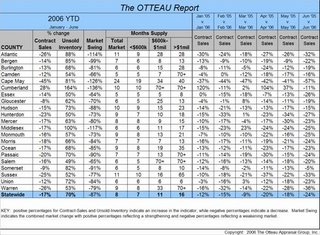

The June Otteau Report has been published, courtesy of Jeffrey Otteau of the Otteau Group (http://www.otteau.com):

JUNE SALES DECLINE AS INVENTORY GROWTH SLOWS

June is an important month for the residential real estate market as it represents the traditional end-point of the Spring selling season and typically sets the high-water mark for home sales in any given year. Thus, the residential market in New Jersey had much at stake as any hopes for a market comeback would fall heavily on the June sales performance.

In June, contract-sales activity ran 9% below May and 24% below June 2005, continuing the pattern set earlier this year and dimming hope for a market comeback any time soon. From an inventory perspective, the number of unsold homes on the market increased by 4% in June adding further to an already saturated market. Year-to-date comparisons indicate a 17% decline in Contract Sales and a 70% increase in Unsold Inventory when compared to last year at this time. Some encouragement can be found in the fact that Unsold Inventory increased by only 4% in both May and June, as compared to a much higher increase in the preceding months of January (+15%), February (+12%), March (+13%), April (+12%), giving some hope that inventory will stop it’s upward spiral. At the same time however, even a modest increase in Unsold Inventory is detrimental to the market given the current high inventory levels.

Looking ahead, the Summer selling season typically brings gentle but steady declines in buying activity followed by more pronounced dips during the Fall and Winter seasons. Add in the effects of rising mortgage rates, record high energy prices, and the erosion of consumer confidence towards the future of the housing market and there’s no reason to expect a rebound any time soon!

From a price perspective, there is mounting evidence that home prices will decline over the short term as motivated sellers make business decisions to accept a lower selling price in exchange for a quicker sale. On the New Construction front, the myriad of sales incentives ranging from discounted pricing on upgrades, mortgage rate buy-downs and other financial incentives are the market equivalent of price reductions which will steer the overall residential market to a lower price point. Given that the New Jersey Housing Market realized an 87% increase in home prices from 2000 – 2005, the adjustments now taking place come as no surprise. Nonetheless, expect a bumpy ride over the next few years as the market struggles to restore an affordability balance in the face of rising mortgage rates and energy prices.

What a difference a year makes?

wow..

Raise cash, get out of debt, and stay out of RE and watch this market tank, the wheels are turning.

If you are a buyer, think twice and sit on the sidelines, if you are a seller, better get the pepto bismol, cause you are going to need it. (better get a good divorce lawyer too while you are at it, chances are your marriage will go down with the home value ).

I still don’t think sellers are yet accepting this amount of reality.

But, hark…they will…..they will….

SAS

thanks grim

I was waiting for these numbers since end of June 06.

Always wondered how Mr.Otteau plays the music. But looks like he did not fudge it unnecessarily

Central Jersey Observer

Hey Grim,

You remember the song “Bad Moon Rising” by Creedence Clearwater Revival?

Here are the lyrics from Google. Now read the lyrics, sing the tune to yourself, and think about the real estate market and the economy. This song sums things up so very perfect (and we haven’t even had a hurricane yet).

———————————-

I see the bad moon arising.

I see trouble on the way.

I see earthquakes and lightnin.

I see bad times today.

Chorus:

Dont go around tonight,

Well, its bound to take your life,

Theres a bad moon on the rise.

I hear hurricanes ablowing.

I know the end is coming soon.

I fear rivers over flowing.

I hear the voice of rage and ruin.

Chorus

All right!

Hope you got your things together.

Hope you are quite prepared to die.

Looks like were in for nasty weather.

One eye is taken for an eye.

———————————-

Yee….I love that song. If I could go back to 1969, I would in a heartbeat. That was the summer I got back from Vietnam and all I did that summer was I & I.

SAS

PS. I & I is USMC talk for intercourse and intoxication.

For all of those readers who just can’t get enough of the bubble:

NNJ Bubble Store

grim

POP!

oh I gotta get me one of them “pop” stickers.

wow, that is going to be a collectors item.

Think I will order several and hand them out for kicks.

SAS

Below is some of the most diabolical advice I have ever seen on the internet :-), saw it at one of the bubble blogs

#2 (see below) seems to be skirting some moral boundaries. Does anyone know if it is also near any LEGAL boundary in the State of NJ?

———————

How to lowball a seller…

1. Put out lowball offers on multiple homes. If one bites you’re ready to start dealing. Chances are if you put in a lowball offer all sellers will return with a number they feel comfortable with. (Which probably won’t be close to your price) When they do show them what their neighbor is willing to sell for. There’s a good chance when they see the neighbors number they’ll try to go lower. This is the reverse of a bidding war. ;-)

2. Here’s the second way to lowball a sellers requires two buyers working together. The buyer that does not want the house to be lowballed submits a REALLY low offer. What this does is shock the seller into a new realty of what their house is worth. If the owners accept the offer you “gracefully” try to bow out but, while doing so have buyer number two submit an offer at the same price. The seller will forget about buyer one and sell to buyer two. If the owners don’t accept the offer you play with them a little then get out. At this point you “softened” the seller up to accepting a lower offer. This is where buyer two comes in knowing how low the seller will go. ;-)

*The second technique is something only buyers can do together (not agents) and it won’t make friends if people find out about what your doing. So don’t ever tell people how you got the house for the price you did.

Interesting that this completely remodeled Summit house has been sitting for 68 days (listed May 24th).

MLS 2282155

115 Ashwood Ave, 07901

http://realtor.com/Prop/1060639919

This house would have been gone in 2 days last year.

Grim,

Thank you for posting this report. Analysis like this, to such a local level, is hard to find.

Great stuff.

I have been lowballing 30% off for last 6 months in south NJ. Now I am trying to do a bit more by putting Ads on various sites for House on sale and I put my price around 15 to 20% less than the houses on MLS sites. When many of the FSBO see this (i am not sure but I see fsbos onthese site), they get a taste of market

From http://www.originationnews.com/plus/

Merrill Declares ‘Bear’ Market in Housing

In a new report, Merrill Lynch declares that housing is in a bear market and that a “buyer’s market” for homes should last for “years.” Merrill notes that the unsold inventories of homes continue to pile up, and that resale prices are flattening in the single-family market, while declining for condominiums. Meanwhile, a new report by Friedman Billings Ramsey says home price gains will continue to slow nationwide. FBR is still bullish on the nation’s largest market, California. It predicts that house prices in the state “should rise by a median year-over-year rate of 24.1% in 1Q07, whereas they had risen by a median year-over-year rate of 21.7% in 1Q06.” FBR cautions that home price gains in California will not be uniform.

CNS

Wasn’t there an anonymous user a few days ago looking for a housing report from one of the big investment houses?

Does anyone know if it is also near any LEGAL boundary in the State of NJ?

I have seen this before on this blog.

An offer taken by a Real Estage Agent is usually written in contract form (8) pages- 4 times and accompanies a One thousand dollar earnest money deposit.

So I would think you would be doing this with FSBO’s only

KL

Yee, I know people who lowball this way.

Anytype of money you put up, you will get back, so its no big deal.

Is it unetical, not at all. Also, why the battle cry?

I suspect there are alot of panic stricken sellers and starving RE agents that traffic through this site. To the all the sellers and RE agents whom read that I just have one thing to say…….You hear that sound??

Indeed, that is the sound of inevitability.

SAS

hmmm… Are we seeing a downturn before majority of the ARM loans reset? This is going to be interesting.

Some sellers are getting the message.

“There’s no question people are leaving. And, they have been for some time. Internal Revenue Service data shows each of New Jersey’s 21 counties suffered a net population loss in 2004, the most recent year data is available. In that year, nearly 100,000 households left the state, taking with them $1 billion in personal income.”

This is really bad news for long-term NJ housing bulls. The Long-term pricing trend looks very negative over the next five to ten years.

this was interesting.

Georgianna Velardi, a broker at Century 21 Petrey Real Estate in Long Beach, said she had recently seen more sellers looking for a way out of high mortgage payments.

A couple in their late 30’s came in to price their three-bedroom ranch. The interest rate on their mortgage had risen to 9.5 percent, from 3.5 percent three years ago. They didn’t have the equity or good credit to qualify for refinancing at a lower rate. To make matters worse, on July 1 the City of Long Beach raised property taxes 25 percent. “They needed to get out because they were so overwhelmed,” Ms. Velardi said.

…

But back in the primary-home markets of western Suffolk and Nassau, Ms. Marten, the buyer’s broker, said she expected to see even more homes sitting on the market longer, and more foreclosures. “It’s not going to bottom out immediately,” Ms. Marten said. “We’re going to see, I believe, what we saw in 1988: a flattening, a gradual downturn and then down and down until it hits bottom.”

I found a house I’d really like to bid on but it needs a lot of work cosmetically but I still want an inspection. They’re asking way too much. I checked some comps through zillow.com and domania.com and found they were asking way way too much. I don’t know how long I can wait until I bid though. What do you think? I want to bid about 20% lower then asking. What do you guys think?

Hat tip to the Housing Bubble Blog (http://thehousingbubbleblog.com) for this piece. From AZ Central:

As Valley home market cools, emotions heat up

Two houses on the same north Valley street, similar in size and age, are for sale. One lists for $749,000 and the other for $775,000. A third house came on the market on the same street a few doors from the other two. The new listing was similar to the others in size and age but priced at $659,000.

Reaction: outrage.

“The neighbors were really mad,” said Thomas Stornelli, principal of Global Network of Homes in Scottsdale. “They knocked on the door and asked, ‘What are you thinking?’ For a lot of people, their home equity is their bank. It’s like taking money out of someone’s bank, their retirement account. People (future buyers) are going to use that house as a comp, even if it doesn’t have the same upgrades. It’s going to leave a mark.”

The owners of the least- expensive home were equally upset. They were in the midst of a corporate relocation and wanted to sell quickly. Suddenly, angry neighbors were confronting them. One night, someone tore down their for-sale sign.

…

A woman walked into Barry’s Realty Executives office about nine weeks ago, sat down and began crying. She said she bought two houses last year, fixed them up and quickly sold them, making a $50,000 profit on each.

She was a novice investor, but it all looked easy. She took her profits, threw in some extra money and bought five more houses. She spent money fixing them up, but when she put the houses on the market, she realized she had bought at the peak, Barry said.

“Her eyes just started to well up, and she just started bawling,” Barry said. “She said she couldn’t sell them for what she bought them for. She said her monthly payments were about $20,000.”

Barry suggested turning them into rentals. She told him she couldn’t get enough rent to make it worthwhile.

“She was expecting to flip them,” he said. “The market flipped her. She was devastated. People have forgotten that houses are not a liquid asset. They never were meant to be.”

Anonymous said…

I found a house I’d really like to bid on but it needs a lot of work cosmetically but I still want an inspection. They’re asking way too much.

….

What do you think? I want to bid about 20% lower then asking. What do you guys think?

7/30/2006 10:00:29 AM

I think you should cross off 2006.

Thank me later.

unrealtor, mt. ararat is not a nice part of town. what seems to (finally) happening is people are starting to look at purchases in the traditional ways, e.g. location, condition, amenities, affordability, etc. quickly leaving are the days to get in now before you miss out on another month of appreciation. that’s why this market is going to continue to stagnate and decline for years to come.

“unrealtor, mt. ararat is not a nice part of town.”

I’m not following, who mentioned Mt Ararat? Is that the name of that Summit subdivision?

Put 40% down on a 500k property. Outlay = 200k

Mortgage on 300k at 6.5%; yearly payment = 12,043.91 principal, 19,145.3 interest.

put on your tax as a residence, not an investment. at 35% tax bracket, you pay 12444 in interest.

Taxes: say 6000 a year – cost is 3900 a year. Total 16,344 a year.

you have invested 212,000; after 1 year, if you put the 212K in market, say you get 10% = 21,200 return.

If the house appreciates by 10%, you get a value of 550,000. Meaning 50k minus the 16K in interest. = 34 K

if you sell the house, you have to pay 550k x realtor fee (6%?) = 33k

So, no profit till the second year. Only at 20% a yr, then you have a profit.

Takes 14 years at 5%. Really lousy. No fun to invest in anything that yields less than 15%. thats why there are so many small investors who buy individual stocks

and trade frequently.

An economist’s projection of job losses:

“But since 2000, housing’s share of the economy has soared, reaching a high of 6.3 percent last year. This year it fell back to just over 6 percent.

If that number were to keep dropping to its long-term average of 4.5 percent, Donnelly calculates it would mean the loss of about 1.5 million jobs.

Worse, he notes that the last two times housing hit peak levels as a share of the economy, deep recessions followed.”

http://tinyurl.com/grseo

I believe the 1.5 million number excludes a majority of the undocumented workers in housing, who will require assistance.

Pat

Help needed: About to put my house on the market (bad time, I know). I have made it my primary residence for the past year and change.

If I sell, what capital gains taxes would i bet subject to?

Is it a tax-bracket thing? Fixed rate? I have heard anywhere from 35% to 8%.

Long story short: Bought low pre-construction in great area in 2004, price has gone up dramatically, i haven’t taken out equity, and i gotta sell. Thinking about renting, but probably can’t get enough to cover the mortgage.

If you can find this on the net, you are good. Because I’ve spent the better portion of the weekend trying.

Thanks!!

its over for housing and

nj now the slow wind down process

starts.

its called a bear market , only

its in housing as well.

however, you would never know it

if you go into some stores.

Everything is A OK.

Anon 1:05

Read the IRS tax topics, then if you need help, call a tax attorney for ideas.

http://tinyurl.com/gf6v9

http://www.irs.gov/taxtopics/tc701.html

anon at 1:05,

Why don’t you first sell the house and then worry about taxes ? Also, see a CPA. The $1500 you pay him is worth the money.

FWIW, the current capital gains tax rate (for federal taxes) for assets held over an year is 20%.

Again, I am not a CPA.

CNS

Help needed: About to put my house on the market (bad time, I know). I have made it my primary residence for the past year and change.

Open a gas valve and leave the house.

-Richie

Grim,

Have you thought what form this blog will take once the housing bubble actually bursts? I mean once you have convinced people, which you are doing an excellent job of, IMHO, what is your next adventure?

Just like the realtors, you will have to find something else to occupy your time!! LOL…

keep up the great work!!

hey i have an idea..why not a blog that is an online support group for out of work realtors!!

Remember way back when I told you boys to familiarize yourself with the “plunge protection team” and the “monetary control act of 1980”.

Looks like JOHN CRUDELE of the NYP did. He is the only one at the NYP with a brain. I have a rapport with John and we goto Aix on w86th sometimes together for lunch. I thought it was interesting when he did this bit in the NYP and yes, I told him about this blog.

Here is his bit:

———————————–

COME CLEAN, BEN!

By JOHN CRUDELE

July 27, 2006 — FEDERAL Reserve Chairman Ben Bernanke revealed that the secretive Plunge Protection Team meets several times a year, but he dodged a congressman’s inquiries about what the group does and whether minutes are kept of those meetings.

So The Post has filed a Freedom of Information Act request for those minutes – specifically for the meetings that likely occurred immediately after the terrorist attacks in 2001.

I wrote about the Plunge Protection Team in a series of articles earlier this month. Formally called the Working Group on Financial Markets, it was formed in 1988 by President Reagan to advise Wall Street.

Headed by the Secretary of the Treasury, it also has top regulators and the chairman of the Fed as members.

But in addition to giving Wall Street advice, I suspect – and former White House adviser George Stephanopoulos seems to have confirmed – that the Plunge Protection team has morphed into something more active.

And Wall Street firms may have been invited to join.

What’s clear from answers to questions posed by Rep. Ron Paul, (R.-Texas) is that new Fed chief Bernanke either doesn’t know much about the role of the working group or preferred not to discuss the matter.

And, I think, it’s time we found out a little more about an organization that could afford some Wall Street firms an opportunity to reap massive profits at the expense of ordinary investors.

Here’s some of the exchange that occurred between Bernanke and Rep. Paul last Thursday at the House Financial Committee hearings.

Rep. Paul: Good afternoon, Chairman Bernanke. I have a question dealing with the Working Group on Financial Markets. I want to learn more about that group and exactly what authority they have and what they do.

Could you tell me, as a member of the group, how often they meet and how often they have actions? And have they done something recently? And are there reports sent out by this particular group?

Bernanke: Yes, congressman. The president’s working group was convened by the president, I believe, after the 1987 stock market crash. It meets irregularly. I would guess about four or five times a year. But I’m not exactly sure.

And its primary function is advisory, to prepare reports. I mentioned earlier that we’ve been asked to prepare a report on the terrorism risk insurance. So that’s what we generally do.

Rep. Paul: In the media you’ll find articles that will claim, at least, that it’s a lot more than advisory.

You know, if there is a stock market crash, that you literally have a lot of authority, you know, to impose restrictions. And we’re talking about many trillions of dollars slushing around in all the financial markets. And this involves the Treasury and, of course, the Fed as well as the SEC (Securities & Exchange Commission) and the CFTC (Commodities Futures Trading Commission.)

And the reason this came to my attention was just recently there was an article that actually made a charge that out of this group came a position that interfered with the price of General Motors stock.

Have you read that? Or do you know anything about that?

Bernanke: No sir. I don’t.

Rep. Paul: But back to the issue of meeting. You tell me it meets irregularly. But are there minutes kept, or are there reports made on this group?

Bernanke: I believe there are records kept by the staff. There are staff, mostly from Treasury, but also from other agencies.

Rep. Paul: And they would be available to us in the committee?

Bernanke: I don’t know. I’m sorry. I don’t know.

Rep. Paul obviously doesn’t have a reporter’s knack for the follow-up question, so here’s what I would have asked next.

Crudele: Well, Mr. Bernanke, how about you find out! Someone in your position should know if, as former White House adviser Stephanopoulos has claimed, the Working Group on Financial Markets – the Plunge Protection Team – has the authority to interfere with the free market for stocks.

And we’d also like to know who makes decision for the group, politicians or guys on Wall Street. Don’t misunderstand, Mr. Bernanke. I’m not saying what the group is doing is wrong. But why should firms like Goldman Sachs – from which two of the last four Treasury secretaries have come – be in a better position than anyone else who gambles in the stock market?

See, that’s why I’ll never be in Congress.

john.crudele@nypost.com

———————————–

SAS

SAS..I love it when you call us all boys.

Mmmwaaaah!

But think about it – wouldn’t an economic slowdown be a little less politically painful if it were due to an “unexplained drop in confidence” rather than all-out rate hike shock? Just think, maybe could save a half percent.

Pat

I’m looking for some opinions. I am thinking of making an offer on a two family house I went to see today. I suspect you will all say wait because the market is going down, but I think this place has some factors that will help it hold value, if not increase. There is a new ferry to New York around the corner starting in Oct., $27K in rental income from the other apartment, and it has a great river view.

newjersey.craigslist.org/rfs/187703347.html

What do you think I should offer for this, and am I crazy? Or does this look like a good opportunity?

Julie

off the topic, what do you guys think of oil prices, trowe price (prnex) stocks are they going up or down?

This post has been removed by the author.

Anonymous said…

I suspect you will all say wait because the market is going down, but I think this place has some factors that will help it hold value, if not increase.

What do you think I should offer for this, and am I crazy? Or does this look like a good opportunity?

Julie

7/30/2006 04:46:53 PM

Jules: It couldn’t be a worse time to put an offer on that place.

The owner’s market is at a dry point where sellers refuse to drop asking prices;

the rental market is on fire, so the rent roll you see is as flush as it has been in years;

you have new data that was just released [adding ferry service – note the ferry system has had fiscal troubles and is precarious at best – question, what happens to your value hedge in the real possibility that the ferry is discontinued to that location?];

Edgewater is one of the most dangerous bubble inflated places in the NYC region due to massive value gains and massive supply;

I am no expert, but you won’t regret passing on this one – lowball 40% – I’m not kidding.

Anonymous said…

Long story short: Bought low pre-construction in great area in 2004, price has gone up dramatically, i haven’t taken out equity, and i gotta sell. Thinking about renting, but probably can’t get enough to cover the mortgage.

If you can find this on the net, you are good. Because I’ve spent the better portion of the weekend trying.

Thanks!!

7/30/2006 01:05:09 PM

If you haven’t lived in AND owned the property for 2 years you must pay capital gains tax and you cannot receive the $250,000 capital gain exception [$500,000 for married couples filing jointly]. There are exceptions that allow you to prorate the exemption [but limited to the list of approved reasons – mostly due to relocation from employer/employment], but you should simply call a CPA as a precursor to having them prepare your taxes for 2006 [I work with one who bills out at $150/hour].

I am not a CPA, and you are foolish if you skimp on paying $300-$450 for advice that could potentially save you $1000’s in capital gains taxes or worse, an IRS audit if you flub something basic. Getting all your information from the Internet often leads to realization of that old cliche “…you get what you pay for….”

Looks like breaking bubbles using economic reality has gone mainstream, based on the news articles this week, and realtor statements like this guy’s:

http://tinyurl.com/o5wks

“THIS WILL BE THE MOST IMPORTANT MARKET UPDATE YOU WILL READ!!!!

Let me start off by giving some background information on the real estate industry. Many agents are part time and or do not depend on their real estate career as the families primary income. Secondly, a large majority of the agents in this area are fairly new. By fairly new I mean less than 3-4 years. In the last 4 years or more, this area has been in a great market. Many agents have no experienced in selling homes in the current market.

The current market is if you do not have to buy and do not have a house to sell, wait. Under the prior mentioned conditions it is not a good time to buy. If you want to upgrade or downgrade and are planning on staying in the new property for a few years any further price reduction in the market will simply be a wash.

The market is a buyers market. However, due to interest rates, oil prices and unrest in the Middle East I feel prices will continue to fall, as the housing market looks for an equilibrium price level. The market is currently on a downward trend. My recommendation to investors, sell now if you must sell and hold of on buying, as there will be better values later on.

As for sellers, if you need to sell, DO NOT wait, sell now and do not plan on prices close to last year…”

From New Jersey..still a lot of cheerleading, but some reality mixed in. They’re getting hungry:

http://tinyurl.com/ez78u

“We are also seeing an increasing number of price reductions–not big decreases, but the escaltion has stopped and many homes are now sitting on the market longer and are adjusting their prices to a 2004 level,–normalizing..”

http://tinyurl.com/jno38

Ocean City is now a buyers market.

bugger……although this information in itself means nothing other than where bond traders are willing to make bets today…..

Treasuries May Gain as Futures Hint at Fed Rate Cuts Next Year

July 31 (Bloomberg)

— Treasuries may extend their monthlong rally as traders bet slower U.S. economic growth will lead the Federal Reserve to lower interest rates next year.

Interest-rate futures contracts traders use to speculate on central bank policy decisions suggest the Fed will reduce the 5.25 percent target rate for overnight loans between banks by the fourth quarter of 2007. The yield on the Eurodollar futures contract that expires next September dropped 11.5 basis points last week to 5.205 percent. Eurodollars are U.S. currency or foreign securities denominated in dollars held in foreign banks.

“The Fed will be shifting gears in late 2006 or 2007,” said Colin Lundgren, head of institutional fixed income at RiverSource Investments in Minneapolis, which manages $100 billion of bonds. “For folks out there buying 10-year Treasuries, the expectation is the next move is an ease in interest rates.”

[edit]

`Next Few Years’

The rally will last for the “next few years,” Bill Gross of Pacific Investment Management Co. in Newport Beach, California, said in comments on the company’s Web site on July 26. Gross, who runs the world’s biggest bond fund at Pimco, began buying Treasuries in June for the first time in eight months. He said the bear market in bonds was over on July 7.

Traders began reducing bets on another rate increase this year after Fed Chairman Ben Bernanke said in testimony to Congress on July 19 that the economy was showing signs of “moderation.” The central bank expects growth

[edit]

“As far as the eye can see there isn’t a U.S. Treasury yielding above” the Fed’s target rate, said Thomas Corona, a senior vice president at Tradition Asiel Securities Inc., a New York-based broker. “According to the Eurodollar futures curve, the Fed is done for now and the next move could be an ease.”

Gee sorry Pat.

Thanks for pointing that out to me.

I will try to do better in the future.

;)

SAS

You do fine for an old guy.

hehehe. ;)

Pat

Not NNJ specific – but a good read nevertheless –

Top San Diego real estate broker says San Diego’s home prices are off FIVE TIMES the offical data!

http://www.prleap.com/pr/42812/

CNS

Hey BOOOOOOOYAH,

Thank you!! The weekend was great. I was sitting at the pool, drinking margarita’s and reading the Star Ledger. No one told me that Grim would be this weekend’s guest editor!!!!!!

1)Headlines on the front page regarding the tax trauma index.

2)Headlines on the business page,”taxes driving people out of NJ”

3)In the Perspective section, the property tax spiral. Has the Star Ledger been logging in to the NNJ RE Bubble????

As I was cooling off I thought what are the realtors doing today??

The phones, at their offices, were ringing off the hooks, “I need to sell now”

Broker 1- “These sellers are just irrational, don’t they know that inventories are up 80% and sales are off 30%” Sell??? To whom?? To whom??

Broker 2- “These sellers want me to work a miracle,don’t they know the fed has now raised rates 17X’s and the party is over” Sell??? To whom?? To whom??

Broker 3- “Don’t these sellers read the news, the NAHB’s index is at the lowest since 1991 and RE declined 15% at that time” Sell??? To whom??? To whom??

There is nobody left to buy, the realtors have exhausted all the fools.

To all those contemplating buying. Remember, we have have just witnessed a once in a lifetime mania/bubble. This is of historic proportions. You will be telling your grandchildren about this one!!!

When any market breaks out of it’s normal range and has a parabolic move like this one, which the fundamentals of the market can in no manner support the move, the corresponding reaction will be just as great if not greater (ask Sir Isaac Newton)!!! Picture a herd of elephants trying to get out of a small door at the same time!!! We are only in the first inning, maybe pre-game warmups, of a nine inning game. If you think you are gettting as deal with a 10% lower price as compared to the 3rd quarter of 2005, I suggest you relax, lay down and take a couple of Tylenols and do more research.

If/when this market comes back to its norm of the past 110 years, prior to 2001, we are looking at a 40% decline. Remember when markets turn after a mania, they go a lot further for a lot longer than you or I can imagine, in many cases below the norm.

PATIENCE,PATIENCE,PATIENCE

BC Bob

By the way, this is MANDATORY reading!!!!!!!!

THE 1924 FLA. RE CRASH: http://www.stock-market-crash.net/florida.htm

You can substitute 2006 for 1924 and substitute hummers/sv’s for automobiles.

PATIENCE,PATIENCE,PATIENCE

BC Bob

This isn’t NJ specific, but confirms everything this blog has been talking about for many months:

http://biz.yahoo.com/ap/060730/condos_on_hold.html?.v=5

Confirmed by an open house I saw today for a humble 1 BR in the upper west side of Manhattan. Owner was asking $675K and monthly maintenance is $1,400; however, comparable rentals in the building are $2,700. “Fundamentals” like these easily foreshadow and command a 30-40% drop in the condo market.

Nice article from NEWS.COM about MLS control by Realtors.

Real estate’s Net turf war

Some FSBO moron thinks they’re going to get $1M for a condo in Summit:

http://tinyurl.com/ropdk

Units sold there in 2004 for $440K.

FSBO are always the worst, living in a total fantasy world.

Shailesh, great article.

This is yet another really bad financing idea:

Morgan Stanley, the US investment bank, is set to launch a product aimed at allowing homeowners to borrow much more money than traditional lenders permit, in exchange for giving up some of the future increase in the value of their houses.

The move is likely to be followed by other lenders as banks seek new business without straining lending criteria. But it could fuel further house price inflation as buyers chase properties with ever-deeper pockets. It will also leave more homeowners exposed to falls in house prices.

The launch comes as Yvette Cooper, housing minister, is expected on Monday to call for more private sector lenders to become involved in similar schemes to help people buy homes.

http://www.ft.com/cms/s/6e7f9fbc-1ffa-11db-9913-0000779e2340.html

http://tinyurl.com/kjbl6

From Star Ledger:

Housing bubble’s latest woe: Land writedowns

The bursting of the five-year housing bubble is hard to miss. As mortgage rates have climbed over the last two years while the Federal Reserve boosted short-term interest rates 17 times, new home construction and building permits have sharply declined, and the demand for home loans has dropped. The National Association of Home Builders said its index of housing- market activity in July slipped to its lowest level since 1991.

unrealtor,

The FT article on Morgan Stanley is for the UK. It is not relevant to the US real estate market.

As it happens, the UK/Australia RE market is on a small upswing.

CNS

I’m going to keep this thread at the top of the page for Monday.

grim

It was a quiet weekend for sellers and realtors.

Fess up. It’s over. Lower your prices or go down with the ship.

30-40-50% lower?

Your choice!

Boooooooooyaaaaaaaaaa

Bob

Could any fellow blogger who with access to the MLS system help with this listing?

What is the address? and how long has been on market? any price reductions?

Thanks! Central Jersey House Hunter

MLS: 2267064

Poole and Yellen speaking today, I believe the Yellen speach starts near noon. Some of Poole’s comments are already hitting the wire.. From Marketwatch:

POOLE SAYS ‘SOME IMPORTANTAT DATA YET TO COME’ BEFORE AUG. 8

FED’S POOLE SAYS HE’S ’50-50′ ON AUG. RATE DECISION

grim

MLS# 2267064

### Byrd

Bridgewater, NJ 08807

OLP: $699,000

LP: $669,000

DOM: 102

Purchased: 7/19/2000

Purchase Amount: $349,900

grim

The Fed Morons contributed to this mess.

Irresponsibly low interest rates, looking the other way while fraud and reckless credit expansion go wild.

Purchased: 7/19/2000

Purchase Amount: $349,900

$446,500 is a generous bid on this bloated overinflated dreamer.

5% appreciation per year over last 5 years.

How much are these Grubbers entitled?

Just take 30% + off 2005 peak prices and it usually takes you to 5% trendline.

Chicago PMI numbers came in strong, 57.9% versus the 55.8% that was expected. While Prices paid dipped down to 86.8% versus a reading of 89% last month, it remains elevated.

If you had to classify this as pro-pause or pro-hike, it would most certainly be a pro-hike piece of data.

grim

http://web-xp2a-pws.ntrs.com/content//media/

attachment/data/econ_research

/0607/document/dd072506.pdf

Fixed the link above:

Econ 101 Applied to Existing Homes

If you compare chart you find in Zillow with the chart in the document Grim post, you can see the bubble grew when supply “-“. Now with great “+++” %, the price should drop huge!

Good source NTRS from Anon earlier.

The report at following link gives a very good chart for House Affordability on page 7.

Composite Housing Affordability Index Chart

The last time Housing went through cycle, it took almost 9 years (1978 to 1987) to come up. I hope this time it will be different.

UnRealtor said…

Some FSBO moron thinks they’re going to get $1M for a condo in Summit

UnRealtor,

Nice observation. Would u be able the similar info the following Condo/townhouse in Summit.

719k 2br Condo – MLS 2303356

one br in the same building was list for 320k and sold within 1 month this Spring

1.4 million townhouse – MLS 227385

Similar Townhouse was listed for 1.8 million and sold within 1 month this Spring

Thx,

CC

“MLS 227385”

This appears to be an invalid MLS #.

In general, anyone who would pay $1M+ for a glorified apartment in a town surrounded by SFRs on actual pieces of property for the same price, needs serious help.

In that price range:

1.4 acres

http://www.realtor.com/Prop/1057767069

.37 acres

http://www.realtor.com/Prop/1057767053

FYI, US News and World Reports current Aug 7th issue is titled:

Real Estate Guide

How to Profit in a Slow Market

Should you buy or rent?

etc.

Most of the stuff we’ve discussed here, but it should help to bring bubble discussions further into the main stream.

Grim,

This is a great site. This site can always be counted on to restore one’s sanity after seeing Unabomber shacks asking over $1M. I had a couple of questions:

1) How can I look up a house’s price history online? Is that capability restricted to people with real estate licenses or restricted in any other way?

2) In light of a probable housing-induced recession, what type of investments are people making for their downpayments and other savings? Is it primarily keeping it in cash (online savings accounts, CDs, etc.) or are people exploring gold funds, energy funds, TIPs, and foreign-denominated CDs that might better protect against inflation and a falling dollar.

Thanks.

MLS 2273859 is what CC is talking about.

Asking almost 1.4M. In a couple years, it would only worth

800K.

http://tinyurl.com/ropdk

This guy paid $510k for this on 01/26/06, and wants to flip it for $925k now. Talking about one greedy grubby seller asking insulting prices

Unrealtor,

Thank you for your information.

CC

im down the shore .

i’ve never seen anything like

it.

dives for 600k , does not look

like they get it yet, down the

shore.

Dian Turton, the realtors keep

saying , best investments , Real

Estate, get em while you can.

1 million down here, no problem

Summit condo, $350K:

$349,000 – Beautiful 2 BR Commuter — MUST SEE– Open House Sunday 8/6, 1-4PM

See yourself in this spacious 2 bedroom condominuim with new bathroom, formal dining room, many updates. Includes garage with opener. Make an impression with hardwood floors, crown molding, resurfaced walls, new doors. Superb condition – move in and enjoy.

Walk to NYC train and town. Enjoy the well-maintained grounds.

Close to Rte’s 24 / 78 / 287 / 22

Open living area with 5 total rooms + bath:

Livingroom ~ 19’9″ x 13’4″

Bedroom 1 ~ 12’6″ x 13’4″

Bedroom2 ~ 12′ x 11′

Updates include: New bathroom, plumbing access in BR closet, crown molding, new doors, updated fixtures and lighting, appliances 1-5yo, all rooms painted, windows ~3yo, closet organizers, high-output electrical, cable in all rooms, wired for DSL.

For Sale by Owner, no hassles! Priced aggressively, come and see.

http://newjersey.craigslist.org/rfs/188675781.html

is there a report similar to the otteau report for PA (or Bucks County)? Thanks

Good info. It looks much worse in San Diego. I just came across a San Diego real estate brokers blog post that says the June values are down by 5% from a year ago.

The blog is at:

http://www.brokerforyou.com/brokerforyou