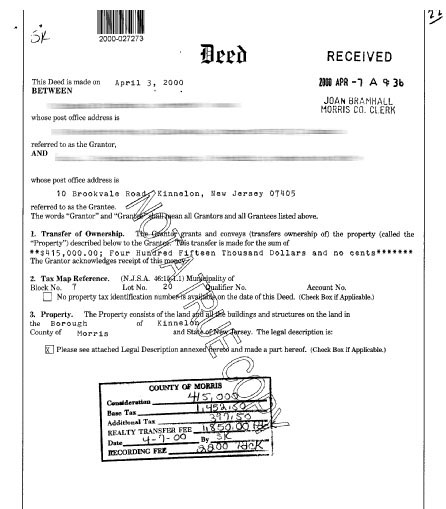

Step 1: Buy a house for $415,000 (April, 2000)

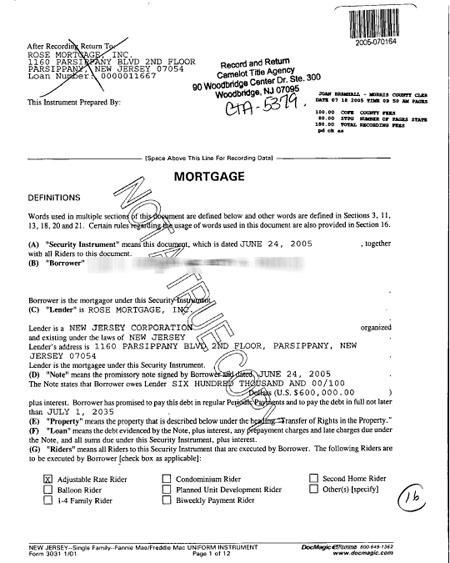

Step 2: Cash out to the tune of $600,000 (June, 2005)

Step 3: Sell out and profit, a 115% gain in 6 years seems reasonable (May, 2006)

MLS# 2276951

10 Brookvale Road, Kinnelon NJ (Smoke Rise)

Listed: 5/11/2006

List Price: $895,000

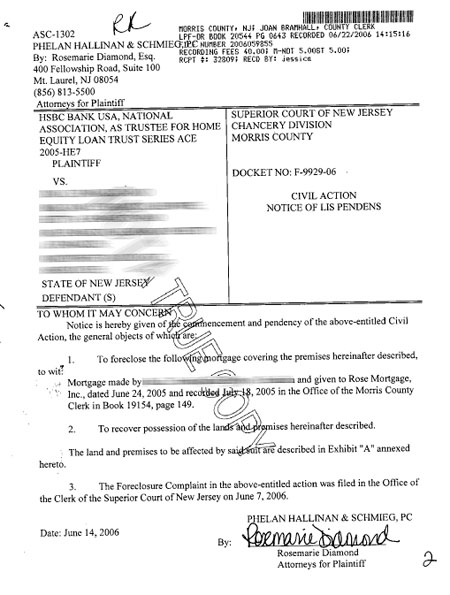

Step 4: Hmm, didn’t plan on step 4 (June, 2006)

Step 5: No problem, so the profit is just a bit lower than expected. (Thru the end of 2006)

MLS# 2276951

Reduced to : $695,000 (not much left after commission and expenses)

Days on Market: 190

Expired

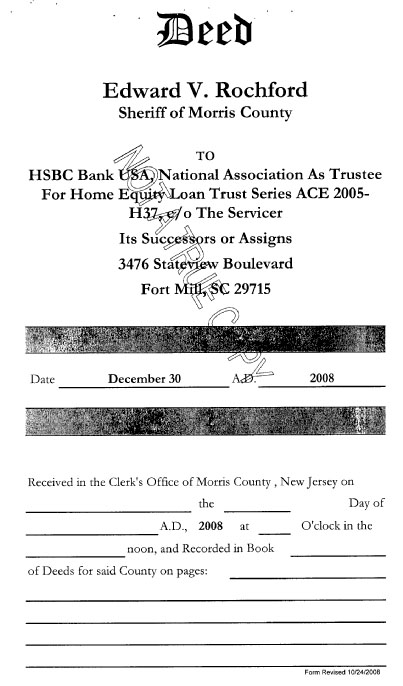

Step 6: Too late for Step 5 (December, 2008)

Step 7: Bank dumps it (October, 2009)

MLS# 2687193

Listed: 6/1/2009

Original List Price: $494,900

Reduced to: $428,000

Days on Market: 101

Sale Price: $330,000

frist!!!!!!!!!!!!!

From the Daily Record:

Hanover postal facility could close

A conveyor belt propelled catalogs and cards through the West Jersey Processing and Distribution Center on Tuesday morning, processing them en route to mailboxes whose ZIP codes start with 079 or 078.

More than a million pieces of mail are processed at the center every day, and during the holiday season the workload doubles, plant manager Joseph Maloney said. Virtually all of the processing is automated, and about 320 employees in the facility transport the mail, and feed and maintain the machines.

But even as the facility gears up toward the peak of the holiday season, the plant on South Jefferson Road in the Whippany section of the township is facing possible closure. Amid a sharp drop in mail volume across the country due to e-mail and a down economy, the Postal Service is trying to better match its resources and workforce to the workload, officials said.

From the NYT:

New York Times News Service to Cut Jobs and Relocate

The New York Times News Service will lay off at least 25 editorial employees next year and will move the editing of the service to a Florida newspaper owned by The New York Times Company, the newspaper and the Newspaper Guild said Thursday.

A spokeswoman for The Times, Diane McNulty, said 25 of 30 news service jobs would be eliminated at the main office in New York, with five employees retaining their positions. The guild put the number of jobs to be cut at 28. Some of the layoffs were scheduled for February and the rest for May.

The layoffs do not count toward the planned elimination of 100 jobs in The New York Times newsroom. That 8 percent reduction is to take effect by the end of the year.

From Bloomberg:

U.S. Treasury Confident Congress Will Increase Debt Ceiling

The Obama administration is confident Congress will raise the country’s debt limit by year end to avert a showdown similar to the one that shuttered parts of the government in 1995, administration officials said.

The White House wants an increase of at least $1 trillion to $1.5 trillion, according to a person familiar with the deliberations between lawmakers and the administration. Record budget deficits are pushing the national debt closer to the $12.1 trillion statutory limit.

The administration’s request, higher than a proposed increase already passed in the House of Representatives, would get the government through the November 2010 midterm congressional elections without needing another increase. Earlier this month, Treasury officials acknowledged they’ll need more borrowing room by year-end to avoid market disruptions.

“Market participants still remain on edge, especially since many have concerns over the rising debt loads that were kicked off this year,” said George Goncalves, chief fixed- income rates strategist in New York at primary dealer Cantor Fitzgerald LP.

From HousingWire:

Temporary Jumbo Loan Limits Extended Through 2010

The temporary increased maximum loan limits originally set to expire at the end of the year will remain in place through 2010, according to the Federal Housing Finance Agency (FHFA).

The limits for conforming jumbo loans eligible for purchase by the government-sponsored enterprises (GSEs) was set at $417,000 for single-family homes by the Economic Stimulus Act of 2008 (ESA) and the Housing and Economic Recovery Act of 2008 (HERA), but were set to expire at the end of 2009.

For those who think foreclosure is a quick process, please review the difference between the Lis Pendens date (the first step in foreclosure), and the Sheriff Sale (the last step).

LPF: 6/22/2006

SHR: 12/30/2008

#6 grim

do you think they were working w/ the bank to try and stay? I would that added to the process. The timeline doesn’t add up for that though. Banks weren’t asked to work w/ people that early on

Re#4 Debt ceiling

The wrecklessness in this government is disgusting.

Our children will never know how great a country

America once was.

I wish I could find a house like that around here for 330.

We actually talked about it on the blog a few months back.

And I did talk to more than 1 blog reader about it.

I really thought it would go for close to the $425k mark.

I never thought it would have sold for that low of a price.

#10 – never thought it would have sold for that low of a

price.

Perhaps all the copper was torn out!!

Perhaps all the copper was torn out!!

That’s a good point. What was the condition of the house when it finally sold?

3: NYT had News Service?

Step 1: Collect underpants

Step 2: ?

Step 3: Profit!

The resemblance to the dot-com mania has never been clearer.

That’s a good point. What was the condition of the house when it finally sold?

That 1.41 acres of dirt is worth the sale price alone.

15 Grim

That 1.41 acres of dirt is worth the sale price alone.

OK but that doesn’t answer my question.

Might have been trashed, no idea, there were no interior pictures on the last listing. The 2006 shots looked decent, although not for the asking price at the time.

Can’t possibly be worse than 274 Long Meadow in Smoke Rise. The owners up and left last winter without shutting off the water. Every pipe burst, massive flooding, the home was almost completely destroyed.

That sold for $320,000 in August of this year. Was purchased for $675,000 in September of 2005.

From Bloomberg:

Home-Purchase Index in U.S. Plunges to Lowest Level Since 2000

Mortgage applications to purchase homes in the U.S. plunged last week to the lowest level in almost nine years as Americans waited for the outcome of deliberations to extend a government tax credit.

The Mortgage Bankers Association’s index of applications to buy a house dropped 12 percent in the week ended Nov. 6 to 220.9, the lowest level since Dec. 2000. The group’s refinancing gauge rose 11 percent as interest rates decreased, pushing the overall index up 3.2 percent.

The drop in buying plans points to the risk that the recent stabilization in housing will unravel without government help. In a bid to sustain the recovery, Congress passed and the administration signed a bill last week to extend jobless benefits and incentives for first-time homebuyers, adding a provision that also made funds available to current owners.

“Uncertainty over the housing tax credit sent some tremors through the market in recent weeks,” Michael Larson, a housing analyst at Weiss Research in Jupiter, Florida, said before the report. “But now that Congress has extended and expanded the credit, we should see demand pick back up.”

I’ll put money on the FTHB credit becoming permanent next year.

Anyone want to take a bet against me?

#19 – Anyone want to take a bet against me?

Nope. While we’re guessing, how big is the next stimulus package going to be?

Sooooooooooooooooooo big!

So 274 Long Meadow became nothing more then a shell and it sold for 320.

I think I’m going to be a de-commissioned missile silo. http://www.missilebases.com/properties

CalculatedRisk has an FHA report on DAP and its problems.

A fun quote;

Yeah, I thought they’d wait until another stock market drop before Quantative Easing II but Bergabe might start that up again before anything like that happens. I am sure his whole US/China sitdown is about how we can mutually destroy our currencies.

Does anybody here work at Bank of America? Congrats, if Corzine becomes CEO your job security just went through roof because as NJ residents we can all vouch that he does not fire or layoff anybody.

Just found out late yesterday that a client of mine- whose short sale approval is not going well- called the mitigator directly and told her that if the approval didn’t come before cold weather, they’d shut off the heat and leave.

My first reaction was to get angry at the client, but I checked it. That was actually a brilliant move. I think we will get approval now.

Ever been in a house where every single radiator has burst?

Looks like a machine gun massacre after it happens.

I think we’re on a track now on which the only real x-factor is trying to game when, how and where the doomsday event hits.

President Barack Obama said Thursday he’ll host a White House summit next month on combating the joblessness that continues to drag on a struggling economy.

How nice, don’t you think? Yes, continue to talk about it, that will solve everything. How’s that $775,000,000,000 stimulus package working? Didn’t you create 1,000,000 jobs and hold that U6 rate under 8%? Here’s a thought, why not give every incentive possible to small and medium sized companies to expand and hire? Drop the campaign rhetoric, Barry, or the proletarians might discover that it was all a ruse.

26 Clot

That sounds like something I would do. I think it was the right move. If the mitigator has a clue, he/she will get things rolling before their house is destroyed.

29 Gary

I think you’ve become immune to your meds. Maybe chat with the doc about increasing? :)

lost,

I just did a 50mg shooter, I should be could in 3… 2… 1… ahhhh…. :)

could = good

Hahaha, now they are bringing that Khalid Sheik Muhammad dude to NY for a show trial. I guess they found the dog and pony show for the sheeple to keep their eyes glued on while they empty their wallets;)

So some of you who have been waiting 5 years already to buy a house are just going to keep waiting for the mother of all implosions to come? Sort of like waiting for Godot isn’t it?

Where do you all buy your patience and do they sell in bulk quantity?

Maybe the chosen one will give this a read before his summit:

Mish Unemployment Projections Through 2020 – It Looks Grim

Inquiring minds are interested in figuring out how long it might take to get back to “full employment” defined as 5%.

http://globaleconomicanalysis.blogspot.com/2009/11/mish-unemployment-projections-through.html

“U.S. Treasury Confident Congress Will Increase Debt Ceiling”

[4],

Ceilings get raised, floors get lowered. Got demand.

“Home-Purchase Index in U.S. Plunges to Lowest Level Since 2000”

[18],

The previous low was right before handouts for houses was implemented. The same can be seen, on the chart, for cash for clunkers. If you don’t bribe them, will anybody show up? Got demand?

One other item, kiss your purchasing power bye-bye.

One Theme Bob

32 Gary

What do I have to do to get you to share?

“Here’s a thought, why not give every incentive possible to small and medium sized companies to expand and hire?”

Gary,

Who’s their lobbyist, how much is put in the kitty?

Why not print $10T and buy every mortgage? It may be cheaper in the long run.

New York is THE CENTER of the finance and media universes. Anyone who is anyone is located here. As such, NY will NEVER suffer the same kind of downturn as lesser cities. It is different here.

After all, it is not like this kind of work can be performed just anyplace, say Florida for instance.

How does China rig up 8% GDP growth? Easy. Build cities, then leave them vacant. This one was built to hold 1mm residents…and it’s empty:

http://www.youtube.com/watch?v=0h7V3Twb-Qk&feature=player_embedded

This is all going to end well.

lost,

When the government healthcare plan kicks in, we’ll have all the free meds we want along with the encouragement to “off” ourselves as quickly as possible as to lessen the burden on the system. ;)

“Increase Debt Ceiling”

Does anyone actually believe there is a cieling? Every time we approach it, Treasury says “increase it or we will default and the world will crumble.” Until congress tells an administration, “NO!,” there will never be any incentive to live within 4x our means.

“Increase Debt Ceiling”

Does anyone actually believe there is a cieling? Every time we approach it, Treasury says “increase it or we will default and the world will crumble.” Until congress tells an administration, “NO!,” there will never be any incentive to live within 4x our means.

#41 – As such, NY will NEVER suffer the same kind of downturn as lesser cities. It is different here.

NY is lucky that the traditional media is doing so well.

… on a related note. Do you think the TV industry, looking at what is going on with newspapers and magazines, know they’re next?

Gary

Well I hope the plan kicks in soon then. I’m not sure my job will outlast the insurance covering the injury I’m being treated for right now.

“. This one was built to hold 1mm residents and its empty”

We can send them our illegals. They work cheap and should fit in well.

Shore (48)-

Probably hard to find a good burrito or chimichanga in Mongolia.

There will come a time when many industries rralize there is no compelling reason to be located in a particular location. Let’s take fashion for instance, the entire industry could up and move to Utica, Akron, etc., drive costs way down, improve the quality of life for the workers who actually make the stuff; the designers could still liveand frolic in The City with no adverse consequences to the business while driving down the costs of operations.

The media is the same way. Everything is traveling via electrons and photons anyway. There is little reason, beyond inertia, to keep the majority of editors and technical staff in a highrise building in midtown Manhattan.

#18 So are we going to have to make the tax credit permanent?

“This one was built to hold 1mm residents…and it’s empty:”

Clot,

No demand. They have all packed up,on their way here, buying up the mold coast.

Grim looked at that house 3 months ago, I disagree the dirt is worth the price, kinnelon makes its budget every year onthe smoke rise taxes. Interior was not trashed but needed major renovations. Who knows what was behind the walls. I love smoke rise security we practically needed an escort to get to the house. I wouldn’t have paid more than 250 for it based on the major updates it needed, but congratulations to the new knife catcher

How bad is the job market? There was a guy interviewing yesterday at the place where I’m contracted for a Business Analyst position. It’s a contract position as they all are now, so companies don’t have to give you benefits and toss you away in a fleeting moment without notice. The position pays $22 per hour. Yup. That should get you that “starter” 3bd/2th home listed at $550,000 with no problem at all, don’t you think? For those of you that haven’t lost your job yet, prepare yourself for the new society. If you think it can’t happen to you, think again.

CAPITAL ONE CAPITAL VI 08.87500% 05/15/2040 MAKE WHOLE

New Issue 014043DAB7

Price 100

This should be a major sign of how disfunctional mortgage market is. Capital One which is actually a pretty good bank that passed stress test with flying colors and is in Too Big Too Fail Club does a new 30 year bond issuance with week with almost a 9% coupon, yet they are lending money out in 30 year mortgages at 5% thanks to uncle sam’s voodoo and zombie fannie and freddie.

#35 Better question is do we even want one any more? No upside and 10K minimum a year in property taxes.

Renting is the new black.

John (55)-

Capital One is insolvent.

35.

Seneca, after 5 years I’ve grown attached to my big, fat down payment.

Seneca #35 – you work at CS? (re: Godot reference)

54- gary- I try not to get discouraged but realistically I feel like I will never see my old salary again. So, I just have to move on from there and re-adjust my expectations. But expectations are one thing and paying one’s bills are another. There are still plenty of people living in their little bubble thinking it can never happen to them. Or, they might just be in that denial state.

I love that endlessly used arrest shot of him. He’s the only guy I’ve ever seen with more chest hair than grim.

34.Dissident HEHEHE says:

November 13, 2009 at 8:03 am

Hahaha, now they are bringing that Khalid Sheik Muhammad dude to NY for a show trial. I guess they found the dog and pony show for the sheeple to keep their eyes glued on while they empty their wallets;)

49.Schumpeter says:

November 13, 2009 at 8:37 am

Shore (48)-

Probably hard to find a good burrito or chimichanga in Mongolia.

strumpet: I think you could still end up with a good case of the runs….

How much is the economic value of that make whole call?

55.John says:

November 13, 2009 at 8:44 am

CAPITAL ONE CAPITAL VI 08.87500% 05/15/2040 MAKE WHOLE

New Issue 014043DAB7

Price 100

Bost: I have to suck it up. You are correct…the retail sales have come out…they have sucked…market has shrugged it off. Supports your opinion that what we are witnessning is a crock of sh!t.

That said, you can argue pretty strongly that we could have had a b!tch of a selloff on these numbers….instead we stand firm…..following my thesis….

Earnings Season in Home Stretch

http://www.zacks.com/commentary/12697/Earnings+Season+in+Home+Stretch

CWS Commentary:

“In other words, cost-cutting has been the major force driving earnings and earnings surprises. However, the costs to one company are either the revenues of another company or someone’s paycheck, which is then spent to create revenues for firms. The bottom-up data coming out of all these individual firms seems to confirm what we have been getting from the government’s macro statistics. The economy is growing due to increases in productivity. Higher GDP with fewer workers.”

I want to get some of this stimulus money. Anyone know how I can get a government loan to buy farmland then get paid by the government to not grow crops on it?

#35 – I think there are some of us that have another insight the NAR does not peddle about what it is to have a house, ‘home’. Most of it has nothing to do with a physical possession to which you hold title.

gary says:

November 13, 2009 at 8:43 am

“How bad is the job market? There was a guy interviewing yesterday at the place where I’m contracted for a Business Analyst position. It’s a contract position as they all are now, so companies don’t have to give you benefits and toss you away in a fleeting moment without notice. The position pays $22 per hour. Yup.

…. For those of you that haven’t lost your job yet, prepare yourself for the new society. If you think it can’t happen to you, think again.”

So spot on I have to laugh now or I’ll cry.

And wait until the contract/employee squeezers show “better” numbers to Wall Street and are more competitive in the short term so other companies paying actual salaries have to follow suit in order to stay in the game.

Of course eventually, median salaries will be half what they are now, plus those same companies will be worthless shells full of panicked “employees” but what the hell, GDP shows growth, the money guys are pleased and investors can always take their money elsewhere.

Gary -and probably 100 people applied for that $22/hr business analyst contract. If they are smart, they’ll offer $18/hr next time.

Chi [64],

There’s not been a selloff because the market is now focused in a different area.

At this time, it’s strictly a dollar/multi national’s trade. I luv stocks that garner 50% of their revenue overseas, saddled with little debt.

You want to watch these for indicators;

FXA

FXC

BZF

XLE

GLD

Euro/Yen cross

When these start to crack with the yen gaining in the cross, versus the euro, it may be time to pound the pavement/or hedge. IMO, I would rather hedge. I think any dollar rally, although can be violent, will be short lived.

Chi,

By the way, we have actually been talking the same trade, just different vehicles.

“I want to get some of this stimulus money.”

Bairen,

Create a song.

http://www.youtube.com/watch?v=yGfQk9XXm24

A fun article from the Time Online about the rise in middle-class shoplifters.

/disclaimers; It’s the UK, the Times, etc, etc, etc.

26: If it comes to it, I wonder if threatening to have a sea wall removed from a vacant lot would get any traction?

“California is in a league of its own, but New Jersey also faces a steep climb out of the recession, according to a new study by the Pew Center on the States. Others in fiscal peril are Arizona, Nevada, Oregon, Florida, Illinois, Michigan, Wisconsin, and Rhode Island, the study authors warned.”

Anybody else finds a common theme with these failed states wrt voting patterns?

Ah the Era of Hope and Change.

Florida and Arizona have been turning blue because of out-taxed dems from failed states, especially NJ and CA have been moving in and bringing in their voting habits.

Captial One is a very good bank with excelent ratios and reserves, they dumped their subprime dog before complete collaspe and bought Northfork bank which is was a good conserative bank with a good management team. COF is the sympbol. I only own one teanie weinie 1k COF bond bought at an odd lot discount so I have really no stake in firm. But it is no citi, gmac, MI, Zions, BAC crap hole it is a pretty well run bank.

Schumpeter says:

November 13, 2009 at 8:55 am

John (55)-

Capital One is insolvent.

From NYT: Pfizer walks away from New London after the town goes to the SCOTUS for landmark eminent domain case:

“From the edge of the Thames River in New London, Conn., Michael Cristofaro surveyed the empty acres where his parents’ neighborhood had stood, before it became the crux of an epic battle over eminent domain.

City Councilman Robert M. Pero said, “I’m sure that there are people that are waiting out there to say, ‘I told you so.’”

“Look what they did,” Mr. Cristofaro said on Thursday. “They stole our home for economic development. It was all for Pfizer, and now they get up and walk away.”

That sentiment has been echoing around New London since Monday, when Pfizer, the giant drug company, announced it would leave the city just eight years after its arrival led to a debate about urban redevelopment that rumbled through the United States Supreme Court, and reset the boundaries for governments to seize private land for commercial use.

Pfizer said it would pull 1,400 jobs out of New London within two years and move most of them a few miles away to a campus it owns in Groton, Conn., as a cost-cutting measure. It would leave behind the city’s biggest office complex and an adjacent swath of barren land that was cleared of dozens of homes to make room for a hotel, stores and condominiums that were never built. . . .”

I think that in New London, payback is gonna be a b1tch.

And going forward, I think that Pfizer’s stiff-arm after the town went to the mat in Kelo means that the idea of a municipality doing another project of this sort is gonna earn local leaders the same sort of treatment that Gov. Hutchinson got in colonial Massachusetts.

75

Florida and Arizona have Republican governors, as do Nevada and RI.

Florida and Arizona also have Republican controlled legislatures.

safe:

“I want to get some of this stimulus money. Anyone know how I can get a government loan to buy farmland then get paid by the government to not grow crops on it?”

If you promise to bring in underage prostitutes from South America, ACORN will kindly help you.

Gary –

The position pays $22 per hour. Yup.

Wow! That is lower than Offshore rates. Looks like the process of wage equalization has begun.

This should provide a fillip to RE prices

78: 9 of 10 failed states voted for Obambi and have been turning blue for the last several years.

dow 6000 before dow 11000

http://finance.yahoo.com/tech-ticker/article/371145/Forget-11000-Dow-Heading-for-6000-and-GE-Still-a-Short-Charles-Ortel-Says?tickers=GE,^GSPC,^dji,PIN,GLD,SPY,DIA&sec=topStories&pos=9&asset=&ccode

i hope this doesn’t happen.

[78] hughesrep.

That is true, but Jamil is also correct. Those states are turning bluer, just as NH did when all of us m@ssholes moved there. I guess you can call them purple.

The whole blue/red thing is also misleading. When you look at county level voting maps, it is pretty apparent that no state is solidly one color or another, and I don’t recall that one candidate ever got more than 2/3 of the voters in a state (could be wrong there but doubt it).

That, BTW, is one reason I don’t foresee a secession happening without an absolute cataclysm that galvanizes voter sentiment in a particular state or region while other states or regions are diametrically opposed. It’s fun to debate secession, but it is, in reality, an exercise in fiction.

Okay, this is OT, and just for fun.

(apologies to the resident brits on the board, but I didn’t make this up)

“Britons Among ‘Ugliest People,’ Dating Site Says

Britons are among the ugliest people in the world, according to a dating Web site that says it only allows “beautiful people” to join.

Fewer than one in eight British men and just three in 20 women who have applied to BeautifulPeople.com have been accepted, an e-mailed statement from the site showed.

Existing members of the “elite dating site” rate how attractive potential members are over a 48-hour period, after applicants upload a recent photo and personal profile.

Swedish men have proved the most successful, with 65 percent being accepted, while Norwegian women are considered the most beautiful with 76 percent accepted, the site said.

The way that BeautifulPeople.com accepts new members is simple. A potential member applies with a photo and a brief profile. Over 48 hours, existing members of the opposite sex vote whether or not to admit them, the site said.

Options are: “Yes definitely,” “Hmm yes, O.K,” “Hmm no, not really” and “No definitely not.”

The site was founded in 2002 in Denmark and went live across the globe last month. Since then, the site has rejected nearly 1.8 million people from 190 countries, admitting just 360,000 new members.

“I would say Britain is stumbling because they don’t spend as much time polishing up their appearance and they are letting themselves down on physical fitness,” Beautiful People managing director Greg Hodge said. “Next to Brazilian and Scandinavian beauties, British people just aren’t as toned or glamorous. . . . ”

Had my fun, now I gotta get back to work while I still have a job.

[66] safe,

looking into it. It’s one way to fund the Nompound (really!)

(now I really have to get back to work).

Grim, others.

I’m just about to sign on the dotted line for a refinance on our Montclair Multi. We are stripping off 5 years from the loan making it a 20-year. Loan amount is 350K and the best quote I could obtain was 4.75 rate with $3320 closing costs, no points.

It works out to a monthly increase if $130 to shorten the loan by 60 payments. Seems to be a no-brainer to me.

Just looking for a sense-check or someone who knows a broker who might beat those rates?

Jamil = broken record

If Acorn didn’t exist, McCain still would have lost by a landslide. Give it up already. You lost. Accept it you doofus.

Jamil, if this was an island I am pretty sure you would be kicked off by now.

Is it taboo to comment on the topic of the original post? (Nt that the various and sundry tangent discussions aren’t enjoyable.)

NJ.com (via Google) puts a business called “Robinson Franklin Group, so-called “general management consultants” at that address. I’m going to have to presume that lag time of getting these things into search engines means that “Robinson Franklin” was the foreclosed owner. I suppose it’s fashionable to call yourself a self-employed “consultant” upon becomming unemployed while trying to tread water, but could anybody realy value such ‘management’ counsulting services that in practice appear to distill to ‘buy high, go broke’?

By the way, we have actually been talking the same trade, just different vehicles.

BC,

I represent the buy real sh*t and hold it safe away from gubmints reach. Very primitive and highly effective aproach for a grashopper/flipper/speculator/dumb and lucky SOB like myself.Now that Shiny has surpassed S&P500 I’m just counting the years before we get to DOW.

Wake me up when we get to 1:1 ratio or Lebron and/or Dwade sign.

35.Seneca says:

November 13, 2009 at 8:03 am

So some of you who have been waiting 5 years already to buy a house are just going to keep waiting for the mother of all implosions to come? Sort of like waiting for Godot isn’t it?

Where do you all buy your patience and do they sell in bulk quantity?

The home that sold in 2005 for $700k will be mine in 2010 for $350k. I pay it off in 7 years while the RE ‘genius’ c. ’05 is still sucking wind. He’s dealing with recast fully amortizing payments on his option arm while I’m buying planes and other toys for cash.

Patience is rewarded handsomely in a capitalist economy. Ever was it thus.

WHAT IS TODAY?

http://www.youtube.com/watch?v=Af1h4ibpKJA

Yikes,

That could well happen. Even Yamada was saying the max upside at this point is Dow 11000 and S&P 1200.

Nom [84],

Time for a vote recount;

http://www.wallpaperbase.com/wallpapers/celebs/elizabethhurley/elizabeth_hurley_58.jpg

ulqin-albani: I can’t believe how much the Nix suck a55. I can’t even watch it. I can’t believe that I am not even willing to sit down and watch 5 minutes. I still remember running around Scores during my bachelor party doing the LJ-sign in 1999.

make money says:

November 13, 2009 at 10:59 am

Wake me up when we get to 1:1 ratio or Lebron and/or Dwade sign.

My favorite bachelor party moment was during my cousin’s in NYC. We were trying to bargain to get 15 guys into the place on W 23rd right by West Street, and one of the guys vomits all over the glass door entrance……big chunks of calamari, spaghetti, marinara etc……it was the closest I had come to pissing my pants since I was 6 years old.

@Nom[83];

In ’84, DC (not a “real” state, I know)went for Mondale 85/14, when Reagan carried 49 states and only Mondale’s own Minesota (49.7/49.5) kept it from being 50-state sweep.

DC can, will, has, and will henceforth and evermore, go more than 2/3 democratic. Tells you alot about DC, don’t it?

-Moose

BC Bob says:

November 13, 2009 at 11:03 am

Nom [84], Time for a vote recount;

Hugh Grant is defective…..so she doesn’t mangia chorizo…WTF?

“I still remember running around Scores during my bachelor party doing the LJ-sign in 1999.”

Chi;

http://www.youtube.com/watch?v=Uloj3EQb0kQ

12 reasons unemployment is going to 12 percent from David Rosenberg.

1. For the first time in at least six decades, private sector employment is negative on a 10-year basis (first turned negative in August). Hence, the changes are not merely cyclical or short-term in nature. Many of the jobs created between the 2001 and 2008 recessions were related either directly or indirectly to the parabolic extension of credit.

2. During this two-year recession, employment has declined a record 8 million. Even in percent terms, this is a record in the post-WWII experience.

3. Looking at the split, there were 11 million full-time jobs lost (usually we see three million in a garden-variety recession), of which three million were shifted into part-time work.

4.There are now a record 9.3 million Americans working part-time because they have no choice. In past recessions, that number rarely got much above six million.

5. The workweek was sliced this cycle from 33.8 hours to a record low 33.0 hours — the labour input equivalent is another 2.4 million jobs lost. So when you count in hours, it’s as if we lost over 10 million jobs this cycle. Remarkable.

6. The number of permanent job losses this cycle (unemployed but not for temporary purposes) increased by a record 6.2 million. In fact, well over half of the total unemployment pool of 15.7 million was generated just in this past recession alone. A record 5.6 million people have been unemployed for at least six months (this number rarely gets above two million in a normal downturn) which is nearly a 36% share of the jobless ranks (again, this rarely gets above 20%). Both the median (18.7 weeks) and average (26.9 weeks) duration of unemployment have risen to all-time highs.

7. The longer it takes for these folks to find employment (and now they can go on the government benefit list for up to two years) the more difficult it is going to be to retrain them in the future when labour demand does begin to pick up.

8. Not only that, but we have a youth unemployment rate now approaching a record 20%. Again, this is going to prove to be very problematic for employers in the future who are going to be looking for skills and experience when the boomers finally do begin to retire.

9. The gap between the U6 and the official U3 rate is at a record 7.3 percentage points. Normally this spread is between 3-4 percentage points and ultimately we will see a reversion to the mean, to some unhappy middle where the U6 may be closer to 15.0-16.0% and the posted jobless rate closer to 12%. This will undoubtedly be a major political issue, especially in the context of a mid-term elections and the GOP starting to gain some electoral ground.

10. But when we do start to see the economic clouds part in a more decisive fashion, what are employers likely to do first? Well, naturally they will begin to boost the workweek and just getting back to pre-recession levels would be the same as hiring more than two million people. Then there are the record number of people who got furloughed into part-time work and again, they total over nine million, and these folks are not counted as unemployed even if they are working considerably fewer days than they were before the credit crunch began.

11. So the business sector has a vast pool of resources to draw from before they start tapping into the ranks of the unemployed or the typical 100,000-125,000 new entrants into the labour force when the economy turns the corner. Hence the unemployment rate is going to very likely be making new highs long after the recession is over — perhaps even years.

12. After all, the recession ended in November 2001 with an unemployment rate at 5.5% and yet the unemployment rate did not peak until June 2003, at 6.3%. The recession ended in March 1991 when the jobless rate was 6.8% and it did not peak until June 1992, at 7.8%. In both cases, the unemployment rate peaked well more than a year after the recession technically ended. The 2001 cycle was a tech capital stock deflation; the 1991 cycle was the Savings & Loan debacle; this past cycle was an asset deflation and credit collapse of epic proportions. And economists think that the unemployment rate is in the process of cresting now? Just remember it is the same consensus community that predicted at the beginning of 2008 that the jobless rate would peak out below 6% this cycle.

http://blogs.reuters.com/james-pethokoukis/2009/11/11/12-reasons-unemployment-is-going-to-at-least-12-percent/

Chi [98],

Will never figure out that one?

1. For the first time in at least six decades, private sector employment is negative on a 10-year basis (first turned negative in August). Hence, the changes are not merely cyclical or short-term in nature. Many of the jobs created between the 2001 and 2008 recessions were related either directly or indirectly to the parabolic extension of credit.

Sean,

Spot on.

#42 Whoever posted that last night from Al Jazeera of all places was a great find.

100 Sean: “12 reasons unemployment is going to 12 percent from David Rosenberg.”

Simpler reasons:

1: Barack Obama

2: Nancy Pelosi

92 CHifi

My father’s birthday!?

A little dated, however, the only update; it’s worse.

“The Federal Reserve’s ‘solution’ to the debt problem is the problem. It has resulted in the Federal Reserve doubling the monetary base of the United States over the span of a mere

nine months. Rather than stimulate the real economy, the QE program has instead resulted in increasing weakness in the international market for US bonds – the proof of which can be

seen in the chart below. Bond investors are running for the exits, and our discussion above confirms what we see in this chart. Traditional buyers of US bonds are now sellers, and they

are exercising a non-confidence vote in the US dollar and in US debt.”

http://www.sprott.com/Docs/MarketsataGlance/June_2009.pdf

If Unemployment was at 50% and we all had stay at home wives we could live like the guys in Mad Man, drinking, smoking and all kinds of fun in the office.

Make [90],

This baby is just starting to crawl. Who knows where the next $100-200 will be. It doesn’t matter. The foundation has been laid. Wait until this thing goes parabolic.

We have witnessd the greatest equity bubble in the US, Nasquack, and the greatest RE bubble in our history. In the future, we will witness the greatest hard asset bubble ever.

These markets went thru a 20 year bear market where dow/gold went from 1-1 to 42-1. In past commodity cycles, on avg, the subsequent bull market lasted 75% of the time of the preceding bear. 2015-2016?

You picked a fine time to leave me Jamil

[97] moose

Yes, I was aware of that, and yes, DC is not a state. It is, rather, part of MD for voting analytics IMO.

Still curious to know if any state did go more than 67% in the modern era in a presidential race. I honestly don’t know. I will concede that a state that is close to that mark is decidedly blue or red, but that, again, is misleading since voters will disregard party based on issues that are important to them. Rather, I think that demographics other than party affiliation are better predictors of elections.

Since there is an employment theme, here is some data from my world:

“2009 Worst Year for Lawyer Headcount in 3 Decades, Says ‘NLJ 250′ Survey

The United States’ largest law firms this year suffered the deepest cuts in their attorney numbers since The National Law Journal began tracking their census figures more than 30 years ago.

The total number of attorneys working at the top 250 law firms plunged by 5,259 lawyers. . . .

The results of the 32nd annual National Law Journal survey of the nation’s 250 largest law firms provide a vivid picture of the toll that the economic recession exacted from law firms this year. The 4.0 percent decline in the total number of attorneys marked only the third time that the lawyer count among the group has dropped since the NLJstarted collecting headcount data in 1978. The last time totals backslid was in 1993, when they dipped by 0.9 percent. The first decline was in 1992, when they fell by 1 percent. The tally this year wipes away nearly one-third of the growth that firms made during the past five years and puts many of them well below levels they enjoyed in 2005.

The number of attorneys in 2009 sank to 126,669 lawyers, compared with 131,928 attorneys last year. In 2008, the number of attorneys increased by 4.3 percent.

. . . The firm with the largest percentage decrease was No. 95 Fried, Frank, Harris, Shriver & Jacobson, which declined by 26.4 percent to 468 attorneys from 636 in 2008. Last year, the firm held the No. 58 slot in the rankings. The firm losing the greatest number of attorneys was Latham & Watkins, which shed 444 lawyers. It had 1,878 attorneys this year, compared with 2,322 in 2008, for a 19.1 percent decline.. . .

Not surprisingly, associate ranks were hit hard by work force reductions. The percentage of those attorneys shrank by 8.7 percent, to 61,733 from 67,648 last year. . . . .

At the same time, partner employment, as a whole, remained unscathed. The number of partners in 2009 was 53,468, compared with 52,980 in 2008, an increase of 0.9 percent. Among the top 50 firms, 30 increased their partner totals. The results confirm that law firms’ strategy in managing the downturn was to save the partners — and partnerships. “The cuts made were done primarily to preserve workloads for partners,” said Ward Bower, a consultant with Altman Weil. And perhaps troubling to clients, “it suggests that work done by partners is work that associates could do,” he added. . . .”

http://www.law.com/jsp/article.jsp?id=1202435276422

I left that last para. in on purpose. I had observed in the last downturn that partners will hoard work; after all, they have to stay billable also. So the associates get the crumbs from the tables.

That can’t sit too well with the GCs I know, and I suspect that they will get pretty activist about partner billing when they see more partner hours and less associate hours. At least one hopes.

86. Stu

I went through a refi with tops credit on my multis, I got jerked around on both points and rate by more than one broker, to the point that I had terms changed up just as I was about to give them my credit card for the appraisal.

If your deal is solid, take it then give me the name and number of your guy/gal, please!

Stu, one more ? My take on rentals is that they are all about cash flow in the now. Why not do a 30 and get more monthly income? I’m not following, I’ve never approached rentals as an equity play.

make (90)-

Love watching any team D’Antoni coaches.

Inevitably, he transforms one guy into a world-beating, conscienceless gunner…while the rest of the team plays in hyperdrive, trying to feed the gunner.

Too bad none of his teams have any idea how to play defense.

BC (101)-

Simple explanation is, Hugh Grant’s gay.

Extremely gay.

Like, this is news??

http://www.nytimes.com/2009/11/13/business/economy/13fha.html?_r=1&th&emc=th

dz (103)-

I couldn’t believe Al-Jazeera was using a Chinese reporter (with an English accent) to tell an embarrassing story about a brand-new ghost town meant to hold a million people.

Surreal.

Can we send SAS to whack Jamil?

I’ll put up the first $500 of the bounty.

Orion (115)-

The 10-megaton plutonium bomb has been primed to perfection.

All we need to do now is get a fruity drink & a pair of good sunglasses. Should be quite a show when FHA blows sky high.

“We have no reserves and record defaults…but, we need no bailout”.

FHA will make Phony/Fraudy seem like Berkshire-Hathaway.

And now, a few words from our partner in the biggest circle jerk ever:

“President Hu Jintao said China is doing what it can to fire up demand at home so that the world’s third-largest economy is less reliant on exports.

“Our focus in countering the crisis is to expand domestic demand, especially consumer demand,” Hu said in a speech on the sidelines of the Asia-Pacific Economic Cooperation forum, which culminates this weekend with meetings of Pacific Rim leaders, including President Barack Obama and Japanese Prime Minister Yukio Hatoyama.

China, which saw 8.9 percent growth in the last quarter, will continue with reforms aimed at improving living standards and reducing social burdens such as educational fees and health care that inhibit spending by frugal Chinese consumers, Hu said.

Such moves by China and other developing economies are seen as crucial for ensuring a sustained global recovery, given the weakness of the U.S. consumer market.”

What will happen once every subsistence farmer in China has a flat screen? Sounds to me like these guys are just kicking the can down the road in a less-sophisticated form than we are.

Schumpeter (120)

I wonder if O’s trip to Asia has anything to do with begging, pleading, imploring them to keep buying our debt….

lest the bomb explodes, poof, poof.

Barb,

It is all about the cash flow, but keep in mind that we plan to take on somewhere in the order of another 400K worth of debt by the Spring when we go for our next place, so it really doesn’t matter that much that we are shortening this one a hair. Ultimately, it’s more about obtaining the 4.75% APR then our current 5.5%. You can only get that low of a rate on a multi on a 20 year or less with excellent credit. I have shopped it around a lot all ready.

We fully expect to be cash flow positive on our place + the tax breaks that comes with slum lording. Looks like we should come in net ($600) minus maintenance.

Really, it is only an extra $100 per month so no real big whoop either way.

orion (122)-

Sure, they’ll keep buying our asswipe: with short maturities.

Anything longer than the lifespan of a flea? Looks like they prefer shiny.

This won’t end well. And, we all know how it will end. I just wonder if all the 16th century diseases will come back when we’re all blasted back to the 16th century financially.

From article posted at #115.

“As recently as a few weeks ago, the F.H.A. had said that even under the bleakest economic forecast, its cash cushion would quickly recover. On Thursday, it abandoned that position.”

Oops, we didn’t know the situation was this bad. Sound familiar?

Please, mister, will you buy my 30-year bond?

10? 5?

stu, the 20 year/low interest makes sense, Any idea what they are offering on a 30 with great credit?

10? 5? No thanks. How ’bout 7 month?

SRS below $9. That means it’s time for Schumpy to take a taste.

orion (129)-

How about 7 minutes?

Schump [121],

That’s the game plan, correct the imbalances. $10 a day slaves will replace the US consumer and become the world’s engine of growth? What are we exporting that will have them jumping? Yao Ming posters?

Five Things: Two Economies, One Deflation

http://www.minyanville.com/articles/deflation-fed-inflation-barrick-disney-gold-dollar-depression-depew/index/a/25419

Barb, I don’t know, but I can give you the digits. Get my email from Grim please.

Schumpy…Aren’t you nervous?

China, which saw 8.9 percent growth in the last quarter, will continue with reforms aimed at improving living standards and reducing social burdens such as educational fees and health care that inhibit spending by frugal Chinese consumers, Hu said

There’s something VERY wrong when the damn commies can enjoy 8.9% growth while rock ribbed American patriots suffer. Those commies are getting away with an unfair advantage.

We need to have a policy to free Taiwan from their clutches. Let’s see them grow at 9% if they have to fight to keep Taiwan.

That’s just another issue I’ll be bringing to my nearest town hall tonight.

#83 – Nom, the reason that the secession talk is ridiculous is primarily because the states suggested for it are the biggest suckers on the Federal teat. Either from cash or federal contracts, usually defense spending.

Comrade Nom Deplume says:

November 13, 2009 at 10:41 am

‘(apologies to the resident brits on the board, but I didn’t make this up)

“Britons Among ‘Ugliest People,’ Dating Site Says

“I would say Britain is stumbling because they don’t spend as much time polishing up their appearance and they are letting themselves down on physical fitness,” ”

No need to apologize, I would say it is probably true, especially compared to Scandinavians and ESPECIALLY the Danes who seem to have won the genetic lottery.

WTF? I am sitting in a Starbucks, first some guido a%%hole is wearing so much cologne that my jacket still stinks 10 minutes after he leaves….then this older couple comes in and sits down….he gets a doppio espresso and the woman turns to him and says “do you need a Percocet with that?”…he says “Thanks”…..

gary: you are a trailblazer!!!!!!

@35:

“Where do you all buy your patience and do they sell in bulk quantity?”

Every time I get the itch to buy after perusing Realtor.com, I email the listing agent and ask what the property taxes are.

That kills any and all urges to purchase.

“It’s not right for those who contributed so much to the economy to be in the damn position of their noses pressed up against the window”

50.5,

Cheers.

Did you mean to say noses pressed to the floor?

The end is nigh….

Jeter a wino….

http://www.nypost.com/p/pagesix/celebrity_photos/derek_jeter_big_screen_cameo_HAUnrIHKNBtbI829udviXL?photo_num=1

http://www.nytimes.com/2009/11/14/world/asia/14pstan.html

I wonder what the odds are that Delta/NEST teams will need to rush in at some point to secure the special weapons in Pakistan? My recollection is that the Pakistanis refused to take our advice to install permissive action links on them, for fear that we would somehow disable them from afar, and that they rely on rudimentary safing, such as steel balls, lengths of chain, perhaps barometric fusing, etc., to prevent unintended detnation. Unfortunately, these are easily overcome by the likes of UBL and his ilk.

New source of waterfront property? It is certainly out of the way:

http://arstechnica.com/science/news/2009/11/nasa-announces-significant-quantities-of-water-on-the-moon.ars

http://www.nypost.com/p/pagesix/celebrity_photos/derek_jeter_big_screen_cameo_HAUnrIHKNBtbI829udviXL?photo_num=10

@60:

“Or, they might just be in that denial state.”

NJ: The Denial State.

I like it.

137

Its the redistribution of wealth. Glad to see you are awake and dont let the politically correct ever shut you up. Vote the mother f#ckers out.

Just bumped into an ex-friend (ex partly because she was mad at me 3 years ago for daring to suggest that homes would decrease in value) who POSITIVELY INSISTS that everything is AOK and with the $8000 credit, NOW really would be a good time to buy.

No she isn’t a realtor either.

And no she couldn’t admit that I was right 3 years ago either.

Yes, the Chinese financial system is more disfunctional than the US one. People salivate over those foreign currency reserves, but they aren’t just assets they also represent liabilities. The banks are all government controlled, and they lend politically, and every few years have to get recapitalized by the government. Chinese people keep depositing money in the banks because there are no alternatives and the principal is govt guaranteed. But everybody with money buys real estate as a second bank account. They don’t even care about finishing or furnishing the apartments half the time, and don’t bother much with renting them out. They just collect empty concrete apartments like gold coins.

I follow the steel industry. More than 50% of the world’s steel this year was made in China, and nearly 40% of it went into real estate. It’s been that way for the past 7-8 years, so they think it’s normal to build stuff that way. This year a lot of the steel is supposed to be going into public works, but it’s still less than real estate. The weird thing is that even though steel production set new records in China, the steel companies still lost money. There’s always too much capacity. Now they build bullet trains between cities, government banks fund it so nobody really cares how much investment it takes. And by the way, most of this investment at the local level gets funded by the government selling land to property developers.

There is a lot of unsustainable stuff going on in China besides making and exporting things to indebted Americans.

The real crisis in China will eventually be a banking and property crisis.

Property prices in Chinese cities are as high or higher than in NJ, while the average income is much lower, and the economy is pretty highly dependent on construction.

#142 – they need to restore the damn credit market back to where the hell it was 3 years ago.

That’s just not fair. Helicopter Ben is trying his little heart out. Why, he’s up all night with Timmy trying to figure out ways to give free money to banks. Your problem is with mean old man Dimon! It’s him that’s not lending out and cash. The grinches at Goldman even href=”http://dealbreaker.com/2009/11/goldman-sachs-officially-cance.php”>canceled christmas.

Face it re, the market is dead but it isn’t from the lack of help.

Also, couldn’t you just reduce your asking price a bit? Maybe sell to a nice Indian couple.

Wireless phone help….

I want to upgrade my phone under a Verizon plan.

I do not want a crackberry or iPhone, but I get enough texts at my phone number from people who just assume that I will easily text back.

Verizon is more than willing to give me anything with a QWERTY keyboard, but the working assumption is that I am going to upgrade my plan. I just rather have the QWERTY just so that in a pinch, I can fire back a text easily.

Anyone have a preference on one of the tweener phones that has a QWERTY but is not a crackberry?

Tosh – interestingly enough, the UK doesn’t (yet) have the same levels of unemployment that we have.

[140] lisoosh,

I don’t disagree.

If you recall, in an excursus some time ago, I included that factor among the centripedal forces that would foster union over dissolution. It is a singularly strong factor, perhaps one of the strongest.

That, however, assumes the gravy train keeps rolling. Will the chair still stand if one leg is kicked out?

Topic for a book perhaps, but as I said, a work of fiction.

“The real crisis in China will eventually be a banking and property crisis.

Property prices in Chinese cities are as high or higher than in NJ, while the average income is much lower, and the economy is pretty highly dependent on construction.”

Andy Xie was on Bloomberg a couple weeks ago discussing the same. The Chinese banks are running out of “prime” borrowers and have begun their own “subprime” in the past year.

l: You should fire back what clot said several days ago…..anyone with even a passing interest in buying has already bought, and you should be storing canned food and MRE’s for the nuclear winter……

lisoosh says:

November 13, 2009 at 2:24 pm

Just bumped into an ex-friend (ex partly because she was mad at me 3 years ago for daring to suggest that homes would decrease in value) who POSITIVELY INSISTS that everything is AOK and with the $8000 credit, NOW really would be a good time to buy.

Stu,

I make that out to about $1,385 interest and $876 principal in the first month. Is there Is there any cnance of taking that $130 a month saved, adding another $60 to it each month and essentially pay 13 payments a month? That would take off several more years.

So I just witnessed a line around the block of people aka sheep waiting to get a Swine flu shot like their lives depended on it. I told my wife, ” look at these idiots. What would make them wait on line to get a shot with a known 1:100,000 chance of Guillian Barre?” Especially when the manufacturers waived liability. Did that set off red flags? Nope.

Yuri Besmenov KGB. Demoralization complete. The inability of the people to make logical decisions based on facts.

Get the Fat #ss Americans a bucket of fried chicken, chips, a 2 liter Pepsi, and cable tv and you can do anything to them.

Shore

Buy now or be priced out of water forever

They aren’t making any more moon

If you sign a contract now we can get you a nice new crater with both mars and earth views.

Close proximity to tranquility base

[111] grim

Grim, 111 in mod. No idea why. Perhaps the “L” word? (“lawyer”)

[158] chi

“and you should be storing canned food and MRE’s for the nuclear winter……”

which reminds me that I have to install shelves in my basement this weekend.

Chi been relatively happy with my env2. good keyboard and battery life. Broke the front screen but that was my fault not the phones. with the new droid coming out the other phones have gotten relatively cheaper

@86:

“I’m just about to sign on the dotted line for a refinance on our Montclair Multi. We are stripping off 5 years from the loan making it a 20-year. Loan amount is 350K and the best quote I could obtain was 4.75 rate with $3320 closing costs, no points.

It works out to a monthly increase if $130 to shorten the loan by 60 payments. Seems to be a no-brainer to me.

Just looking for a sense-check or someone who knows a broker who might beat those rates?”

Does that extra $130/month include the $3320 you’re paying out of pocket?

What would the difference be if you didn’t refi and instead paid an extra $130 (plus a share of that $3320 if not factored into the $130) towards your principal each month?

This is good for a laugh (though I thought Bugattis were made in Italy?)

“Police say a low-flying pelican distracted a driver in Texas, causing him to veer off a road and drive his million-dollar sports car into a salt marsh.

La Marque police Lt. Greg Gilchrist says the man claimed he lost concentration while driving his French-built Bugatti Veyron on Wednesday because the bird swooped into sight.

Gilchrist says the driver dropped his phone, reached down to pick it up and strayed into the brackish water in La Marque, about 35 miles southeast of Houston.

Gilchrist does not know if the car can be salvaged but conceded that “salt water isn’t good for anything.”

4.625% 30 year fixed thanks to helicopter Ben last winter.

I was paying double principal but stopped and have been buying gold and oil instead with the savings. Debt is good in the Weimar Republic.

“10? 5? No thanks. How ’bout 7 month?”

0% interest on any timeframe is still 0. Makes more sense to keep it in the old checking account at this point.

re: #160 – errrrr… the odds of dying of the FLU in your lifetime are 1 in 62.

168.

Make sure you are an independent. It makes both parties nervous.

Watch the assault that is going to happen on the NEA (the union that takes money from teachers)

Licking my chops.

Meter and Shore:

You guys both offered excellent suggestions, but I suspect that the lower interest rate 5.5 down to 4.75 is the better deal than paying extra principle at 5.5!

I also get a greater benefit from the tax break on the mortgage interest as I am solidly in the worst bracket for deductions. Trust me folks…When your income breaches the 200 mark, looking for tax savings is like searching for a Jamil post that does not contain a mention of Acorn.

Anyone want to try to calculate the math on this equation? I tried and couldn’t really come up with the proper Alegbra. PERT right?

Any musicians in the house who are looking for a tax deductible trip to Costa Rica may find this of interest:

http://www.ascap.com/calendar/Default.aspx?action=display&ID=1896

Stu,

The tax deduction is no reason to avoid paying extra principal. In the end, one pays more in interest than one saves in taxes.

172.

I would take the 4.75 for sure and I would take on more mortgage so long as it doesnt stress your budget. Take the additional cash and buy gold, silver, or oil.

Do you think the Chapmans will like my song.

I drive slow on the L-I-E

I am just hoping to D-I-E

I go 30 mph in my Rabbit

I guess that is a bad Habit

Oh Look a Big Truck

I think I am about to get #ucked

My name is Harry Chappin

That truck that crushed me

just gave me a new name

You can call me scrapin Chappin

http://www.ascap.com/calendar/Default.aspx?action=display&ID=1896

174.

They arent going to make you pay but they will send you to prison. Once your done you will be a felon. Good times in America.

Bucket of fried chicken anyone?

“I’ll renouce my citizensip before I let them do that to me.”

As they say in programming: this is a feature, not a bug.

Ok, I found a mortgage calculator that allows you to factor in extra payments to the principle.

doing the extra $130 per month on top of my current mortgage payment reduces the 25 year loan to 22 and 3 months. It’s almost a year worse than that if you simply make one extra payment a year of $1560.

Of course, this calculator is not an exact science since it’s calculating the amortization tables based on a 25-year loan with extra payments, vs. a 20-year loan without. What I really need to check is the financial impact of an extra payment starting in the 6th year of a 30 year loan.

Ultimately, I still think the refi is significantly cheaper over the length of the loan.

Those f*king idiots actually going outside of their homes. Don’t they know that the chance of dying of a bee sting are 1-100,000?

And those other ignorant dolts driving around all day in cars don’t they know the odds of dying in a Motor Vehicle Accident are 1 in 100 in a lifetime? Crap today could be the day, quick pull over the car I am gonna walk. Wait the chances of getting killed crossing the street are 1 in 40,000. Ahhhhhhhh!

“The tax deduction is no reason to avoid paying extra principal. In the end, one pays more in interest than one saves in taxes.”

True Shore, and I appreciate the advice. Just looking to find some balance. My total assets, if I throw in my retirement assets, would easily allow Gator and I to buy the home outright.

As for collecting debt in the current economy of a deflating dollar. I think $750,000 of mortgage debt is enough leverage for our household. This should be our total sometime before the tax credit expires ;)

Sean, you sound like one of the fools that waited in line. LMAO. Dont worry the govenment will take care of you.

Fing moron. LOL.

Sean,

May favorite are the shark attack numbers.

You are 325 times more likely to be killed by a deer than by a shark.

Yet I know many people who won’t swim in the ocean because of a fear of a shark attack.

A couple of things:

1) The job market was crap long before Obama was elected. We have been on a race to the bottom since 1980. The internet boomlet was simply a brief respite. I don’t know how anyone thinks the economy will ever recover when no one can earn a living.

2) Follow-up on question yesterday regarding inspection contingency. Contract DOES have this contingency, but inspection report shows MAJOR multiple water infiltration points and other serious problems that spooked buyer so buyer has no confidence that seller will do appropriate repairs. I told buyer that he has to let the process play itself out or get sued. Atty thinks sellers will be unwilling to do the repairs and it will be moot.

Also, couldn’t you just reduce your asking price a bit? Maybe sell to a nice Indian couple

And I missed this little cute commment. I’d rather put on gasoline underdrawers, strap on some C-4 and parachute into hell, BEFORE I’D EVER REDUCE MY ASKING PRICE. I don’t give a tinkers damn who buys it, BUT NO ONE IS GONNA TAKE MY HOUSE FOR NOTHING.

Nice job with your mortgage lock bye bye. We locked in 5.5 in October of 2004, which was quite a sweet deal at the time. Keep in mind, most lenders charge an extra quarter to the interest rate for a multi-unit mortgage loan vs. a single family due to the vacancy risk.

The rates just haven’t dropped low enough except for a few dips under 5% where it would have made sense for us to refinance for any savings when one considers the closing costs.

You did well with your loan. Did you actually get that rate without buying any points?

Not as much advice, as points to ponder when making the decisions.

also, “doing the extra $130 per month on top of my current mortgage payment reduces the 25 year loan to 22 and 3 months. It’s almost a year worse than that if you simply make one extra payment a year of $1560.” don’t forget the closing costs NOT paid by just paying extra.

I suspect that your balance makes it worth the refi, but were it me, I would plow the saved $, and the extra $15week into the mortgage, just for the sake of knocking a few more years off without any pain whatsoever. I know that that approach flies in the face of the borrow as much as possible crowd, and I appreciate their position; however, for a principal residence, which this still is for you (or could become again if you end up walking away from a different mortgage at some point), I prefer to be debt free.

Shore guy,

I understand your position. Especially considering that the mega debt collecting mentality here could be completely wrong.

Once again, thanks for the perspective.

187.

Yeah that was no points. My closing cost were similiar to yours. I was 8 months into a 30 year at 5.87 and then helicopter Ben dropped some treats off to me so I took them. No brainer. My monthly payments dropped by 200 bucks a month and my principal payment increased by 100 bucks based on the amortization schedule. I was making double princpal payments but stopped because I now realize my mortage is my best defense against the coming inflation.

4.75 is still great. If you need a broker I can give you a recommendation.

http://www.nytimes.com/2009/11/10/science/10patch.html

BC

I feel some charts coming on…… Later 2nite

Shore,

You and I have the same mentality regarding debt destruction but these are unusual times. If interest rates go up to 18-25% like the early 80’s early payment on a sub 5% mortgage is going to look silly. I understand your logic though.

ByeBye – re: “my mortage is my best defense against the coming inflation.”

You are a real bright flashbulb I see.

What happens when your home does not appreciate in the next 10 years but inflation is a mild 5% a year?

“my mortage is my best defense against the coming inflation.”

Texas hedge.

What do you think will happen to property taxes in a high-inflation environment?

194.

No home appreciation in 10 years? What is your logic?

Keep getting your swine flu shots, I think the mercury is getting to your head.

Training video for North Hunterdon girl’s soccer….

http://www.abcnews.go.com/Video/playerIndex?id=1710092

What do you think will happen to property taxes in a high-inflation environment?

You have the potential for a positive feedback loop there.

Damn, I want to short this market but how can you when they’re just printing more money to buy more stock?

Stu that is why I shoot deer just trying improve my odds of being offed by them ; )

In other news wife and I may have finally found a home we both agree on. I’m doomed to be a debt slave again.

195.

Good question re: property taxes. That is the biggest dillema of them all. At the shore we arent governed by Communists like in North Jersey. We will cut every stinkin government employee possible before we ever pay more. In my town we cut 2 million in spending over the past year by eliminating government jobs. The mayor was reelected easily as a result.

Excellent point though.

Meanwhile, the pigeons keep chirping away…..

Realtors: home prices to rise 4 percent in 2010

Realtors’ economist sees resale home values, sales rising in 2010

By Alex Veiga, AP Real Estate Writer

On 2:22 pm EST, Friday November 13, 2009

Buzz up! 16

Print

SAN DIEGO (AP) — Home prices are expected to grow modestly next year and sales will keep rising as the housing market continues to recover from the worst downturn since the Great Depression, the National Association of Realtors said Friday.

Home resales are projected to total 5.7 million next year, up from an estimated 5 million this year. Prices will climb 4 percent after a projected decline of 13 percent this year, according to Lawrence Yun, chief economist for the trade association.

“Going into 2010, I anticipate that prices will also begin stabilizing or begin to modestly improve,” Yun told the audience at the association’s annual conference and expo in San Diego.

The housing market’s rebound has been aided by an aggressive federal intervention to lower mortgage rates and bring more buyers into the market. Home resales rose in September to the highest level in more than two years, something Yun said shows buyers are eager to get back into the market.

A federal tax credit of up to $8,000 for first-time

#200 – wife and I may have finally found a home we both agree on

Good luck and enjoy!

re #194 – no logic simply an example….

After the 80s real estate bubble housing prices were flat for 10 years.

And to Grim’s point about property taxes, they are estimated to double in the next decade, so who you gonna call the ghostbusters?

What now, you gonna call me a moron again and do a LOL!

Listen you want to come out swinging fine, just make sure the punch lands.

#196 I lived in my first house for 10 years, and did not make a dime, not one dime, zilch nada, nunca, zero.

In fact I sold it for $2500 less than I paid for it 10 years prior,, and made substanial imrprovements too.

In of course a blue ribbon Bergen co train town;just saying.

I apologize….correct link…

chicagofinance says:

November 13, 2009 at 3:26 pm

Training video for North Hunterdon girl’s soccer….

http://abcnews.go.com/Video/playerIndex?id=9032161

Danzud,

You can’t play this market based on fundamentals.

It would be like trying to kick a field goal to win the Super Bowl, but they only put 2 points up on the board as you find out the NFL changed the scoring rules during the 4th quarter.

I hate to give John a big head, but his too big to fail strategy was absolutely brilliant. I wish I played along.

“I hate to give John a big head, but his too big to fail strategy was absolutely brilliant. I wish I played along.”

I have to agree. Chalk one up for Belmar.

151) “Just bumped into an ex-friend”

Lish, If this whole crash has taught me only one thing its that you cant talk re with anyone, especially friends.

It may all be economics and fundamental math equations to you but the minute you suggest that prices will not continue to climb at astronomical rates, your closest friends will most likely look at you like an American-hating anti-christ. I’ve seen it too many times and thats one reason why i only talk RE here now. And then when i see how overly-negative everyone here is, i understand why all my friends dont want to talk re with me either. lol.

Grim – if you are still thinking of Tennessee, the People of Walmart site has posted some updates.

http://www.peopleofwalmart.com/?paged=9

204.

Property taxes cant continue to go up. There has been no private sector job growth in the past 10 years in NJ. That is 0, meanwhile government jobs have increased by 55,000. This is the critical point. Christie has to make big decisions and if Lonegan has a hook in him, which I think he does then spending is going to come down drastically. Sucks for the government worker losers but hey why should they be different.

The alternative to doing nothing is to take the hit and move out of the state. I Christie doesnt make the hard decisions then thats exactly what I will do. Better to lose 50k up front then to lose multiples of that over 10 years. Ill move my business to another state. Already discussed and the only thing keeping me here is family.

Grim Correction:

“What do you think will happen IN NEW JERSEY to property taxes in a high-inflation environment?”

On a lighter note, I present actual proof as to why the 70’s may have been a cooler decade than now.

The Fed’s airheaded bubble orthodoxy

For many investors, in fact, the cost of money is effectively less than zero, as economist Nouriel Roubini likes to point out. If you borrow dollars at near zero percent interest in the United States, exchange the dollars for Thai bhat, and invest the bhat in government bonds paying 4 or 5 percent, you not only get the benefit of the interest rate arbitrage but you also gain when you sell the bond and exchange the bhat back into dollars that have since depreciated. Roubini calls it “the mother of all carry trades,” and in recent months he calculates that it has been generating annualized returns for investors of 50 to 70 percent.

This carry trade is now so widespread that it has become a major factor driving down the value of the dollar against many other currencies and driving up the flow of hot money into a number of developing countries. Not only has it spawned stock, bond, or real estate bubbles in those countries, but it’s also driven up the value of their currencies to the point that their exports are less competitive relative to countries, including China, that peg their currencies to the U.S. dollar. To counteract these trends, central banks in Thailand, South Korea, Russia and the Philippines have intervened in currency markets, buying up dollars and selling their own currencies. Hong Kong has tightened up on lending rules, while Brazil has put a 2 percent tax on capital inflows. Taiwan has banned foreigners from making certain types of bank deposits.

There’s no way to know how long all this can continue before one of these bubbles finally bursts, the dollar spikes upward and investors all rush to unwind their trades at the same time. But it is a good guess that it will last as long as the Fed and other central banks indicate there is no end in sight for the current cheap-money regime. The longer they wait, the bigger the bubbles, and the bigger the mess to clean up.

re #211 – ByeBye “spending is going to come down drastically”

Sure it will, it has in the past right?

No worries this one is not a trick question.

[212] bye

My solution is to refinance the state debt into bonds maturing at least 20 years from now. Keep rolling it over. Issue new bonds for everything. Long maturities.

My plan is to have exited the state by the time that can stops rolling.

“Property taxes cant continue to go up. There has been no private sector job growth in the past 10 years in NJ. That is 0, meanwhile government jobs have increased by 55,000. This is the critical point. Christie has to make big decisions and if Lonegan has a hook in him, which I think he does then spending is going to come down drastically. Sucks for the government worker losers but hey why should they be different.”

Welcome to NJ. You appear to be new here.

Let me ask you this: you are the proud owner of a new home in the Denial State (TM). What exactly are you going to do when the above logic fails to pan out and instead your property taxes are rising by 10 to 15% per year?

China’s economic miracle is a fragile one

Which brings us back to that pile of cash building up in Chinese coffers. China has grown to its current size, as do most “young” economies, by exporting cheap goods to richer countries. In its case, this has resulted in the biggest trade surplus in history. The proceeds of that surplus have to go somewhere but, rather than buying General Electric, the country’s leaders have splurged it in the currency markets, doing whatever they can to keep their currency, the renminbi, down.

Such a policy made sense when China had an economy that was relatively underdeveloped, and was trying to shield nascent exporters from volatility; but now, by keeping assets artificially cheap, it serves to exacerbate the bubble that is building up as a result of those low US interest rates. And while this approach worked when consumers here and in America would spend on Chinese exports, that is no longer assured. As if this weren’t dangerous enough, the authorities have also taken to trying to pump up the economy further by channelling cheap credit to companies.

There could hardly be a more reliable recipe for an asset bubble, and too many economists assume that the omnipotent Chinese leaders know better. In reality, this bubble is being allowed to grow by a Communist party which is well aware that, if economic growth drops below a certain level, their positions could become less secure; the authorities are also less in control than they would like to be.

China is not alone. Brazil, India, and a host of other countries are following a similar trend. The Buenos Aires stock exchange has more than doubled in the past six months. Brazil recently imposed controls on the amount of foreign cash allowed into the country, in a bid to dampen speculation. But a Chinese collapse would be disastrous for the global economy in a way Japan’s slump never was; Chinese growth is one of the few things supporting global growth at the moment.

There is a simple way to stem the expansion of this bubble: China should allow its currency to appreciate, and bear down on its economy by raising borrowing costs. Both tactics would depress economic growth and risk social unrest, which terrifies a Communist party feverishly obsessed with suppressing any whiff of dissent. But, in avoiding difficult decisions now, China’s rulers are setting themselves up for an even more violent reaction if and when this asset bubble eventually implodes.

[172] stu

“looking for tax savings is like searching for a Jamil post that does not contain a mention of Acorn.”

Stop it; my sides are aching!

“Swine Flu shots… Bucket of fried chicken anyone?”

SAS – is this you steroids?

#214 – Tosh, you might be on to something. (Hat tip to Barry).

The Hubbert Peak Theory of Rock, or, Why We’re All Out of Good Songs