Kevin Lansing, and the San Fran Fed, have some very important words for aging workers approaching retirement..

FRBSF Economic Letter – Spendthrift Nation

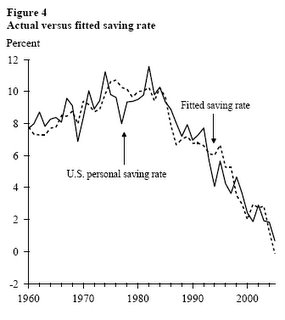

In September 2005, the personal saving rate out of disposable income was negative for the fourth consecutive month. A negative saving rate means that U.S. consumers are spending more than 100% of their monthly after-tax income. The recent data are part of a trend of declining personal saving rates observed for two decades. During the 1980s, the personal saving rate averaged 9.0%. During the 1990s, the personal saving rate averaged 5.2%. Since 2000, the personal saving rate has averaged only 1.9%.

This Economic Letter discusses some of the factors that appear to be driving the secular decline in the personal saving rate. These factors include rapid increases in stock market and residential property wealth, which households apparently view as a substitute for the quaint practice of putting aside money each month from their paychecks. Rapidly rising stock and house prices, fueled by an accommodative environment of low interest rates and a proliferation of “exotic” mortgage products (loans with little or no down payment, minimal documentation of income, and payments for interest-only or less) have sustained a boom in household spending and provided collateral for record-setting levels of household debt relative to income.

Going forward, the possibility of cooling asset markets and rising borrowing costs may cause the personal saving rate to revert to levels which are more in line with historical averages. While such a development would act as near-term drag on household spending and GDP growth, an increase in domestic saving would help correct the large imbalance that now exists in the U.S. current account (the combined balances of the international trade account, net foreign income, and unilateral transfers).

Figure 4 suggests that the decades-long decline in the U.S. personal saving rate is largely a behavioral response to long-lived bull markets in stocks and housing together with falling nominal interest rates over the same period. Since 2000, the rate of residential property appreciation has been more than double the growth rate of personal disposable income. In many areas of the country, the ratio of house prices to rents (a valuation measure analogous to the price-earnings ratio for stocks) is at an all-time high, raising concerns about a housing bubble. Reminiscent of the widespread margin purchases by unsophisticated investors during the stock market mania of the late-1990s, today’s housing market is characterized by an influx of new buyers, record transaction volume, and a growing number of property acquisitions financed almost entirely with borrowed money.

…

The decline in the U.S. personal saving rate and the dearth of internal saving raise concerns for the future. In coming decades, a growing fraction of U.S. workers will pass their peak earning years and approach retirement. In preparation, aging workers should be building their nest eggs and paying down debt. Instead, many of today’s workers are saving almost nothing and taking on large amounts of adjustable-rate debt with payments programmed to rise with the level of interest rates. Failure to boost saving in the years ahead may lead to some painful adjustments in the future when many of today’s workers could face difficulties maintaining their desired lifestyle in retirement.

Kevin J. Lansing

Senior Economist

…

Caveat Emptor,

Grim

Update:

Came across this image at Bubble Meter, it’s a Freddie Mac Ad that ran in the Washington Post earlier this week..

Frankly, I’m disgusted. I really don’t know what to say. Thousands of Americans stand to be cheated out of their retirement because they put their faith in these fools. Has anyone ever seen any investment paperwork that didn’t carry the disclaimer:

“Past performance is no guarantee of future results”

Why can the housing industry make these claims so blindly without being held responsible?

Nice blog. You need to change the colors though, hard to read.

Home equity doesn’t ensure future

“The increase in the housing market really accelerated in the last five years,” Lansing said in the interview. “The movement into flat or negative territory for the savings rate coincided with the very rapid rise in the housing market.”

From 1995 to 2000, household stock market wealth increased 122 percent, but from 2000 through early 2005, it declined 39 percent, according to a Times analysis of the Fed Bank’s data. In contrast, household residential property wealth rose 6 percent from 1995 to 2000, and jumped 39 percent from 2000 to 2005.

“Aging workers should be building their nest eggs and paying down debt,” Lansing said in his research report. “Instead, many of today’s workers are saving almost nothing and taking on large amounts of adjustable-rate debt with payments programmed to rise with the level of interest rates. Many of today’s workers could face difficulties maintaining their desired lifestyle in retirement.”

Grim

I have to agree with the first post. I find white on black much harder to read than black on white.

Otherwise — yes, great blog.

Colors and template will be updated early next week!

grim

The REal Estate Industry is corrupt and sleazy.

It will all catch up to them when class action lawsuits and flying all over the place in few years.

This refers to savings of after tax income (which is, of course, pathetically low).

However, what, I think, is more important for retirees is the savings of pre-tax income – going into their 401K’s, IRA’s etc. Typically automatically removed from the paycheck. In this respect, we actually have the highest savings rate in the entire world.

Something screwy with the search tool, but

more likely me. I was searching for something

else and ended up here, but lucky me, some

good info. Thanks.

and if you have a dog you might be interested

in this…Healthy Dog Food Recipes