From Yahoo Finance:

Housing Prices Are Expected to Drop in These Cities — Is Yours One of Them?

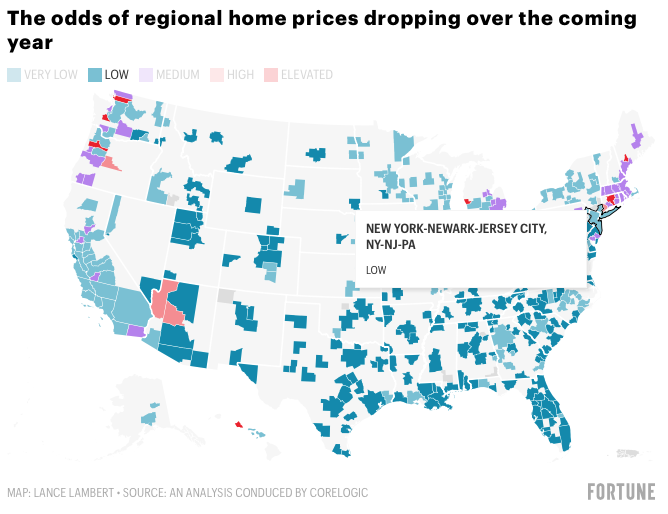

Housing prices could drop by as much as 10% in many U.S. cities, per Fortune, referencing a new report from Moody’s Analytics. However, the dip won’t represent a national home price correction, according to Moody’s chief economist Mark Zandi.

Rather, per Zandi, within the next 12 months, home price growth will reach zero year-over-year. Some of the most overpriced housing markets will experience declines, he predicts.

Zandi attributes the cooling market to rapidly rising mortgage rates in an already-overvalued market. He doesn’t consider the current prices to represent a housing bubble, because the market overvaluation isn’t accompanied by speculation, he told Fortune. However, he noted that he sees some “speculation creeping in” to markets like Phoenix and Charlotte, which are overvalued by 46% and 33%, Fortune reports.

When a housing market is overvalued, it means home prices are higher than expected compared to average local incomes. Moody’s research showed that 96% of the 392 metropolitan area markets considered are “overvalued,” with 149 overvalued by at least 25%.