From CNBC:

U.S. home sales post 12th straight monthly decline; house price inflation cools

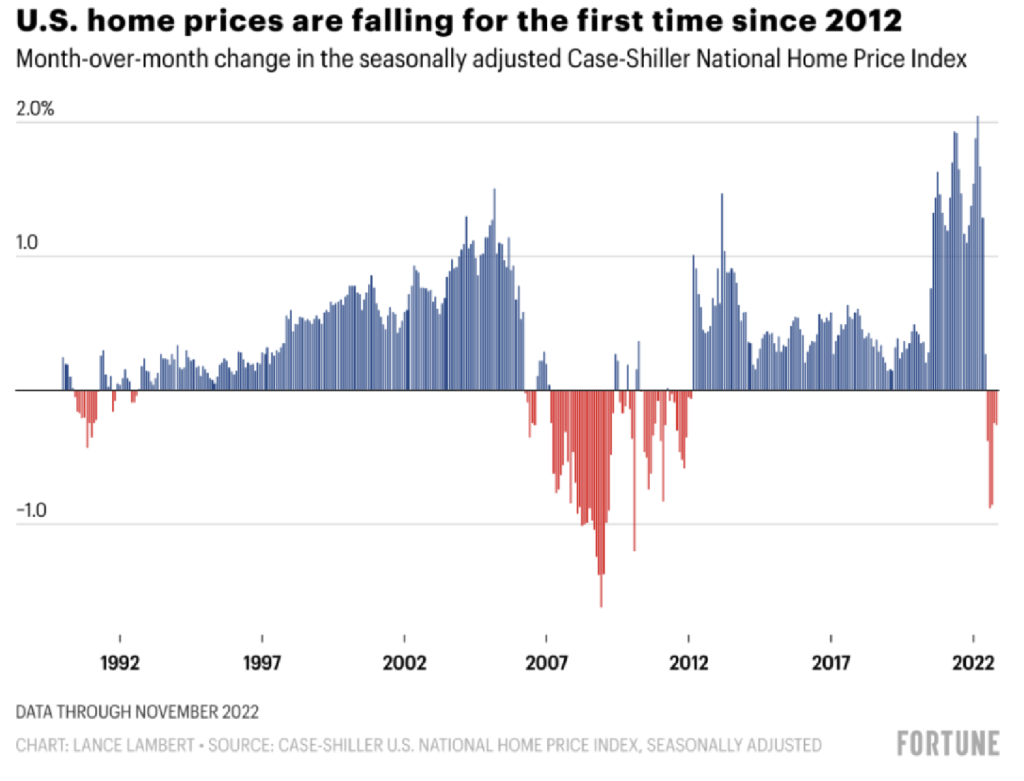

U.S. existing home sales dropped to the lowest level in more than 12 years in January, but the pace of decline slowed, raising cautious optimism that the housing market slump could be close to reaching a bottom.

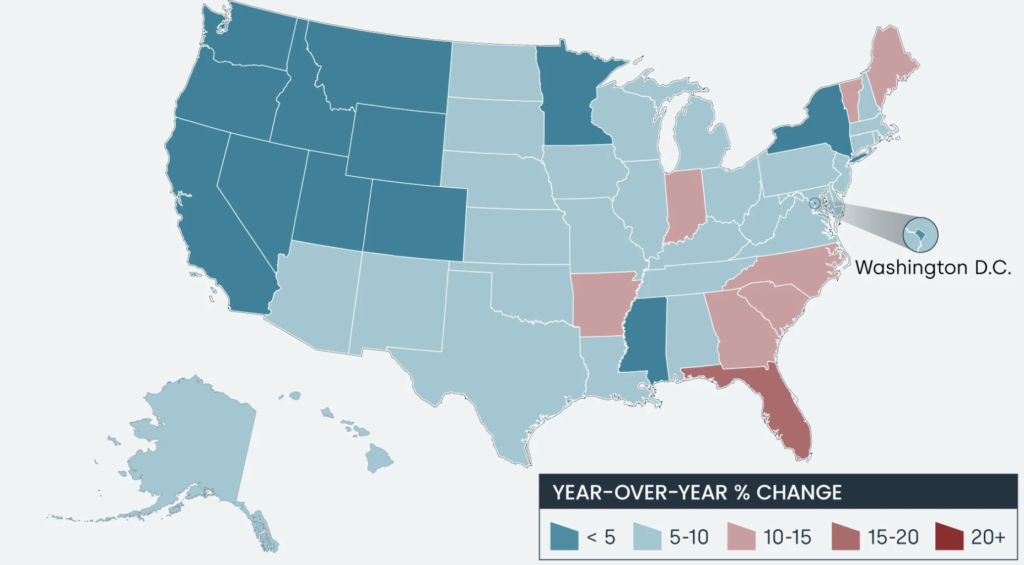

The report from the National Association of Realtors on Tuesday also showed the smallest increase in annual house prices since 2012, which should help to improve affordability. It will, however, be a while before the housing market turns the corner.

Mortgage rates have resumed their upward trend after robust retail sales and labor market data as well as strong monthly inflation readings raised the prospect of the Federal Reserve maintaining its interest rate hiking campaign through summer.

Existing home sales fell 0.7% to a seasonally adjusted annual rate of 4.00 million units last month, the lowest level since October 2010, when the nation was grappling with the foreclosure crisis. That marked the 12th straight monthly decline in sales, the longest such stretch since 1999.

Sales fell in the Northeast and Midwest, but rose in the South and West. Economists polled by Reuters had forecast home sales rising to a rate of 4.10 million units. Home resales, which account for the biggest share of U.S. housing sales, plunged 36.9% on a year-on-year basis in January.