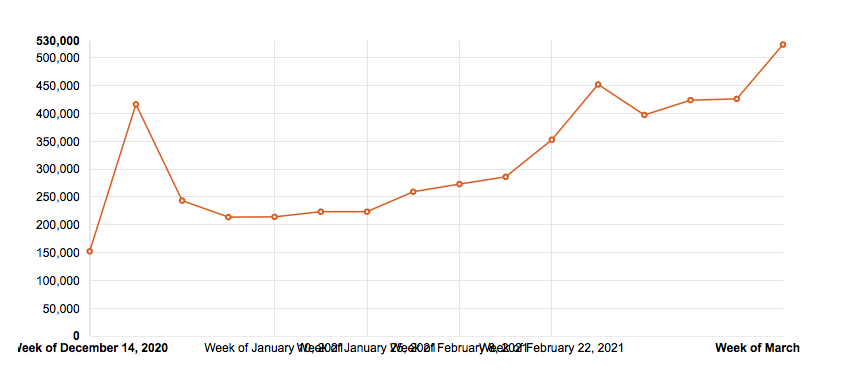

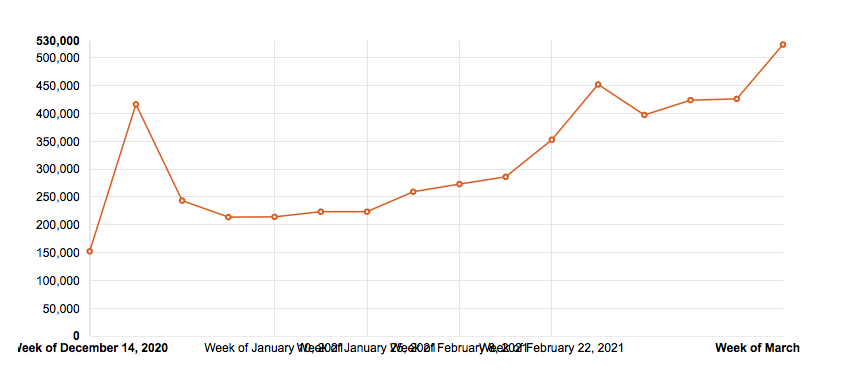

Weekly COVID Vaccine Allocations – New Jersey

Weekly COVID Vaccine Allocations – New Jersey

From the Star Ledger:

Lenders behind the American Dream mega mall project are in the final stages of taking a 49% stake in two other malls owned by developer Triple Five that were used as collateral for a $1.2 billion construction loan in New Jersey, the Financial Times reported, citing people involved in the deal.

The loan that was defaulted on is held largely by JP Morgan, along with Goldman, Starwood Capital, CIM Group, Soros Fund Management, Wafra and iStar. The restructuring, the Financial Times reported Friday, was expected to close as early as “this week,” although the process has been complicated by the number of lenders and could be delayed.

A spokesperson for American Dream declined to comment.

The cash crisis at American Dream came to light earlier this month when Kurt Hagen, senior vice president of development for Triple Five, told a joint meeting of the Bloomington, Minn. city council and its port authority that the pandemic created a “very significant cash flow crisis” for American Dream and that collecting on the collateral was “likely to happen.”

Hagen described the collateral pledge as an indirect ownership interest that does not include any assets or Mall of America property. “It simply means that once we return to profitability, 49% of those profits would go to the American Dream lenders until such time as that collateral is released,” Hagen said.

The developer has also filed a lawsuit against a prospective tenant for breach of contract because it failed to open two eateries. And construction companies have filed nearly $41 million in liens against Triple Five, saying they are owed for work performed at the site.

From Mansion Global:

Low supply and high demand have pushed U.S. home prices to record levels during the Covid-19 pandemic.

The median sale price for a home in the U.S. hit an all-time high of $331,590 during the four-week period ending March 21, a 16% jump compared to the same time in 2020, according to a report Friday from Redfin.

At the same time, active listings plummeted 42% year over year for the month ending March 21, marking the biggest decline since at least 2016, when Redfin began tracking the data.The number of new listings was down 12% in the same time period, while the asking price rose to $349,973, an 11% increase.

“It’s concerning how much home prices have risen during the pandemic,” the chief economist of Redfin, Daryl Fairweather, said in the report. “When the pandemic is over, purchasing a home is going to cost much more than ever before, putting homeownership much further out of reach for many Americans. That means a future in which most Americans will not have the opportunity to build wealth through home equity, which will worsen inequality in our society.”

Homes are also selling faster than ever, according to the report.

From ABC 7:

The median home selling price on Long Island rose by at least $73,000 throughout the last year, according to broker listing database OneKey MLS, due to high buyer demand and low inventory of homes.

“It’s a great time to be a seller,” said real estate agent Christine Tabacco-Weber, with Cold Spring Harbor-based Lucky to Live Here Realty. “It’s a really tough time to be a buyer.”

According to OneKey MLS, the median home sale price in Suffolk County in February 2020 was $402,444, compared to $475,000 in February 2021.

In Nassau County, the median home sale price in February 2020 was $525,000, compared to $600,000 in February 2021, an increase of $75,000.

At the same time, inventory has dropped significantly since this time last year, creating all-out bidding wars between buyers.

…

She said buyers are paying for seller’s moving costs, closing costs, and even are offering sellers to live in the house by paying rent or staying there completely free for a certain period of time.

“If you want to leave New York, this is the time,” she said. “Your house will probably sell in a weekend.”

From the Star Ledger:

Gov. Phil Murphy urged more New Jersey schools to return to in-person learning Wednesday, just days after rallying parents placed blame for lingering closures squarely at the governor’s feet.

“Now is the time for all of our schools to meaningfully move forward with a return to in-person instruction, whether it be full-time or with a hybrid schedule,” Murphy said during his regular coronavirus briefing in Trenton.

The governor pointed to billions in federal funding headed to schools from the American Rescue Plan and said his administration is doing everything in its power “to get as many kids back safely and responsibly into a classroom.”

Murphy’s comments come as the number of students with the opportunity to attend classes in person continues to grow. The governor reported 142 school districts, serving 107,498 kids, are now providing full in-person instruction. Another 534 districts, representing 843,394 students, are operating under hybrid schedules.

However, 317,044 students across 98 districts remain in all-remote instruction a full year after most schools initially closed due to the coronavirus pandemic. Parent frustration in many of those communities has long since boiled over, leading to parent rallies, legal battles and even a police investigation into the suggestion of “physical violence” against those keeping schools closed.

From the Star Ledger:

Thousands of families forced from their homes. Homelessness at historic levels. A city already devastated by COVID-19 facing yet another crisis.

Newark is on the brink of a housing emergency — hastened by the coronavirus — that could have cascading effects across New Jersey.

More than 14,000 eviction cases are pending in Essex County court — most of them thought to involve Newark tenants — delayed because evictions have been suspended during the pandemic under Gov. Phil Murphy’s emergency order.

But as more people get vaccinated and the state climbs out of the devastation wrought by the pandemic, Newark and other cities could be plunged into an eviction crisis they’re not prepared to face.

“Unless there is something systemically done to address this overwhelming backlog and imminent avalanche (of evictions), I do not think things are going to be back to normal,” said Khabirah Myers, a lawyer in Newark’s Office of Tenant Legal Services. “We’re going to see potential homelessness at historic levels.”

The problem is not confined to Newark. A staggering number of New Jersey residents could be thrown out of their housing unless substantial funding is earmarked for rental assistance for tenants who have fallen behind on rent and evictions are further delayed, experts say.

Around 60,000 evictions are pending across the state, data from the state judiciary shows. Matt Shapiro, president of the New Jersey Tenants Association, said those likely represent only a fraction of evictions that will be filed once the moratorium ends.

“Most landlords haven’t filed evictions because of the lockout moratorium,” Shapiro said. “If we don’t do something, you’re going to see 200,000, 300,000 pending evictions.”

From Politico:

The booming housing market helped stave off economic collapse in 2020. But soaring prices are starting to worry policymakers, who fear the market could lock a generation of would-be buyers out of homeownership.

Home prices in January — typically a slow month for the market — were up 14 percent over the same month the previous year, while sales jumped 24 percent, despite an unemployment rate that was almost twice as high. Demand for existing homes is so strong that the average residence is on the market for just three weeks, and inventory is at a record low after seeing its steepest drop last year since the data was first tracked in 1999.

It all threatens to freeze broad swaths of the population out of the market, leaving millions of Americans in a less secure financial position, widening the racial wealth gap and forcing millennials, already lagging previous generations in building wealth and forming families, to fall even further behind.

“The dream of homeownership is out of reach for so many working people,” said Senate Banking Chair Sherrod Brown (D-Ohio). “Rising home prices and flat wages means that many families, especially families of color, may never be able to afford their first home.”

Brown, who insists on calling his panel the “Senate Banking and Housing Committee,” vowed that these issues will be a top priority in the months ahead as the country struggles to recover from the pandemic-induced recession. Among other things, he said he plans to work with the Biden administration to address the rising cost of housing and expand access to homeownership “so that more families can rent and own homes in inclusive communities.”

The last time the U.S. saw such skyrocketing home prices, the ensuing crash brought down the global economy. Most industry analysts say the current boom is not a “bubble” akin to that frenzy of more than a decade ago, which led to the financial crisis.

From NJ Best:

New Jersey is hot.

New Jersey real estate, that is.

Close observers of the housing market in the Garden State eagerly pointed out areas and towns that are really smoking.

All of Bergen and Essex counties for their proximity to New York, but especially Wykoff in Bergen County and Montclair and Glen Ridge in Essex County.

All of Monmouth and Ocean counties — the Jersey Shore — but especially waterfront and water view properties.

The heat wave extends west, to Morris County, especially Madison; to Hunterdon County, especially Tewksbury and Clinton; and even as far west as Sparta. In Union County, Westfield is in high demand.

In the Trenton area, it’s West Windsor.

In the Philadelphia suburbs, Cherry Hill — with a sale price up over 14% — and Willingboro — up 10.5% — are exceptional.

“In Montclair and Glen Ridge, homes are selling for $100,000 to $200,000 above the asking price — big, older houses,” said Angela Sicoli, a Century 21 broker-owner and president of the New Jersey Association of Realtors.

Recent sales statistics for Montclair show the median home price at $975,000, up almost 30% year over year, and buyers were paying 116% of the asking price. Montclair had 57 new home listings last August, considered an 18-month supply of inventory in normal times.

From NJ Spotlight:

The pandemic brought with it a number of unexpected economic surprises, among them a booming housing market in much of New Jersey, with low inventory and intense competition among buyers often leading to bidding wars; average home prices are at the highest level in state history.

Contributing to the competitive real estate market, says Morris Davis, the Paul V. Profeta Chair at the Rutgers Business School, is that millennials are reaching the age when they’re starting families and looking for homes. Correspondent Joanna Gagis reports.

Wow.

From the NYT:

The Food and Drug Administration on Saturday authorized Johnson & Johnson’s single-shot Covid-19 vaccine for emergency use, beginning the rollout of millions of doses of a third effective vaccine that could reach Americans by early next week.

The announcement arrived at a critical moment, as the steep decline in coronavirus cases seems to have plateaued and millions of Americans are on waiting lists for shots.

Johnson & Johnson has pledged to provide the United States with 100 million doses by the end of June. When combined with the 600 million doses from the two-shot vaccines made by Pfizer-BioNTech and Moderna slated to arrive by the end of July, there will be more than enough shots to cover any American adult who wants one.

But federal and state health officials are concerned that even with strong data to support it, some people may perceive Johnson & Johnson’s shot as an inferior option.

The new vaccine’s 72 percent efficacy rate in the U.S. clinical trial site — a number scientists have celebrated — falls short of the roughly 95 percent rate found in studies testing the Moderna and Pfizer-BioNTech vaccines. Across all trial sites, the Johnson & Johnson vaccine also showed 85 percent efficacy against severe forms of Covid-19 and 100 percent efficacy against hospitalization and death.

From ABC News:

U.S. home prices surged at the fastest pace in nearly seven years in December, fueled by low mortgage rates and Americans moving from crowded urban areas to houses in the suburbs.

The S&P CoreLogic Case-Shiller 20-city home price index, released Tuesday, climbed 10.1% in December from a year earlier. The year-end jump was the biggest since April 2014 and follows a strong 9.2% year-over-year gain in November.

Home prices climbed 14.4% in Phoenix , 13.6% in Seattle and 13% in Seattle in December. But prices rose all over. Chicago, which recorded the slowest price gain, saw a 7.7% uptick. Detroit was not included in the year-over-year figures because of record-keeping delays caused by the coronavirus pandemic.

“These data are consistent with the view that COVID has encouraged potential buyers to move from urban apartments to suburban homes,” said Craig Lazzara, global head of index investment strategy at S&P DJI.XX. But he said it was unclear whether the trend would last.

Prices have also been pushed up by the limited supply of homes on the market. “With mortgage rates remaining relatively low and the wave of eager buyers continuing to swell, it’s unlikely that this competition for housing, and subsequent strong price appreciation, will meaningfully abate in the near future,” said Matthew Speakman, economist at the real estate firm Zillow.

Homebound consumers are also sprucing up their living quarters. Commenting on a year-end surge of revenue and earnings at Home Depot, Neil Saunders of GlobalData calculated that Americans each spent the equivalent of $402 last year at the home-improvement giant.

From Barrons:

Last year was an exceptional one for the housing market, which boomed in the second half. The National Association of Realtors’ January existing-home-sales data show the continuation of some of the same trends this year—as well as some key changes and rising challenges.

Existing-home sales in January reached a seasonally adjusted annual rate of 6.69 million, faster than the 6.61 million FactSet consensus expected, and an increase of 0.6% from December’s revised rate. Sales were up 23.7% compared with last January, the release said.

That high rate shows the resale market is still hot after home sales shot up in the second half of the year. January’s seasonally adjusted rate is one of the highest since April 2006, second only to the rate reported in October 2020, Lawrence Yun, chief economist at the National Association of Realtors, said on a conference call with reporters.

While single-family sales remained strong at a rate of 5.93 million, condo and co-op sales made a greater leap. Sales of condos and co-ops increased 4.1% month over month and 28.8% year over year, compared with a single-family sales increase of 0.2% month over month and 23% year over year.

Single-family-home sales jumped 23% compared with last January—but the picture varies by price point.

Homes priced between $250,000 and $500,000 comprised the greatest share of homes sold at 40.1%. Sales in this category grew 27% year-over-year.

A historically tight supply of existing homes for sale could have cut into transactions in 2020—a trend that shows little sign of slowing in 2021. Housing inventory set another record low in the first month of the new year, Yun said on the call, falling to 1.04 million units. Months’ supply, or how long it would take at the current sales pace to sell every home listed, remained at 1.9 months, flat with December but down from 3.1 months last year. “Sales could be even higher, but just inventory is simply not there,” Yun said.

From CBS:

President Joe Biden is extending a ban on housing foreclosures to June 30 to help homeowners struggling during the coronavirus pandemic.

The moratorium on foreclosures of federally guaranteed mortgages had been set to expire on March 31. On his first day in office, Mr. Biden had extended the moratorium from January 31. Census Bureau figures show that almost 12% of homeowners with mortgages were late on their payments.

The White House says the coordinated actions announced Tuesday by the Departments of Housing and Urban Development, Veterans Affairs and Agriculture also will extend to June 30 the enrollment window for borrowers who want to request mortgage payment forbearance — a pause or reduction in payments — and will provide up to six additional months of forbearance for borrowers who entered forbearance on or before June 30 of last year.

The White House says more than 10 million homeowners are behind on mortgage payments and Mr. Biden’s actions are to help keep people in their homes amid “a housing affordability crisis” triggered by the pandemic. It says “homeowners will receive urgently needed relief as we face this unprecedented national emergency.”

From the Star Ledger:

If you’re thinking about renting a house at the Jersey Shore this summer, brokers have one piece of advice for you: Don’t wait.

The increased demand that was seen last summer is continuing into the summer of 2021 as more people have discovered this close-to-home getaway and those who didn’t book in time last season who locked in earlier this time around.

“We saw a tremendous surge in May of last year once (Gov. Phil) Murphy said the shore would be open,” said Matthew Schlosser, vice president of Schlosser Real Estate in Lavallette.

The company booked 800 rentals between May and June, up 35 percent from the previous year.

And people who rented last summer began booking their stays for this summer even earlier than normal. By fall, Schlosser said, he had 30 percent more rentals booked for Summer 2021 than he normally does. And from Jan. 1 until now he’s done another 500 or so reservations.

“The problem is now, we’ve pretty much run out of inventory for late July/early August,” he said. Typically the inventory isn’t this low until April or May.