I’m sure everyone will be waiting on the edge of their seats for the Fed Open Market Committee policy statement at 2:15pm (EST) this afternoon. A quarter point rate increase is widely expected by the market. The big unknown will be what the first statement under the Bernanke watch will read.

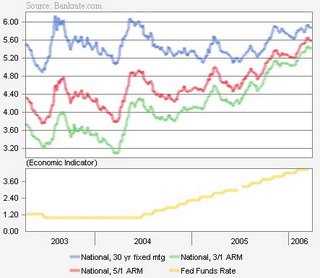

To get a feel for how the Fed Funds Rate affects the mortgage market, I’ve included a graph from Bankrate displaying the 30y-fixed, the 5/1 ARM, and the 3/1 ARM.

The graph illustrates Greenspan’s conundrum perfectly. While the short term mortgages moved up in lock-step fashion with the fed moves, the 30y seems almost disconnected. Well, it is disconnected, as the 30y has more in common with longer yield bond market, not the short term. This isn’t to say there has been no effect on the mortgage or housing markets, it’s clear that these rate moves are making the current (un)affordability mortgage products even more unaffordable. Another key part of this graph is the spread between rates among products. Look at how wide the spread was in 2003 compared to now.

While we are on the subject of mortgages, sub-prime lender Aames Financial, announced it would cut 100 jobs in it’s Florida and Parsippany, N.J. locations citing a difficult mortgage market.

Aames Investment to Close Offices, Trim Staff

Cutting costs in reaction to a tough mortgage market, Los Angeles-based sub-prime lender Aames Investment Corp. said Monday that it would close offices in Deerfield, Fla., and Parsippany, N.J., and eliminate 100 jobs in its wholesale lending division, which makes loans through mortgage brokers.

Caveat Emptor,

Grim

So sorry to hear that a subprime lender is going through the death spiral. Not!

They need to fire all witness now to protect them from the lawsuits later.

witness = witnesses

$40,000 price drop:

MLS 2251860

42 Winding Way, Short Hills

$799,000 => $759,000

Days on Market: 27

What happened to the NJ “bubble wrap” theory???

And just think this is only the beginning of the downtrend.

When MOMO picks up on the downside it will be like a falling knife.Don’t try to be heroe and try to catch it at least not yet!

Psychology is shifting.

MOMO = Momentum

Great little fluff piece

http://www.rporealty.com/6%20Great%20Myths.pdf

Lots of Price reductions and desperate sellers once the spring time thaw comeback does not materialize.

BOOOOYAAAAAAA!

SELL SELL SELL SELL!

CD

alot of the sellers are still in

denial… look at the prices and

see how many price reductions.

still hasnt kicked in.

1/4 to 4.75%

capacity utilization, and inflation of eneregy and commodities are the keys to further

hikes, if any

immediate reaction – people are acting as if going through 5% is more likely [as intangible as that thought is]

modestly hawkish – but what did you expect?

People will draw their own conclusions – as such, your opinion is as good as anyone else’s

Pingback: Anonymous