Break out your crystal ball and let’s hear ’em!

Recession / Economic

Real Estate

Stocks/Securities

Commodities

Inflation

Mortgage Rates

Geopolitics

Whatever

Bragging rights to anyone who nailed it for 2024:

Predictions 2024!

Break out your crystal ball and let’s hear ’em!

Recession / Economic

Real Estate

Stocks/Securities

Commodities

Inflation

Mortgage Rates

Geopolitics

Whatever

Bragging rights to anyone who nailed it for 2024:

Predictions 2024!

From the NY Post:

Sales of previously occupied US homes rose in November to their fastest pace since March with home shoppers encouraged by a wider selection of properties on the market, even as mortgage rates mostly ticked higher.

Existing home sales rose 4.8% last month, from October, to a seasonally adjusted annual rate of 4.15 million, the National Association of Realtors said Thursday.

Sales accelerated 6.1% compared with November last year, representing the biggest year-over-year gain since June 2021.

The latest home sales topped the 4.1 million pace economists were expecting, according to FactSet.

Home prices increased on an annual basis for the 17th consecutive month.

The national median sales price rose 4.7% from a year earlier, to $406,100.

Despite increasing in November and October, home sales are still running below last year’s pace, when they sank to a nearly 30-year low.

“Looks like we won’t match last year in terms of the annual total, so it will be the lowest home sales since 1995,” said Lawrence Yun, the NAR’s chief economist.

The US housing market has been in a sales slump dating back to 2022, when mortgage rates began to climb from pandemic-era lows. A shortage of homes for sale has helped prop up prices, which as of last month are up 50% nationally since 2019.

From NorthJersey.com:

Bergen County’s hottest towns for homebuying, by ZIP code

Passaic County’s hottest towns for homebuying, by ZIP code

Morris County’s hottest towns for homebuying, by ZIP code

Essex County’s hottest towns for homebuying, by ZIP code

Sussex County’s hottest towns for homebuying, by ZIP code

From NorthJersey.com:

New Jersey’s historic Crocker Mansion in Mahwah was officially put back on the market this month after it was seized from a billionaire fraudster in 2023.

The 120-year-old estate at 675 Ramapo Valley Road is a 58-room, four-story brick palace that boasts nearly 50,000 square feet of living space on 12.5 acres along the Ramapo Mountains. It is privately listed for $33 million by Compass New Jersey agents Diane Cookson and Carl Gambino and the Fox & Stokes team.

Built between 1901 and 1907 by railway heir George Crocker, the property features 21 bedrooms, 29 bathrooms, a massive great hall and dining room, a library with gold leaf décor, marble staircases, an indoor spa and sauna, a tearoom, a billiards hall and a movie theater.

…

This listing comes after the lavish property was seized in April 2023 from its previous owner, Ho Wan Kwok — better known as Miles Guo — who was charged with masterminding an elaborate scheme in which he allegedly cheated thousands of online followers out of more than $1 billion. A 12-count indictment that was unsealed in federal court charged Guo and his financier, Kin Ming Je, or William Je, with bank fraud, money laundering, securities fraud and wire fraud.

Guo initially purchased the Crocker Mansion for $26 million in late December 2021, making it the priciest home to sell in all of New Jersey that year. The estate was just one of many pieces of property — including a 98-inch TV, a Bösendorfer grand piano and multiple high-end sports cars — as well as hundreds of millions of dollars that were seized by the federal government.

In July, a jury found him guilty on nine criminal fraud and conspiracy counts but acquitted him on three counts, according to Courthouse News Service.

From HousingWire:

Despite rising home prices and mortgage rates, second-home investors overtook a select group of vacation real estate markets. This week, online marketplace Pacaso highlighted counties in New Jersey, Florida and Massachusetts as leading markets for sales of luxury vacation homes.

Pacaso’s report revealed the top 20 counties for luxury home sales across the U.S. Counties are ranked by an index score, which was determined by the share of second-home sales to primary home sales in 2023 and 2024. The list excludes counties with less than 50 mortgage rate locks for second homes. All counties on the list have average prices above $700,000 — with further growth anticipated.

The No. 1 market is Cape May County, New Jersey. It is followed by Gulf County, Florida; Walton County, Florida; Barnstable County, Massachusetts; and Collier County, Florida.

“The destinations on this year’s list really capture the breadth of the luxury vacation home market,” Austin Allison, CEO and co-founder of Pacaso, said in a statement. “Legacy destinations remain as timeless as ever, Florida’s panhandle is solidifying its status as a favorite for vacationers, and Manhattan is resurging as a place where buyers are doubling down on second-home investments.

“These aren’t just weekend getaways anymore — they’re lifestyle investments for people looking to create endless cherished memories with friends and family.”

Allison went on to note that mortgage rates are beginning to ease, purchase mortgage applications have reached their highest levels since January and growing inventory is helping to drive more transactions.

From the Star Ledger:

In a room with brick floors, off the wood-paneled library inside a stately Tudor home in Princeton, is a stained glass window that pays homage to the home’s original owner.

It illustrates the laboratory process for making Arrid deodorant. The home’s original owner was John Higgins Wallace, Jr. a chemist who developed Arrid deodorant in 1935.

Wallace had the more than 5,800 square foot, five bedroom, four full and three half bathroom home built in 1931. Three owners later, it’s now listed for sale for $3,850,000.

The home was designed by renowned architect Rolf Bauhan, who helped establish the School of Architecture at Princeton University and designed about 300 homes in Princeton and New Hope, Pennsylvania.

It underwent a $2 million restoration about 20 years ago, said Mark Davies of Callaway Henderson Sotheby’s International Realty, the listing agent.

“They didn’t spoil any of the original details,” he said.

From Robb Report:

As 2024 draws to a close, it’s time for buyers, sellers, and renters to prepare for what the housing market will have in store next year.

If you’re planning on snapping up a second home or parting ways with your property, the real estate sector is entering a new phase. As a refresher, homeprice growth hit 4 percent in 2024, up from 1.1 percent in 2023, while average mortgage rates hovered around 6.3 percent, according to Realtor.com’s 2025 forecast. As of the third quarter, the median sale price in the United States was $420,400, a 32 percent jump from Q3 2020. Rents nationwide rose as well, coming in at $1,382 a month in November which is 20 percent higher than what they were in January 2020, The New York Times reported.

“This past year brought us a surprising upward trend in home price growth despite the persistence of high mortgage rates and rising inventory,” Realtor.com economists wrote in the report. “Mortgage rates are expected to keep mortgage payments essentially unchanged in 2025 despite continued home price growth.”

Per the experts, home prices are projected to soar an additional 3.7 percent within the next year after hitting an all-time high. On the upside, when it comes to supply, inventory is expected to surge 11.7 percent, making the market less competitive and giving buyers more time to negotiate. However, those who have been waiting on the sidelines may actually drive up the number of home sales in 2025. Redfin predicts approximately four million homes will be sold by the end of next year with an expected annual increase in the number of sales rising between 2 percent and 9 percent.

“Prices are going to keep rising because we’re not going to have a recession,” Ralph McLaughlin, a senior economist at Realtor.com, told Business Insider. “If you look at the times that home prices fall, it’s typically only when there’s a recession, and only when people are forced to sell.”

From Newsweek:

The housing market is vulnerable to decline in parts of the country with analysis suggesting that prices are more at risk of falling in three specific areas.

Real estate experts at ATTOM, a property data firm, suggested that California, New Jersey and Illinois are home to the counties with the most at-risk housing markets.

Some areas in Florida now fall into this category, according to the Quarter 3 2024 Housing Market Impact Risk Report, which was published on Friday.

The news follows a string of warnings about the state of the U.S. housing market in recent months, although the picture is very different depending on the location of the market.

Back in July, ATTOM warned that homes were becoming ever more unaffordable with Americans being forced to spend much more of their paychecks to achieve home ownership.

And house prices had hit an all-time high that same month, according to the National Association of Realtors. But, around the same time, an ATTOM study warned that some counties in California, Illinois, and New Jersey were among the most vulnerable housing markets in the country, with owners there more likely to see the value of their homes slide during a downturn.

…

ATTOM CEO Rob Barber said the analysis showed how the U.S. market is exposed to “varying pockets of vulnerability”.

He added: “As with past reports, this one is not meant to suggest any given area is about to fall or is immune from problems. Rather, it spotlights locations that look to be more or less able to withstand significant changes in market conditions. We will continue to keep a close watch on markets throughout the country to see how things track.”

The counties with the housing markets most at risk of decline, according to ATTOM, included Cook, Kane, Kendall, McHenry and Will counties in Illinois, while the counties of Essex, Passaic and Sussex featured in New Jersey. A further 13 most at-risk counties were in California: Butte, Contra Costa, El Dorado, Humboldt, Solano, Kern, Kings, Madera, Merced, San Joaquin, Stanislaus, Riverside and San Bernardino counties.

From CNBC:

Housing is not cheap — whether you’re buying or renting.

In October, the median sales price for a single-family home in the U.S. was $437,300, up from $426,800 a month prior, according to the latest data by the U.S. Census.

Meanwhile, the median rent price in the U.S. was $1,619 in October, roughly flat or up 0.2% from a year ago and down 0.6% from a month prior, according to Redfin, an online real estate brokerage firm.

While it can be difficult to exactly pinpoint how the housing market is going to play out in 2025, several economists lay out predictions of what’s likely to happen next year in a new report by Redfin, an online real estate brokerage firm.

“If the housing market were going to crash, it would have already crashed by now,” said Daryl Fairweather, chief economist at Redfin. “The housing market has been so resilient to interest rates going up as high as they have.”

Here are five housing market predictions for 2025, according to Fairweather and other economists.

…

The median asking price for a home in the U.S. will likely rise 4% over the course of 2025, a pace similar to that of the second half of this year, according to Redfin.

The 4% annual pace is a “normalization” compared to the accelerated growth last seen in 2020, said Fairweather.

…

At a national level, the median asking rent price in the U.S. will likely stay flat over the course of a year in 2025, as new rental inventory becomes available, according to Redfin.

…

Redfin forecasts mortgage rates will average 6.8% in 2025, and hover around the low-6% range if the economy continues to slow.

Yet experts expect 2025 will be a “bumpy” and “volatile” year for mortgage rates.

…

Pent-up demand from buyers and sellers on the sidelines may drive home transactions next year.

“People have waited long enough,” Fairweather said.

…

The risk of extreme weather and natural disasters may anchor down home prices or slow down price growth in areas like coastal Florida, California and parts of Texas, which are at high risk of hurricanes, wildfires or other disasters, Redfin expects.

From Seeking Alpha:

U.S. home prices are expected to slow further than previously forecast next year and in 2026, according to Fannie Mae’s (OTCQB:FNMA) latest Home Prices Expectations survey released Thursday.

According to the survey of 100 housing experts in the industry and academia for the current Q4, average home prices are expected to slow by 3.8% in 2025 and 3.6% in the following year. That’s up from the Q3 survey that showed deceleration of 3.1% and 3.3%, respectively.

The panelists, on average, expect existing home sales to stay “sluggish” for another year while new home sales will “trend slightly upward,” Fannie Mae said. Mortgage rates are expected to remain “elevated by but modestly decline” over the year to 6.3%, it added.

The average contract interest rate for a 30-year fixed-rate mortgage was 6.85% in the week ended November 29, the Mortgage Bankers Association said Wednesday.

Fanne Mae said Thursday around 80% of respondents expect home prices to decelerate due to ongoing high mortgage interest rates, rising housing inventory, and slowing wage growth.

“While home price growth is expected to ease next year, HPES panelists’ big-picture view for 2025 appears to be little changed compared to 2024, with most seeing another year of elevated mortgage rates and weak home sales,” said Fannie Mae Chief Economist Mark Palim. “We share our panelists’ view that home price growth is likely to decelerate next year, as the mix of continued elevated mortgage rates and the run-up in home prices of the past four years will likely continue to strain affordability and remain an impediment to many would-be homebuyers.”

Meanwhile, Fannie Mae said, the minority of respondents who are expecting home prices to appreciate to accelerate cited strong pent-up demand by first-time homebuyers, tightening inventory, and declining interest rates.

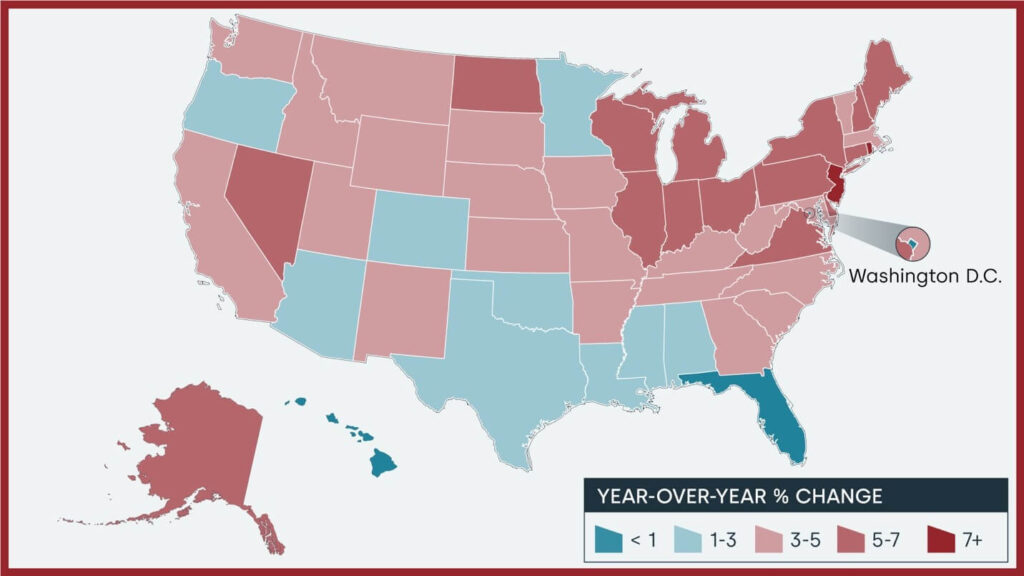

From CoreLogic:

Home prices nationwide, including distressed sales, increased year over year by 3.4% in October 2024 compared with October 2023. On a month-over-month basis, home prices increased by 0.02% in October 2024 compared with September 2024 (revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results).

The CoreLogic HPI Forecast indicates that home prices will drop by -0.03% from October 2024 to November 2024 and increase by 2.4% on a year-over-year basis from October 2024 to October 2025.

U.S. home price growth has remained relatively flat since this summer, only eking out gains in certain pockets of the country. The Northeast has proved particularly resilient to current economic conditions despite slower job growth, elevated interest rates, and ongoing affordability concerns.

New Jersey, Rhode Island, and New Hampshire claimed three out of the top five spots for year-over-year price gains, rising 8.1%, 7.5%, and 6.3%, respectively. Rhode Island and New Jersey prices reached new highs in October.

Meanwhile Washington D.C., Idaho, and Montana top the list this month for the states that are furthest from their price peaks. Each location was down from its former high point by -3.5%, -2.5%, -2.1%, respectively. However, on a year-over-year basis, Washington D.C. prices are still up 4.7%.

Despite the price declines seen in certain areas of the country, overall national price growth is expected to continue at a muted pace. Still, forecasts suggest that national single-family home prices will reach a new peak level in April 2025. Currently, the median sales price for all single-family homes in the U.S. is $385,000.

From Business Insider:

Here are four predictions Zillow has for next year’s market.

Olsen said the housing market was slowly becoming “unstuck,” a trend that should continue as home prices rise at a “modest” pace.

The firm predicts that home prices will rise by 2.6% in 2025, while existing-home sales will notch 4.3 million, up from the 4 million sales it expects this year.

“While affordability challenges will remain, buyers should expect more homes on the market, meaning more time to consider their options and more leverage in negotiations,” Olsen said.

Zillow predicted that mortgage rates would bounce throughout next year.

The firm pointed to recent changes in the 30-year fixed mortgage rate, which fell this year before climbing to nearly 7% as markets adjusted their expectations for borrowing costs amid sticky inflation and a robust economy.

“More swings like this are expected in 2025, with refinancing sprints occurring during the dips,” Olsen said.

Zillow’s data indicates most “buyer’s markets” in the US are in the Southeast. But it said buyers could find more opportunities in the Southwest next year as more inventory in the region becomes “unstuck” and attracts homebuyers.

“These buyer’s markets should have the greatest number of movers, while sellers will feel the heat of competition as buyers will have more homes to choose from,” Olsen said.

But Olsen added that falling mortgage rates could prevent buyers from moving west, as lower borrowing costs stimulate demand and give sellers the upper hand.

Zillow predicted that small homes would continue to rise in popularity. The firm said the word “cozy” appeared in 35% more Zillow listings this year than last year, a sign that buyers could be more interested in downsizing to smaller and more affordable abodes.

“Home values of small condos are finally stabilizing after remote work left downtowns more empty, even while home value appreciation of larger properties — though much stronger — continues to soften,” Olsen said.

From NJ1015:

President-elect Donald Trump said Saturday he intends to nominate real estate developer Charles Kushner, father of Trump’s son-in-law Jared Kushner, to serve as ambassador to France.

Trump made the announcement in a Truth Social post, calling Charles Kushner “a tremendous business leader, philanthropist, & dealmaker.”

Kushner is the founder of Kushner Companies, a real estate firm based in Florham Park. Jared Kushner is a former White House senior adviser to Trump who is married to Trump’s eldest daughter, Ivanka.

The elder Kushner was pardoned by Trump in December 2020 after pleading guilty years earlier to tax evasion and making illegal campaign donations.

From NJ Digest:

New Jersey residents will pay more in taxes over their lifetimes than those in any other state, according to a recent study by Self Financial.

The analysis, titled A Life of Tax, estimates the average American will pay $524,625 in taxes over a lifetime, accounting for just over one-third of total earnings. However, New Jersey’s tax burden far surpasses that figure, with residents paying an average of $987,117 throughout their lives — the highest in the nation.

The study determined that this tax burden amounts to 54.3% of lifetime earnings, also the largest percentage among all states.

Here’s how New Jersey’s taxes break down:

The report included property, income, sales, and vehicle taxes for all 50 states and Washington, D.C.

Other locations with high lifetime tax burdens include Washington, D.C. ($884,820), Connecticut ($855,307), Massachusetts ($816,700), and New York ($748,199).

From MarketWatch:

Home prices in the 20 biggest U.S. metropolitan areas lost more steam in September, buckling under the pressure of high mortgage rates and historic unaffordability.

The S&P CoreLogic Case-Shiller 20-city house-price index rose 0.2% in September, compared with the previous month.

Home prices in the 20 major U.S. metropolitan markets were up 4.6% in the 12 months ending in September.

That’s a deceleration compared with an increase of 5.2% the previous month. Economists surveyed by Dow Jones Newswires and the Wall Street Journal expected the 20-city index to increase by 4.8%.

A broader measure of home prices, the national index, rose 0.3% in September and was up 3.9% over the past year. All numbers are seasonally adjusted.

Home prices posted the slowest gain since September 2023.

Even though prices are growing less rapidly, the 20-city and national indexes still inched to new record highs in September.