From CNBC:

Home sales surged in October, just before mortgage rates jumped

A sharp drop in mortgage rates brought homebuyers off the fence in October after a slow summer.

Sales of previously owned homes last month rose 3.4% from September to a seasonally adjusted, annualized rate of 3.96 million units, according to the National Association of Realtors. Sales were 2.9% higher than October of last year, marking the first annual increase in more than three years.

This count is based on signed contracts, meaning most of the deals were made in August and September. During that time, the average rate on the popular 30-year fixed mortgage was falling. It started August around 6.6% and dropped to a low of 6.11% by mid-September, according to Mortgage News Daily.

“The worst of the downturn in home sales could be over, with increasing inventory leading to more transactions,” said Lawrence Yun, NAR’s chief economist, in a release. “Additional job gains and continued economic growth appear assured, resulting in growing housing demand. However, for most first-time homebuyers, mortgage financing is critically important. While mortgage rates remain elevated, they are expected to stabilize.”

There were 1.37 million units for sale at the end of October, an increase of 19.1% from October 2023. That puts inventory at a 4.2-month supply at the current sales pace. It is still on the leaner side, as a six-month supply is considered balanced between buyer and seller.

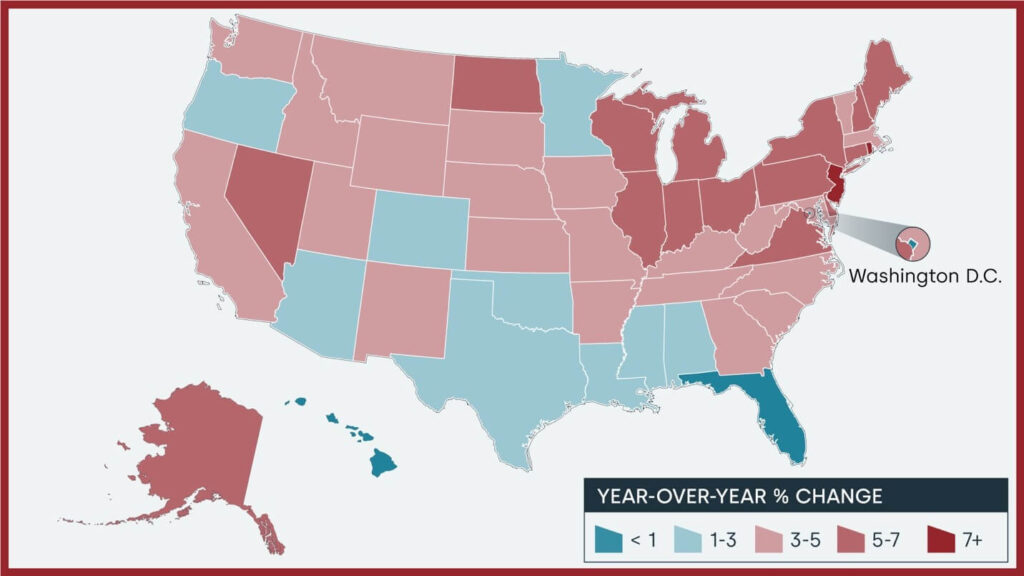

Tight supply continues to put upward pressure on prices. The median price of an existing home sold in October was $407,200, an increase of 4% from the year before. By price category, the higher end of the market is seeing more activity than the lower end.

“We still need another 30% in inventory just to get us back to the pre-Covid conditions,” Yun said.

The share of all-cash buyers pulled back to 27%, down from 29% in October 2023. That is still high historically, but lower mortgage rates likely caused that share to drop.

First-time buyers made up 27% of sales, down from 28% the year before and still historically low. They usually make up 40% of sales.