From the Record:

Location still holds key to value

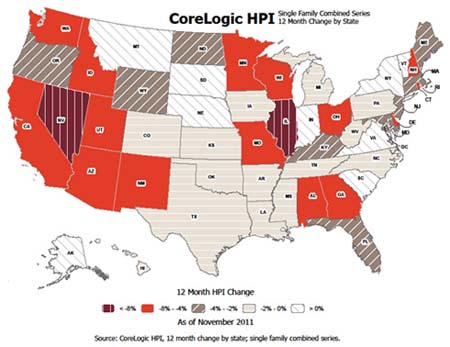

The decline in housing values has not fallen equally on all towns.

A Record analysis of home prices in the first half of 2011 (the latest available in public records) found that, overall, prices were down about 3 percent in Bergen and Passaic counties from the period a year earlier. (Prices are down 17 percent in Bergen and 21.6 percent in Passaic since 2007, when housing prices peaked.)

But in early 2011 at least, wealthier towns generally fared better than lower-income areas affected by the foreclosure crisis.

In addition, less-affluent towns were more affected by tighter mortgage standards and unemployment above 9 percent.

Geography played a role, too.

Towns in eastern Bergen County, close to the George Washington Bridge, also seemed to hold their value better from 2010 to 2011.

From the Press of Atlantic City:

South Jersey towns see more than 16 percent increase in vacant homes

U.S. Census reports show that while the number of total housing units increased nationally by almost 14 percent from 2000 to 2010, the number of vacant housing units ballooned by almost 44 percent.

Michael Busler, a fellow at the William J. Hughes Center for Public Policy at Richard Stockton College, says the gloomy trend may not have reached its end point. “It’s going to get a little bit worse before it gets better,” he said.

New Jersey’s numbers are just as striking — an increase in housing of more than 7 percent while the number of vacant units increased by more than 38 percent. One Essex County town, Belleville, for example, saw the number of vacant housing units jump 134 percent as the number of overall units went up just 1 percent.

Locally, 14 of 23 Atlantic County municipalities have seen the number of vacant housing units increase by 16 percent or more from 2000 to 2010. In addition, 11 of 16 towns in Cape May County and 10 of 14 towns in Cumberland County have seen a similar jump.

“People are becoming frustrated by the system, and a lot of them are walking away from properties,” said James Schroeder, an attorney and real estate agent with Keller Williams in Northfield. He cited statistics from the New Jersey Law Review stating that there were 1.5 million homes nationwide in foreclosure and ready for sale, another 3.5 million to 4 million within three to six months of being sold.

In the end, he said, his company believes that it will be another five to seven years before the traditional housing market picks up again.

…

Cape May County saw an overall increase in vacant units for sale, not seasonal, of 75 percent compared with just an 8 percent increase in total units.Upper Township saw an increase of 232 percent (83 vacant units for sale in 2010 compared with 25 in 2000), while Cape May saw a 245 percent increase (38 compared to 11), Wildwood Crest a 442 percent increase (130 compared to 24) and Cape May Point a whopping 650 percent increase (15 compared to 2).

Nine Atlantic County towns have seen increases in vacant units for sale of 75 percent or more, including increases of 100 percent in Longport and Estell Manor, 111 percent in Buena Vista Township, 126 percent in Linwood and 204 percent in Somers Point — which saw the number of homes vacant and for sale almost triple, going from 24 in 2000 to 73 in 2010.

Nine other towns in the county have a double-digit increase in the percentage of vacant units for sale, leading to a 32 percent increase overall — in a county that saw just an 11 percent increase in total units.

In Ocean County, the number of homes vacant and for sale in Barnegat Township more than doubled (76 to 172). In Stafford Township, that figure jumped from 151 to 272.