From CoreLogic:

Loan Performance Insights – June 2023

30 Days or More Delinquent – National

In April 2023, 2.8% of mortgages were delinquent by at least 30 days or more including those in foreclosure. This represents a 0.1 percentage point decrease in the overall delinquency rate compared with April 2022.

Mortgage Delinquency and Foreclosure Rates Remain Near Historic Lows in April

Although almost a dozen states and more than 150 metro areas posted year-over-year increases in overall mortgage delinquency rates in April, U.S. loan performance remains resilient, with delinquencies and foreclosures continuing to hover near record lows. The national overall delinquency rate increased slightly from March to April, but this is a typical seasonal pattern, as tax bills can stretch homeowners’ budgets in the short term and result in late mortgage payments for some borrowers.

Loan Performance – National

CoreLogic examines all stages of delinquency to more comprehensively monitor mortgage performance.

The nation’s overall delinquency rate for April was 2.8%. The rate for early-stage delinquencies – defined as 30 to 59 days past due – was 1.4% in April 2023, up from April 2022. The share of mortgages 60 to 89 days past due was 0.4%, up from April 2022. The serious delinquency rate – defined as 90 days or more past due, including loans in foreclosure – was 1.1% down from 1.4% in April 2022.

As of April 2023, the foreclosure inventory rate was 0.3%, unchanged from April 2022.

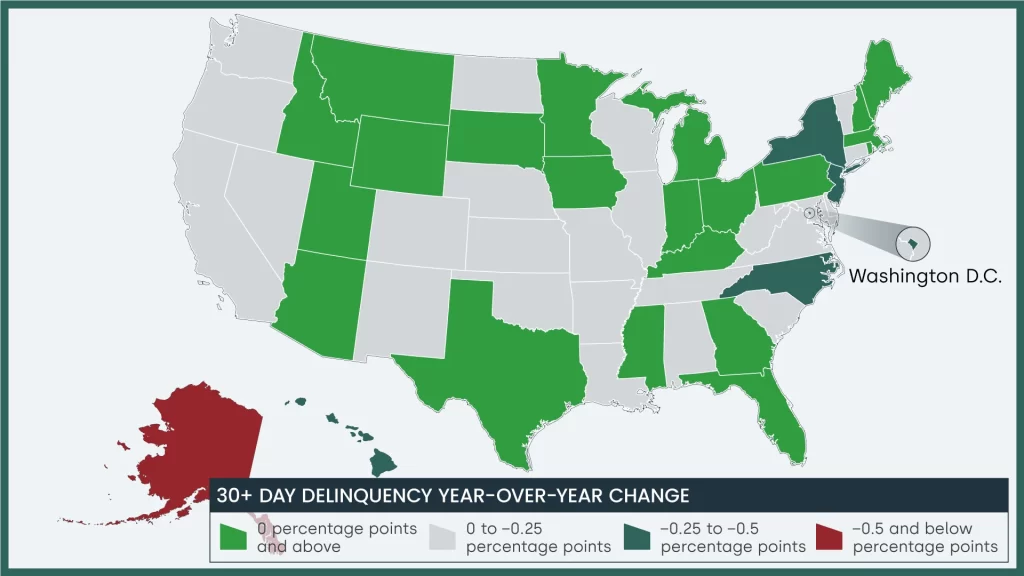

Overall Delinquency – State

Overall delinquency is defined as 30 days or more past due including loans in foreclosure.

In April 2023, 11 states posted year-over-year increases in overall delinquency rates, while 11 states were unchanged. The states with the largest declines were Alaska (-0.7%), Hawaii (-0.5%) and New York (-0.4%).

It almost seems there are more listings in Morris county lately? Could the high interest rates finally taking some effect?

First by the way, everybody sleeping in today?

No logic. Boomer owns house in disaster area, refuses to move, forces government to protect the old goats. My taxpayer dollars. Boomer sells house for massive profit, bank doesn’t care that house is in disaster area. Rich young kid buys it, thinking his and his wife are “invincible.” Gets bailed out by my tax dollars as well.

But Smith Islanders rejected leaving, instead organizing to get tens of millions in government funding for infrastructure upgrades and fortifications against the waves. And in recent years, something improbable has trailed in its wake: a real estate boom.

More homes have sold on Smith Island in the last three years than in the previous 11 combined, according to sales data. Locals see a story of hope. Their efforts to rescue a 400-year-old way of life tied to tide and season are beginning to bear fruit. Many question the doomsday predictions for the island or hope they can find a way to ride out rising waters.

Environmentalists see a dangerous kind of denialism. They say Smith Island’s long-term survival is doubtful, so the only rational path is retreat. They see the recent interest in the island as part of an unsettling national trend — studies show more Americans are moving into climate danger zones.

Nick Pueschel and Tiffanie Woutila live on this knife’s edge between hope for renewal and peril from global warming. The couple in their 30s moved to Smith Island last summer, one of the group of new homeowners.

They love island life and wanted to continue it as part of a next generation in a place where the median age is 70, but disaster struck almost as soon as they arrived: A waterspout whipping across the bay slammed into their property.

Saw Boomer King Neil Young in SB Bowl Friday night.

Neil: https://www.tiktok.com/t/ZT8dSwy3B/