has been tumbling for five months at an annualised rate of 18.4pc, while mortgage applications are down 20pc.

“There’s been a huge jump in inventories, which are now at the highest level since 1996 and it is only going to get worse with a surge of homes built in the first quarter,” said Mr Dumas.

Americans withdrew over $600bn (£320bn) in equity from their homes last year, according to a Fed study, giving them a windfall to help pay fuel bills and keep the malls humming. A property slide will bring the process to a halt, while many buyers are saddled with negative equity.

Lombard Street Research said it expected at least four quarters of zero growth but warned that the downturn could snowball into a full-blown slump.

“We were here before in 2001, but this time the US cannot resort to huge tax cuts and extra borrowing to keep consumption going,” he said.

“Household balance sheets have been trashed in the process, and now there isn’t anything left to trash,” he said.

Love that last line.

I’m a little dense; what is Grim being so careful about drawing conclusions? What is the strange trend here? Could Grim restate tentative conclusions?

I’m a little dense; what is Grim being so careful about drawing conclusions? What is the strange trend here? Could Grim restate tentative conclusions?

anon 6:02

re: hundreds vs thousands

I sell 200 less x compared to this time last year…last year and the years before that being the hottest years in the history of selling x.

x= homes, cars, computers, easter eggs, whatever.

big deal? depends what happens the rest of the year. that’s all I’m saying.

hype about a hard landing…

ok, bubble exhibit A: Hoboken. Please look at these numbers and tell me there is not a hard landing happening in Hoboken, formerly one of the hottest markets in NNJ…

Month/Year/# of sales/Avg. Price

4/06/2/$296,000

3/06/5/$326,000

2/06/5/$426,000

1/06/6/$300,000

4/05/122/$479,000

3/05/86/$425,000

2/05/39/$419,000

1/05/34/$441,000

Here’s the source:

http://tinyurl.com/gdh75

JM

Anon @ 6:15,

Are you talking about house prices or the median home price? Those are two different things. The median is very easily swayed.

But just in case you are talking about the median home price in NJ..

NJAR Stats

http://www.njar.com/pressroom_statspub.shtml

Northern New Jersey

2 Bedrooms or Less

2005 Q3 – $286,400

2005 Q4 – $276,500

3 Bedrooms

2005 Q3 – $393,700

2005 Q4 – $381,200

3 Bedrooms or More

2005 Q3 – $597,300

2005 Q4 – $563,700

grim

anon 6:27

The scale of the market we are looking at is in the low thousands: 1500 to about 2500.

The prior months including September are about the same scale and show the same declines of X%.

That’s about three quarters of data (8 months exactly). In my estimation, that’s a trend. Now, as you said, what really matters is what happens over the next 8 months to give a complete picture. Right, but I think we can say we are headed into a trough with some confidence at this point. How deep and how long is the question.

Grim,

Is it possible to superimpose available properties data across the three years on this graph? We might be able to see a better trend supporting our hypothesis.

Disregarding all the hype – from here, the media or otherwise…indicators show a gradual decrease in sales activity with prices still INCREASING (however slightly) overall.

i feel sorry for you.

Anon @ 6:26,

I tend not to trust data that shows large swings. The data swung much lower than even I had expected. Thus, I have to call into question the accuracy of the data..

grim

“STARVING REALTORS AND GREEDY DESPERATE SELLERS.”

So Bob – did you ever buy or sell any real estate? If you did, then I assume you offered what you thought was market price. If that is lower than what the seller is expecting, that that make you CHEAP?

I also take exception to your reference to “starving” realtors. And no, I’m not a realtor.

Not all realtors are thieves. They’re simply trying to support themselves and/or families.

SPW

JM, not sure if I trust melissadata as a source for accuracy but you have a point – Hoboken, despite what people around there like to claim, is definitely on the downfall. Having lived there a while, I have never seen the inventory or open houses the likes of which I have been seeing. And imagine when all these folks wake up and realize that they paid 650K for a 2bed/2bath 1300 sq. ft. apartment and are about to have twins? Seriously, the boom there caught a lot of younger couples/first time buyers – I can’t imagine being underwater on my first place with no way out.

Seeing reports from around the country of a sharp slowdown in April. Fits in with this data..

Valley real estate market shows slow April sales

The Valley housing market slowed in April, registering the lowest sales total for that month in six years, the Arizona Real Estate Center announced Thursday.

The resale market slowed last month to 5,980 sales, a decrease from the 7,264 sales for March 2006 and well below last April’s 8,735 sales.

The report found that April 2006 was the weakest April since 2000, when only 4,870 resales were recorded.

Twin Cities real estate sales plummet 15%

Home sales in the Twin Cities, Minn., area fell by double digits in April, while the median home price grew modestly from a year ago, according to three metro Twin Cities Realtor associations.

Realtors reported 3,919 closed home sales last month, down 15.6 percent from a year ago when 4,645 sales were recorded.

Be careful with the recent months on Melissadata. It’s very possible that the public records information hasn’t made it to them yet.

grim

njgal-

Would be more than happy to see someone else’s data on Hoboken. It’s almost hard to believe these numbers are 100% accurate.

Melissadata seems accurate…They also don’t have any agenda about manipulating the data. They just collect data and resell it.

JM

Grim-

I totally agree with you about Melissa Data. However, the trend for Hoboken seems to have really started last fall. So, even if you take out the last two months there is something really happening in Hoboken.

I invite posters to take at a look at Meliss Data and give opinions on the data they see and give some feedback.

Here’s a link:

http://tinyurl.com/lxm87

JM

Check out this price reduction:

Upper Montclair

MLS 2276197

5/9: 1.3

5/11: 1.19

Look how much you can save now by waiting just one day!

The Melissa data looks fishy. One sale in October then 44 sales in November? The October sale was for $115K? I doubt you could buy a parking space in Hoboken for $115K.

August 2003 lists 1 sale, August 2004 lists 266? Something funny is going on.

Stan-

Did you try any other zip codes? I’ve looked a dozens of zips and it seems to be pretty accurate.

Again, I invite other sources for Hoboken sales data.

Chicago, any ideas on how to get confirmation/refuting data?

I’m open. Don’t have any stake in Melissa Data.

JM

JM:

Sorry – I’m not real good like that…

Also, I’ve been busy tracking HTB and Toll

http://www.hudsonteatenants.org/tearoom/viewtopic.php?t=495

I am in agreement with grim. This will will not be a sudden drop. Although, to borrow the quote it won’t repeat but it will rhyme. I personally think the rhyme will be a little of rhythm bringing the cheaper prices sooner due to the funny loan practices.

Hey Grim,

can you give us some date on scotch plains, nj?

great job

JM

Here’s the source:

http://tinyurl.com/gdh75

JM

I followed the link and checked out the data by putting in a zip code I can check, while the first month I checked the amount of homes that sold was correct – the average price was wrong. It was over the avg by about 30000

KL

JM

Here’s the source:

http://tinyurl.com/gdh75

JM

I followed the link and checked out the data by putting in a zip code I can check, while the first month I checked the amount of homes that sold was correct – the average price was wrong. It was over the avg by about 30000

KL

JM

Here’s the source:

http://tinyurl.com/gdh75

JM

I followed the link and checked out the data by putting in a zip code I can check, while the first month I checked the amount of homes that sold was correct – the average price was wrong. It was over the avg by about 30000

KL

JM

I followed the link and checked out the data by putting in a zip code I can check, while the first month I checked the amount of homes that sold was correct – the average price was wrong. It was over the avg by about 30000

KL

I am taking that back – I am running these reports and the amount of homes is also wrong.

KL

And the inventory keeps rising…

For the curious in Bergen County, here are the number of residential listings NOT including condos & co-ops from NJMLS

03/03 3,132

03/10 3,230

03/17 3,337

03/23 3,432

03/30 3,543

04/05 3,628

04/12 3,706

04/19 3,781

04/24 3,856

05/08 4,082

05/10 4,133

1,000 more single-family home on the market since March 3.

Question for the thread –

Does anyone living in Jersey City or Hudson County know how the real estate marketplace is faring ? They have lots of multifamily housing and many new condo developments – some near the PATH train stations (Journal Square etc).

Thanks,

CNS

“Please note the lower bound of the x-axis. It’s set to 1000, not to zero.”

Grim, my calc days are long ago, but I believe you’re referring to the y axis.

Shady realtors, the new ‘spring bounce’ to understand is: a 23% drop in sales — I hope the last few years involved banking cash and not leasing a big Mercedes to impress buyers, because the party is over.

Here’s a desperate flipper:

MLS 2237332

http://www.realtor.com/Prop/1055026444

Here’s the history:

1) Bought for $525K in Sept 2005.

2) January 2006, the flipper added some granite counters and puts the house on the market for $759K.

3) A few doors down from the above flip house, a BRAND NEW giant house was built from scratch, and sold for $680K in Feb, 2006. Here’s a photo:

http://tinyurl.com/mq9v2

4) The flipper’s worst nightmare has occurred — a BRAND NEW, larger, better, nicer, house a few doors down has just sold for almost $100K less! In March the flipper drops the price $60K to $698,999.

5) Still no Greater Fools showing up, what’s a flipper to do with a comparable that’s just blown him out of the water? Why lower the price, of course — by one dollar, to $698,998.

Watching this property has been comic relief.

Now at 100+ days on the market, carrying the mortgage, taxes, insurance…

Not all realtors are thieves. They’re simply trying to support themselves and/or families.

Agree, realtors are not thieves…just very unskilled people with no marketable job skills

Lowest form of employment

Agree, realtors are not thieves…just very unskilled people with no marketable job skills

Lowest form of employment

That’s not true either. Are the commisions worth it… not at 6%.

Are ALL realtors scrupulous, no. But are all bakers, clerks, managers, lawyers, doctors, teachers, landscapers? No.

But don’t cloud your thoughts about the market or your frustration about the affordability of housing to assume all realtors are evil.

Let alone sellers. I sure if I was selling in this market I would try to get the highest price possible as would ANYONE else. Including “Bob”.

I find a lot of realtors to be meticulous amd motivated. Sometimes their ambition can come across as greed and I have met a few realtors who are very smug. But I wouldn’t say they have no skills. Dealing with the public in any kind of market is a skill in it’s self.

Look all you want but there is no “evil doer” to blame for the cost of housing. It’s a free market and as in the late ’80s early ’90s the market will turn.

Hmmm, who will be to blame when it does? The FED again? Or will it be YOU, the buyer?

HA!

I wouls think that lowering it by a dollar gets it resent to people as a “changed” listing. That guy must think that not enough people have seen it – he’s not clear on the concept of why it’s not selling. Maybe you should stick a copy of your post in his mailbox!

I think it’s time we took a look at Hoboken, since so many of us seem interested….one of the big issues I see there is that right now, there are a ton of new buildings coming to market that aren’t in the MLS. What is the REAL inventory there?

KL-

Thanks…I was thinking about asking you since I figured you could get your hands on the real data.

How far off are the # of homes sold and the purchase price?

JM

It’s impossible to track median price on a month by month basis when transaction volume is low.

The volatility is going to be so large as to make the data almost entirely meaningless.

At a zipcode level, you are going to need to look at each transaction and make a subjective determination about prices.

While sales volume is a bit less volatile on a zip basis, the month to month variations are still large enough to make the data almost useless.

Transaction volume is simply not there, you’ll need to aggregate upwards to a county level to begin to even make sense of median price and volume trends..

grim

KL-

My mistake…overlooked your note about the average price. Just to confirm, you mean the information you can see says the prices were about $30,000 more than the MelissaData?

Also, all, I sent an email to Melissa Data’s customer support via their web site to get more information about this feature. On the web site, they say the information is:

Compiled from Property Transfers and Deed Recordings

If it’s not 100% accurate, I’d still be curious if it’s good for directional purposes/trend spotting.

JM

Hoboken Real Estate Sales….

Pretty good data but its only through December… stumbled upon during a search

http://realestate.nytimes.com

/Community/recentsales_details.asp

bobby

KL-

Thanks…I was thinking about asking you since I figured you could get your hands on the real data.

How far off are the # of homes sold and the purchase price?

JM

Jm

In the one town I checked the amount of homes sold in the month was doubled , that may be because the way I get the data is in a format that gives total sold and then lists below the break down of how ( co-broke or in house) so if you add the figures up looking at it quick you will double it. That is why in my first post I said the number was wrong _ I also looked at it wrong. The total sales amount in that one particular town was off by 30,000$

KL